The Oil and Money Predicament

If you understand the basic formula that ever-increasing cheap energy resources were the fundamental condition for industrial growth for two centuries, then you must realize that they are also behind the modern operations of capital, especially the mechanism that allows massive volumes of interest on debt to be repaid -- hence behind all of contemporary banking. And if you get that, it is easy to see how the end of cheap energy has screwed the pooch for modern finance.

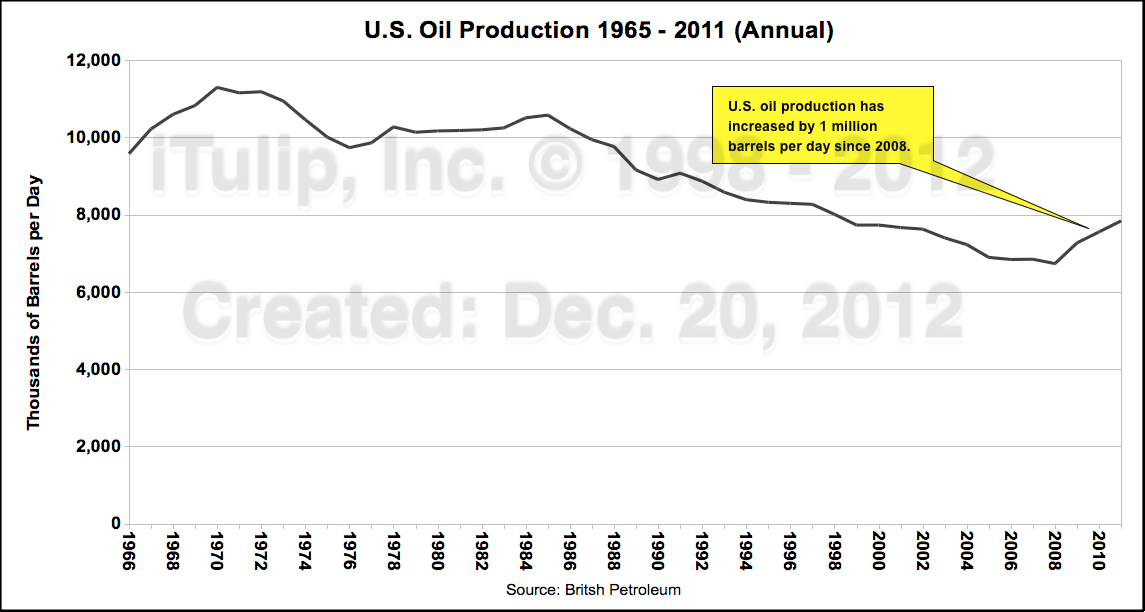

In fact, let's step back for a panoramic view of what happened with that relationship in recent times: In 1970 you get American peak oil production at just under 10 mmbd (million barrels a day). This chart tells the story:

The net effect for the USA was that our economy went off the rails for a decade and lots of strange things started happening in the financial sector. They called it "stagflation" -- stagnant economic activity + rising prices. It was hardly a conundrum. The OPEC price-jackings of 1973 and 1979 made everything Americans had to buy more costly, in effect devaluing the dollar while throwing sand in the gears of industrial production. Meanwhile, dazed and confused American industry started losing out to Japan and Europe in things like electronics and cars. Price inflation was running over 13 percent in the late '70s. Interest rates skyrocketed. When Federal Reserve chair Paul Volker aggressively squashed inflation with a punitive prime rate of 20 percent in 1981, the economy promptly tanked.

Now look at this chart:

Notice that our oil consumption kept rising from the early 1980s until the middle of the early 2000s. Now look at the circle in the chart below. That rise of production from the late 1970s to about 1990 is mostly about production from the Prudhoe Bay oil fields in Alaska -- one of the last great discoveries of the oil age (along with the North Sea and the fields of Siberia). US production did not regain the 1970 peak level, but it put a smile on the so-called Reagan Revolution and on Margaret Thatcher's exertions to revive comatose Great Britain.

Now look at the price of oil (chart below). You can see what a fiasco the period 1973 to 1981 was for US oil prices: huge rapid price rises in '73 and '79. But then the price started to fall steeply after 1981 and stayed around the same price levels as its pre-1973 lows.

Notice the price started to fall after 1981 and landed close to its pre-1973 levels by 1986 and hung out there (though more erratically) until the mid-2000s. Because of those aforementioned last great giant oil field discoveries, OPEC lost its price leverage over world oil markets. Through the 1980s and 90s the price of oil went down until it reached the modern low of about $11 a barrel. That was when The Economist magazine ran a cover story that declared the world was "drowning in oil." It was the age of "Don't worry, be happy."

The price behavior of the oil markets after 1981 had interesting reverberations in both the macro economy and the financial sector (which is supposed to be part of the macro economy, not a replacement for it). A consensus formed in business and politics that it was okay to yield manufacturing to other nations. It was dirty and nasty and caused pollution, so let other countries have it. We followed the siren call of clean and tidy forms of production: "knowledge work!" The computer revolution had begun in earnest. The financial sector began its metastasis from 5 percent of the economy to, eventually, 40 percent, and really cheap oil prompted the last great suburban sprawl-building pulsation into the Martha Stewart bedecked McMansion exurbs. In effect, financial shenanigans and sprawl-building became the basis for the vaunted "Next Economy." It lasted about 20 years.

That incarnation of the US economy failed spectacularly as soon as oil prices started to creep up in the early 2000s. And, of course, the final suburban sprawl boom went hand-in-hand with all the shenanigans in banking. So when it all blew up, beginning in 2007 with the collapse of Bear Stearns, the USA was left with a gutted economy, insolvent banks, and a living arrangement with no future.

We're now entering the seventh year of a smoke-and-mirrors, extend-and-pretend, can-kicking phase of history in which everything possible is being done to conceal the true condition of the economy, with the vain hope of somehow holding things together until a miracle rescue remedy -- some new kind of cheap or even free energy -- comes on the scene to save all our complex arrangements from implosion. The chief device to delay the reckoning has been accounting fraud in banking and government, essentially misreporting everything on all balance sheets and in statistical reports to give the appearance of well-being where there is actually grave illness, like the cosmetics and prosthetics Michael Jackson used in his final years to pretend he still had a face on the front of his head.

The secondary tactic has been intervention in markets wherever possible and the intemperate manipulation of interest rates, all of which has the effect of defeating the principle purpose of markets: price discovery -- the process by which the true value of things is established based on what people will freely pay. For instance the price of money-on-loan. The functionally less-than-zero percent interest rates on money loaned between giant institutions like central banks and their client "primary dealers" (the Too Big To Fails) essentially pays these outfits for borrowing, which is obviously a distortion in the natural order of things (because it violates the second law of thermodynamics: entropy) as well as a racket. The campaign of intervention and manipulation also deeply impairs the other purpose of markets, capital formation, by the resultant mismanagement and misallocation of whatever real surplus wealth remains in this society. What's more, it allows these TBTF banks to become ever-bigger monsters which hold everybody else hostage by threatening to crash the system if they are molested or interfered with.

Which brings us to the third tactic for pretending everything is all right: complete lack of enforcement and regulation by all the authorities charged with making sure that rules are followed in money matters. This includes the alphabet soup of agencies from the Securities and Exchange Commission to the Commodities Futures Trading Commission, to the Federal Housing Authority, and so on (the list of responsible parties is very long) not to mention the Big Kahunas: the US Department of Justice, and the federal and state courts. Aside from Bernie Madoff and a few Hedge Fund mavericks nipped for insider trading and arrant fraud, absolutely nobody in the TBTF banking community has been prosecuted or even charged for the monumental swindles of our time, while the regulators have behaved in ways that would be considered criminally negligent at best, and sheer racketeering at less-than-best, in any self-respecting polity. The crime runs so deep and thick through all the levels of money management and regulation that one can say the whole system has gone rogue, up to the President of the US himself, the chief enforcement officer of the land, who has not lifted a finger to discipline any of the parties involved. The fact that Jon Corzine, late of MF Global, is still at large says it all.

Fourth-and-finally, the news media in league with the public relations industry have undertaken a campaign of happy talk to persuade the public that everything is okay and all the machinations cited above are kosher so that there is absolutely no political agitation over these crimes against their own interest, which is to say, the public interest. The PR/media happy talk racket is also aimed at maintaining various subsidiary fictions about the economy, such as the fibs that the housing market is bouncing back, that "recovery" is ongoing, and that the channel-stuffing monkeyshines of the car industry amount to booming sales of new vehicles. Perhaps the most pernicious big lie is the bundle of fairy tales surrounding shale oil and shale gas, including the idea that America will shortly become "energy independent" or that we have "a hundred years of shale gas" as President Obama told the nation. It is pernicious because it gives us collectively an excuse to do nothing about changing our behavior or preparing for the new arrangements in daily life that the future will require.

Let's start with shale gas. The gas is there in the "tight" rock strata, all right, but it is difficult and expensive to get out. The process is nothing like the old conventional process of sticking a pipe in the ground and getting "flow." It's not necessary to go into the techno-details (you can read about that elsewhere) but to give you a rough idea, it takes four times as much steel pipe to get shale gas out of the ground. I have previously touched on the impairment of capital formation due to machinations in banking - themselves a perverse response to the loss of capacity to pay back interest at all levels of the money system, which was caused by the world's running out of cheap oil and gas. (Note emphasis on cheap.) The net effect of all that turns out to be scarcity in another resource: capital, i.e. money, rather specifically money for investment in things like shale oil and gas.

Ironically, plenty of money was available around 2004-5 when the campaign to go after shale oil and gas got ramped up over premonitions of global peak oil. How come there was money then and not now? Because we were at peak cheap oil and hence peak credit back then, which is to say peak available real capital. So, the oil and gas companies were able then to attract lots of investment money to set out on this campaign. They brought as many drilling rigs as they could into the shale oil and gas play regions and they drilled the shit out of them. Natural gas was selling for over $13 a unit (thousand cubic feet) around 2005, and it was that high precisely because conventional cheap nat gas production was in substantial decline.

That was then, this is now. As a result of drilling the shit out of the gas plays, the producers created a huge glut for a brief time. They queered their own market long enough to wreck their business model. Unlike oil, nat gas is much more difficult to export -- it requires expensive tankers, compression and refrigeration of the gas to a liquid, seaboard terminals to accomplish all that (which we don't have), so there was no way to fob off the surplus gas on other nations. The domestic market was overwhelmed and there was no more room to store the stuff. So, for a few years the price sank and sank until it was under $2 a unit by 2011. Since shale gas production is just flat-out uneconomical at that price, the companies engaged in it began to suffer hugely.

In the process of all this a pattern emerged showing that shale gas wells typically went into depletion very quickly after year one. So all of the activity from 2004 to 2011 was a production bubble, aimed at proving what a bonanza shale gas was to stimulate more investment. It required a massive rate of continuous drilling and re-drilling just to keep the production rate level -- to maintain the illusion of a 100-year bonanza -- and that required enormous quantities of capital. So the shale gas play began to look like a hamster wheel of futility. After 2011 the rig count began to drop and of course production leveled off and the price began to go up again. As I write the price is $3.31 a unit, which is still way below the level where natural gas is profitable for companies to produce --say, above $8. The trouble is, once the price rises into that range it becomes too expensive for many of its customers, especially in a contracting economy with a shrinking middle class, falling incomes, and failing businesses. So what makes it economical for the producers (high price) will make it unaffordable for the customers (no money). Because of the complex nature of these operations, with all the infrastructure required, and all the money needed to provide it, the shale gas industry will not be able to go through more than a couple of boom / bust cycles before it begins to look like a fool's game and the big companies throw in the towel. The catch is: there are no small companies that can carry on operations as complex and expensive as shale requires. Only big companies can make shale gas happen. So a lot of gas will remain trapped in the "tight" rock very far into the future.

Obviously I haven't even mentioned the "fracking" process, which is hugely controversial in regard to groundwater pollution, and a subject which I will not elaborate on here, except to say that there's a lot to be concerned about. However, I believe that the shale gas campaign will prove to be a big disappointment to its promoters and will founder on its own defective economics rather than on the protests of environmentalists.

Much of what I wrote about shale gas is true for shale oil with some departures. One is that the price of oil did not go down when US shale oil production rose. That's because the amount of shale oil produced -- now about 900,000 barrels a day -- is working against the headwinds of domestic depletion in regular oil + world consumption shifting to China and the rest of Asia + the declining ability of the world's exporters to keep up their levels of export oil available to the importers (us). We still import 42 percent of the oil we use every day.

The fundamental set up of life in the USA -- suburban sprawl with mandatory driving for everything -- hasn't changed during the peak cheap oil transition and represents too much "previous investment" for the public to walk away from. So we're stuck with it until it manifestly fails. (Life is tragic and history doesn't excuse our poor choices.) The price of oil has stayed around the $90 a barrel range much of 2012. Oil companies can make a profit in shale oil at that price. However, that's the price at which the US economy wobbles and tanks, which is exactly what is happening. The US cannot run economically on $90 oil. If the price were to go down to a level the economy might be able to handle, say $40 a barrel, the producers of shale oil would go broke getting it out of the ground. This brings us back to the fact that the issue is cheap oil, not just available oil. As the US economy stumbles, and the banking system implodes on the incapacity of debt repayment, there will be less and less capital available for investment in shale oil. As with shale gas, the shale oil wells deplete very rapidly, too, and production requires constant re-drilling, meaning more rigs, more employees, more trucks hauling fracking fluid, and more capital investment. This is referred to as "the Red Queen syndrome," from Lewis Carrol's Through the Looking Glass tale in which the Red Queen tells Alice that she has to run as fast as she can to stay where she is.

The bottom line for shale oil is that we're likely to see production fall in the years directly ahead, to the shock and dismay of the 'energy independence' for lunch bunch. 2012 may have been peak shale oil. If the price of oil does go down to a level that seems affordable, it will be because the US economy has been crushed and America is mired in a depression at least as bad as the 1930s, in which case a lot of people will be too broke to even pay for cheaper oil. Hence, the only possibility that America will become energy independent would be a total collapse of the modern technological-industrial economy. The shale oil and gas campaign therefore must be regarded as a desperate gambit by a society in deep trouble engaging in wishing and fantasy to preserve a set of behaviors that can no longer be justified by the circumstances reality presents.

Between government and central bank interventions, accounting fraud, control fraud, the computer hugger-mugger of algorithmic trading, and AWOL rule of law, the financial markets have practically destroyed themselves. They can't be depended on to express the real value of things and capital formation struggles against the headwinds of peak cheap energy on top of massive fraud and swindling. The markets can only blow up. When the wreckage clears and new, smaller markets form, as they will, they must operate differently, with new rules and restraints, because the blow up of today's markets will be such a trauma that nobody will venture to engage with them if they don't. A world without simplified and honest capital, commodity, and equity markets would beat a quick path back to a dark age, and in the process a lot of people will die of cold and starvation.

The full workout of all that may be some years further out, but the blowout will commence in 2013. The glue that held these markets together was faith that they meant something -- and that faith has been pissed away by fools in high places who drained all the honesty out of them. It was a classic case out of the Joseph Tainter playbook: diminishing returns of ever-increasing complexity addressed with ever-more layers of complexity, larded with systematic lying based on mystifying, opaque jargon, sanctioned statistical misreporting, felonious cronyism, and scuttling of the rule of law. In short, the markets have been taken over in effect by a criminal racketeering syndicate. In doing this, so much resilience has been removed from these market structures that they are riddled with rot, like a mansion infested with carpenter ants. In other words, borrowing a term from Taleb, they are hopelessly fragile.

Any little vibration could reduce the whole creaking arrangement into a heap of rubble and ashes. There's plenty of vibration available out there. Events are humming.

The debt mountains in the USA and elsewhere far overshadow the equity and commodity market molehills, and unpaid debt will eventually overcome all the forces of untruth. Debt is a subsidiary of the force known as reality. Its will cannot be denied, even by Goldman Sachs, JP Morgan, the US Treasury, and the Federal Open Markets Committee. And the unwinding of unpaid debt, honestly acknowledged or not, will thunder through the system sucking wealth out of advanced societies so efficiently that it will make the Seven Plagues of the Bible look like a flat tire on a sunny day.

Jim Kunstler

If you understand the basic formula that ever-increasing cheap energy resources were the fundamental condition for industrial growth for two centuries, then you must realize that they are also behind the modern operations of capital, especially the mechanism that allows massive volumes of interest on debt to be repaid -- hence behind all of contemporary banking. And if you get that, it is easy to see how the end of cheap energy has screwed the pooch for modern finance.

In fact, let's step back for a panoramic view of what happened with that relationship in recent times: In 1970 you get American peak oil production at just under 10 mmbd (million barrels a day). This chart tells the story:

US Oil production 1920 to 2012

That event was little noted at the time, but by 1973, the rest of the world was paying attention, especially the OPEC countries led by the big exporters in the Middle East. All they had to do was look at the published production figures and by 1973 the trend was apparent. They apprehended that US production had entered decline -- predicted by American geologist M. King Hubbard -- and that they, OPEC, could respond to the USA going off the gold standards. They had leverage.. Which they commenced to do to our still-growing industrial economy. The catch was that since everything in the US economy used oil in one way or another, the entire cost structure of our manufacture, supply, distribution, and retail chains was thrown askew.

The net effect for the USA was that our economy went off the rails for a decade and lots of strange things started happening in the financial sector. They called it "stagflation" -- stagnant economic activity + rising prices. It was hardly a conundrum. The OPEC price-jackings of 1973 and 1979 made everything Americans had to buy more costly, in effect devaluing the dollar while throwing sand in the gears of industrial production. Meanwhile, dazed and confused American industry started losing out to Japan and Europe in things like electronics and cars. Price inflation was running over 13 percent in the late '70s. Interest rates skyrocketed. When Federal Reserve chair Paul Volker aggressively squashed inflation with a punitive prime rate of 20 percent in 1981, the economy promptly tanked.

Now look at this chart:

Notice that our oil consumption kept rising from the early 1980s until the middle of the early 2000s. Now look at the circle in the chart below. That rise of production from the late 1970s to about 1990 is mostly about production from the Prudhoe Bay oil fields in Alaska -- one of the last great discoveries of the oil age (along with the North Sea and the fields of Siberia). US production did not regain the 1970 peak level, but it put a smile on the so-called Reagan Revolution and on Margaret Thatcher's exertions to revive comatose Great Britain.

Post Peak Bump up from Alaskan Oil

Now look at the price of oil (chart below). You can see what a fiasco the period 1973 to 1981 was for US oil prices: huge rapid price rises in '73 and '79. But then the price started to fall steeply after 1981 and stayed around the same price levels as its pre-1973 lows.

1970s Oil Price Spike and Thereafter

Notice the price started to fall after 1981 and landed close to its pre-1973 levels by 1986 and hung out there (though more erratically) until the mid-2000s. Because of those aforementioned last great giant oil field discoveries, OPEC lost its price leverage over world oil markets. Through the 1980s and 90s the price of oil went down until it reached the modern low of about $11 a barrel. That was when The Economist magazine ran a cover story that declared the world was "drowning in oil." It was the age of "Don't worry, be happy."

The price behavior of the oil markets after 1981 had interesting reverberations in both the macro economy and the financial sector (which is supposed to be part of the macro economy, not a replacement for it). A consensus formed in business and politics that it was okay to yield manufacturing to other nations. It was dirty and nasty and caused pollution, so let other countries have it. We followed the siren call of clean and tidy forms of production: "knowledge work!" The computer revolution had begun in earnest. The financial sector began its metastasis from 5 percent of the economy to, eventually, 40 percent, and really cheap oil prompted the last great suburban sprawl-building pulsation into the Martha Stewart bedecked McMansion exurbs. In effect, financial shenanigans and sprawl-building became the basis for the vaunted "Next Economy." It lasted about 20 years.

That incarnation of the US economy failed spectacularly as soon as oil prices started to creep up in the early 2000s. And, of course, the final suburban sprawl boom went hand-in-hand with all the shenanigans in banking. So when it all blew up, beginning in 2007 with the collapse of Bear Stearns, the USA was left with a gutted economy, insolvent banks, and a living arrangement with no future.

We're now entering the seventh year of a smoke-and-mirrors, extend-and-pretend, can-kicking phase of history in which everything possible is being done to conceal the true condition of the economy, with the vain hope of somehow holding things together until a miracle rescue remedy -- some new kind of cheap or even free energy -- comes on the scene to save all our complex arrangements from implosion. The chief device to delay the reckoning has been accounting fraud in banking and government, essentially misreporting everything on all balance sheets and in statistical reports to give the appearance of well-being where there is actually grave illness, like the cosmetics and prosthetics Michael Jackson used in his final years to pretend he still had a face on the front of his head.

The secondary tactic has been intervention in markets wherever possible and the intemperate manipulation of interest rates, all of which has the effect of defeating the principle purpose of markets: price discovery -- the process by which the true value of things is established based on what people will freely pay. For instance the price of money-on-loan. The functionally less-than-zero percent interest rates on money loaned between giant institutions like central banks and their client "primary dealers" (the Too Big To Fails) essentially pays these outfits for borrowing, which is obviously a distortion in the natural order of things (because it violates the second law of thermodynamics: entropy) as well as a racket. The campaign of intervention and manipulation also deeply impairs the other purpose of markets, capital formation, by the resultant mismanagement and misallocation of whatever real surplus wealth remains in this society. What's more, it allows these TBTF banks to become ever-bigger monsters which hold everybody else hostage by threatening to crash the system if they are molested or interfered with.

Which brings us to the third tactic for pretending everything is all right: complete lack of enforcement and regulation by all the authorities charged with making sure that rules are followed in money matters. This includes the alphabet soup of agencies from the Securities and Exchange Commission to the Commodities Futures Trading Commission, to the Federal Housing Authority, and so on (the list of responsible parties is very long) not to mention the Big Kahunas: the US Department of Justice, and the federal and state courts. Aside from Bernie Madoff and a few Hedge Fund mavericks nipped for insider trading and arrant fraud, absolutely nobody in the TBTF banking community has been prosecuted or even charged for the monumental swindles of our time, while the regulators have behaved in ways that would be considered criminally negligent at best, and sheer racketeering at less-than-best, in any self-respecting polity. The crime runs so deep and thick through all the levels of money management and regulation that one can say the whole system has gone rogue, up to the President of the US himself, the chief enforcement officer of the land, who has not lifted a finger to discipline any of the parties involved. The fact that Jon Corzine, late of MF Global, is still at large says it all.

Fourth-and-finally, the news media in league with the public relations industry have undertaken a campaign of happy talk to persuade the public that everything is okay and all the machinations cited above are kosher so that there is absolutely no political agitation over these crimes against their own interest, which is to say, the public interest. The PR/media happy talk racket is also aimed at maintaining various subsidiary fictions about the economy, such as the fibs that the housing market is bouncing back, that "recovery" is ongoing, and that the channel-stuffing monkeyshines of the car industry amount to booming sales of new vehicles. Perhaps the most pernicious big lie is the bundle of fairy tales surrounding shale oil and shale gas, including the idea that America will shortly become "energy independent" or that we have "a hundred years of shale gas" as President Obama told the nation. It is pernicious because it gives us collectively an excuse to do nothing about changing our behavior or preparing for the new arrangements in daily life that the future will require.

Let's start with shale gas. The gas is there in the "tight" rock strata, all right, but it is difficult and expensive to get out. The process is nothing like the old conventional process of sticking a pipe in the ground and getting "flow." It's not necessary to go into the techno-details (you can read about that elsewhere) but to give you a rough idea, it takes four times as much steel pipe to get shale gas out of the ground. I have previously touched on the impairment of capital formation due to machinations in banking - themselves a perverse response to the loss of capacity to pay back interest at all levels of the money system, which was caused by the world's running out of cheap oil and gas. (Note emphasis on cheap.) The net effect of all that turns out to be scarcity in another resource: capital, i.e. money, rather specifically money for investment in things like shale oil and gas.

Ironically, plenty of money was available around 2004-5 when the campaign to go after shale oil and gas got ramped up over premonitions of global peak oil. How come there was money then and not now? Because we were at peak cheap oil and hence peak credit back then, which is to say peak available real capital. So, the oil and gas companies were able then to attract lots of investment money to set out on this campaign. They brought as many drilling rigs as they could into the shale oil and gas play regions and they drilled the shit out of them. Natural gas was selling for over $13 a unit (thousand cubic feet) around 2005, and it was that high precisely because conventional cheap nat gas production was in substantial decline.

That was then, this is now. As a result of drilling the shit out of the gas plays, the producers created a huge glut for a brief time. They queered their own market long enough to wreck their business model. Unlike oil, nat gas is much more difficult to export -- it requires expensive tankers, compression and refrigeration of the gas to a liquid, seaboard terminals to accomplish all that (which we don't have), so there was no way to fob off the surplus gas on other nations. The domestic market was overwhelmed and there was no more room to store the stuff. So, for a few years the price sank and sank until it was under $2 a unit by 2011. Since shale gas production is just flat-out uneconomical at that price, the companies engaged in it began to suffer hugely.

In the process of all this a pattern emerged showing that shale gas wells typically went into depletion very quickly after year one. So all of the activity from 2004 to 2011 was a production bubble, aimed at proving what a bonanza shale gas was to stimulate more investment. It required a massive rate of continuous drilling and re-drilling just to keep the production rate level -- to maintain the illusion of a 100-year bonanza -- and that required enormous quantities of capital. So the shale gas play began to look like a hamster wheel of futility. After 2011 the rig count began to drop and of course production leveled off and the price began to go up again. As I write the price is $3.31 a unit, which is still way below the level where natural gas is profitable for companies to produce --say, above $8. The trouble is, once the price rises into that range it becomes too expensive for many of its customers, especially in a contracting economy with a shrinking middle class, falling incomes, and failing businesses. So what makes it economical for the producers (high price) will make it unaffordable for the customers (no money). Because of the complex nature of these operations, with all the infrastructure required, and all the money needed to provide it, the shale gas industry will not be able to go through more than a couple of boom / bust cycles before it begins to look like a fool's game and the big companies throw in the towel. The catch is: there are no small companies that can carry on operations as complex and expensive as shale requires. Only big companies can make shale gas happen. So a lot of gas will remain trapped in the "tight" rock very far into the future.

Obviously I haven't even mentioned the "fracking" process, which is hugely controversial in regard to groundwater pollution, and a subject which I will not elaborate on here, except to say that there's a lot to be concerned about. However, I believe that the shale gas campaign will prove to be a big disappointment to its promoters and will founder on its own defective economics rather than on the protests of environmentalists.

Much of what I wrote about shale gas is true for shale oil with some departures. One is that the price of oil did not go down when US shale oil production rose. That's because the amount of shale oil produced -- now about 900,000 barrels a day -- is working against the headwinds of domestic depletion in regular oil + world consumption shifting to China and the rest of Asia + the declining ability of the world's exporters to keep up their levels of export oil available to the importers (us). We still import 42 percent of the oil we use every day.

The fundamental set up of life in the USA -- suburban sprawl with mandatory driving for everything -- hasn't changed during the peak cheap oil transition and represents too much "previous investment" for the public to walk away from. So we're stuck with it until it manifestly fails. (Life is tragic and history doesn't excuse our poor choices.) The price of oil has stayed around the $90 a barrel range much of 2012. Oil companies can make a profit in shale oil at that price. However, that's the price at which the US economy wobbles and tanks, which is exactly what is happening. The US cannot run economically on $90 oil. If the price were to go down to a level the economy might be able to handle, say $40 a barrel, the producers of shale oil would go broke getting it out of the ground. This brings us back to the fact that the issue is cheap oil, not just available oil. As the US economy stumbles, and the banking system implodes on the incapacity of debt repayment, there will be less and less capital available for investment in shale oil. As with shale gas, the shale oil wells deplete very rapidly, too, and production requires constant re-drilling, meaning more rigs, more employees, more trucks hauling fracking fluid, and more capital investment. This is referred to as "the Red Queen syndrome," from Lewis Carrol's Through the Looking Glass tale in which the Red Queen tells Alice that she has to run as fast as she can to stay where she is.

The bottom line for shale oil is that we're likely to see production fall in the years directly ahead, to the shock and dismay of the 'energy independence' for lunch bunch. 2012 may have been peak shale oil. If the price of oil does go down to a level that seems affordable, it will be because the US economy has been crushed and America is mired in a depression at least as bad as the 1930s, in which case a lot of people will be too broke to even pay for cheaper oil. Hence, the only possibility that America will become energy independent would be a total collapse of the modern technological-industrial economy. The shale oil and gas campaign therefore must be regarded as a desperate gambit by a society in deep trouble engaging in wishing and fantasy to preserve a set of behaviors that can no longer be justified by the circumstances reality presents.

Between government and central bank interventions, accounting fraud, control fraud, the computer hugger-mugger of algorithmic trading, and AWOL rule of law, the financial markets have practically destroyed themselves. They can't be depended on to express the real value of things and capital formation struggles against the headwinds of peak cheap energy on top of massive fraud and swindling. The markets can only blow up. When the wreckage clears and new, smaller markets form, as they will, they must operate differently, with new rules and restraints, because the blow up of today's markets will be such a trauma that nobody will venture to engage with them if they don't. A world without simplified and honest capital, commodity, and equity markets would beat a quick path back to a dark age, and in the process a lot of people will die of cold and starvation.

The full workout of all that may be some years further out, but the blowout will commence in 2013. The glue that held these markets together was faith that they meant something -- and that faith has been pissed away by fools in high places who drained all the honesty out of them. It was a classic case out of the Joseph Tainter playbook: diminishing returns of ever-increasing complexity addressed with ever-more layers of complexity, larded with systematic lying based on mystifying, opaque jargon, sanctioned statistical misreporting, felonious cronyism, and scuttling of the rule of law. In short, the markets have been taken over in effect by a criminal racketeering syndicate. In doing this, so much resilience has been removed from these market structures that they are riddled with rot, like a mansion infested with carpenter ants. In other words, borrowing a term from Taleb, they are hopelessly fragile.

Any little vibration could reduce the whole creaking arrangement into a heap of rubble and ashes. There's plenty of vibration available out there. Events are humming.

The debt mountains in the USA and elsewhere far overshadow the equity and commodity market molehills, and unpaid debt will eventually overcome all the forces of untruth. Debt is a subsidiary of the force known as reality. Its will cannot be denied, even by Goldman Sachs, JP Morgan, the US Treasury, and the Federal Open Markets Committee. And the unwinding of unpaid debt, honestly acknowledged or not, will thunder through the system sucking wealth out of advanced societies so efficiently that it will make the Seven Plagues of the Bible look like a flat tire on a sunny day.

Jim Kunstler

Comment