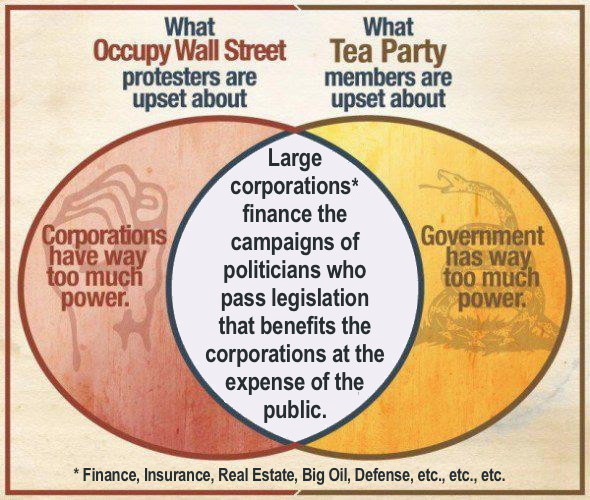

Re: It's the Government! No, it's the Corporations! No, it's the Government!

precisely.

http://www.opensecrets.org/pfds/index.php is illuminating, as is:

MF Global Saga Spotlights Crony Capitalism and Washington-Wall Street Revolving Door

but here's the most damning evidence: (from just last fall)

and more:

old news, yeah - but still as pertinent today as it was a year ago and yet we hear NOTHING about it THIS YEAR???

and on and on and ON:

right...

esp when their up for re-election.

so when anybody tells me that TERM LIMITS FOR CONGRESS isnt at least ONE way, if not The Best way to begin the process to fix the mess THE BOZOS OF THE BELTWAY HAVE CREATED ??

IMHO - they are PART OF THE PROBLEM and merely apologists for the status quo and continuation of the BLATANT AND IN YOUR FACE CORRUPTION that passes for 'governance'.

you can blame wall st all ya want, but its the political aristocracy that enables them!

TERM LIMITS FOR CONGRESS, NOW!

its really quite simply The Only Hope for REAL change we can believe in.

Originally posted by flintlock

View Post

http://www.opensecrets.org/pfds/index.php is illuminating, as is:

MF Global Saga Spotlights Crony Capitalism and Washington-Wall Street Revolving Door

but here's the most damning evidence: (from just last fall)

Former Alaska governor and GOP vice-presidential candidate Sarah Palin blasted rampant corruption in the marbled halls of Congress Friday, calling it an “endemic problem” affecting both parties.

“The only solution to entrenched corruption is sudden and relentless reform,” she wrote.

Palin’s remarks came in an op-ed column in The Wall Street Journal, in response to revelations this week that Congress has exempted itself from the prohibitions against insider trading that all other Americans are subject to.

Under current law, members of Congress are free to profit off of equity swings tied to pending legislative actions decisions they are privy to as members of Congress.

The Center for Responsive Politics has determined that 47 percent of all members of Congress are millionaires. This compares to about 1 percent of the population generally.

“How do politicians who arrive in Washington, D.C. as men and women of modest means leave as millionaires?” Palin asks in her column. “How do they miraculously accumulate wealth at a rate faster than the rest of us? How do politicians’ stock portfolios outperform even the best hedge fund managers?”

Palin’s answer: “Politicians derive power from the authority of their office and their access to our tax dollars, and they use that power to enrich and shield themselves.”

Special exemptions that Congress has written for itself to insider trading and other laws have come under intense scrutiny this week, in part due to the illuminating new book by Hoover fellow Peter Schweizer titled: “Throw Them All Out.”

“The very idea that politicians trade stocks while they are considering major bills comes as a shock to many people, but it is standard practice in Washington,” Schweizer writes in the book. As to Palin’s WSJ column, he tells Newsmax: “Governor Palin understands how Washington works and the battle that needs to be fought.”

A CBS 60 Minutes expose on Sunday highlighted trades made by former House Speaker Nancy Pelosi and by Spencer Bachus, R-Ala., chairman of the House Financial Services committee.

Schweizer said Bachus received private briefings in 2008 from the Treasury Secretary and the Chairman of the Federal Reserve warning that the financial system was about to implode. He then made a series of investments that would generate profits as the market tanked. Bachus disputes Schweizer’s allegations, however.

Pelosi, a Democrat from San Francisco, also has denied making any inappropriate investments. Sources say Pelosi and husband Paul, an investor, bought stock in Visa when the House was considering a bill that would limit credit card companies’ ability to levy fees on consumers -- a significant source of their revenues. In response, Pelosi has touted her record as a champion of pro-consumer reforms.

Among the “money-making opportunities” for members of Congress Palin exposes in her column:

Insider Trading – using government information not available to the public at large to predict which companies’ stocks will rise or fall.

IPO Gifts – While it is illegal for members of Congress to accept cash gifts from interested parties, there is no restriction on their being offered initial public offerings in firms, which can be very profitable.

Self-Serving Earmarks – Some members of Congress have submitted infrastructure earmark requests for their districts that appeared to increase their value of their real estate holdings.

Encouraging Campaign Donations – Palin calls this “subtly extorting campaign donations through the threat of legislation unfavorable to an industry.”

Palin wrote that the revelations don’t surprise her, owing to her experience fighting cronyism as governor of Alaska. She said that Congress has largely exempted itself from compliance with the Freedom of Information Act used to obtain public documents. Also, unlike other government officials, members of Congress can punish staff members who expose abuses with impunity, because they aren’t subject to whistleblower laws, she said.

Palin called for “real transparency."

“From now on, laws that apply to the private sector must apply to Congress, including whistleblower, conflict-of-interest, and insider trading laws,” wrote Palin. “Trading on nonpublic government information should be illegal both for those who pass on the information and those who trade on it.”

On Tuesday, GOP Sen. Scott Brown of Massachusetts filed a bill to make it illegal for members of Congress or their staffs to disclose information or make investments related to pending legislation based on nonpublic government knowledge.

“The only solution to entrenched corruption is sudden and relentless reform,” she wrote.

Palin’s remarks came in an op-ed column in The Wall Street Journal, in response to revelations this week that Congress has exempted itself from the prohibitions against insider trading that all other Americans are subject to.

Under current law, members of Congress are free to profit off of equity swings tied to pending legislative actions decisions they are privy to as members of Congress.

The Center for Responsive Politics has determined that 47 percent of all members of Congress are millionaires. This compares to about 1 percent of the population generally.

“How do politicians who arrive in Washington, D.C. as men and women of modest means leave as millionaires?” Palin asks in her column. “How do they miraculously accumulate wealth at a rate faster than the rest of us? How do politicians’ stock portfolios outperform even the best hedge fund managers?”

Palin’s answer: “Politicians derive power from the authority of their office and their access to our tax dollars, and they use that power to enrich and shield themselves.”

Special exemptions that Congress has written for itself to insider trading and other laws have come under intense scrutiny this week, in part due to the illuminating new book by Hoover fellow Peter Schweizer titled: “Throw Them All Out.”

“The very idea that politicians trade stocks while they are considering major bills comes as a shock to many people, but it is standard practice in Washington,” Schweizer writes in the book. As to Palin’s WSJ column, he tells Newsmax: “Governor Palin understands how Washington works and the battle that needs to be fought.”

A CBS 60 Minutes expose on Sunday highlighted trades made by former House Speaker Nancy Pelosi and by Spencer Bachus, R-Ala., chairman of the House Financial Services committee.

Schweizer said Bachus received private briefings in 2008 from the Treasury Secretary and the Chairman of the Federal Reserve warning that the financial system was about to implode. He then made a series of investments that would generate profits as the market tanked. Bachus disputes Schweizer’s allegations, however.

Pelosi, a Democrat from San Francisco, also has denied making any inappropriate investments. Sources say Pelosi and husband Paul, an investor, bought stock in Visa when the House was considering a bill that would limit credit card companies’ ability to levy fees on consumers -- a significant source of their revenues. In response, Pelosi has touted her record as a champion of pro-consumer reforms.

Among the “money-making opportunities” for members of Congress Palin exposes in her column:

Insider Trading – using government information not available to the public at large to predict which companies’ stocks will rise or fall.

IPO Gifts – While it is illegal for members of Congress to accept cash gifts from interested parties, there is no restriction on their being offered initial public offerings in firms, which can be very profitable.

Self-Serving Earmarks – Some members of Congress have submitted infrastructure earmark requests for their districts that appeared to increase their value of their real estate holdings.

Encouraging Campaign Donations – Palin calls this “subtly extorting campaign donations through the threat of legislation unfavorable to an industry.”

Palin wrote that the revelations don’t surprise her, owing to her experience fighting cronyism as governor of Alaska. She said that Congress has largely exempted itself from compliance with the Freedom of Information Act used to obtain public documents. Also, unlike other government officials, members of Congress can punish staff members who expose abuses with impunity, because they aren’t subject to whistleblower laws, she said.

Palin called for “real transparency."

“From now on, laws that apply to the private sector must apply to Congress, including whistleblower, conflict-of-interest, and insider trading laws,” wrote Palin. “Trading on nonpublic government information should be illegal both for those who pass on the information and those who trade on it.”

On Tuesday, GOP Sen. Scott Brown of Massachusetts filed a bill to make it illegal for members of Congress or their staffs to disclose information or make investments related to pending legislation based on nonpublic government knowledge.

old news, yeah - but still as pertinent today as it was a year ago and yet we hear NOTHING about it THIS YEAR???

references Peter Schweizer's book Throw Them All Out.

We're all born wanting the freedom to imagine a better and more beautiful future. Modern America has become a place so drearily confining and predictable that it chokes the life out of that built-in desire. Everything from our pop culture to our economy to our politics feels oppressive and unresponsive. We see 10 million commercials a day, and every day is the same life-killing chase for money, money and more money; the only thing that changes from minute to minute is that every tick of the clock brings with it another space-age vendor dreaming up some new way to try to sell you something or reach into your pocket.

The relentless sameness of the two-party political system is beginning to feel like a Jacob's Ladder nightmare with no end; we're entering another turn on the four-year merry-go-round, and the thought of having to try to get excited about yet another minor quadrennial shift in the direction of one or the other pole of alienating corporate full-of-shitness is enough to make anyone want to smash his own hand flat with a hammer...

According to a new book called Throw Them All Out by Peter Schweizer, as relayed by Dave Weigel at Slate, Rep. Bachus made more than 40 trades in his personal account in the summer and fall of 2008, in the early months of the financial crisis.

Weigel quotes from Schweizer's book. On the evening of September 18, at 7 p.m., Bachus received [a] private briefing for congressional leaders by Hank Paulson and Federal Reserve Bank Chairman Ben Bernanke about the current state of the economy. They sat around a long table in the office of Nancy Pelosi, then the Speaker of the House. These briefings were secretive. Often, cell phones and Blackberrys had to be surrendered outside the room to avoid leaks.

As Paulson recounts, “Ben [Bernanke] emphasized how the financial crisis could spill into the real economy. As stocks dropped perhaps a further 20 percent, General Motors would go bankrupt, and unemployment would rise . . . if we did nothing.” The members of Congress around the table were, in Paulson’s words, “ashen-faced.”

Bernanke continued, “It is a matter of days before there is a meltdown in the global financial system.” Bachus was among those who spoke. According to Paulson, he suggested recapitalizing the banks by buying shares.

The meeting broke up. The next day, September 19, Congressman Bachus bought contract options on Proshares Ultra-Short QQQ, an index fund that seeks results that are 200% of the inverse of the Nasdaq 100 index. In other words, he was shorting the market. It was an inexpensive way to bet that the market would fall. He bought options for $7,846 on a day when the Dow Jones Industrial Average opened at 8,604. A few days later, on September 23, after the market had indeed fallen, he sold the options for over $13,000 and nearly doubled his money.

Lest you think that only Bachus was involved, Blodget also mentions John Kerry and Dick Durban. 60 Minutes interviewed Schweizer on November 13th. Here's part of that report.As Paulson recounts, “Ben [Bernanke] emphasized how the financial crisis could spill into the real economy. As stocks dropped perhaps a further 20 percent, General Motors would go bankrupt, and unemployment would rise . . . if we did nothing.” The members of Congress around the table were, in Paulson’s words, “ashen-faced.”

Bernanke continued, “It is a matter of days before there is a meltdown in the global financial system.” Bachus was among those who spoke. According to Paulson, he suggested recapitalizing the banks by buying shares.

The meeting broke up. The next day, September 19, Congressman Bachus bought contract options on Proshares Ultra-Short QQQ, an index fund that seeks results that are 200% of the inverse of the Nasdaq 100 index. In other words, he was shorting the market. It was an inexpensive way to bet that the market would fall. He bought options for $7,846 on a day when the Dow Jones Industrial Average opened at 8,604. A few days later, on September 23, after the market had indeed fallen, he sold the options for over $13,000 and nearly doubled his money.

When Nancy Pelosi, John Boehner, and other lawmakers wouldn't answer Steve Kroft's questions, he headed to Washington to get some answers about their stock trades.

Go for it Steve! Most former congressmen and senators manage to leave Washington - if they ever leave Washington - with more money in their pockets than they had when they arrived, and as you are about to see, the biggest challenge is often avoiding temptation.

Peter Schweizer: This is a venture opportunity. This is an opportunity to leverage your position in public service and use that position to enrich yourself, your friends, and your family.

Peter Schweizer is a fellow at the Hoover Institution, a conservative think tank at Stanford University. A year ago he began working on a book about soft corruption in Washington with a team of eight student researchers, who reviewed financial disclosure records. It became a jumping off point for our own story, and we have independently verified the material we've used.

Schweizer says he wanted to know why some congressmen and senators managed to accumulate significant wealth beyond their salaries, and proved particularly adept at buying and selling stocks.

Schweizer: There are all sorts of forms of honest grafts that congressmen engage in that allow them to become very, very wealthy. So it's not illegal, but I think it's highly unethical, I think it's highly offensive, and wrong.

Steve Kroft: What do you mean honest graft?

Schweizer: For example insider trading on the stock market. If you are a member of Congress, those laws are deemed not to apply.

Kroft: So congressman get a pass on insider trading?

Schweizer: They do. The fact is, if you sit on a healthcare committee and you know that Medicare, for example, is considering not reimbursing for a certain drug that's market moving information. And if you can trade stock on-- off of that information and do so legally, that's a great profit making opportunity. And that sort of behavior goes on.

Kroft: Why does Congress get a pass on this?

Schweizer: It's really the way the rules have been defined. And the people who make the rules are the political class in Washington. And they've conveniently written them in such a way that they don't apply to themselves.

I have searched for just the right response to this stuff, and I think I found it in something Matt Taibbi said while talking about the meaning of the Occupy movement.Peter Schweizer: This is a venture opportunity. This is an opportunity to leverage your position in public service and use that position to enrich yourself, your friends, and your family.

Peter Schweizer is a fellow at the Hoover Institution, a conservative think tank at Stanford University. A year ago he began working on a book about soft corruption in Washington with a team of eight student researchers, who reviewed financial disclosure records. It became a jumping off point for our own story, and we have independently verified the material we've used.

Schweizer says he wanted to know why some congressmen and senators managed to accumulate significant wealth beyond their salaries, and proved particularly adept at buying and selling stocks.

Schweizer: There are all sorts of forms of honest grafts that congressmen engage in that allow them to become very, very wealthy. So it's not illegal, but I think it's highly unethical, I think it's highly offensive, and wrong.

Steve Kroft: What do you mean honest graft?

Schweizer: For example insider trading on the stock market. If you are a member of Congress, those laws are deemed not to apply.

Kroft: So congressman get a pass on insider trading?

Schweizer: They do. The fact is, if you sit on a healthcare committee and you know that Medicare, for example, is considering not reimbursing for a certain drug that's market moving information. And if you can trade stock on-- off of that information and do so legally, that's a great profit making opportunity. And that sort of behavior goes on.

Kroft: Why does Congress get a pass on this?

Schweizer: It's really the way the rules have been defined. And the people who make the rules are the political class in Washington. And they've conveniently written them in such a way that they don't apply to themselves.

We're all born wanting the freedom to imagine a better and more beautiful future. Modern America has become a place so drearily confining and predictable that it chokes the life out of that built-in desire. Everything from our pop culture to our economy to our politics feels oppressive and unresponsive. We see 10 million commercials a day, and every day is the same life-killing chase for money, money and more money; the only thing that changes from minute to minute is that every tick of the clock brings with it another space-age vendor dreaming up some new way to try to sell you something or reach into your pocket.

The relentless sameness of the two-party political system is beginning to feel like a Jacob's Ladder nightmare with no end; we're entering another turn on the four-year merry-go-round, and the thought of having to try to get excited about yet another minor quadrennial shift in the direction of one or the other pole of alienating corporate full-of-shitness is enough to make anyone want to smash his own hand flat with a hammer...

Congress cleaning up its act? Don’t count on it

By JONATHAN ALLEN | 12/6/11 11:31 PM EST

House Financial Services Chairman Spencer Bachus made hundreds of financial transactions as the stock market plummeted and spiked in 2008, sometimes turning five-figure profits in a matter of hours.

Now, he wants to ban that practice.

Continue Reading

The sudden interest in financial ethics comes after Bachus, who sat in on high-level financial bailout meetings in 2008, was profiled in an unflattering new book and a companion “60 Minutes” piece on potential insider trading in Congress. Bachus’s new bill would require lawmakers to put their investments in blind trusts.

But here’s the kicker: The punishment for breaking the blind-trust rule, if it was enforceable, would be a $50,000 civil penalty — reminiscent of paltry pro-football fines that for years made after-the-whistle cheap shots on the quarterback seem worth the price.

Fine print aside, what the Bachus measure really shows is just how sensitive members of Congress have become to the public perception that they use their offices for personal gain. It’s just one of a bumper crop of feel-good ethics bills that have popped up as Congress’s approval ratings have cratered around the 10 percent mark.

Some lawmakers see this as a critical moment in trying to regain the trust of voters.

“We cannot survive as a democracy unless there is more confidence in our elected officials than there is now,” Rep. Brad Miller (D-N.C.) said Tuesday at a Financial Services Committee hearing on the STOCK Act, which takes a different approach than the Bachus bill to preventing insider trading on Capitol Hill. “The first step to restore their trust is to be trustworthy.”

But are these types of bills going anywhere? Not likely — many don’t stand a chance of passing, but they make for good press release fodder.

Rep. Tim Griffin (R-Ark.) introduced a bill just before Thanksgiving that would end the congressional pension system for new members and force current members to opt-in if they want to continue to accrue benefits; Illinois Republican Tim Johnson’s “STAY PUT” bill would enact a moratorium on lawmakers using public money to take foreign trips; Rep. Jason Chaffetz (R-Utah) wants to require members of Congress to disclose any tax liabilities so that their wages can be garnished; and Sen. Claire McCaskill (D-Mo.) wants to crack down on pay raises and foreign trips.

That’s the same McCaskill who used public funds to pay the costs of flights on a private plane that she and her husband co-owned with other investors. After POLITICO questioned McCaskill about the arrangement in March, she decided to reimburse the Treasury $88,000. Later that month, McCaskill announced that she would pay $287,273 in back taxes on the plane.

With the public angry at Congress, there’s a lot of incentive for a lawmaker to draw up a bill that limits congressional pay and benefits, even if it’s just a showpiece to demonstrate to constituents that the local congressman or congresswoman is fighting the powers-that-be on Capitol Hill.

So who could resist an effort — any effort — to clean up Congress? Well, the folks who would have to live under the new rules, of course.

In a thinly veiled swipe at “60 Minutes” and author Peter Schweizer, freshman Rep. Francisco Canseco (R-Texas) argued Tuesday that “innuendo and bad research” aren’t reason enough to approve the STOCK Act, which he said “would have the perverse effect of decreasing transparency.”

Canseco has his own solution: A resolution that would change House rules to require the use of blind trusts — a move that could happen without Senate action.

Critics across the ideological spectrum said the bill’s provisions cracking down on insider trading on Capitol Hill could have a chilling effect on lawmakers’ constitutionally protected speech.

Bachus announced Tuesday that his committee will vote on the STOCK Act next week, but he notes that current law already prohibits members of Congress — just like everyone else — from improperly using inside information to profit in stock deals.

“There is an erroneous perception that insider trading laws do not apply to members of Congress and congressional staff. That perception is unfortunate because it is false,” Bachus said in a statement. “However, legislation that clarifies and improves the existing law would be welcomed and committee members will have the opportunity to consider, debate and vote on H.R. 1148.

It’s possible that public outrage — and political need — could push legislation like the STOCK Act or the Bachus bill forward in advance of the 2012 election, but they haven’t gained that kind of traction yet.

John Wonderlich, policy director for the nonprofit Sunlight Foundation, said it will be a while before the STOCK Act or any of its cousins become law.

“One of the biggest hurdles to the insider-trading bills moving soon is a lack of consensus in Congress about what the right approach is to dealing with it,” he said.

That suggests that any insider-trading rules or laws would be written by congressional leaders, who would have to sort out those varying approaches and then come to a bipartisan agreement between the chambers — a tall order under any circumstances. But for now, everyone has a bill to point to as the means to clean up Washington.

“There’s almost always a sincere intention,” Wonderlich said of the members who introduce ethics bills. “And then there’s almost always an effort to tap into populist rage at the way Congress is functioning.”

By JONATHAN ALLEN | 12/6/11 11:31 PM EST

House Financial Services Chairman Spencer Bachus made hundreds of financial transactions as the stock market plummeted and spiked in 2008, sometimes turning five-figure profits in a matter of hours.

Now, he wants to ban that practice.

Continue Reading

The sudden interest in financial ethics comes after Bachus, who sat in on high-level financial bailout meetings in 2008, was profiled in an unflattering new book and a companion “60 Minutes” piece on potential insider trading in Congress. Bachus’s new bill would require lawmakers to put their investments in blind trusts.

But here’s the kicker: The punishment for breaking the blind-trust rule, if it was enforceable, would be a $50,000 civil penalty — reminiscent of paltry pro-football fines that for years made after-the-whistle cheap shots on the quarterback seem worth the price.

Fine print aside, what the Bachus measure really shows is just how sensitive members of Congress have become to the public perception that they use their offices for personal gain. It’s just one of a bumper crop of feel-good ethics bills that have popped up as Congress’s approval ratings have cratered around the 10 percent mark.

Some lawmakers see this as a critical moment in trying to regain the trust of voters.

“We cannot survive as a democracy unless there is more confidence in our elected officials than there is now,” Rep. Brad Miller (D-N.C.) said Tuesday at a Financial Services Committee hearing on the STOCK Act, which takes a different approach than the Bachus bill to preventing insider trading on Capitol Hill. “The first step to restore their trust is to be trustworthy.”

But are these types of bills going anywhere? Not likely — many don’t stand a chance of passing, but they make for good press release fodder.

Rep. Tim Griffin (R-Ark.) introduced a bill just before Thanksgiving that would end the congressional pension system for new members and force current members to opt-in if they want to continue to accrue benefits; Illinois Republican Tim Johnson’s “STAY PUT” bill would enact a moratorium on lawmakers using public money to take foreign trips; Rep. Jason Chaffetz (R-Utah) wants to require members of Congress to disclose any tax liabilities so that their wages can be garnished; and Sen. Claire McCaskill (D-Mo.) wants to crack down on pay raises and foreign trips.

That’s the same McCaskill who used public funds to pay the costs of flights on a private plane that she and her husband co-owned with other investors. After POLITICO questioned McCaskill about the arrangement in March, she decided to reimburse the Treasury $88,000. Later that month, McCaskill announced that she would pay $287,273 in back taxes on the plane.

With the public angry at Congress, there’s a lot of incentive for a lawmaker to draw up a bill that limits congressional pay and benefits, even if it’s just a showpiece to demonstrate to constituents that the local congressman or congresswoman is fighting the powers-that-be on Capitol Hill.

So who could resist an effort — any effort — to clean up Congress? Well, the folks who would have to live under the new rules, of course.

In a thinly veiled swipe at “60 Minutes” and author Peter Schweizer, freshman Rep. Francisco Canseco (R-Texas) argued Tuesday that “innuendo and bad research” aren’t reason enough to approve the STOCK Act, which he said “would have the perverse effect of decreasing transparency.”

Canseco has his own solution: A resolution that would change House rules to require the use of blind trusts — a move that could happen without Senate action.

Critics across the ideological spectrum said the bill’s provisions cracking down on insider trading on Capitol Hill could have a chilling effect on lawmakers’ constitutionally protected speech.

Bachus announced Tuesday that his committee will vote on the STOCK Act next week, but he notes that current law already prohibits members of Congress — just like everyone else — from improperly using inside information to profit in stock deals.

“There is an erroneous perception that insider trading laws do not apply to members of Congress and congressional staff. That perception is unfortunate because it is false,” Bachus said in a statement. “However, legislation that clarifies and improves the existing law would be welcomed and committee members will have the opportunity to consider, debate and vote on H.R. 1148.

It’s possible that public outrage — and political need — could push legislation like the STOCK Act or the Bachus bill forward in advance of the 2012 election, but they haven’t gained that kind of traction yet.

John Wonderlich, policy director for the nonprofit Sunlight Foundation, said it will be a while before the STOCK Act or any of its cousins become law.

“One of the biggest hurdles to the insider-trading bills moving soon is a lack of consensus in Congress about what the right approach is to dealing with it,” he said.

That suggests that any insider-trading rules or laws would be written by congressional leaders, who would have to sort out those varying approaches and then come to a bipartisan agreement between the chambers — a tall order under any circumstances. But for now, everyone has a bill to point to as the means to clean up Washington.

“There’s almost always a sincere intention,” Wonderlich said of the members who introduce ethics bills. “And then there’s almost always an effort to tap into populist rage at the way Congress is functioning.”

esp when their up for re-election.

so when anybody tells me that TERM LIMITS FOR CONGRESS isnt at least ONE way, if not The Best way to begin the process to fix the mess THE BOZOS OF THE BELTWAY HAVE CREATED ??

IMHO - they are PART OF THE PROBLEM and merely apologists for the status quo and continuation of the BLATANT AND IN YOUR FACE CORRUPTION that passes for 'governance'.

you can blame wall st all ya want, but its the political aristocracy that enables them!

TERM LIMITS FOR CONGRESS, NOW!

its really quite simply The Only Hope for REAL change we can believe in.

Comment