Everyone talks about the China bubble. But the most extreme bubble economy is not China, neither was it Japan.

http://seekingalpha.com/article/9050...y-is-maxed-out

http://seekingalpha.com/article/9050...y-is-maxed-out

Singapore's Economy Is Maxed Out October 4, 2012 | 18 comments | about: EWS, includes: EWSS

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

As a former runner, I know that the best way to reach your peak performance is to run as many miles per week as you can without getting injured. I clocked a 5:00 minute mile in high school while running about 40-45 miles per week. Two summers ago, at a music venue near where I live, I met a guy who I thought looked like a legendary runner, Steve Prefontaine. I went up to him and asked him if he knew who Steve Prefontaine was and he said, "yeah." I then told him I thought he looked like him. He replied that he is a runner, opened up his button down shirt and showed his Cornell Track T-Shirt. It turned out, this fellow was Bruce Hyde, who only a few years back ran the mile in 3:55. I was stunned at my prejudice. I then asked how many miles per week he was running when he ran that time and he said, "144."

144 miles per week, for a miler, is basically maxing out. It's an incredible feat in itself. Singaporeans may not run 140 miles per week, but on average, they work over 2400 hours per year.

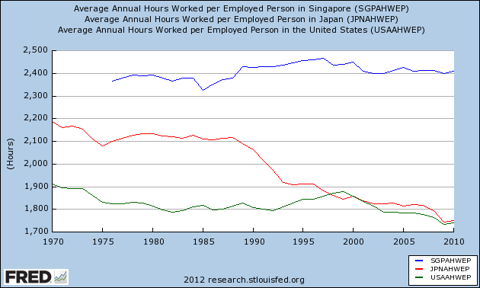

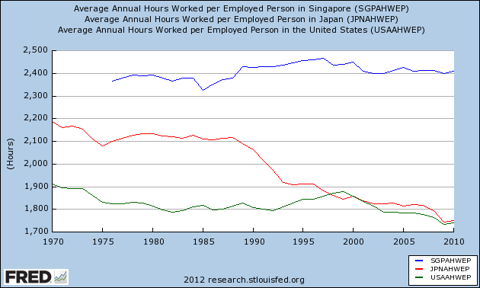

This chart below shows average annual hours worked per employed person in Singapore (Blue), Japan (Red) and the U.S. (Green):

(click to enlarge)

Singaporeans work on average, 650 more hours per year than both the U.S. and Japanese workers.

Singapore, it needs to be noted, is a very small country. The total population is 5,312,400 people in a land area of only 714.3 square kilometers. The population density is 7,257 people per square kilometer. In NYC, the population density is 10,194 people per square kilometer.

So Singapore is like one big city.

In terms of total annual hours worked, it seems 2400 is the maximum and Singapore is maxed out on that juncture.

Another factor in measuring work in a country is the percent of the population that is employed in a job.

Here is a chart showing the percent of the population that is employed:

(click to enlarge)

About 60% of the total population of Singapore is employed Vs. under 50% for Japan and about 45% for the U.S. as of 2010.

Neither the U.S. or Japan have ever seen more than 54% of our total population employed in a job. So again, Singapore is maxed out in terms of the total percent of its population being employed.

Not surprisingly, real GDP per capita in Singapore is now higher than that of the U.S. and Japan.

(click to enlarge)

Singapore is like Bruce Hyde, running 140 miles a week and thus putting out awesome times. But in Singapore's case, it's GDP per capita that is the "time" we are measuring here.

So when Bruce Hyde is running 144 miles per week and clocks a 3:55 mile, how does he improve from there?

When 60% of the population is employed and on average, each of those employed is working 2400 hours a year, how do you improve from there?

We have a precedent. In 1990, Japan was the economic miracle country. The Nikkei was at an all-time high and in the movie, Back to the Future Part II (1989), when Marty McFly goes into the future, he finds his future boss was Japanese. Didn't quite work out that way and the Japanese stock market index has been falling for the most part ever since then as well.

One measure that correlates well to the long-term drop in the Japanese stock market is the total number of hours worked in the country. This is had by taking the total number of employees in a given year and multiplying by the average annual hours worked.

Since both the average annual hours worked per week in Japan has been declining since 1990 and the percent of the population that is employed in Japan has been falling since 1990 as well, this has contributed to a relentless decline in total hours worked in Japan.

Below is a chart of the total hours worked in Japan since 1970:

(click to enlarge)

Here is a chart of the Nikkei 225 since 1984:

(click to enlarge)

Demographics plays a big role in the percent of the population that is employed.

Here is the age demographics of Singapore:

The bulk of Singapore's population is of working age, which gives reason to the 60% of it being employed. This chart above suggests a wave of folks in their 50s will be coming to retirement age soon likely to bring down the percent of the population that is employed.

Population growth would help bring about more hours worked in the aggregate economy, but the population density is already close to that of NYC. At the same time, Singapore's birth rate of just 7.72 births per 1,000 population in 2011 ranks it the lowest of 222 nations measured.

It's actually a demographic time bomb. Today, there are 6.3 working age Singaporeans for every senior citizen, by 2030, it'll be 2:1.

It looks to me like Singapore is mightily close to what Japan was in 1990 and could be in for decades of lower total aggregate hours worked, which will mean very low GDP growth that will mostly come from gains in productivity.

This may well pose a risk to investments in Singapore's stock markets.

iShares MSCI Singapore ETF (EWS) and iShares MSCI Singapore Small Cap Index Fund (EWSS) may find they share the same fate as Japan's stock markets. While I would not call them bubbles like the Nikkei was in 1990, I do have low expectations for growth. While I don't recommend shorting it, I simply wouldn't want to own it.

Here is a chart of iShares MSCI Singapore :

(click to enlarge)

In essence, be careful when investing for growth in the guy when he's running 140 miles per week and the mile in a time of 3:55. Look to invest in the guy who's running 20 miles a week and a mile in just 7:00. That guy has plenty of potential for growth.

This article was sent to 421 people who get email alerts on EWS.

Get email alerts on EWS

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

As a former runner, I know that the best way to reach your peak performance is to run as many miles per week as you can without getting injured. I clocked a 5:00 minute mile in high school while running about 40-45 miles per week. Two summers ago, at a music venue near where I live, I met a guy who I thought looked like a legendary runner, Steve Prefontaine. I went up to him and asked him if he knew who Steve Prefontaine was and he said, "yeah." I then told him I thought he looked like him. He replied that he is a runner, opened up his button down shirt and showed his Cornell Track T-Shirt. It turned out, this fellow was Bruce Hyde, who only a few years back ran the mile in 3:55. I was stunned at my prejudice. I then asked how many miles per week he was running when he ran that time and he said, "144."

144 miles per week, for a miler, is basically maxing out. It's an incredible feat in itself. Singaporeans may not run 140 miles per week, but on average, they work over 2400 hours per year.

This chart below shows average annual hours worked per employed person in Singapore (Blue), Japan (Red) and the U.S. (Green):

(click to enlarge)

Singaporeans work on average, 650 more hours per year than both the U.S. and Japanese workers.

Singapore, it needs to be noted, is a very small country. The total population is 5,312,400 people in a land area of only 714.3 square kilometers. The population density is 7,257 people per square kilometer. In NYC, the population density is 10,194 people per square kilometer.

So Singapore is like one big city.

In terms of total annual hours worked, it seems 2400 is the maximum and Singapore is maxed out on that juncture.

Another factor in measuring work in a country is the percent of the population that is employed in a job.

Here is a chart showing the percent of the population that is employed:

(click to enlarge)

About 60% of the total population of Singapore is employed Vs. under 50% for Japan and about 45% for the U.S. as of 2010.

Neither the U.S. or Japan have ever seen more than 54% of our total population employed in a job. So again, Singapore is maxed out in terms of the total percent of its population being employed.

Not surprisingly, real GDP per capita in Singapore is now higher than that of the U.S. and Japan.

(click to enlarge)

Singapore is like Bruce Hyde, running 140 miles a week and thus putting out awesome times. But in Singapore's case, it's GDP per capita that is the "time" we are measuring here.

So when Bruce Hyde is running 144 miles per week and clocks a 3:55 mile, how does he improve from there?

When 60% of the population is employed and on average, each of those employed is working 2400 hours a year, how do you improve from there?

We have a precedent. In 1990, Japan was the economic miracle country. The Nikkei was at an all-time high and in the movie, Back to the Future Part II (1989), when Marty McFly goes into the future, he finds his future boss was Japanese. Didn't quite work out that way and the Japanese stock market index has been falling for the most part ever since then as well.

One measure that correlates well to the long-term drop in the Japanese stock market is the total number of hours worked in the country. This is had by taking the total number of employees in a given year and multiplying by the average annual hours worked.

Since both the average annual hours worked per week in Japan has been declining since 1990 and the percent of the population that is employed in Japan has been falling since 1990 as well, this has contributed to a relentless decline in total hours worked in Japan.

Below is a chart of the total hours worked in Japan since 1970:

(click to enlarge)

Here is a chart of the Nikkei 225 since 1984:

(click to enlarge)

Demographics plays a big role in the percent of the population that is employed.

Here is the age demographics of Singapore:

The bulk of Singapore's population is of working age, which gives reason to the 60% of it being employed. This chart above suggests a wave of folks in their 50s will be coming to retirement age soon likely to bring down the percent of the population that is employed.

Population growth would help bring about more hours worked in the aggregate economy, but the population density is already close to that of NYC. At the same time, Singapore's birth rate of just 7.72 births per 1,000 population in 2011 ranks it the lowest of 222 nations measured.

It's actually a demographic time bomb. Today, there are 6.3 working age Singaporeans for every senior citizen, by 2030, it'll be 2:1.

It looks to me like Singapore is mightily close to what Japan was in 1990 and could be in for decades of lower total aggregate hours worked, which will mean very low GDP growth that will mostly come from gains in productivity.

This may well pose a risk to investments in Singapore's stock markets.

iShares MSCI Singapore ETF (EWS) and iShares MSCI Singapore Small Cap Index Fund (EWSS) may find they share the same fate as Japan's stock markets. While I would not call them bubbles like the Nikkei was in 1990, I do have low expectations for growth. While I don't recommend shorting it, I simply wouldn't want to own it.

Here is a chart of iShares MSCI Singapore :

(click to enlarge)

In essence, be careful when investing for growth in the guy when he's running 140 miles per week and the mile in a time of 3:55. Look to invest in the guy who's running 20 miles a week and a mile in just 7:00. That guy has plenty of potential for growth.

This article was sent to 421 people who get email alerts on EWS.

Get email alerts on EWS