If we were to take a count of how many people lost their homes to foreclosure since 2006, that figure will reach 5,000,000 by the end of the year. This is an enormous number and is rarely discussed as a historical case study in action. It is interesting how many seem to ignore this grim figure and pretend that it never happened. So keep in mind the turmoil those 5,000,000 completed foreclosures have had on the overall housing market. Will the current shadow inventory impact the current upward trend in housing? Banks are selling into some fierce momentum but things are still tepid with the overall economy. Most importantly, household income growth is nowhere to be found.

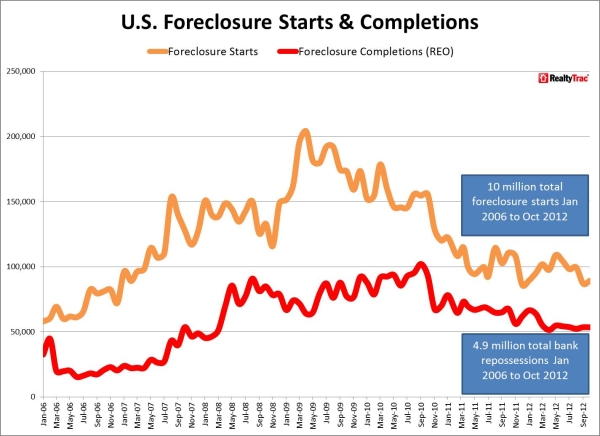

Completed bank repossessions are still running at about 50,000 per month and foreclosure starts are still close to 100,000. This housing bounce as we have mentioned is coming from a trifecta of low interest rates, Wall Street investors, and foreign money. I think it is useful to take a look at where we were and where things are heading.

The impact of the housing crisis

RealtyTrac put together an excellent chart highlighting the damage caused by this housing bubble bursting:

Source: RealtyTrac

If you want to take 2006 as a baseline, it appears that repossessions run at around 20,000 per month and foreclosure starts are around 50,000 in better times. Since 2006 the housing crisis has cost nearly 5,000,000 Americans their homes while another 10,000,000 have faced the prospect of foreclosure. This is an incredibly high figure considering that nationwide, roughly 50 million households carry a mortgage on their property. This context is important when we examine the following current data:

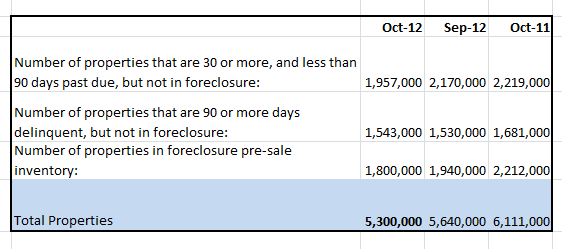

You still have over 5,300,000 mortgages in the foreclosure pipeline. Rising home values make it easier for banks to unload these properties via short sales and other mechanisms. Given that the entire market was turned upside down because of 5 million completed foreclosure, the 5,300,000 homes in the foreclosure pipeline is still a big concern and the fact that nearly 100,000 are being put back into this bucket each month is concerning. The current momentum is clearing out properties but as we had mentioned, prices in areas like Arizona are actually turning investors away.

Modifying out of the shadows

There was an interesting angle taken over at SoberLook regarding the shadow inventory figures:

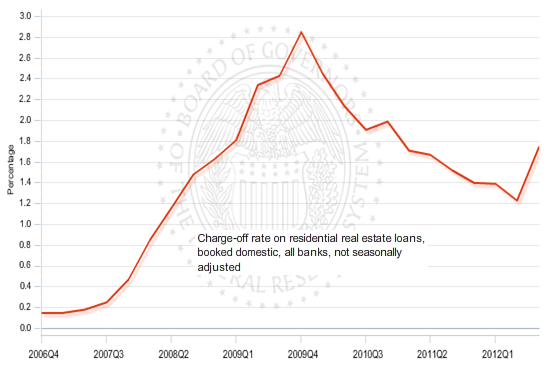

“This could be a cause for concern. However, banks have some leeway in when they actually take charge-offs during the year, so it is worth taking a look at a more up to date delinquency data. JPMorgan recently published the October delinquency results. Indeed there was an increase in delinquencies, mostly in October (there seems to be some delay in reporting delinquencies that the Fed picked up in Q3, particularly by Bank of America). But delinquencies seem to the heaviest in sub-prime mortgages. Is this another wave of subprime defaults?”

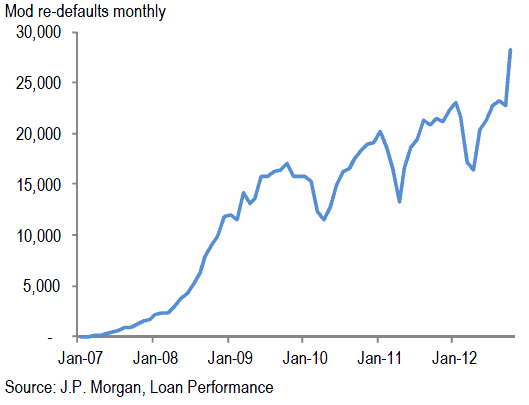

A modified mortgage is yanked out of the shadow inventory pipeline. From data from the OCC and other figures from HAMP, re-defaults on modified loans are very high. It might take one or two years to re-default but the success rate is poor. In other words, was the shadow inventory figure temporarily depressed because of these weak modifications?

From looking at the figures, this does seem to be the case. What is interesting however, is the massive jump in short sales being approved by banks. The shell game allowed these homeowners to tread water until the Fed went into QE3 and now, banks are “working” with these homeowners to unload the properties at higher prices to new buyers and in many cases, investors. I’m not sure if this is really the core function of helping homeowners out.

Something is definitely going on because charge-off rates have spiked recently and the housing market is moving up:

Source: FRB

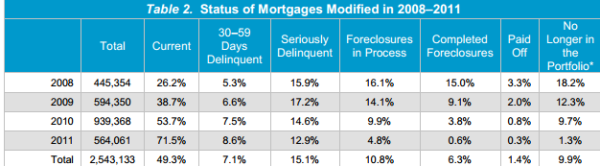

So how many mortgages have been modified? Since 2008 it looks like over 2.5 million:

In other words, you have a solid number of modified homes re-entering the shadow inventory figures. With investor demand and short sales, the figure is moving lower. But it is important to always keep things in perspective especially when moving buckets around.

http://www.doctorhousingbubble.com/m...losures-total/