Fed Injects $41 Billion in Liquidity

By EMILY BARRETT

November 1, 2007 11:55 a.m.

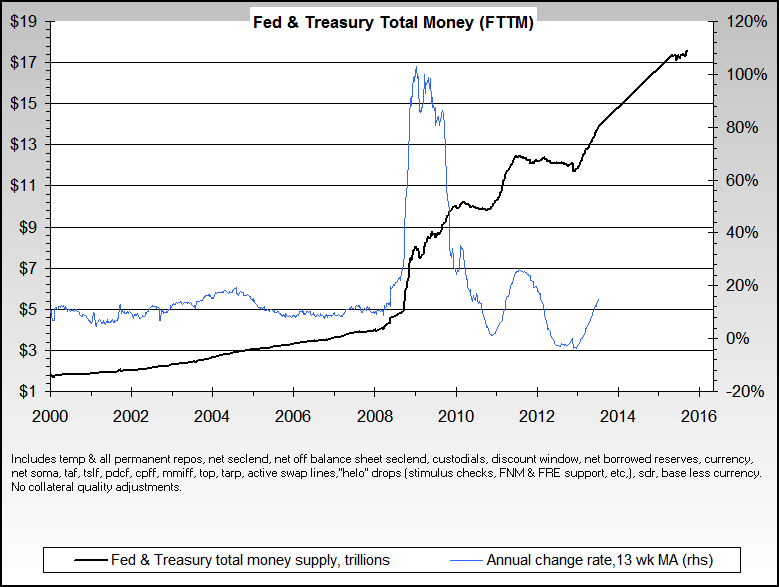

NEW YORK -- The Federal Reserve pumped a total $41 billion to the U.S. financial system in three separate operations Thursday, amounting to the largest injection of funds since the liquidity crisis took hold this summer.

The size of the injection may come as a surprise, coming just a day after the central bank delivered its second consecutive rate cut. Wednesday's 25 basis point cut -- which brings the target rate to 4.5% -- follows a half percentage-point drop in September, which was intended in part to help ease stubbornly high lending rates in the interbank market.

By EMILY BARRETT

November 1, 2007 11:55 a.m.

NEW YORK -- The Federal Reserve pumped a total $41 billion to the U.S. financial system in three separate operations Thursday, amounting to the largest injection of funds since the liquidity crisis took hold this summer.

The size of the injection may come as a surprise, coming just a day after the central bank delivered its second consecutive rate cut. Wednesday's 25 basis point cut -- which brings the target rate to 4.5% -- follows a half percentage-point drop in September, which was intended in part to help ease stubbornly high lending rates in the interbank market.

Thank goodness the credit crunch and liquidity issues are behind us. Explains the stock market tanking Thu.

Comment