http://www.reghardware.com/2012/08/0...one_shipments/

Note the dichotomy - exaggerated because of Apple's release cycle: Android OS smartphones sold 54 million more YoY while Apple sold 5.6 million more YoY - with a large fraction of Apple sales in the US (over 25% according to comscore).

A look at Apple's annual iPhone sales in the past few years according to IDC:

2008: 13.8M

2009: 25.1M

2010: 48.4M

2011: 93M

The question then is - will 2012 see a leveling off of this trend? If so that will likely be the first sign of the end of the bubble.

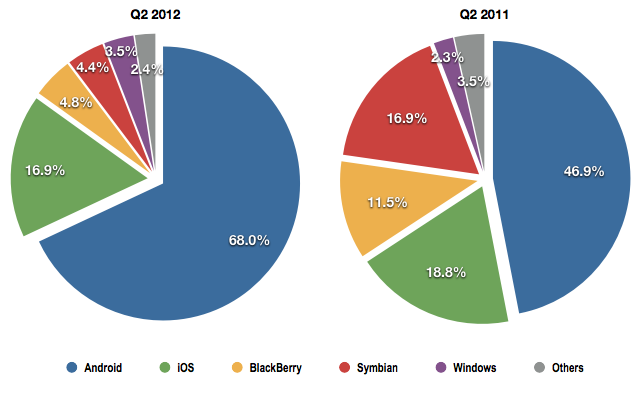

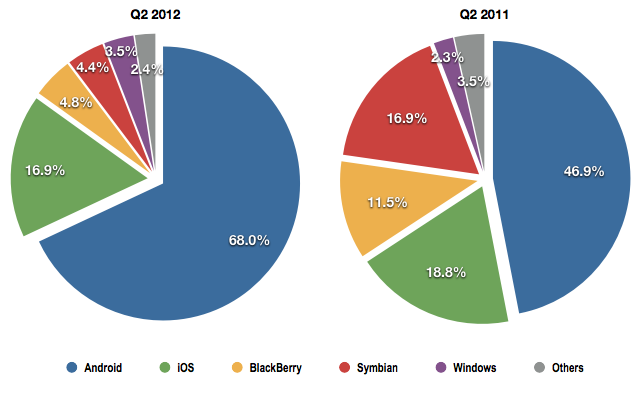

It's a two-horse race, no question. Apple and Google's grip on the world smartphone market tightened even further during Q2, with everyone else's combined share falling to 15 per cent from 34.3 per cent in the year-ago quarter.

The numbers come from IDC, a market watcher, and they chart RIM's decline - from an 11.5 per cent share to 4.8 per cent in a year - and Symbian's even steeper fall: down from 16.9 per cent to 4.4 per cent.

Microsoft's Windows Phone platform has undoubtedly increased Redmond's presence in the market, but by a tiny amount: a 2.3 per cent share became 3.5 per cent in the months between Q2 2011 and Q2 2012. But it's clearly gaining on RIM, so there's scope for optimism at Microsoft. Question is, is it actively winning share - or is RIM simply losing it?

Data source: IDC

Data source: IDC

Microsoft, like Google, is merely an OS supplier - their shares are spread across multiple vendors. Not so Apple which, like RIM and Symbian, saw its market share fall year on year. Unlike those others, Apple nonetheless increased its unit shipments, and since it's shipping units and selling them that makes money, we'd say it's a lot more cheerful than RIM and Nokia, Symbian's owner, are.

Apple can also take heart from increasing its market share in the US, its home market, according to recent figures from Strategy Analytics. But IDC's data show the value of enabling low-cost product in other markets, particularly emerging ones. The rise of the budget Android smartphone is clearly playing dividends for Google.

Its hardware partners doubled the combined unit shipments year on year, from 50.8m to 104.8m. Apple's went from 20.4m to 26m. ®

The numbers come from IDC, a market watcher, and they chart RIM's decline - from an 11.5 per cent share to 4.8 per cent in a year - and Symbian's even steeper fall: down from 16.9 per cent to 4.4 per cent.

Microsoft's Windows Phone platform has undoubtedly increased Redmond's presence in the market, but by a tiny amount: a 2.3 per cent share became 3.5 per cent in the months between Q2 2011 and Q2 2012. But it's clearly gaining on RIM, so there's scope for optimism at Microsoft. Question is, is it actively winning share - or is RIM simply losing it?

Smartphone OS World market shares Q2 2012 and 2011

Data source: IDC

Data source: IDCMicrosoft, like Google, is merely an OS supplier - their shares are spread across multiple vendors. Not so Apple which, like RIM and Symbian, saw its market share fall year on year. Unlike those others, Apple nonetheless increased its unit shipments, and since it's shipping units and selling them that makes money, we'd say it's a lot more cheerful than RIM and Nokia, Symbian's owner, are.

Apple can also take heart from increasing its market share in the US, its home market, according to recent figures from Strategy Analytics. But IDC's data show the value of enabling low-cost product in other markets, particularly emerging ones. The rise of the budget Android smartphone is clearly playing dividends for Google.

Its hardware partners doubled the combined unit shipments year on year, from 50.8m to 104.8m. Apple's went from 20.4m to 26m. ®

A look at Apple's annual iPhone sales in the past few years according to IDC:

2008: 13.8M

2009: 25.1M

2010: 48.4M

2011: 93M

The question then is - will 2012 see a leveling off of this trend? If so that will likely be the first sign of the end of the bubble.

Comment