Source:

http://www.slate.com/blogs/moneybox/2012/08/20/slouching_toward_recovery.html

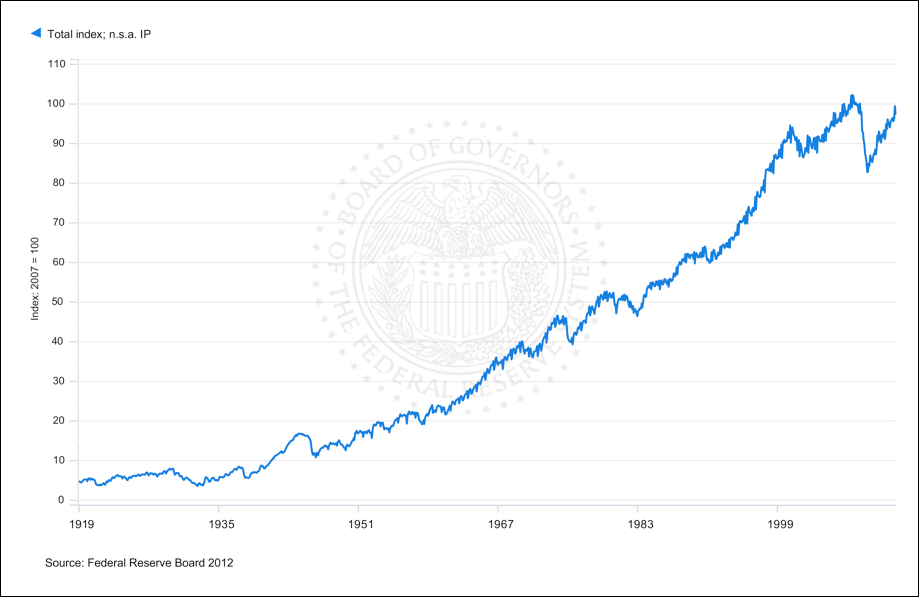

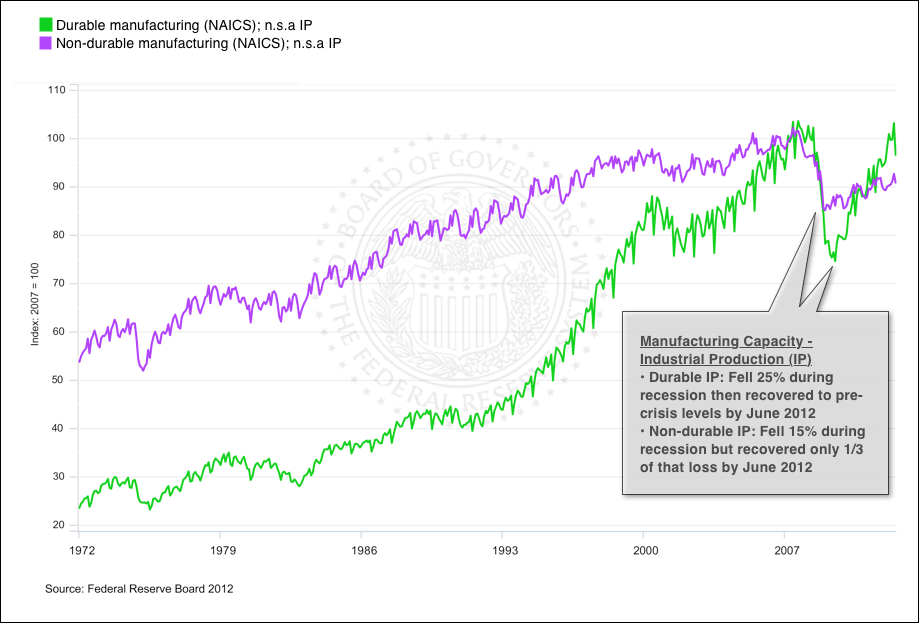

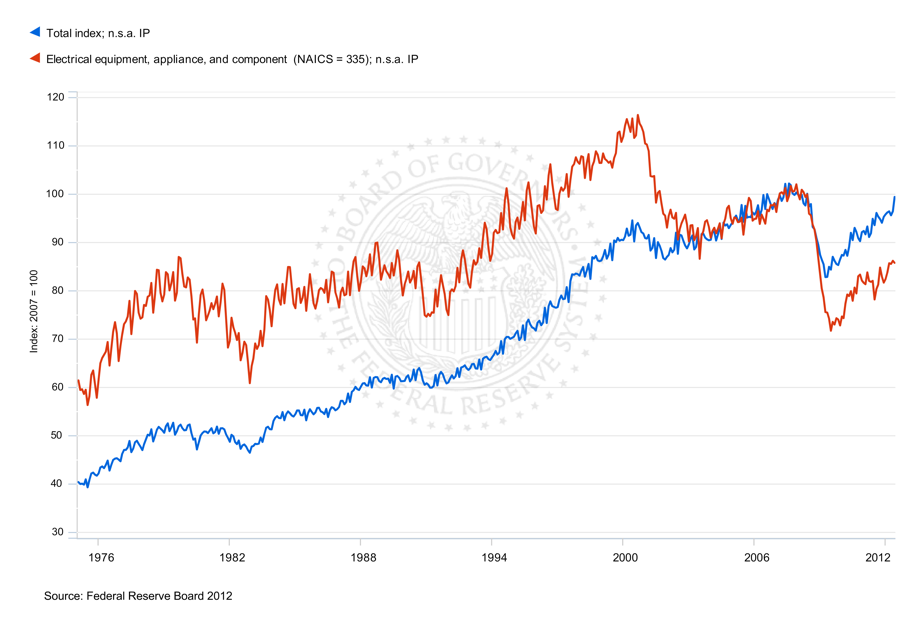

US Capacity Utilization is back at 80%. It rarely went above that level prior to the onset of the recession. Does this mean the output gap - despite GDP not having returned to it's long-run trend - is closed and some of the major inflationist arguments will materialize now? Has hysteresis worked it's magic and crushed the keynesian dream of reviving an idle economy by simply raising demand? Is the neo-keynesian argument for low inflation now wiped off the table and will Krugman's smug smirk be wiped off his face?

Apologies for dramatizing a bit, but surely this at least means that GDP growth loses a lot of its momentum now that producing more stuff is no longer a matter of pushing the "on" button on idle machinery?

Comment