This isn't a great article - it doesn't say anything about the lobbying for a repatriation of overseas money act for example, nor does it talk about the introduction of Social Security and the Payroll tax skews perceptions, but the abuses outlined are real.

http://www.economicpopulist.org/cont...ica-goes-broke

http://www.economicpopulist.org/cont...ica-goes-broke

The Senate Subcommittee on Investigations held a hearing, Offshore Profit Shifting and the U.S. Tax Code. Did you know U.S. Multinational Corporations have more than $1.7 trillion in untaxed profits stashed as undistributed foreign earnings and keep at least 60% of their cash overseas? That these earnings have increased 400% in the last decade? That corporate tax as a percentage of total Federal revenues has dropped to only 8.9%?

The hearing exhibits has some real gems to show how these two companies are more in the business of manipulating the international corporate tax code than designing much. No surprise since both corporations slashed and burned their U.S. citizen R&D staff, which shows in their products and declining market share.

All of this is perfectly legal. Microsoft and HP along with a host of other companies manipulate the U.S. tax code through transfer pricing and loopholes. The tax law in question is subpart F, section 956 and FASB accounting standard, APB 23.

Sounds like something out of the Hitchhiker's Guide to the Galaxy and in a way it is. Corporations only pay tax on active income, but it is called deferred income if left offshore. Passive income from royalties, patents, intellectual property though, the tax is supposed to be paid, offshore or not.

The U.S. Treasury found it was not sales causing foreign profits parked offshore to swell, instead it was their manipulation of international corporate tax codes.

Transfer pricing is a fancy way of saying multinational corporations "sell" something to their foreign affiliates and to make profits look real good they set the price on these "sales" to absurdly low levels. Imagine a corporation "sells" to their offshore outsourced R&D unit in India services they provide. But instead of the retail price of $200,000, the U.S. multinational "sells" those services to their affiliate for 1˘ It's much more complex than that, all sorts of services, patents, intellectual property and licensing rights are "sold" to their foreign affiliate oompany, all to move profits offshore. From the exhibit (MNC means multinational corporation, CFC is the foreign affiliate of that MNC):

Loaning Back to the Parent Company

This one is a classic. There is a loophole in the tax code which allows foreign subsidiaries, like the one above, created in the Cayman's, to offer a short term loan to the U.S. parent company without paying tax. It's all done by timing these loans, issued one after another to avoid a tax time window and is, in effect, a way to transfer foreign profits back into the United States without paying taxes.

Uncle Sam Helps Offshore Outsource Jobs

The tax code gives a permanent tax break to corporations if they invest their offshore profits in foreign countries. I kid you not.

Reforms

Now the above are clearly no brainer corporate tax code problems that should be fixed. Wouldn't it be much better to give corporations a 0% tax if they invested their profits in America? How about a 0% tax for every U.S. citizen they hire and retain? How about even a tax credit for every worker they offer on the job training to? When it comes to R&D, that's a permanent, long term tax credit!

Yet, Congress cannot get it together and do the practical and the obvious. Plug up these loopholes and use the corporate tax code to get these companies to hire U.S. citizens. Why? In part because multinational corporations with their lobbyists demand their crack cocaine tax loopholes and will stop at nothing to keep them. Damn logic, damn spreadsheets and damn America, these MNCs want their global international tax code stupid hat tricks. Here are the reform recommendations from the exhibit.

Think any of them will get done? Not a prayer's chance unless you, dear public, start studying documents such as the ones presented at this hearing, write to your Congressional representatives, raise hell and don't stop until these loopholes are plugged, once and for all.

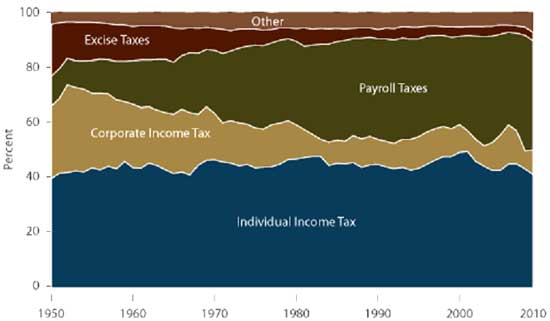

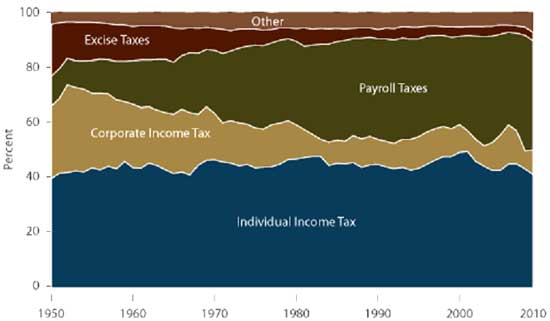

At its post-WWI peak in 1952, the corporate tax generated 32.1% of all federal tax revenue. In that same year the individual tax accounted for 42.2% of federal revenue, and the payroll tax accounted for 9.7% of revenue. Today, the corporate tax accounts for 8.9% of federal tax revenue, whereas the individual and payroll taxes generate 41.5% and 40.0%, respectively, of federal revenue.

These and other damning facts make the committee hearing exhibits a must read. On the Senate hearing hot seat was Microsoft and Hewlett Packard. Both of these tech companies have fired thousands of U.S. workers, offshore outsourced thousands of jobs and to this day spend millions lobbying Congress to import more foreign workers. In the midst of their never ending layoff bloodbath, Microsoft and HP claim they cannot find tech workers, a very obvious lie.The hearing exhibits has some real gems to show how these two companies are more in the business of manipulating the international corporate tax code than designing much. No surprise since both corporations slashed and burned their U.S. citizen R&D staff, which shows in their products and declining market share.

Microsoft Corporation has used aggressive transfer pricing transactions to shift its intellectual property, a mobile asset, to subsidiaries in Puerto Rico, Ireland, and Singapore, which are low or no tax jurisdictions, in part to avoid or reduce its U.S. taxes on the profits generated by assets sold by its offshore entities.

While America needed jobs, Microsoft was busy shifting profits offshore from 2009-2011.From 2009 to 2011, by transferring certain rights to its intellectual property to a Puerto Rican subsidiary, Microsoft was able to shift offshore nearly $21 billion, or almost half of its U.S. retail sales net revenue, saving up to $4.5 billion in taxes on goods sold in the United States, or just over $4 million in U.S. taxes each day.

Not to be outdone, HP has been busy transferring profits back into the United States, untaxed through another corporate tax code rig up. Since at least 2008, Hewlett Packard Co. has used billions of dollars of intercompany offshore loans to effectively repatriate untaxed foreign profits back to the United States to run their U.S. operations, contrary to the intent of U.S. tax policy.

Subcommittee hearing chair Carl Levin pulled no punches in his opening hearing statement:The share of federal tax revenue contributed by corporations has plummeted in recent decades. That places an additional burden on other taxpayers. The massive offshore profit shifting that is taking place today is doubly problematic in an era of dire fiscal crisis. Budget experts across the ideological spectrum are unified in their belief than any serious attempt to address the deficit must include additional federal revenue. Federal revenue, as a share of our economy, has plummeted to historic lows – about 15 percent of GDP, compared to a historic average of roughly 19 percent. The Simpson-Bowles report sets a goal for federal revenue at 21 percent of GDP. The fact that we are today so far short of that goal is, in part, due to multinational corporations avoiding U.S. taxes by shifting their profits offshore.

In other words, America is broke and multinational corporations continue to blood suck the United States dry. This is a great hearing, loaded with facts and figures on the corporate tax code. The pattern becomes clear, U.S. Multinational corporations are out to not pay taxes, come hell or high water.All of this is perfectly legal. Microsoft and HP along with a host of other companies manipulate the U.S. tax code through transfer pricing and loopholes. The tax law in question is subpart F, section 956 and FASB accounting standard, APB 23.

Sounds like something out of the Hitchhiker's Guide to the Galaxy and in a way it is. Corporations only pay tax on active income, but it is called deferred income if left offshore. Passive income from royalties, patents, intellectual property though, the tax is supposed to be paid, offshore or not.

Subpart F is often referred to as an “anti-deferral” regime. It is only active income of a CFC that may be deferred until repatriated, but passive income earned by a CFC such as royalties, dividends and interest is currently subject to U.S. tax and reportable under Subpart F regardless of whether the earnings have been repatriated

Deferral is why multinational corporations leave profits in other countries, offshore, so they don't have to pay U.S. tax. Corporations are literally shifting income (and people) offshore, in part, to avoid paying their taxes. This is what they mean by undistributed foreign earnings. The list of corporations keeping profits offshore is a who's who of multinational giants. Cisco, G.E., Apple, Google, Pfizer, Qualcomm, Walmart, Ebay, Dell, even Coca-Cola. Apple, for example, has $74 billion in profits parked offshore. The U.S. Treasury found it was not sales causing foreign profits parked offshore to swell, instead it was their manipulation of international corporate tax codes.

The differential between a company’s U.S. and foreign effective tax rates exerts a significant effect on the share of its income abroad, largely through changes in foreign and domestic profit margins rather than a shift in sales.

Transfer PricingTransfer pricing is a fancy way of saying multinational corporations "sell" something to their foreign affiliates and to make profits look real good they set the price on these "sales" to absurdly low levels. Imagine a corporation "sells" to their offshore outsourced R&D unit in India services they provide. But instead of the retail price of $200,000, the U.S. multinational "sells" those services to their affiliate for 1˘ It's much more complex than that, all sorts of services, patents, intellectual property and licensing rights are "sold" to their foreign affiliate oompany, all to move profits offshore. From the exhibit (MNC means multinational corporation, CFC is the foreign affiliate of that MNC):

One way that income shifting occurs is when a MNC sells or licenses the foreign rights to intangible assets developed in the U.S. to its subsidiary in a low-tax country. For example, a U.S. parent may license the economic rights of its intellectual property to a subsidiary located in Bermuda, a subsidiary which, in many cases, was created for that purpose. Once the foreign subsidiary owns the rights, the profits derived from the technology become those of the subsidiary, not the parent.

The license payment made by the subsidiary to its parent is taxable income, but the parent has an incentive to set the price as low as possible. If the price paid is low compared to future profits generated by the license rights, less income is taxable to the parent and the subsidiary’s expenses are lower. Thus, the U.S. parent has successfully shifted taxable profits out of the United States to Bermuda, where no corporate taxes apply.

Let's say one holds a critical patent on the iPhone. Apple would then sell that patent to some special purpose company they had set up in the Cayman Islands for licensing rights. Then that PO BOX tax haven affiliate in the Cayman's would reap all of the profits associated with licensing those patent rights to others as well as Apple themselves. Slick trick huh? The license payment made by the subsidiary to its parent is taxable income, but the parent has an incentive to set the price as low as possible. If the price paid is low compared to future profits generated by the license rights, less income is taxable to the parent and the subsidiary’s expenses are lower. Thus, the U.S. parent has successfully shifted taxable profits out of the United States to Bermuda, where no corporate taxes apply.

Loaning Back to the Parent Company

This one is a classic. There is a loophole in the tax code which allows foreign subsidiaries, like the one above, created in the Cayman's, to offer a short term loan to the U.S. parent company without paying tax. It's all done by timing these loans, issued one after another to avoid a tax time window and is, in effect, a way to transfer foreign profits back into the United States without paying taxes.

Uncle Sam Helps Offshore Outsource Jobs

The tax code gives a permanent tax break to corporations if they invest their offshore profits in foreign countries. I kid you not.

Another incentive to shift or keep profits offshore is provided by an accounting standard known as APB 23, recently renamed ASC 740-30-25.

APB 23 permits U.S. multinationals to defer recognition of tax liability on foreign earnings for financial reporting purposes so that earnings are not reduced by the tax liability if they affirmatively assert that their foreign earnings are permanently or indefinitely reinvested. In 2011, more than 1,000 U.S. multinationals made such an assertion in their SEC filings, reporting in total that more than $1.5 trillion is or is intended to be reinvested offshore.

Gets worse than that. Of these funds declared permanently reinvested offshore, a study found that 46% of it was sitting in U.S. bank accounts, buying up stocks in other U.S. companies or U.S. treasuries. APB 23 permits U.S. multinationals to defer recognition of tax liability on foreign earnings for financial reporting purposes so that earnings are not reduced by the tax liability if they affirmatively assert that their foreign earnings are permanently or indefinitely reinvested. In 2011, more than 1,000 U.S. multinationals made such an assertion in their SEC filings, reporting in total that more than $1.5 trillion is or is intended to be reinvested offshore.

Reforms

Now the above are clearly no brainer corporate tax code problems that should be fixed. Wouldn't it be much better to give corporations a 0% tax if they invested their profits in America? How about a 0% tax for every U.S. citizen they hire and retain? How about even a tax credit for every worker they offer on the job training to? When it comes to R&D, that's a permanent, long term tax credit!

Yet, Congress cannot get it together and do the practical and the obvious. Plug up these loopholes and use the corporate tax code to get these companies to hire U.S. citizens. Why? In part because multinational corporations with their lobbyists demand their crack cocaine tax loopholes and will stop at nothing to keep them. Damn logic, damn spreadsheets and damn America, these MNCs want their global international tax code stupid hat tricks. Here are the reform recommendations from the exhibit.

- Reform Tax Provisions that Encourage Offshoring of Profits. Reform tax code Sections 482 and 956 regarding transfer pricing and offshore loan practices, and the check-the-box and CFC look-through rules, that encourage U.S. multinationals to transfer and keep profits offshore and untaxed.

- Issue APB 23 Guidance. FASB should re-evaluate whether the indefinite reversal exception to ABP 23 is being used by multinationals to manipulate their earnings reports, and issue additional guidance or restrictions to clarify how the standard should be applied.

- Use Anti-Abuse Rules. The IRS should make greater use of its anti-abuse rules to stop offshore schemes and transactions that substantively violate the intent of the code, but are structured to appear to meet the most technical reading of, the tax code rules governing the taxation of offshore income.

Think any of them will get done? Not a prayer's chance unless you, dear public, start studying documents such as the ones presented at this hearing, write to your Congressional representatives, raise hell and don't stop until these loopholes are plugged, once and for all.

Comment