I WORK on retirement policy, so friends often want to talk about their own retirement plans and prospects. While I am happy to have these conversations, my friends usually walk away feeling worse — for good reason.

Seventy-five percent of Americans nearing retirement age in 2010 hadless than $30,000 in their retirement accounts. The specter of downward mobility in retirement is a looming reality for both middle- and higher-income workers. Almost half of middle-class workers, 49 percent, will be poor or near poor in retirement, living on a food budget of about $5 a day.

In my ad hoc retirement talks, I repeatedly hear about the “guy.” This is a for-profit investment adviser, often described as, “I have this guy who is pretty good, he always calls, doesn’t push me into investments.” When I ask how much the “guy” costs, or if the guy has fiduciary loyalty — to the client, not the firm — or if their investments do better than a standard low-fee benchmark, they inevitably don’t know. After hearing about their magical guy, I ask about their “number.”

To maintain living standards into old age we need roughly 20 times our annual income in financial wealth. If you earn $100,000 at retirement, you need about $2 million beyond what you will receive from Social Security. If you have an income-producing partner and a paid-off house, you need less. This number is startling in light of the stone-cold fact that most people aged 50 to 64 have nothing or next to nothing in retirement accounts and thus will rely solely on Social Security.

Even for those who know their “number” and are prepared for retirement (it happens, rarely), these conversations aren’t easy. At dinner one night, a friend told me how much he has in retirement assets and said he didn’t think he had saved enough. I mentally calculated his mortality, figured he would die sooner than he predicted, and told him cheerfully that he shouldn’t worry. (“Congratulations!”) But dying early is not the basis of a retirement plan.

If we manage to accept that our investments will likely not be enough, we usually enter another fantasy world — that of working longer. After all, people hear that 70 is the new 50, and a recent report from Boston College says that if people work until age 70, they will most likely have enough to retire on. Unfortunately, this ignores the reality that unemployment rates for those over 50 are increasing faster than for any other group and that displaced older workers face a higher risk of long-term unemployment than their younger counterparts. If those workers ever do get re-hired, it’s not without taking at least a 25 percent wage cut.

But the idea is tempting; people say they don’t want to retire and feel useless. Professionals say they can keep going, “maybe do some consulting” or find some other way to generate income well into their late 60s. Others say they can always be Walmart greeters. They rarely admit that many people retire earlier than they want because they are laid off or their spouse becomes sick.

Like the nation’s wealth gap, the longevity gap has also widened. The chance to work into one’s 70s primarily belongs to the most well off. Medical technology has helped extend life, by helping older people survive longer with illnesses and by helping others stay active. The gains in longevity in the last two decades almost all went to people earning more than average. It makes perfect sense for human beings to think each of us is special and can work forever. To admit you can’t, or might not be able to, is hard, and denial and magical thinking are underrated human coping devices in response to helplessness and fear.

So it’s not surprising that denial dominates my dinner conversations, but it is irresponsible for Congress to deny that regardless of how much you throw 401(k) advertising, pension cuts, financial education and tax breaks at Americans, the retirement system simply defies human behavior. Basing a system on people’s voluntarily saving for 40 years and evaluating the relevant information for sound investment choices is like asking the family pet to dance on two legs.

Not yet convinced that failure is baked into the voluntary, self-directed, commercially run retirement plans system?

Consider what would have to happen for it to work for you. First, figure out when you and your spouse will be laid off or be too sick to work. Second, figure out when you will die. Third, understand that you need to save 7 percent of every dollar you earn. (Didn’t start doing that when you were 25 and you are 55 now? Just save 30 percent of every dollar.) Fourth, earn at least 3 percent above inflation on your investments, every year. (Easy. Just find the best funds for the lowest price and have them optimally allocated.) Fifth, do not withdraw any funds when you lose your job, have a health problem, get divorced, buy a house or send a kid to college. Sixth, time your retirement account withdrawals so the last cent is spent the day you die.

As we all know, these abilities are not common for our species. The current model for retirement savings, which forces individuals to figure out a plan for their retirement years, whether through a “guy” or by individual decision making, will always fall short. My friends are afraid, and they are not alone. In March, according to the Employee Benefit Research Institute, only 52 percent of Americans expressed confidence that they will becomfortable in retirement. Twenty years ago, that number was close to 75 percent.

I hope that fear can make us all get real. The coming retirement income security crisis is a shared problem; it is not caused by a set of isolated individual behaviors. My plan calls for a way out that would create guaranteed retirement accounts on top of Social Security. These accounts would be required, professionally managed, come with a guaranteed rate of return and pay out annuities. This is a sensible way to get people to prepare for the future. You don’t like mandates? Get real. Just as a voluntary Social Security system would have been a disaster, a voluntary retirement account plan is a disaster.

It is now more than 30 years since the 401(k)/Individual Retirement Account model appeared on the scene. This do-it-yourself pension system has failed. It has failed because it expects individuals without investment expertise to reap the same results as professional investors and money managers. What results would you expect if you were asked to pull your own teeth or do your own electrical wiring?

Although humans may be bad at some behaviors, we are good at others, including coming together and finding common solutions that protect all of us from risk. Surely we can find a way to help people save — adequately and with little risk — for their old age.

http://www.nytimes.com/2012/07/22/op...me&ref=general

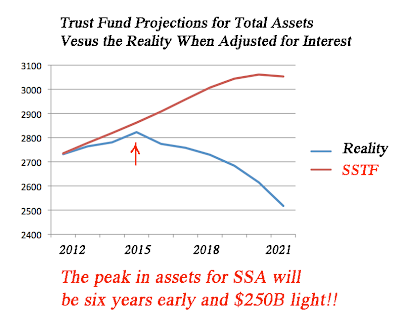

jk comment- although iras and 401k's are certainly failures as social policy, i question the "guaranteed rate of return" on the mandatory, "professionally managed" program she proposes. surely this money would be forced into treasuries and the guaranteed rate of return will turn this program into just a bigger social security program, wherein the mandatory contributions are in essence a bigger social security tax, and the guaranteed returns - in the form of an annuity- a bigger social security payment. i suppose setting it up this way would extend the time before social security hits the wall, because of the bigger forced contributions by all current workers, but i think that's all it would do.

Comment