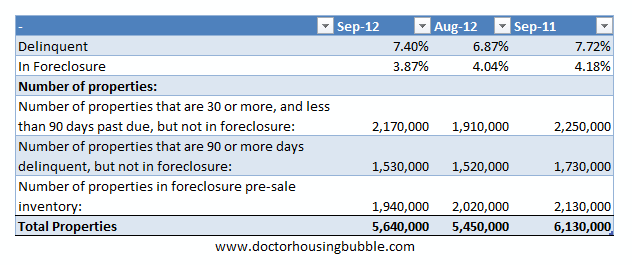

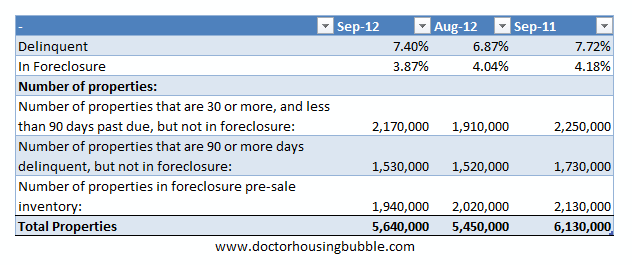

There was an interesting trend that emerged last month. 2012 has seen a reversal in the housing market yet this topic has been largely absent from all debates. The piece of data that was released addressed the still formidable foreclosure pipeline. Foreclosure starts saw a 260,000 increase from the previous month. It is expected that actual foreclosures are decreasing as the pipeline is being sold and as the economy recovers, this figure will slowly move down. Yet to see the foreclosure starts pipeline increase goes counter to everything we are hearing. What gives? There are a few reasons for this increase. We also need to explore the building side of the equation and how rents have been picking up in 2012. The flood of investors and Wall Street swarming into the rental market is a new experience. What are the trends for housing going into 2013?

Trend #1 – Foreclosure pipeline

It was surprising for some to see the earliest distressed pipeline bucket increase by 260,000 last month. The reason this was surprising is that there has been a steady decline in foreclosure starts for over a year. What this means is that we will be seeing more of these foreclosure hit the market in the next few months. Why the sudden jump? Banks are being calculating and want to sell into a positive trend for the housing market. They see big investors over bidding and buying properties, many times without viewing the place in lots, and pushing prices higher. Yet at some point markets do get saturated.

Economics would tell you that more rental supply on the market will likely push rents lower. Yet many are now buying to flip thus removing property for sale (until ready for the flip) or rent. This is one reason why rents and prices have been pushed up this year as well including the ultra-low mortgage rate. Yet this trend is not being driven by solid economic fundamentals. Certainly not to the level we are seeing with price increases. The trend to look for into 2013 is how much momentum this can carry going forward.

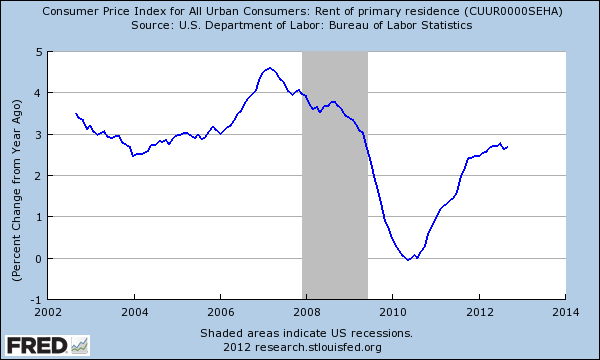

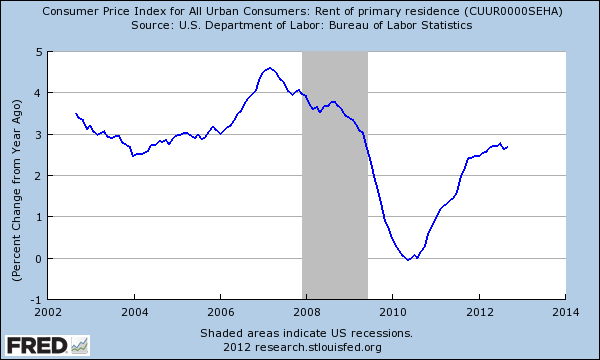

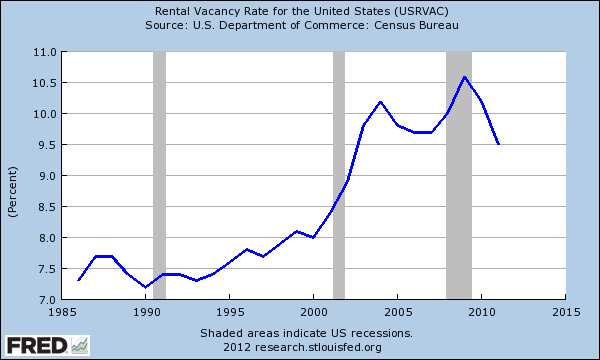

Trend #2 – Rental Market

Rental prices have seen a nice move up in 2012:

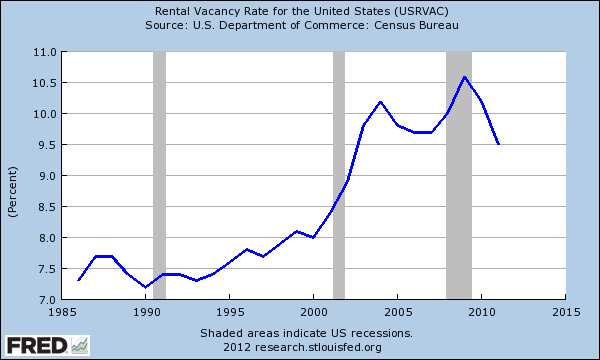

Too bad incomes have remained stagnant. That is the unfortunate reality with this push up in rentals. More household income is now being spent on rental housing. This usually impacts those least able to afford these price increases. The rental vacancy rate has also been falling:

Big pocket investors are diving into the market trying to chase yields. Yet being a landlord is an expensive business and probably will not scale well with single-family homes. The projections many of these investors have are too rosy and this usually is not seen until a few years of property ownership. We have to see if this trend continues going into the new year.

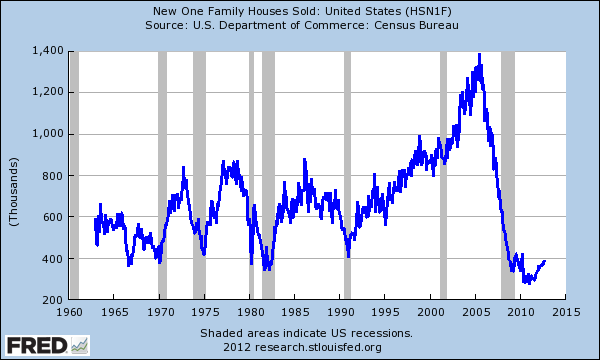

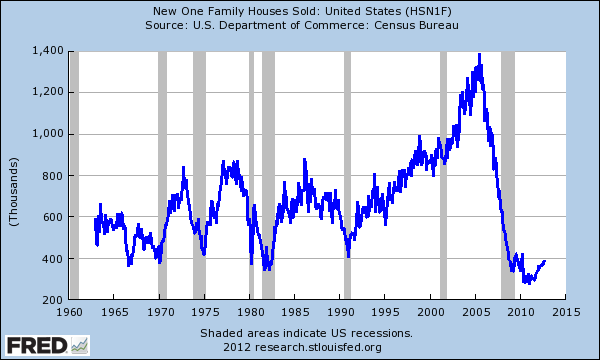

Trend #3 – New home sales?

New home sales are a better indicator of a real rebound in housing since this trend is likely to put people back to work in new home construction and shows demand exceeding current supply. This trend is barely visible:

There is a modest pickup in new home sales but it hardly registers on the chart above. The real demand from Wall Street and many funds is for cheaper properties. So far, we have yet to see this trend impact the new home sales market. We are well below the annual trends going back to 1960. All the activity at the moment is at the lower end plus a major part of the market (above 30 percent) is being dominated by investors.

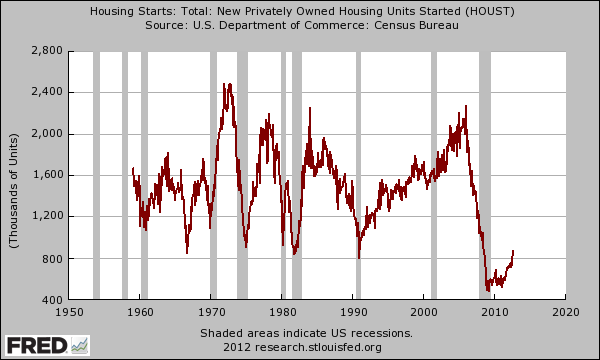

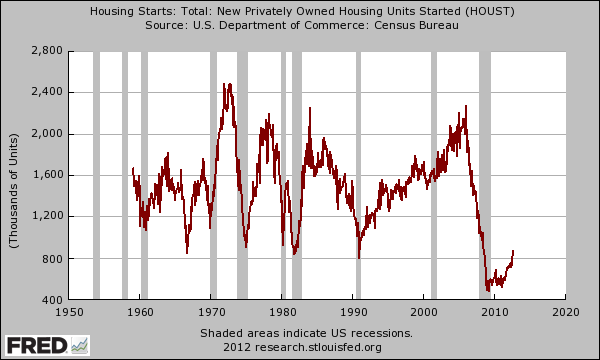

Housing starts are picking up but the trend is small:

This is another trend to keep our eyes on going into 2013.

Trend #4 – Expensive state housing

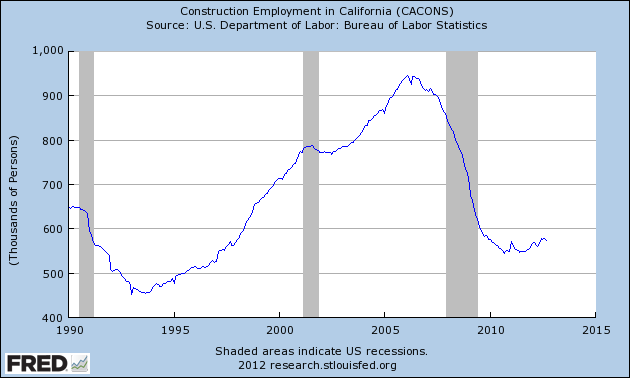

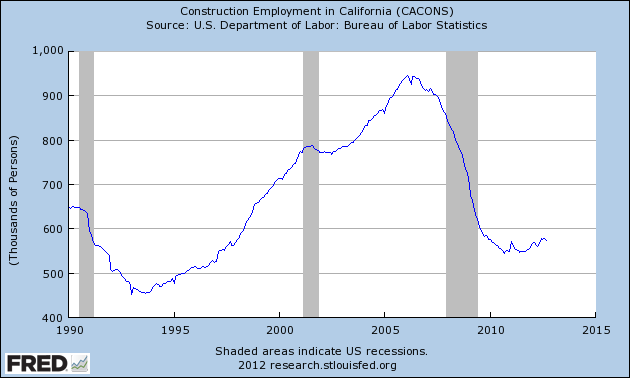

Some areas in California have seen no correction since the bubble burst. In fact, many homes are selling for prices above the previous peak price. Construction employment in California is still stuck in the 1990s:

And given the sales volume and the reality that all loans are government back, you can forget about the hundreds of thousands of jobs that were dependent on housing bubble 1.0. If housing is in such a good trend, why are we not seeing construction jobs pickup? The reason again is investor demand is for existing lower priced homes while flippers are targeting high priced markets for used homes. Construction employment would also see a boom if people were remodeling their homes but short-term investors are looking more for an in and out strategy.

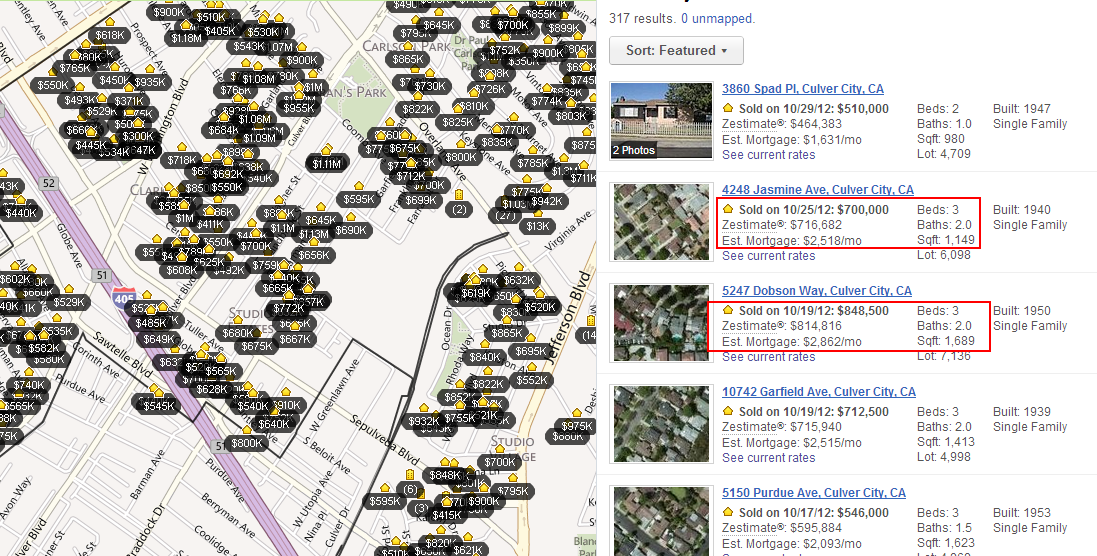

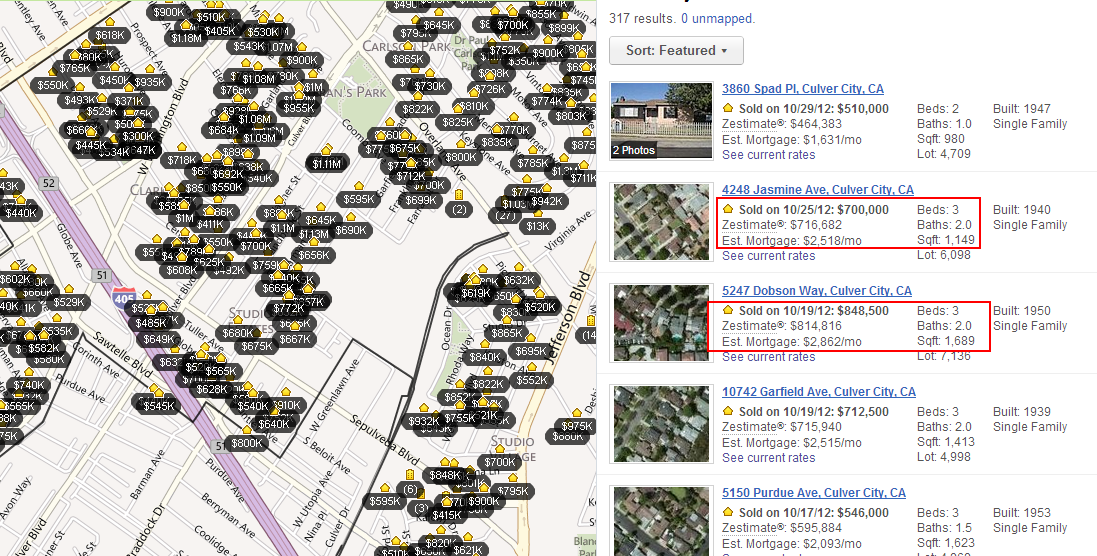

Take a look at some recent Culver City home sales:

$700,000 for a 1,100 square foot home? $848,000 for a 3 bedroom and 2 baths home? You be the judge and ask whether these are realistic prices. These prices are completely dependent on low interest rates.

Trend #5 – Prices going up

The Case Shiller Index turned positive in 2012. Will this trend continue into 2013? The large boost came about because of low interest rates. Ben Bernanke has already hinted that he will be leaving in 2014. We are already seeing the impact of low rates on the standard of living for many. As more and more seniors become dependent on fixed incomes (the majority rely on Social Security as their primary source of retirement income) how are they going to feel about their income being stuck while food and energy prices soar?

There is always a cost to taking actions like this. This was not organic growth. The Fed with QE3 is buying $40 billion in MBS each month and already has a balance sheet of over $2.8 trillion. This engineered growth will need to continue to keep the trend in housing going. The market is already addicted to sub-4% mortgage rates. The market is all government backed loans or big pocket investors.

The trend for prices moving up will depend largely on mortgage rates but also on how investors treat the rental market. Will many try to sell into the current market? We are already seeing this with flipping rates increasing.

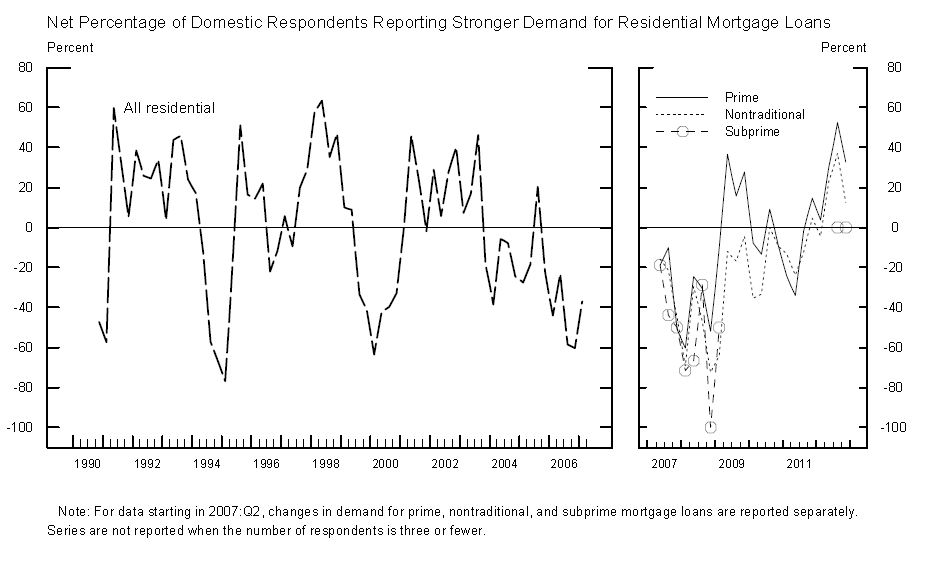

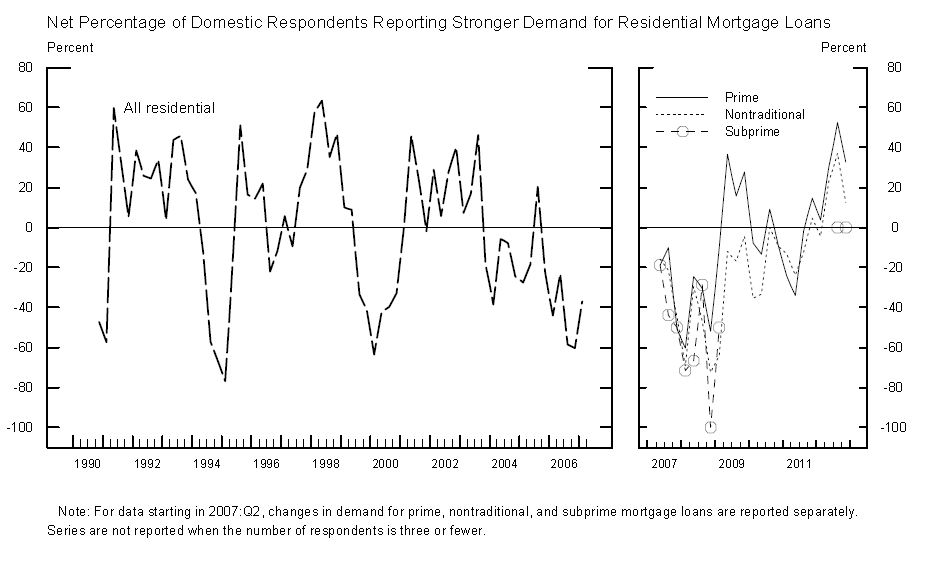

Trend #6 – Demand for loans

Demand for loans is high:

This push was driven by lower and lower rates. It is hard to envision rates moving any lower from here. Rates are already in a negative scenario courtesy of the Federal Reserve. At this point, we are simply conditioning the market to these low rates and the Fed will need to purchase $40 billion a month in MBS to maintain this path. The Fed has never gone this deep into their balance sheet expansion so those saying they know how this will play out have no historical reference point. The only other country that has gone this deep into quantitative easing is Japan and their economy isn’t so hot. They also entered these agreements to save their zombie banking sector.

Trend #7 – Remember history

There are some interesting stories in the news that are worth examining:

“ From Cincinnati.com. “The costs of the housing crisis remain steep in Greater Cincinnati and across the nation, yet the presidential candidates barely touch on the topic. ‘I find it absolutely remarkable,’ said Bill Faith, executive director of the Coalition on Homelessness and Housing in Ohio. ‘If you look at what triggered this whole financial market seize-up, it was housing.’”

This was an interesting trend. The entire election largely stayed away from housing even though it was at the core of our current financial crisis. Why? It is a losing proposition to discuss even while prices are going up. The big winners are large money investors and flippers. For the typical home owner, as we know many are still underwater so bringing this up in the debate might bring to surface some unwanted feelings. Plus, who is going to address the mortgage interest deduction for wealthy households?

“Since 2006, Greater Cincinnati homeowners have joined families nationwide who’ve lost $7 trillion in home equity. One in four local families – 111,397 in all – are ‘under water’ on their mortgages. That cripples their ability to refinance at today’s historically low rates or sell their homes, leaving them vulnerable to foreclosure if their finances take a downturn.”

This speaks to my previous point. Talking about housing brings back memories of the financial crisis. Many across the nation, especially in crucial swing states like Ohio or Florida are deep underwater.

The trends in 2012 largely came from the low rate interest environment and massive investor buying. Will this keep up into 2013? For the investor portion, we are already seeing many turn away from places like Arizona where the market is saturated. Time will tell but those trying to apply open market economic theory here are contending with a deux ex machina with the Fed and government policy.

This is a command control housing market being driven by policy, banking intervention, and the government.

http://www.doctorhousingbubble.com/7...ine-increases/

Trend #1 – Foreclosure pipeline

It was surprising for some to see the earliest distressed pipeline bucket increase by 260,000 last month. The reason this was surprising is that there has been a steady decline in foreclosure starts for over a year. What this means is that we will be seeing more of these foreclosure hit the market in the next few months. Why the sudden jump? Banks are being calculating and want to sell into a positive trend for the housing market. They see big investors over bidding and buying properties, many times without viewing the place in lots, and pushing prices higher. Yet at some point markets do get saturated.

Economics would tell you that more rental supply on the market will likely push rents lower. Yet many are now buying to flip thus removing property for sale (until ready for the flip) or rent. This is one reason why rents and prices have been pushed up this year as well including the ultra-low mortgage rate. Yet this trend is not being driven by solid economic fundamentals. Certainly not to the level we are seeing with price increases. The trend to look for into 2013 is how much momentum this can carry going forward.

Trend #2 – Rental Market

Rental prices have seen a nice move up in 2012:

Too bad incomes have remained stagnant. That is the unfortunate reality with this push up in rentals. More household income is now being spent on rental housing. This usually impacts those least able to afford these price increases. The rental vacancy rate has also been falling:

Big pocket investors are diving into the market trying to chase yields. Yet being a landlord is an expensive business and probably will not scale well with single-family homes. The projections many of these investors have are too rosy and this usually is not seen until a few years of property ownership. We have to see if this trend continues going into the new year.

Trend #3 – New home sales?

New home sales are a better indicator of a real rebound in housing since this trend is likely to put people back to work in new home construction and shows demand exceeding current supply. This trend is barely visible:

There is a modest pickup in new home sales but it hardly registers on the chart above. The real demand from Wall Street and many funds is for cheaper properties. So far, we have yet to see this trend impact the new home sales market. We are well below the annual trends going back to 1960. All the activity at the moment is at the lower end plus a major part of the market (above 30 percent) is being dominated by investors.

Housing starts are picking up but the trend is small:

This is another trend to keep our eyes on going into 2013.

Trend #4 – Expensive state housing

Some areas in California have seen no correction since the bubble burst. In fact, many homes are selling for prices above the previous peak price. Construction employment in California is still stuck in the 1990s:

And given the sales volume and the reality that all loans are government back, you can forget about the hundreds of thousands of jobs that were dependent on housing bubble 1.0. If housing is in such a good trend, why are we not seeing construction jobs pickup? The reason again is investor demand is for existing lower priced homes while flippers are targeting high priced markets for used homes. Construction employment would also see a boom if people were remodeling their homes but short-term investors are looking more for an in and out strategy.

Take a look at some recent Culver City home sales:

$700,000 for a 1,100 square foot home? $848,000 for a 3 bedroom and 2 baths home? You be the judge and ask whether these are realistic prices. These prices are completely dependent on low interest rates.

Trend #5 – Prices going up

The Case Shiller Index turned positive in 2012. Will this trend continue into 2013? The large boost came about because of low interest rates. Ben Bernanke has already hinted that he will be leaving in 2014. We are already seeing the impact of low rates on the standard of living for many. As more and more seniors become dependent on fixed incomes (the majority rely on Social Security as their primary source of retirement income) how are they going to feel about their income being stuck while food and energy prices soar?

There is always a cost to taking actions like this. This was not organic growth. The Fed with QE3 is buying $40 billion in MBS each month and already has a balance sheet of over $2.8 trillion. This engineered growth will need to continue to keep the trend in housing going. The market is already addicted to sub-4% mortgage rates. The market is all government backed loans or big pocket investors.

The trend for prices moving up will depend largely on mortgage rates but also on how investors treat the rental market. Will many try to sell into the current market? We are already seeing this with flipping rates increasing.

Trend #6 – Demand for loans

Demand for loans is high:

This push was driven by lower and lower rates. It is hard to envision rates moving any lower from here. Rates are already in a negative scenario courtesy of the Federal Reserve. At this point, we are simply conditioning the market to these low rates and the Fed will need to purchase $40 billion a month in MBS to maintain this path. The Fed has never gone this deep into their balance sheet expansion so those saying they know how this will play out have no historical reference point. The only other country that has gone this deep into quantitative easing is Japan and their economy isn’t so hot. They also entered these agreements to save their zombie banking sector.

Trend #7 – Remember history

There are some interesting stories in the news that are worth examining:

“ From Cincinnati.com. “The costs of the housing crisis remain steep in Greater Cincinnati and across the nation, yet the presidential candidates barely touch on the topic. ‘I find it absolutely remarkable,’ said Bill Faith, executive director of the Coalition on Homelessness and Housing in Ohio. ‘If you look at what triggered this whole financial market seize-up, it was housing.’”

This was an interesting trend. The entire election largely stayed away from housing even though it was at the core of our current financial crisis. Why? It is a losing proposition to discuss even while prices are going up. The big winners are large money investors and flippers. For the typical home owner, as we know many are still underwater so bringing this up in the debate might bring to surface some unwanted feelings. Plus, who is going to address the mortgage interest deduction for wealthy households?

“Since 2006, Greater Cincinnati homeowners have joined families nationwide who’ve lost $7 trillion in home equity. One in four local families – 111,397 in all – are ‘under water’ on their mortgages. That cripples their ability to refinance at today’s historically low rates or sell their homes, leaving them vulnerable to foreclosure if their finances take a downturn.”

This speaks to my previous point. Talking about housing brings back memories of the financial crisis. Many across the nation, especially in crucial swing states like Ohio or Florida are deep underwater.

“Roger Davis of Fairfield, a retired police officer, is one of millions of Americans looking for answers. He has pinched pennies to keep up payments on the house he and his wife bought five years ago. Their home has lost so much value in the years since that the family is now underwater. Davis is disgusted that his bank hasn’t met him halfway by allowing him to refinance. ‘People are walking away from their homes – we’re not doing that, and we’re getting penalized,’ Davis said. ‘We’re trying to be good Americans.’”

This is another important point. I keep hearing about well off households in California refinancing giant loans while in many other states, banks simply choose to ignore those homeowners. This kind of selective assistance is a reason why longer-term I see the mortgage interest deduction being cut back significantly for wealthier households and this will have a major impact on a state like California. By the way, the majority of homeowners in the US don’t even itemize so the deduction doesn’t even help but of course the lobbying arm of the industry will try to complicate the facts.The trends in 2012 largely came from the low rate interest environment and massive investor buying. Will this keep up into 2013? For the investor portion, we are already seeing many turn away from places like Arizona where the market is saturated. Time will tell but those trying to apply open market economic theory here are contending with a deux ex machina with the Fed and government policy.

This is a command control housing market being driven by policy, banking intervention, and the government.

http://www.doctorhousingbubble.com/7...ine-increases/

Comment