I'm not kidding guys - I can get you both qualified!

It was only a matter of time for flippers to engulf the market once again.

House flippers never really left but the magnitude hit a temporary lull during the housing crisis. Apparently all is well in SoCal once again and bubble 2.0 is back in full fashion. It is only a matter of time before the cable shows shift from the insane Canadian housing bubble and start filming our local neighbors taking a plunge into the new bubble market. Flipping at these levels can only exist in a partial mania like atmosphere. The constrained inventory and rising prices is pulling many people off the sidelines and I have heard this said a few times already, “I’m not missing the housing market this time!” Maybe it is the California sunshine that gets into our heads but we appear to have forgotten the housing bubble that just hit us a few minutes ago. Flippers are back in fashion and many hipster neighborhoods in SoCal and the Bay Area are bringing along a new party.

Flippers in Silverlake

Silverlake is a hipster neighborhood in Los Angeles. This was the nucleus of the housing bubble during round one and appears to be making a full fledge turn around. Let us examine our first exhibit today:

631 North Vendome St

Los Angeles, CA 90026

Square feet: 852

Beds: 2

Baths: 1

Built: 1923

Los Angeles, CA 90026

Square feet: 852

Beds: 2

Baths: 1

Built: 1923

I remember this post because someone over on the Redfin forums posted this back in October of 2011. Someone bought this home in March of 2010 for $211,000 as a foreclosure. Not bad considering the home sold in 1990 (20 years prior) for $158,000 during another SoCal bubble. The initial comments were laughing since it was listed at $599,000 after your typical HGTV work. In other words, someone thought their work added $388,000 in value over a couple of months. Most rational minds saw the lunacy in this.

Take a look at some of the HGTV work:

Silverlake is a big hipster neighborhood and you see a good amount of HGTV style flips. Of course many in this area are unlikely to track the housing market as a profession or understand the magnitude of QE3 but something did work. I had this link saved in a folder and was just pulling up a few files. Well guess what? The home sold for $535,000 this July. Not a bad flip for an 852 square foot property.

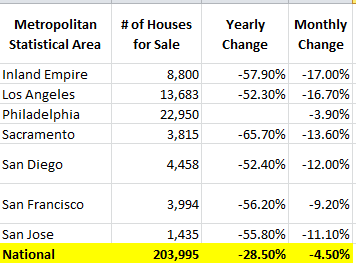

This is one of many examples I am now seeing and believe that the low inventory is causing another sort of mania. Think about it, home prices in California are up 12.9 percent over the year at a time that incomes fell. In essence the only push came because of low mortgage rates but how much can lower can rates go? Are these buyers geared up to stay put for 10, 20, or even 30 years? Inventory levels are back to where they were during the mania:

Last month 7,917 homes sold in Los Angeles County. In other words Los Angeles County has less than 2 months of inventory given the current sales rate. And prices are reflecting this:

Median home price

August 2011: $315,000

August 2012: $335,000

So prices in Los Angeles County are up 6.3 percent over the year and flippers are now out roaming the market in full force. The good news for all those home flipping TV lovers, you can expect a new line up to show up shortly. No need to watch the shows with Canadian buyers going into their full mania anymore. We’re bringing it back to SoCal!August 2011: $315,000

August 2012: $335,000

http://www.doctorhousingbubble.com/s...n-market-2012/