Beneath the hand wringing, whining and Magical Thinking, there are bedrock reasons housing can't recover. Here's one of them . . .

The sustainability of the housing market is going to come from the potential pool of younger home buyers. The housing market since World War II has followed a very common and steady path up until the 2000s. Each year it was expected that home values would increase but this also came hand and hand with rising household incomes. There is little mention of how big of a hit household income has taken over the last decade. The pattern is broken so to expect that we are now going to be back on a similar path that was very familiar to the baby boomer generation is simply not the case. When we look at the actual income declines taken by the younger groups we realize that something is very different now. Combine this stagnant household income with large levels of student debt and you have headwinds that are likely to keep a lid on the entry level of the market.

The lack of income growth

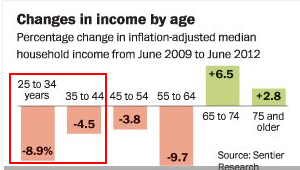

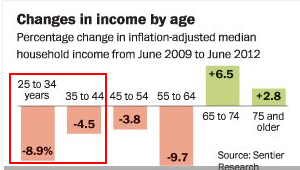

The below chart shows income changes during the recent recovery period:

Source: The Washington Post, Sentier Research

Over this most recent three year period, those in the 25 to 34 age group saw household incomes fall by a stunning 8.9 percent. Those in the 35 to 44 age range saw incomes fall by 4.5 percent. In this same period, the 30-year fixed rate mortgage fell from 6 percent to 3.5 percent (a drop of 41 percent). The additional leverage provided by this falling interest rate covered up the lack of growth in household incomes and also put a floor on falling home prices:

Nationwide there does appear to be a bottom forming in home prices. Yet the above household income data signifies that in order to keep this market going, the government is going to need to keep in place what amounts to negative interest rates while providing programs like FHA insured loans to make up for the lack of growth in household income. Yet the desires of many younger buyers are much more different from older generations. Do they want the suburb life? Many do not. With rising fuel costs and lower incomes, factors that were once not considered are now a big deal.

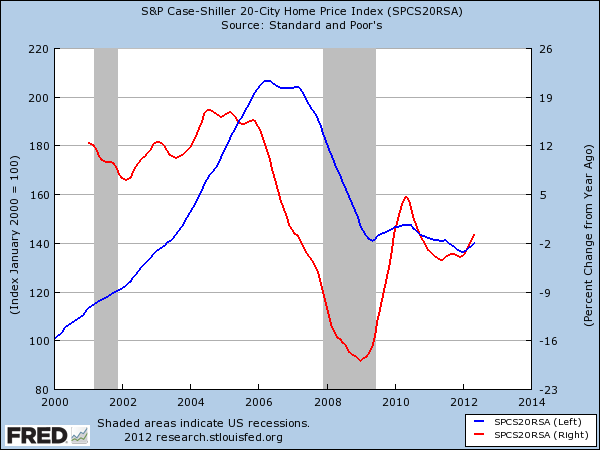

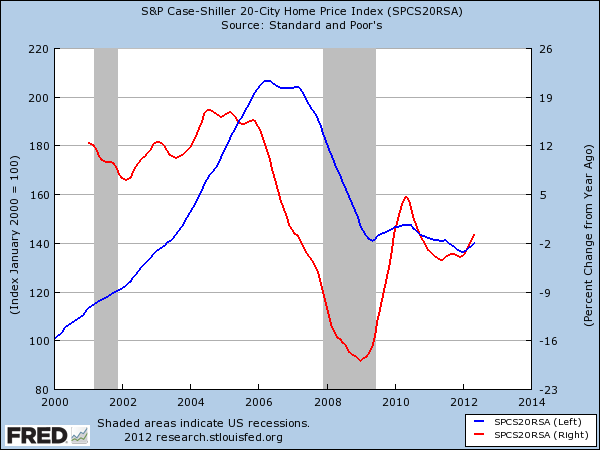

The above chart shows that it is likely that the Case Shiller Index will finally go positive year-over-year shortly. Yet will this be something that is sustained? The sustainability again will only remain if all of the government and Fed support efforts stay in place. The household income figures seem to be ignored in many cases but truly are the most viable figures for a longer term sustainable housing market. What is more challenging is a big part of the recession is falling on the backs of younger Americans. How so?

-The massive student debt bubble has largely fallen on their balance sheets

-They have witnessed the weakest income growth of any group

-The median net worth of those 35 and younger is $3,500 nationwide

-Nearly half of mortgage holders under 40 are underwater, twice the rate of older borrowers

Yet this is the group that is expected to purchase all those houses in the future. Most of the buying in the last few years has been a process of soaking up excess inventory:

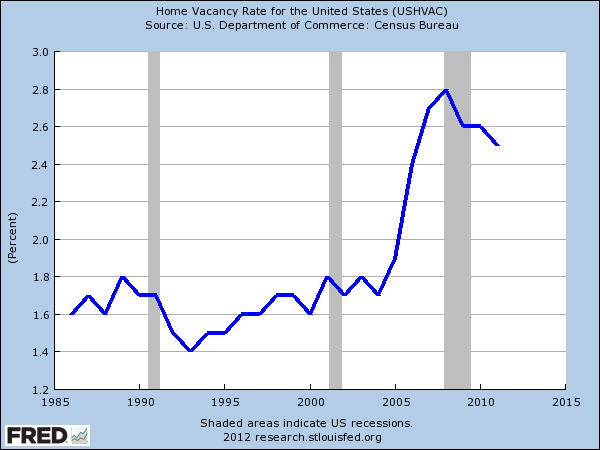

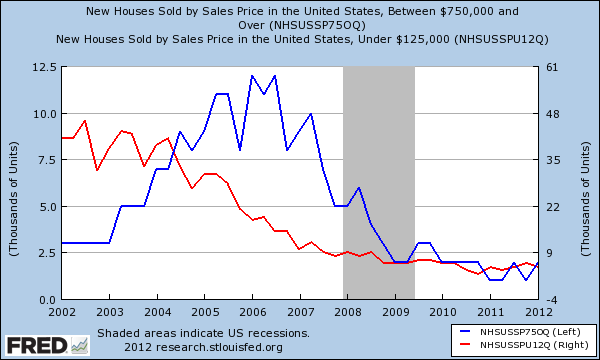

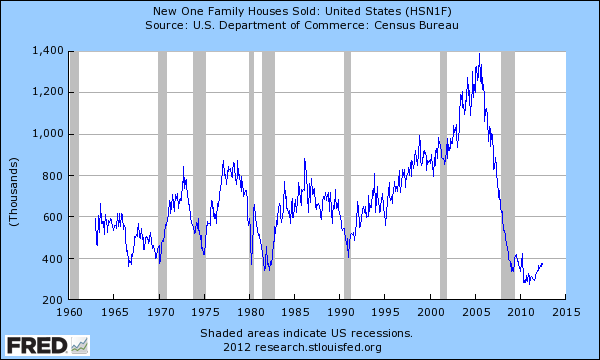

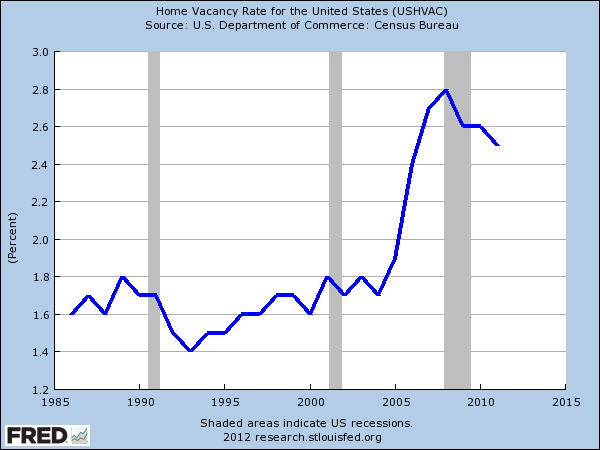

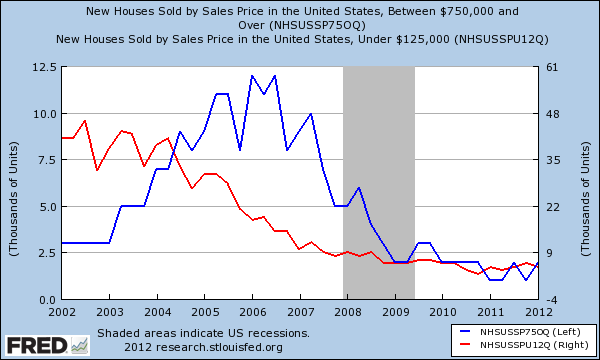

The home vacancy rate is declining as more of the distressed inventory is sold off. If we look at the high-end and low-end of the new home market we see that the appetite for newer homes has largely not come back:

Demand for new homes above $750,000 is a shell of what it was in 2006. At that point, over 12,000 homes on a quarterly basis were being sold. Today it is down to 2,000 (a drop of 83 percent). Even at the lower end, the drop from 2006 to now is substantial. This is largely due to the reality that after 2007, most of the buying activity came from re-sale homes for deeper discounts and a disproportionately large amount of buying from investors; home building largely slowed down to a halt.

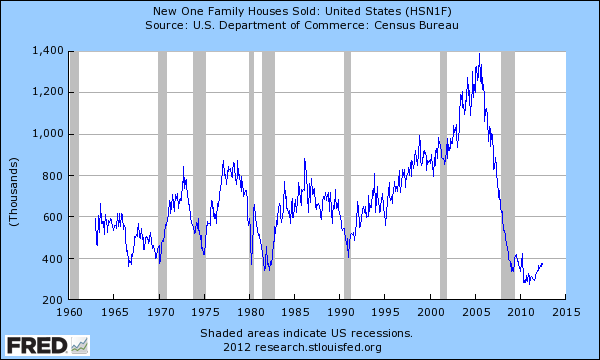

Those that claim some kind of GDP booster is going to occur because of a new housing market simply believe that their past history is going to repeat yet again. Will younger buyers go for the suburb model with lower incomes, deep student debt, and a desire to be closer to city centers? Also, families are much smaller today so the need for bigger spaces is not needed. New family home sales have picked up but put this into a bigger context:

The money flowing into the market right now is going to banks that are making good money with closing costs and other associated fees with the refinancing boom. The low rates are being used not to help Americans but to speculate internationally in stocks and other investments since commercial and investment banking are still intertwined. This is why the mortgage market is largely being fueled by government backed debt while banks place no faith in the American household when it comes to making mortgages.

Yet how much lower can rates go? We’ve discussed in a previous article that there are hidden costs now being put on other segments of the economy. The bottom only means that prices nationwide are no longer flying off a cliff but why would home prices rise if incomes are stagnant? The booster shots from low interest rates, low down payment FHA insured loans, and other artificial stimulus is already showing signs of hitting breaking points.

The problem with the last decade was the focus on running fiscal policy through the banking sector. This is why most Americans have seen their bottom line collapse:

Source: CNN Money

The middle-class shrank by 10 percent in the last 40 years. Nearly 30 percent of all Americans are now considered low income. The upper-income group went up by 6 percent. Nationwide you need a strong middle class to have a sustained and growing housing market.

Household income will be the most important catalyst in sustaining any semblance of a healthy housing market.

http://www.doctorhousingbubble.com/i...income-growth/

The sustainability of the housing market is going to come from the potential pool of younger home buyers. The housing market since World War II has followed a very common and steady path up until the 2000s. Each year it was expected that home values would increase but this also came hand and hand with rising household incomes. There is little mention of how big of a hit household income has taken over the last decade. The pattern is broken so to expect that we are now going to be back on a similar path that was very familiar to the baby boomer generation is simply not the case. When we look at the actual income declines taken by the younger groups we realize that something is very different now. Combine this stagnant household income with large levels of student debt and you have headwinds that are likely to keep a lid on the entry level of the market.

The lack of income growth

The below chart shows income changes during the recent recovery period:

Source: The Washington Post, Sentier Research

Over this most recent three year period, those in the 25 to 34 age group saw household incomes fall by a stunning 8.9 percent. Those in the 35 to 44 age range saw incomes fall by 4.5 percent. In this same period, the 30-year fixed rate mortgage fell from 6 percent to 3.5 percent (a drop of 41 percent). The additional leverage provided by this falling interest rate covered up the lack of growth in household incomes and also put a floor on falling home prices:

Nationwide there does appear to be a bottom forming in home prices. Yet the above household income data signifies that in order to keep this market going, the government is going to need to keep in place what amounts to negative interest rates while providing programs like FHA insured loans to make up for the lack of growth in household income. Yet the desires of many younger buyers are much more different from older generations. Do they want the suburb life? Many do not. With rising fuel costs and lower incomes, factors that were once not considered are now a big deal.

The above chart shows that it is likely that the Case Shiller Index will finally go positive year-over-year shortly. Yet will this be something that is sustained? The sustainability again will only remain if all of the government and Fed support efforts stay in place. The household income figures seem to be ignored in many cases but truly are the most viable figures for a longer term sustainable housing market. What is more challenging is a big part of the recession is falling on the backs of younger Americans. How so?

-The massive student debt bubble has largely fallen on their balance sheets

-They have witnessed the weakest income growth of any group

-The median net worth of those 35 and younger is $3,500 nationwide

-Nearly half of mortgage holders under 40 are underwater, twice the rate of older borrowers

Yet this is the group that is expected to purchase all those houses in the future. Most of the buying in the last few years has been a process of soaking up excess inventory:

The home vacancy rate is declining as more of the distressed inventory is sold off. If we look at the high-end and low-end of the new home market we see that the appetite for newer homes has largely not come back:

Demand for new homes above $750,000 is a shell of what it was in 2006. At that point, over 12,000 homes on a quarterly basis were being sold. Today it is down to 2,000 (a drop of 83 percent). Even at the lower end, the drop from 2006 to now is substantial. This is largely due to the reality that after 2007, most of the buying activity came from re-sale homes for deeper discounts and a disproportionately large amount of buying from investors; home building largely slowed down to a halt.

Those that claim some kind of GDP booster is going to occur because of a new housing market simply believe that their past history is going to repeat yet again. Will younger buyers go for the suburb model with lower incomes, deep student debt, and a desire to be closer to city centers? Also, families are much smaller today so the need for bigger spaces is not needed. New family home sales have picked up but put this into a bigger context:

The money flowing into the market right now is going to banks that are making good money with closing costs and other associated fees with the refinancing boom. The low rates are being used not to help Americans but to speculate internationally in stocks and other investments since commercial and investment banking are still intertwined. This is why the mortgage market is largely being fueled by government backed debt while banks place no faith in the American household when it comes to making mortgages.

Yet how much lower can rates go? We’ve discussed in a previous article that there are hidden costs now being put on other segments of the economy. The bottom only means that prices nationwide are no longer flying off a cliff but why would home prices rise if incomes are stagnant? The booster shots from low interest rates, low down payment FHA insured loans, and other artificial stimulus is already showing signs of hitting breaking points.

The problem with the last decade was the focus on running fiscal policy through the banking sector. This is why most Americans have seen their bottom line collapse:

Source: CNN Money

The middle-class shrank by 10 percent in the last 40 years. Nearly 30 percent of all Americans are now considered low income. The upper-income group went up by 6 percent. Nationwide you need a strong middle class to have a sustained and growing housing market.

Household income will be the most important catalyst in sustaining any semblance of a healthy housing market.

http://www.doctorhousingbubble.com/i...income-growth/

Comment