http://www.financialsense.com/Expert...2007/1024.html 10/24/07

Prechter's in blue. The first quote is the one of the day or perhaps of the year.

Nice brief commentary in Q & A format.

Prechter's in blue. The first quote is the one of the day or perhaps of the year.

Originally posted by Prechter

Most people would say the response of the Fed is crucial.

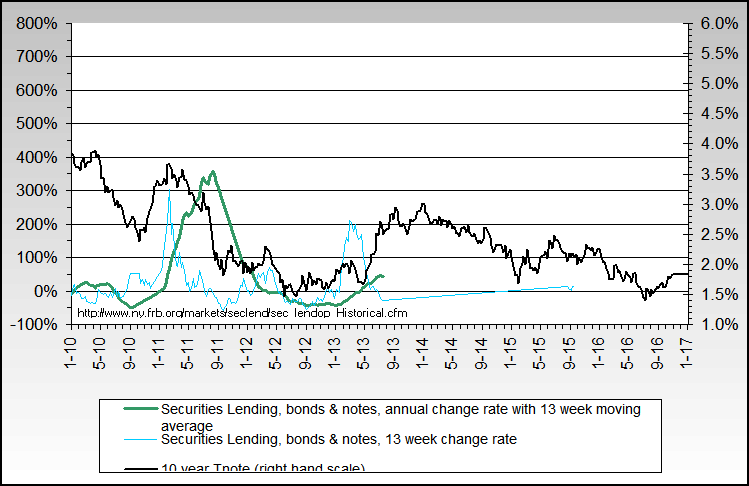

When it comes to interest rates, the Fed is irrelevant. All it does is adjust its rates to those set by the market. If you plot the yield on T-bills against the discount rate, you will see that the former leads the latter. That’s why the ½-point drop in the discount rate last month was easy to predict. The T-bill yield had already dropped a full point, and the Fed follows the market. Despite all the rhetoric about it, the Fed has not kept rates artificially low, just as it did not make them soar in the 1970s. The market sets the rates, and the Fed follows. Greenspan said exactly that on TV last month, and the charts confirm it.

When it comes to interest rates, the Fed is irrelevant. All it does is adjust its rates to those set by the market. If you plot the yield on T-bills against the discount rate, you will see that the former leads the latter. That’s why the ½-point drop in the discount rate last month was easy to predict. The T-bill yield had already dropped a full point, and the Fed follows the market. Despite all the rhetoric about it, the Fed has not kept rates artificially low, just as it did not make them soar in the 1970s. The market sets the rates, and the Fed follows. Greenspan said exactly that on TV last month, and the charts confirm it.

So the central banks won’t stop the decline?

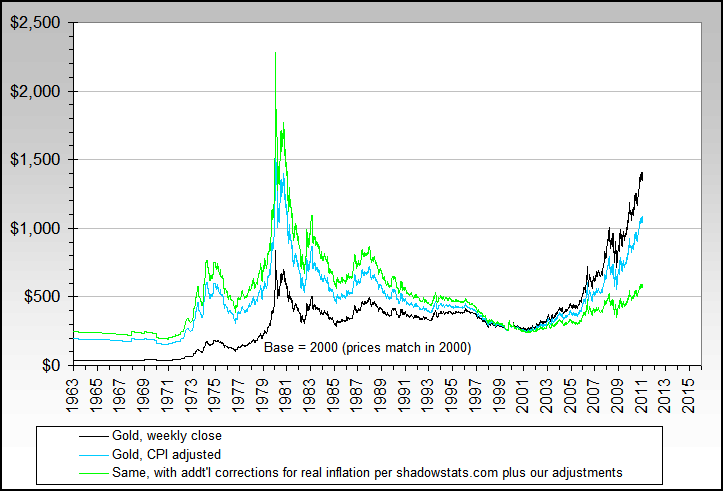

All they do is make things worse. They aren’t so much printing cash as offering credit. IOUs are not money; they’re IOUs. When the reversal occurs, few will want to borrow. If the central banks make conscious decisions to destroy their currencies, that will be a different matter. But nothing, not even hyperinflation, can save the purchasing power of stock shares. That bull market ended in 1999, and today, the Dow buys less than half of the commodities and real money (gold) that it did then, despite the nominal new high. This is a bear market almost no one sees.

All they do is make things worse. They aren’t so much printing cash as offering credit. IOUs are not money; they’re IOUs. When the reversal occurs, few will want to borrow. If the central banks make conscious decisions to destroy their currencies, that will be a different matter. But nothing, not even hyperinflation, can save the purchasing power of stock shares. That bull market ended in 1999, and today, the Dow buys less than half of the commodities and real money (gold) that it did then, despite the nominal new high. This is a bear market almost no one sees.

Nice brief commentary in Q & A format.

Comment