Social Security: Yahoo Just Explains It Wrong

http://www.cepr.net/index.php/blogs/...lains-it-wrong

Graph inside that debunks any scare stories regarding US demographic changes in one handy visual. I can't retrieve the URL of the picture. Here's a transcript:

Changes in Living Standards 2012-2035 Due to Aging and Productivity Growth:

Aging: about -8%

1% Annual Productivity Growth: about 25%

1.5% Annual Productivity Growth: about 41%

2% Annual Productivity Growth: about 57%

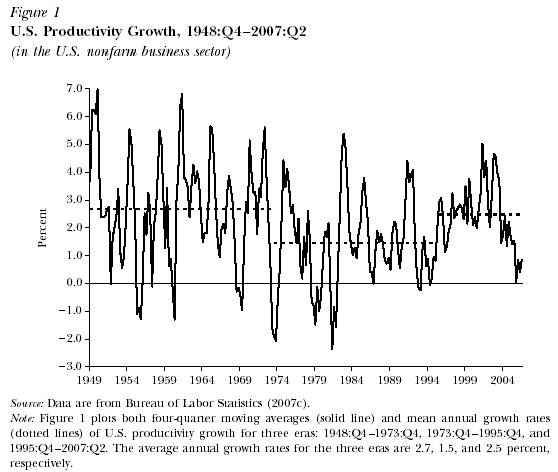

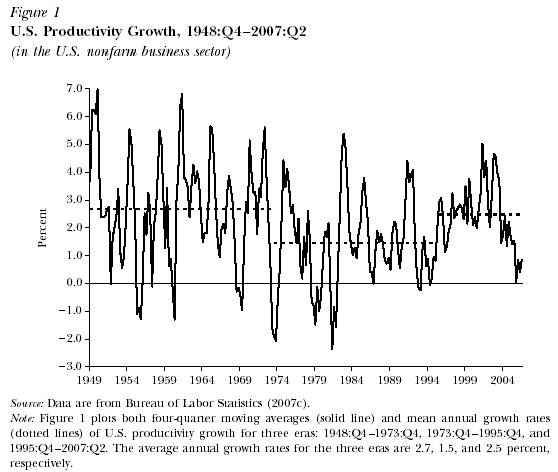

For reference, historical US productivity growth (well over 1.5% a year though most of post-war history):

http://theunbrokenwindow.com/2008/05...-productivity/

Also via one of the commenters:

http://www.skeptometrics.org/RealDemographics.html

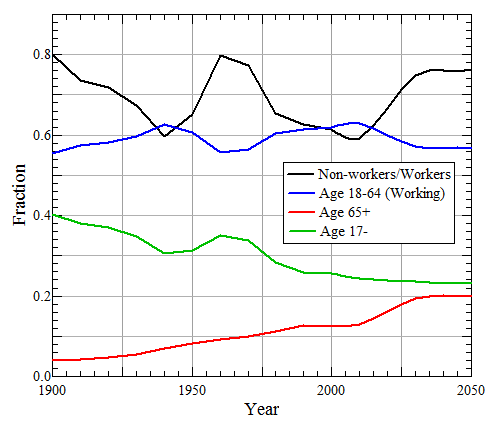

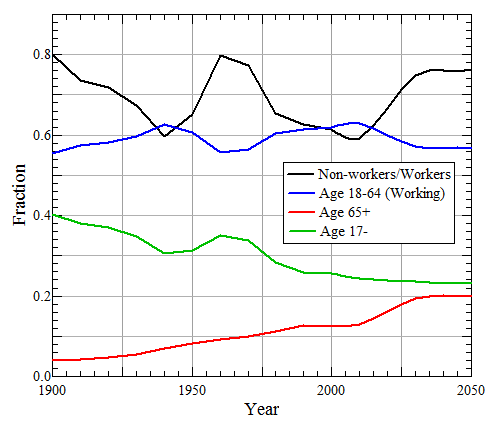

Ratio between workers and non-workers is more useful as a metric than ratio between workers and retirees.

http://www.cepr.net/index.php/blogs/...lains-it-wrong

Graph inside that debunks any scare stories regarding US demographic changes in one handy visual. I can't retrieve the URL of the picture. Here's a transcript:

Changes in Living Standards 2012-2035 Due to Aging and Productivity Growth:

Aging: about -8%

1% Annual Productivity Growth: about 25%

1.5% Annual Productivity Growth: about 41%

2% Annual Productivity Growth: about 57%

For reference, historical US productivity growth (well over 1.5% a year though most of post-war history):

http://theunbrokenwindow.com/2008/05...-productivity/

Also via one of the commenters:

http://www.skeptometrics.org/RealDemographics.html

Ratio between workers and non-workers is more useful as a metric than ratio between workers and retirees.

Comment