Originally posted by sudden debt blog

Tuesday, October 23, 2007

Still At Work, But Not For Long

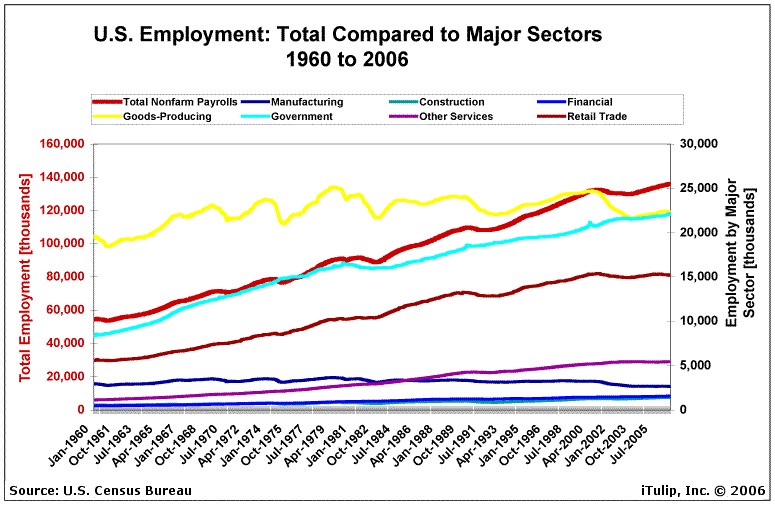

One puzzle that even Fed presidents find difficult to solve has to do with construction jobs. Though new housing starts have plunged, so far there have been no massive layoffs in the sector - at least not as measured by the BLS (see chart below).

The two explanations that I hear most often have to do with (a) illegal, undocumented aliens not being counted and (b) switching work to commercial construction. Both are correct to a certain extent, but: (a) I find it hard to imagine that the proportion of jobs held by aliens was very much higher in 2006 than, say, 1988-90 and (b) the BLS does not show a commensurate increase in the number of jobs for the non-residential construction sector - employment there is flat. Plus, the number of jobs in the housing construction sector doubled since the last major housing recession in 1992, in line with housing construction activity (see chart below). So, the puzzle remains...

The answer to the puzzle is much simpler, I believe. Unlike other housing recessions, this time housing starts fell off a cliff from a record high level - everything happened very, very fast. This means that there was still a lot of work to be completed at the time. Now, a builder will not abandon a project in the middle of construction - he has already invested too much money. Knowing that things are turning negative on the demand side, what he will do, instead, is rush every worker available to the sites already in progress, in an effort to complete and sell as many houses as possible, as soon as possible. This is the logical reaction to a dropping market: houses that come late to the market will fetch lower prices. Look at the chart below (click to enlarge): starts have plunged, but units still under construction are high. This can only mean that builders are working hard to finish existing projects already in the pipeline. And that's why construction workers are still at work.

But what the future has in store is another matter altogether. Given the collapse in starts, construction layoffs are going to occur suddenly, too, just as soon as work in progress is finished. And that's when we may see half a million jobs disappear within months.

ADDENDUM: When will the job losses happen?

First a chart - you definitely need to click on it to enlarge and study it. Too many squiggly lines.

The top two lines are starts and completions; they track quite closely, meaning that builders are completing what they started and not really abandoning many projects.

The top two lines are starts and completions; they track quite closely, meaning that builders are completing what they started and not really abandoning many projects.

The next two lines present somewhat of a puzzle. The blue line is sales and the pink one units under construction. After tracking for decades, as one would expect, after 1996 sales overtook construction significantly. What happened? It must be that cancellations became a significant factor (figures for sales are reported when contracts are signed and do not adjust for subsequent cancellations).

The green line at the bottom is the most interesting of all: new houses for sale. They are stuck near all time highs, meaning that inventory is a big problem.

OK, let's put it all together, from the jobs viewpoint:

a) New construction activity (starts) is collapsing. Future employment will decline.

b) Sales are approaching the number of units under construction, after being significantly higher. Builders are building fewer buildings, but sales are dropping faster.

c) The result is that inventory is not coming down. Builders will have to do fire sales and cut costs - i.e. cut jobs soon.

When and how much? Given the last three months data on starts, units under construction will probably drop to the 575.000/yr. level by year-end (September was at 675.000). This level is the same as in 1998, when residential construction employment averaged 725.000 jobs (September was at 981.000). So I project a loss of ~ 250.000 construction jobs in the next three months. Furthermore, starts currently are at 1993 levels, when employment was at 580.000 jobs and it seems to me we will drop to that level within another three months, for a total of 400.000 jobs lost in six months.

If starts keep going lower then construction jobs will drop even further.

Still At Work, But Not For Long

One puzzle that even Fed presidents find difficult to solve has to do with construction jobs. Though new housing starts have plunged, so far there have been no massive layoffs in the sector - at least not as measured by the BLS (see chart below).

The two explanations that I hear most often have to do with (a) illegal, undocumented aliens not being counted and (b) switching work to commercial construction. Both are correct to a certain extent, but: (a) I find it hard to imagine that the proportion of jobs held by aliens was very much higher in 2006 than, say, 1988-90 and (b) the BLS does not show a commensurate increase in the number of jobs for the non-residential construction sector - employment there is flat. Plus, the number of jobs in the housing construction sector doubled since the last major housing recession in 1992, in line with housing construction activity (see chart below). So, the puzzle remains...

The answer to the puzzle is much simpler, I believe. Unlike other housing recessions, this time housing starts fell off a cliff from a record high level - everything happened very, very fast. This means that there was still a lot of work to be completed at the time. Now, a builder will not abandon a project in the middle of construction - he has already invested too much money. Knowing that things are turning negative on the demand side, what he will do, instead, is rush every worker available to the sites already in progress, in an effort to complete and sell as many houses as possible, as soon as possible. This is the logical reaction to a dropping market: houses that come late to the market will fetch lower prices. Look at the chart below (click to enlarge): starts have plunged, but units still under construction are high. This can only mean that builders are working hard to finish existing projects already in the pipeline. And that's why construction workers are still at work.

But what the future has in store is another matter altogether. Given the collapse in starts, construction layoffs are going to occur suddenly, too, just as soon as work in progress is finished. And that's when we may see half a million jobs disappear within months.

ADDENDUM: When will the job losses happen?

First a chart - you definitely need to click on it to enlarge and study it. Too many squiggly lines.

The next two lines present somewhat of a puzzle. The blue line is sales and the pink one units under construction. After tracking for decades, as one would expect, after 1996 sales overtook construction significantly. What happened? It must be that cancellations became a significant factor (figures for sales are reported when contracts are signed and do not adjust for subsequent cancellations).

The green line at the bottom is the most interesting of all: new houses for sale. They are stuck near all time highs, meaning that inventory is a big problem.

OK, let's put it all together, from the jobs viewpoint:

a) New construction activity (starts) is collapsing. Future employment will decline.

b) Sales are approaching the number of units under construction, after being significantly higher. Builders are building fewer buildings, but sales are dropping faster.

c) The result is that inventory is not coming down. Builders will have to do fire sales and cut costs - i.e. cut jobs soon.

When and how much? Given the last three months data on starts, units under construction will probably drop to the 575.000/yr. level by year-end (September was at 675.000). This level is the same as in 1998, when residential construction employment averaged 725.000 jobs (September was at 981.000). So I project a loss of ~ 250.000 construction jobs in the next three months. Furthermore, starts currently are at 1993 levels, when employment was at 580.000 jobs and it seems to me we will drop to that level within another three months, for a total of 400.000 jobs lost in six months.

If starts keep going lower then construction jobs will drop even further.

Comment