David: I don't think we are at the beginning of the recovery. I think we are at the end of a disastrous debt supercycle that has gone on for the last thirty or forty years, really. It started when Nixon defaulted on our obligations under Bretton Woods and closed the gold window. Incrementally, year after year since then, we have been going in a direction of extremely unsound money, of massive borrowing in both the private and the public sector. We now have an economy that is saturated with debt: $54 trillion or $53 trillion – 3.5 times the GDP – way off the charts from where it was for a hundred years prior to the beginning of this. The idea that somehow all of that debt is irrelevant, as the Keynesians would tell us, is fundamentally wrong – and the reason why the economy can't get up off the mat.

This market isn't real. The two percent on the ten-year, the ninety basis points on the five-year, thirty basis points on a one-year – those are medicated, pegged rates created by the Fed and which fast-money traders trade against as long as they are confident the Fed can keep the whole market rigged. Nobody in their right mind wants to own the ten-year bond at a two percent interest rate. But they're doing it because they can borrow overnight money for free, ten basis points, put it on repo, collect 190 basis points a spread, and laugh all the way to the bank. And they will keep laughing all the way to the bank on Wall Street until they lose confidence in the Fed's ability to keep the yield curve pegged where it is today. If the bond ever starts falling in price, they unwind the carry trade. They unwind the repo, because then you can't collect 190 basis points.

Then you get a message, "Do not pass go." Sell your bonds, unwind your overnight debt, your repo positions. And the system then begins to contract – exactly what happened in September and October of 2008. Only, that time it was an unwind to the repo on mortgage-backed securities and CDOs and so forth. That was a minor trial run for the great unwind that is going to happen when the Treasury market is finally shattered with a lack of confidence because, on the margin, no one owns a Treasury bond: they just rent it on borrowed money. If the price starts falling, they'll get out of that trade as fast as they got out of toxic CDOs.

The Fed has destroyed the money market. It has destroyed the capital markets. They have something that you can see on the screen called an "interest rate." That isn't a market price of money or a market price of five-year debt capital. That is an administered price that the Fed has set and that every trader watches by the minute to make sure that he's still in a positive spread. And you can't have capitalism if the capital markets are dead, if the capital markets are simply a branch office – branch casino – of the central bank. That's essentially what we have today.

The Fed has taken its balance sheet to $3 trillion. That's enough for the next 50 years. They don't have to do a damn thing except maybe have a discount window that floats above the market, and if things get tight, let the interest rate go up. People who have been speculating will be carried out on a stretcher.

As Badgett said (Walter Badgett, the great 19th-century British financial thinker): provide liquidity at a penalty rate to sound collateral.

Now, that's what J.P. Morgan did in 1907, in the great crisis of 1907, from his library. He didn't have a printing press. He didn't bail out everybody. He didn't do what Bernanke did and say: "Stop the presses, freeze everybody, and prop up Morgan Stanley and Goldman Sachs and all the rest of the speculators." The interest rate, the call-money interest rate, which was the open-market interest rate at the time, some days went to 30, 40, 70% – and they were carrying out the speculators left and right, liquidating margin debt, taking out the real estate speculators. Eight or ten railroads went bankrupt within a couple of months. The copper magnates got carried out on their shields.

This is the only way a capital market can work, but it needs an honest interest rate. And we have no interest rate, so therefore we solve nothing and we have the kind of impaired, incapacitated markets that we have today.

Greenspan panicked in December 2000. The interest rate was 6.5%; we had an economy that was threatened by competitors around the world. We needed high interest rates, not low. He panicked after the dot-com crash, and as you remember in two years they took the interest rate all the way down to 1%, and they catalyzed an explosion of mortgage borrowing, which was crazy.

When they cut the final rate down to 1% in May, June 2003, in that quarter – the second quarter of 2003 – the run rate of mortgage borrowing was $5 trillion at an annual rate. That was nuts! There had never been even a trillion-dollar annual rate of mortgage borrowing previously. In that quarter the run rate was $5 trillion, 40% of GDP. Why? Because the Fed took the rate down to 1%. Floating-rate product got invented everywhere. Anybody that had a pulse was being given mortgage loans by the brokers. The mortgage brokers didn't have any capital or funding. They went to Wall Street. They got warehouse lines, and the whole thing got out of control. Millions of households were lured into taking on debt that was insane, and now we have a generation of debt slaves.

There are 25 million households in America who couldn't move if they wanted to, because their mortgages are under water. They cannot generate a down payment and the 5% or 6% broker fee that you need to move. So we've got 25 million households immobilized, paralyzed, and worried every day about when they are going to lose property, because of what the Fed did. It's a terrible indictment.

Alex: That's a pretty stark picture. So as an individual investor, what are we to do? How do we protect ourselves in this type of situation? Should I be owning bonds and staying out of stocks? Should I be owning stocks?

David: No, I would stay out of any security markets. These are unsafe markets at any speed. It's all tied together. As I was saying when the great margin call comes and they start selling the Treasury bond, they'll take everything else with it. Real estate is priced off Treasuries. Mortgaged-backed securities are priced off Treasuries. Corporates are priced off Treasuries. Junk bonds are priced off Treasuries. Everything. The stock market will go into a panic. We don't know when the timing will come – we've never been in a world where there is $15 trillion worth of central-bank balance sheets, like we have today. The only thing I think you can conclude is preservation is the only thing you are about as an investor. Forget about yield. Forget about return. Just keep yourself liquid and preserve your capital, because you can't predict the day when, as I say, the great margin call in the sky comes down.

Alex: So if it's not about coming out ahead, it's about coming out not behind everybody else. It's just losing a little less. What's the most effective way to do that? Do you want to hold cash? Alternative options?

David: Yes. I don't even think there's nothing wrong with owning Treasury bills. I mean, if you want to get, for a one-year Treasury, what is the thing now? Twenty basis points or something.

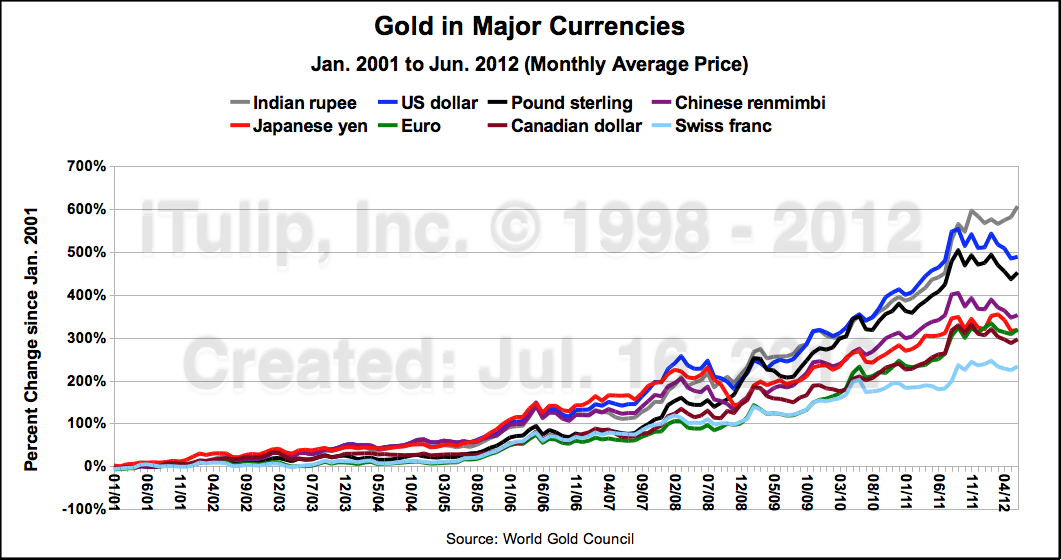

Alex: The dollar will be okay, because we still need a medium of exchange and the dollar is the least-bad currency in the world. How does gold fit into the picture? Do you think that gold is a good asset?

David: Yes, I think that gold is a good asset. It's the only currency that anybody is going to believe in after a while.

Alex: Okay, so maybe hold that as an insurance policy. Do you own gold yourself?

David: Yes, as an insurance policy.

Alex: Where else do you invest in today?

David: I'm preserving capital. I'm in cash. I don't think the risk of the system is worth it.

Alex: So you are practicing what you preach, 100%?

David: Yes.

Comment