Announcement

Collapse

No announcement yet.

It's official: Deal reached on "fiscal cliff"

Collapse

X

-

Re: It's official: Deal reached on "fiscal cliff"

Its a headline driven world. Especially when that world is hungover. Please please, don't give me numbers, my head hurts. Just tell me it is all ok.Originally posted by BadJuju View Post

-

Re: It's official: Deal reached on "fiscal cliff"

zerohedge running with a headline saying "no deal". The house has not yet passed the bill.Originally posted by BadJuju View Post

Comment

-

Re: It's official: Deal reached on "fiscal cliff"

http://www.cbsnews.com/8301-250_162-...r-senate-vote/

The Senate has already voted for it. If the House votes against it, expect a GOP meltdown.

Comment

-

Re: It's official: Deal reached on "fiscal cliff"

Ah ZH, always good for a laugh. Although I'm not sure which is more amusing, the posts or the comments section.Originally posted by globaleconomicollaps View Postzerohedge running with a headline saying "no deal". The house has not yet passed the bill.

It is most certainly not official. The House is in session today and might vote on it. Even if they don't today, this outcome is not what ZH forecasted back in November. If this deal isn't passed as a bill until Thursday or Friday, that is most certainly not "nothing".As we forecast back in November, it is now official that the House will not vote on any deal out of the Senate

Their forecast implies a market crash and drawn-out negotiations that drag on well into the calendar of the 113th Congress.And it is a certainty that in the 15 (see calendar below) remaining days it is expected to be session it will get nothing done. Which means, that once again, it will be up to the market, just like last August, just like October of 2008, to implode and to shock Congress into awakening and coming up with a compromise of sorts.

Comment

-

Re: It's official: Deal reached on "fiscal cliff"

- First best wishes for a successful 2013 to my itulip colleagues..

Finster has said the same as Chris Martenson said last night (see excerpt below). That this whole fiscal cliff deal in the context of what we face is minimal. Our structural problems cant be solved with last minute car selling negotiation like tactics.

IMO The news headline here is not the fiscal cliff. The news headline is Obama and democrats trying to gain control of House in 2014. Add the news headline stories of Obama leaving his family behind in Hawaii, Joe Biden leaving his family behind to meet with negotiators coupled with the usual class warfare rhetoric and you have a couple of hard working dedicated men (Joe and Obama) who will rescue the middle class by taxing the rich to pay their fair share. Here are Chris's comments...

"Okay, time for some context here...$600 billion over ten years would be $60 billion per year, assuming it's evenly spread, which it is not, but let's just pretend as if it were.The current deficit is around $1.1 trillion, so $60 billion represents a whopping 5.5% dent in the deficit.That is almost in the category of being utterly meaningless, because the typical rounding error on yearly budget guesstimates – er, proposals – is a lot higher than that. In the past five years, the actual spending for any given year has typically exceeded the budget by some $100 to $200 billion. So $60 billion is pretty much in the realm of noise for DC, sad to say."Last edited by jpetr48; January 01, 2013, 10:30 AM.

Comment

-

Re: It's official: Deal reached on "fiscal cliff"

http://www.breitbart.com/Big-Governm...ing-cuts-ratio

Comment

-

Re: It's official: Deal reached on "fiscal cliff"

When Bernanke stood at the podium not ten feet from me at the Boston Federal Reserve building Oct. 2011 and uttered the phrase "fiscal cliff" in his speech I clearly recall thinking, "Oh, here we go. We're going to hear this stupid phrase 10,000 times over the next 14 months."

It was designed to market the Fed's position that it cannot via monetary policy cope with the aftermath of a failure of Congress and the White House to avert a sudden increase in taxes and reduction in spending when the economy is still stuck in an output gap left over from the last recession. The Fed gave politicians 14 months to figure it out once Bernanke shot "fiscal cliff" from of its rhetorical firing gun.

Raise taxes and cut spending while the economy is still recovering from the last recession? What could possibly go wrong?

The truth of course is that there is no cliff but a rocky slope of automatic tax hikes and spending program timeouts the negative impact of which likely add up to more than 2013 GDP. The Congressional Budget office came to the Fed's aid in May 2012 with a specific "fiscal cliff" economic forecast in a paper Economic Effects of Reducing the Fiscal Restraint That Is Scheduled to Occur in 2013: "Under those fiscal conditions, which will occur under current law, growth in real (inflation-adjusted) GDP in calendar year 2013 will be just 0.5 percent, CBO expects—with the economy projected to contract at an annual rate of 1.3 percent in the first half of the year and expand at an annual rate of 2.3 percent in the second half."

I remind readers that in the year 2007 when we forecast a recession, plunging tax receipts, and a skyrocketing budget deficit for 2008 and 2009, the CBO forecast revenue growth and budget deficit reductions for those years. Putting aside the CBO's dismal forecasting record and giving them credit for learning from past errors, their fiscal cliff argument makes sense from a historical standpoint: if the private sector is suddenly taxed more and government spending is quickly reduced during a period of economic recovery that a recession will result, which recession will cause tax receipts to plunge again as unemployment rises, resulting in rising budget deficit. The CBO and the Fed both preach that deficits need to be managed the mythical long run, but not until the economy is out of the woods. Their credo is, "Yes to deficits reductions, but not yet!"

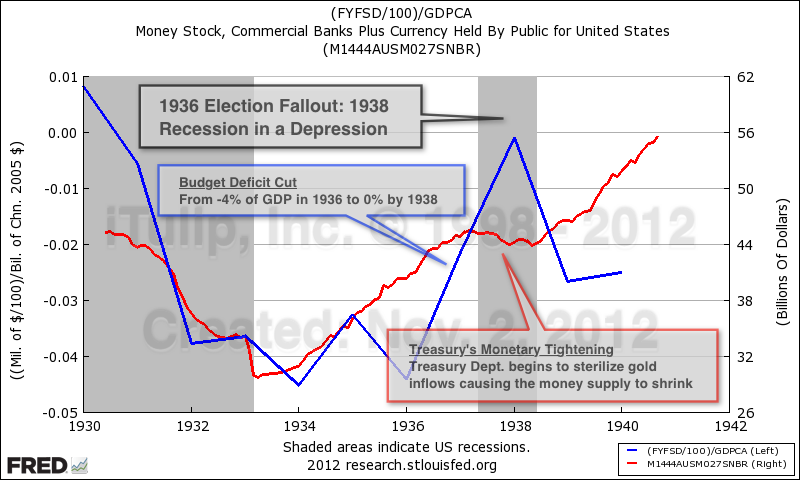

The last time politicians talked themselves into balancing a budget during a recession recovery was in 1937 when a combination of unintentional monetary tightening by the Treasury and intentional budget balancing by Congress sent the economy back into recession in 1937 and 1938.

The Treasury quickly reversed course in early 1938 and the recession ended, although the positive impact on the economy of policy changes is difficult to separate from economic stimulus from increased defense spending.

The relevance of this history is it should be remembered that the phrase "fiscal cliff" was designed by the Fed with the CBO's assistance to market an idea to Congress to not act on the assumption that the Fed can deal with the consequence of automatic policy changes that collectively could send the economy back into recession. With interest rates at zero and each round of QE giving the economy less stimulus bang for the money printing buck, the Fed doesn't want to be left holding the bag if Congress and the White House can't arrive at a compromise.

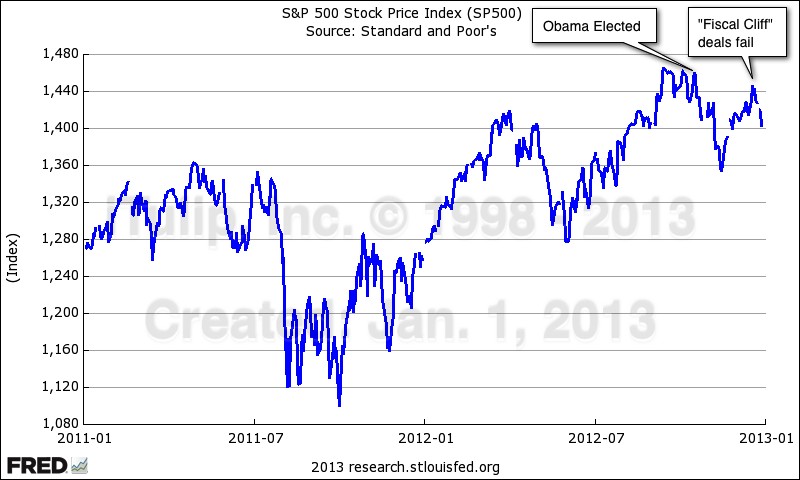

One way to measure the likely impact of a fiscal cliff deal failure is the reaction of the stock market to fiscal cliff deal rumors and news. Overall the markets appear less concerned about the impact of a failure to reach a deal by a date certain than it was about the re-election of President Obama.

The reason in my opinion is that there is no fiscal cliff and never was. The market understands that Congress and the White House will work out a compromise consisting of enough tax hikes to satisfy the ideological positions of the Democrats and the GOP, respectively that the rich don't pay enough taxes and that the budget deficit is bad for the country. The deal can be effectively back-dated to December 2012. Once we have the details we'll take a shot at an estimate of the impact. The delay in a deal is one of the main reasons we haven't published my latest article yet; without knowing what our fine political establishment has in mind for us in 2013, forecasting the early part of the year is impossible.

As far as the whole year goes, it's not the wrangling over taxes and spending that worries us, its the fact that it is going on while the economy remains stuck in an output gap following a massive recession induced by the collapse of a multi-decade credit bubble. In this context the stock market is telling us that the gig is about up.

This meager albeit expensive post-bubble reflation cycle produced a private sector annual job growth rate that peaked at just under 2% in late 2010 when it began to gently decline. A new recession could wipe out half of the 4 million jobs added since Q2 2009.

As everyone knows, those new jobs are not the same as the old jobs that were lost. They pay less and offer fewer benefits. That translates into weaker consumer spending.

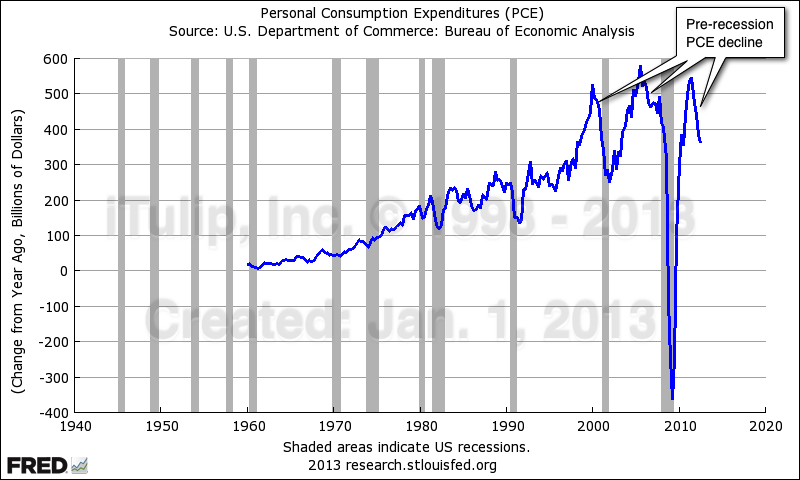

Weak holiday spending was a bad omen for this unlucky numbered year. In fact, personal consumption expenditures (PCE) has been declining the way it does only before a recession.

As I wil demonstrate in my next article all of our major recession forecast indicators are flashing orange or red. I expect a recession and major market correction in 2013. Stay tuned.Last edited by EJ; January 01, 2013, 03:33 PM.

Comment

-

Re: It's official: Deal reached on "fiscal cliff"

Eeeek....has that much changed in the last month?Originally posted by EJ View PostAs I wil demonstrate in my next article all of our major recession forecast indicators are flashing orange or red. I expect a recession and major market correction in 2013. Stay tuned.

"We're working on a recession forecast using our own methodology. So far the analysis point to a recession in 2013 that is relatively short and shallow."

http://www.itulip.com/forums/showthr...372#post244372

Comment

-

Re: It's official: Deal reached on "fiscal cliff"

http://www.npr.org/2012/12/30/168283...-holiday-sales

That might have something to do with it.

Comment

-

Re: It's official: Deal reached on "fiscal cliff"

Yes this is what Eric is saying that the decline in PCE is happening at a rate and level that usually indicates a recession. See his last chart aboveOriginally posted by BadJuju View Post

Comment

-

Re: It's official: Deal reached on "fiscal cliff"

EJ has been more ominous than that.Originally posted by lektrode View Postand a happy new year to you too...

;)

it doesnt get more ominous than that - does it?

thanks for the update Mr J.

Best wishes to all for the coming year!!If the thunder don't get you then the lightning will.

Comment

-

Re: It's official: Deal reached on "fiscal cliff"

http://www.washingtonpost.com/busine...46f_story.html

House passed the bill.

Comment

Comment