long ago and far away wages and salaries had ample room for non-essential consumer goods. as wages and salaries flattened and fell, cheap credit propped up discretionary spending. now the air is being pushed out of the non-essential overhead, making the essentials a larger percentage of the household budget . . .

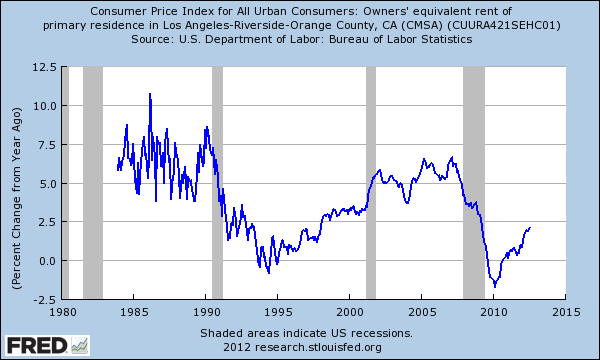

Inflation has been picking up since the recession ended in 2009. The problem with the CPI increasing year over year with no rise in household incomes is that the standard of living for most Americans erodes every year that incomes do not keep up. Household incomes are back to levels last seen in the mid-1990s while the cost of necessities has gone up. This brings us to our article today that examines the nuts and bolts of what constitutes the Consumer Price Index (CPI). The CPI attempts to measure the changes in price for consumer goods and services. Overall it did a very poor job of measuring the housing bubble because of the owner’s equivalent of rent metric. Today, it is understating inflation because of the excess spending on “wants” that occurred in the 2000s has now shifted to spending on “needs” but is being dragged down by the amount of family spending on needed goods. We will dig deep into this data but suffice it to say that the Fed is creating inflation in items most Americans actually need to live their daily lives.

Do not believe the talk that inflation is nonexistent

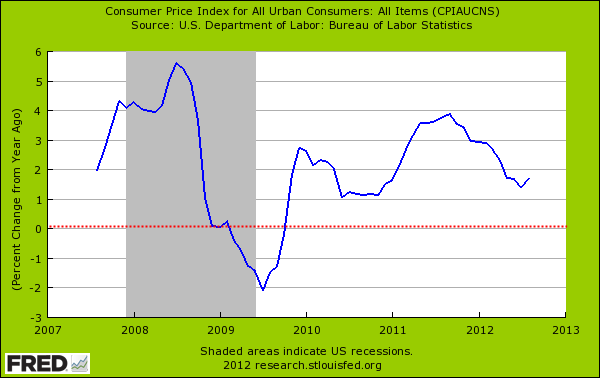

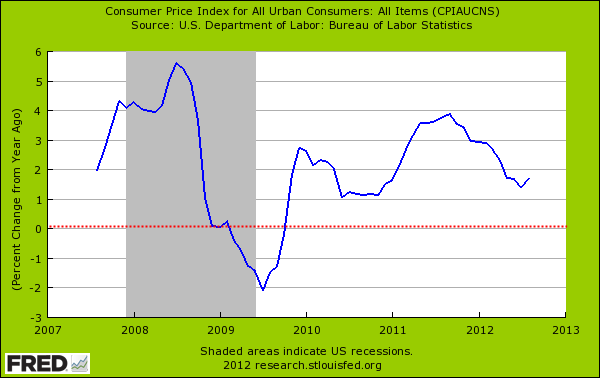

Even a one percent rate of inflation is troubling if incomes are stagnant or falling. Since the recession has ended inflation has occurred even as measured by the CPI:

Over this same timeframe, household incomes have remained stagnant and household net worth has fallen close to 40 percent. Yet there is something more troubling in the actual data. The inflation rate is actually being understated because Americans have shifted consumption from non-essential goods to actually seeing inflation in things that they actually need. In the 2000s spending on wasteful items was rampant and much of it came because of the easy access to debt. Yet with 100 million credit cards being yanked out of the system, this spending has fallen dramatically. So where exactly is the inflation occurring?

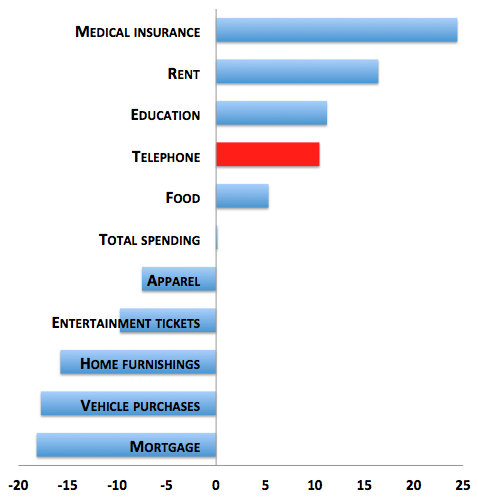

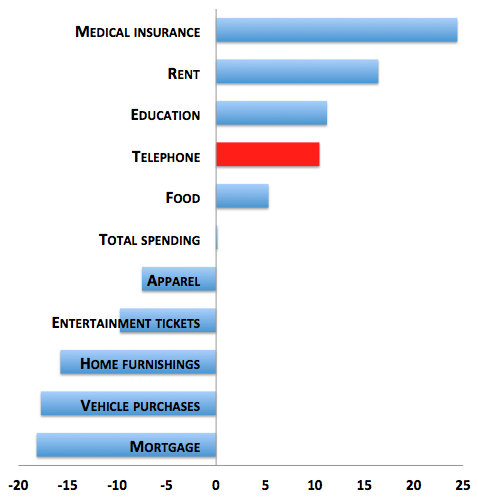

Change in Family Spending: 2007 – 2011

Source: The Atlantic

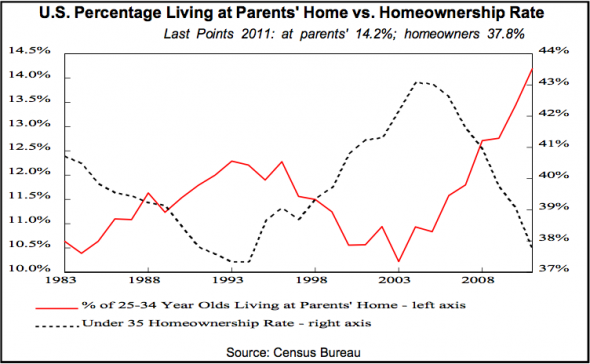

This is a very important chart to examine. What we find is that family spending has gone up on items that are daily needs. The biggest change has occurred on medical insurance and rents. The cost of rents going up has come thanks to the financial system allowing million of properties to be held off the market thus allowing prices to be pushed up as the population grows. The price of rents going up isn’t a sign that incomes are going up but a troubling fact that Americans have to allocate more of their funding to housing. Of course, this is hitting working, middle class, and younger Americans hardest who actually do not own a home.

Next you have the bubble in higher education raging. Students are taking on incredible levels of debt to support their educational pursuits. No other generation has had to face so much debt with such a minefield of scam artist institutions that basically have millionaire presidents and are one step above a paper mill. Yet thanks to easy government loans and banking lobbyist in cahoots with these institutions, the ultimate bill is passed on to taxpayers and those taking on the loans. It is sophisticated way to launder money under the guise of helping Americans. The quality checks are removed like selling a car for cheaper because it has no seat belts or brakes. It also waters down degrees from quality institutions as more subpar degrees flood the market.

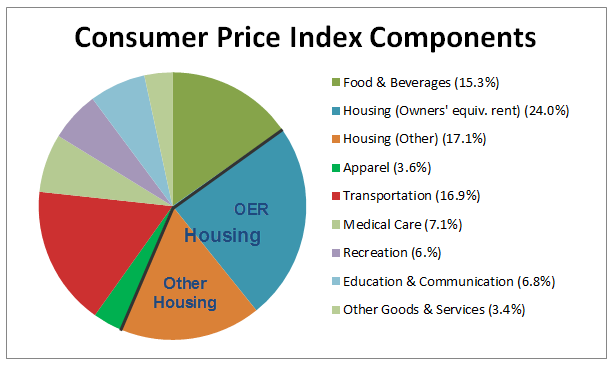

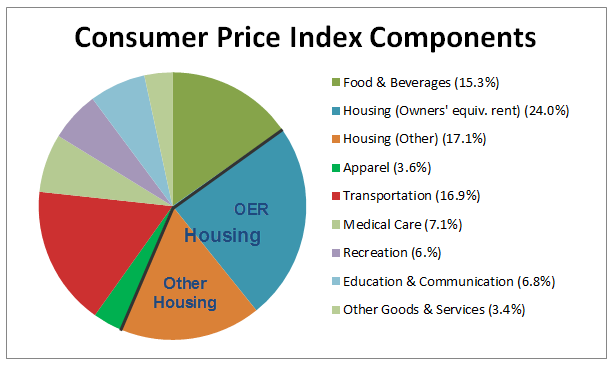

Finally you have an increase in the price of telephone service and foods. The only item that has increased that might be considered a luxury is in the telephone category. Yet food is an absolute necessity. If we break down the CPI weighting we find the following:

Food and housing are the biggest line items. However because mortgage spending has fallen thanks to the Federal Reserve and Americans spending less on home furnishing and vehicle purchases the CPI is not reflecting the big changes occurring. A 15+ percent increase in rent from 2007 to 2011 with no increase in income is sizeable. Yet the items where family spending has fallen is largely elective. So when we look at family spending and then look at the CPI, you can understand why the increase in inflation seems modest yet most Americans are feeling the pinch to their wallets much tighter.

This is why the Federal Reserve through QE 3 and massive amounts of mortgage backed security purchases is essentially robbing from Peter to pay Paul. The end result is that you have shifted more of a burden to renters to essentially take off a bit of steam from home owners. Now you have major private equity investors buying properties and hiking rental prices since they are able to borrow money cheaply. In all reality you have shifted a larger burden on those least likely to have the means to afford it. This is why we have seen the middle class shrink in the last few decades and the ranks of the poor grow even larger. With over 46 million Americans on food stamps we really are becoming a split nation. And again, refer to the chart above on family spending. With the rise in the cost of food you are squeezing the lowest rung even further. Yet this is the setup of the current system. The Fed is picking winners at the expense of others. This is what occurs when you have manipulated money creation and coddling the banking sector versus actual real growth in the economy. When you see those headlines about inflation figures keep all this data in mind.

http://www.mybudget360.com/inflation...pi-components/

Inflation has been picking up since the recession ended in 2009. The problem with the CPI increasing year over year with no rise in household incomes is that the standard of living for most Americans erodes every year that incomes do not keep up. Household incomes are back to levels last seen in the mid-1990s while the cost of necessities has gone up. This brings us to our article today that examines the nuts and bolts of what constitutes the Consumer Price Index (CPI). The CPI attempts to measure the changes in price for consumer goods and services. Overall it did a very poor job of measuring the housing bubble because of the owner’s equivalent of rent metric. Today, it is understating inflation because of the excess spending on “wants” that occurred in the 2000s has now shifted to spending on “needs” but is being dragged down by the amount of family spending on needed goods. We will dig deep into this data but suffice it to say that the Fed is creating inflation in items most Americans actually need to live their daily lives.

Do not believe the talk that inflation is nonexistent

Even a one percent rate of inflation is troubling if incomes are stagnant or falling. Since the recession has ended inflation has occurred even as measured by the CPI:

Over this same timeframe, household incomes have remained stagnant and household net worth has fallen close to 40 percent. Yet there is something more troubling in the actual data. The inflation rate is actually being understated because Americans have shifted consumption from non-essential goods to actually seeing inflation in things that they actually need. In the 2000s spending on wasteful items was rampant and much of it came because of the easy access to debt. Yet with 100 million credit cards being yanked out of the system, this spending has fallen dramatically. So where exactly is the inflation occurring?

Change in Family Spending: 2007 – 2011

Source: The Atlantic

This is a very important chart to examine. What we find is that family spending has gone up on items that are daily needs. The biggest change has occurred on medical insurance and rents. The cost of rents going up has come thanks to the financial system allowing million of properties to be held off the market thus allowing prices to be pushed up as the population grows. The price of rents going up isn’t a sign that incomes are going up but a troubling fact that Americans have to allocate more of their funding to housing. Of course, this is hitting working, middle class, and younger Americans hardest who actually do not own a home.

Next you have the bubble in higher education raging. Students are taking on incredible levels of debt to support their educational pursuits. No other generation has had to face so much debt with such a minefield of scam artist institutions that basically have millionaire presidents and are one step above a paper mill. Yet thanks to easy government loans and banking lobbyist in cahoots with these institutions, the ultimate bill is passed on to taxpayers and those taking on the loans. It is sophisticated way to launder money under the guise of helping Americans. The quality checks are removed like selling a car for cheaper because it has no seat belts or brakes. It also waters down degrees from quality institutions as more subpar degrees flood the market.

Finally you have an increase in the price of telephone service and foods. The only item that has increased that might be considered a luxury is in the telephone category. Yet food is an absolute necessity. If we break down the CPI weighting we find the following:

Food and housing are the biggest line items. However because mortgage spending has fallen thanks to the Federal Reserve and Americans spending less on home furnishing and vehicle purchases the CPI is not reflecting the big changes occurring. A 15+ percent increase in rent from 2007 to 2011 with no increase in income is sizeable. Yet the items where family spending has fallen is largely elective. So when we look at family spending and then look at the CPI, you can understand why the increase in inflation seems modest yet most Americans are feeling the pinch to their wallets much tighter.

This is why the Federal Reserve through QE 3 and massive amounts of mortgage backed security purchases is essentially robbing from Peter to pay Paul. The end result is that you have shifted more of a burden to renters to essentially take off a bit of steam from home owners. Now you have major private equity investors buying properties and hiking rental prices since they are able to borrow money cheaply. In all reality you have shifted a larger burden on those least likely to have the means to afford it. This is why we have seen the middle class shrink in the last few decades and the ranks of the poor grow even larger. With over 46 million Americans on food stamps we really are becoming a split nation. And again, refer to the chart above on family spending. With the rise in the cost of food you are squeezing the lowest rung even further. Yet this is the setup of the current system. The Fed is picking winners at the expense of others. This is what occurs when you have manipulated money creation and coddling the banking sector versus actual real growth in the economy. When you see those headlines about inflation figures keep all this data in mind.

http://www.mybudget360.com/inflation...pi-components/

Comment