Student-Loan Borrowers Average $26,500 in Debt

By TAMAR LEWIN

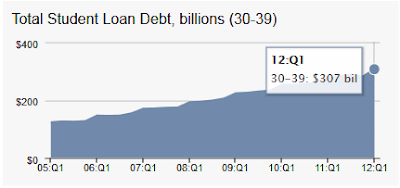

The average student-loan debt of borrowers in the college class of 2011 rose to about $26,500, a 5 percent increase from about $25,350 the previous year, according to a report by the Institute for College Access and Success’s Project on Student Debt.

The project said that about two-thirds of those who earned bachelor’s degrees last year had loans. About one-fifth of the debt was from private student loans, which have fewer consumer protections and repayment options than federal loans.

Although federal data show that graduates of for-profit colleges are far more likely to borrow, and borrow more, than those who attend other types of colleges, the report’s findings focus only on public and nonprofit colleges, because only nine for-profit colleges (less than 2 percent) reported the necessary figures.

“Twelve percent of the colleges that reported debt data for 2010 didn’t report for 2011, and virtually no for-profit colleges reported at all.” “The need for federal collection of key debt information at all colleges could not be more clear,” Mr. Reed added.

http://www.nytimes.com/2012/10/18/ed...gewanted=print

right on time . . . the Phoenix Express . . . Toot, toot

University of Phoenix to Shutter 115 Locations

By TAMAR LEWIN

The University of Phoenix, the nation’s largest for-profit university, is closing 115 of its brick-and-mortar locations, including 25 main campuses and 90 smaller satellite learning centers. The closings will affect some 13,000 students, about 4 percent of its student body of 328,000.

It is also laying off about 800 employees out of a staff of 17,000, according to Mark Brenner, senior vice president for communications at the Apollo Group, which owns the university.

After the closings, which are to be completed next year, the University of Phoenix will be left with a nationwide network of 112 locations and a physical presence in 36 states, the District of Columbia and Puerto Rico.

Apollo stock closed Wednesday at $21.40, down $6.09, a 22 percent decline.

Enrollments at the University of Phoenix and in the for-profit sector over all have been declining in the last two years, partly because of growing competition from other online providers, including nonprofit and public universities, and a steady drumroll of negative publicity about the sector’s recruiting abuses, low graduation rates and high default rates.

Late last month, Kaplan Higher Education, a division of the Washington Post Company, announced that it was closing nine of its campuses and consolidating four others into nearby locations. The company did not give a reason, but in an August filing with the Securities and Exchange Commission it disclosed that an accrediting commission had warned that its campuses in Baltimore, Indianapolis and Dayton could lose their accreditation — and with it, eligibility for the federal student aid that makes up more than 80 percent of Kaplan’s revenues — for failure to meet student achievement requirements.

As the negative publicity about for-profits mounted — including many charges that the schools enrolled students who had almost no chance of succeeding, to get their federal student aid — both Kaplan and the University of Phoenix announced new programs, offering some form of free trial, to ensure that they enrolled only students who had a reasonable likelihood of success. Those programs cut substantially into their enrollment numbers.

sure sounds like the old subprime mortgage scam redux . . . albeit streamlined. No waiting for a bailout - the $$ comes directly from the taxpayer to the 'college'. Sweet . . . .

Question for the 'tulipers - is FIRE missing out gilding the lily on student debt by not 'temporarily' privatizing it into CDOs, rated as simply as A-B-C . . . .

http://www.nytimes.com/2012/10/18/ed...gewanted=print

By TAMAR LEWIN

The average student-loan debt of borrowers in the college class of 2011 rose to about $26,500, a 5 percent increase from about $25,350 the previous year, according to a report by the Institute for College Access and Success’s Project on Student Debt.

The project said that about two-thirds of those who earned bachelor’s degrees last year had loans. About one-fifth of the debt was from private student loans, which have fewer consumer protections and repayment options than federal loans.

Although federal data show that graduates of for-profit colleges are far more likely to borrow, and borrow more, than those who attend other types of colleges, the report’s findings focus only on public and nonprofit colleges, because only nine for-profit colleges (less than 2 percent) reported the necessary figures.

“Twelve percent of the colleges that reported debt data for 2010 didn’t report for 2011, and virtually no for-profit colleges reported at all.” “The need for federal collection of key debt information at all colleges could not be more clear,” Mr. Reed added.

http://www.nytimes.com/2012/10/18/ed...gewanted=print

right on time . . . the Phoenix Express . . . Toot, toot

University of Phoenix to Shutter 115 Locations

By TAMAR LEWIN

The University of Phoenix, the nation’s largest for-profit university, is closing 115 of its brick-and-mortar locations, including 25 main campuses and 90 smaller satellite learning centers. The closings will affect some 13,000 students, about 4 percent of its student body of 328,000.

It is also laying off about 800 employees out of a staff of 17,000, according to Mark Brenner, senior vice president for communications at the Apollo Group, which owns the university.

After the closings, which are to be completed next year, the University of Phoenix will be left with a nationwide network of 112 locations and a physical presence in 36 states, the District of Columbia and Puerto Rico.

Apollo stock closed Wednesday at $21.40, down $6.09, a 22 percent decline.

Enrollments at the University of Phoenix and in the for-profit sector over all have been declining in the last two years, partly because of growing competition from other online providers, including nonprofit and public universities, and a steady drumroll of negative publicity about the sector’s recruiting abuses, low graduation rates and high default rates.

Late last month, Kaplan Higher Education, a division of the Washington Post Company, announced that it was closing nine of its campuses and consolidating four others into nearby locations. The company did not give a reason, but in an August filing with the Securities and Exchange Commission it disclosed that an accrediting commission had warned that its campuses in Baltimore, Indianapolis and Dayton could lose their accreditation — and with it, eligibility for the federal student aid that makes up more than 80 percent of Kaplan’s revenues — for failure to meet student achievement requirements.

As the negative publicity about for-profits mounted — including many charges that the schools enrolled students who had almost no chance of succeeding, to get their federal student aid — both Kaplan and the University of Phoenix announced new programs, offering some form of free trial, to ensure that they enrolled only students who had a reasonable likelihood of success. Those programs cut substantially into their enrollment numbers.

sure sounds like the old subprime mortgage scam redux . . . albeit streamlined. No waiting for a bailout - the $$ comes directly from the taxpayer to the 'college'. Sweet . . . .

Question for the 'tulipers - is FIRE missing out gilding the lily on student debt by not 'temporarily' privatizing it into CDOs, rated as simply as A-B-C . . . .

http://www.nytimes.com/2012/10/18/ed...gewanted=print

Comment