The making of a housing market – like a Hollywood set, housing inventory looks to be low only because that is what is being presented. Orange County foreclosure pipeline twice the size of non-distressed MLS inventory.

The decrease in nationwide inventory is an ongoing trend. Keeping supply constricted has clearly helped with pushing prices higher as demand is now competing for a smaller number of homes. A lower mortgage rate has also pushed the monthly payment amount lower thus allowing home buyers to purchase more home with stagnant income levels. The recent employment report should come as no surprise. The recent moves in the housing market are spurred on by record low interest rates and constrained inventory. Yet this should not be mistaken with an improving economy that is pushing prices higher which would be healthier. We have a limited horizon before the summer selling season comes to an end and the market is put to a bigger test in fall and winter. Looking at market data from a variety of perspectives shows that the market is far from being normal.

Orange Country Snapshot

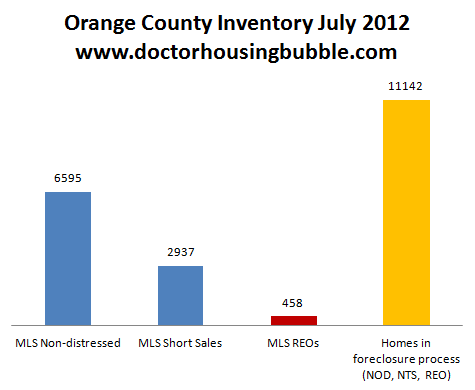

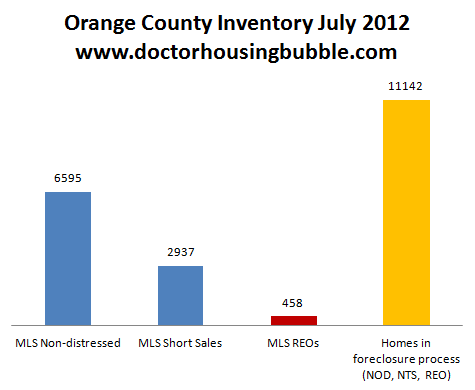

Orange County is seeing a solid jump in sales this year. We have seen a good amount of short sales hit the market recently. If we look at MLS inventory and last month sales we have approximately two months of inventory! This is back to the days of the mania. Yet this is only part of the story. Take a look at the total Orange County market:

Short sales are a big part of the visible MLS inventory making up roughly 30 percent of all inventory. Look at how tiny the REO listings are. But take a look at the yellow foreclosure pipeline. These are homes in the foreclosure process. This figure is nearly twice the size of the non-distressed visible inventory. These are households unable (or unwilling) to pay their mortgages in an expensive county. Does that seem healthy to you? Just because banks are selectively leaking out inventory does not mean the market is healthy.

It is an interesting observation on human behavior when you examine the thought process of those buying.

“Banks can do whatever they want and I need a home to start a family.”

“These record low interest rates are making it tempting to buy.”

It is fascinating that many do thoroughly understand what is occurring. That is, the market is like a Hollywood set and is fake. It is a façade yet the financial system that proclaims “free market” capitalism all the way through is more than willing to let a command-control housing market take place. The irony of this all is that many of the programs holding up the market (i.e., FHA insured loans, GSEs MBS, etc) at their core are set to keep housing affordable for Americans.

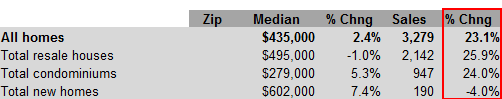

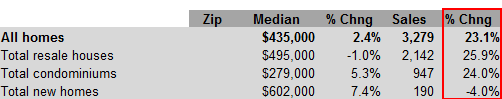

So what you see for example in Orange County is a surge in home sales:

Price gains are seen in condos and new home sales. Prices declined a bit in resale homes. The jump in sales from last year is solid.

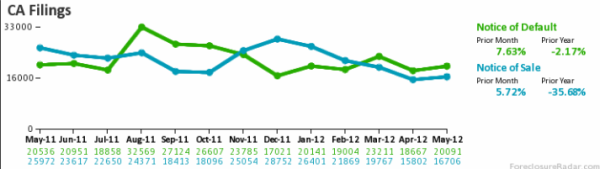

Foreclosure filings still occurring

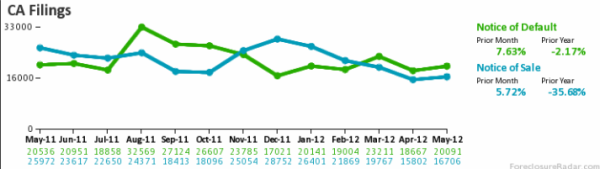

In spite of home prices moving up and visible inventory going down, foreclosure filings are still occurring at an elevated level:

These are fresh filings entering the pipeline. These are filings that will go to the yellow column above. The good news is that year-over-year the number of filings has declined substantially. This is a positive for the market. At this rate we are years away from any semblance of a normal market.

What needs to be taken into context as well is the desire to modify loans and also, the jump in short sales. Banks seem to be willing to agree to short sales (if a place like Orange County has 30 percent of visible MLS inventory as short sales this is definitely a strategy that is being pursued). Short sales by definition will likely push prices lower in metrics like the Case-Shiller that look at repeat home sale.

Nationwide inventory

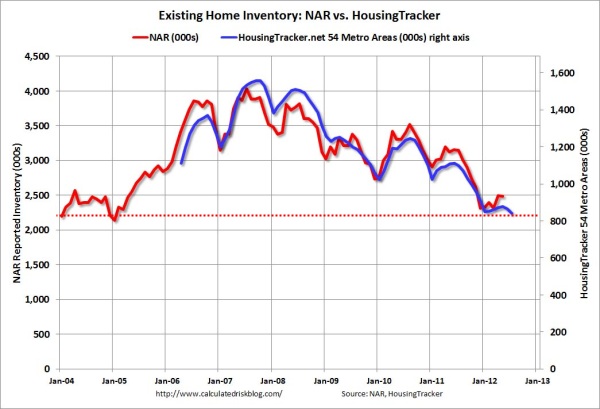

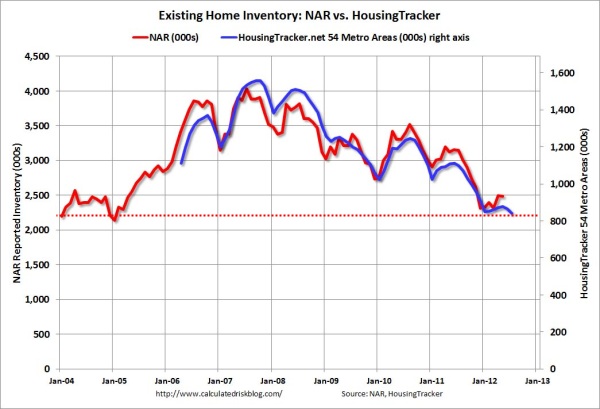

The trend of lower inventory is occurring on a nationwide basis:

Inventory is back to levels last seen in 2005. The strategy of leaking out inventory in a controlled fashion while leveraging low mortgage rates seems to be the ongoing plan. If you speak with many investors in the trenches their investment strategy really is dependent on the moves the banks and government make. If you truly looked at the market as being transparent and open, you would likely jump in with both hands since visible supply is low and demand is still there. Yet you are contenting with a multitude of other factors:

-If the market is healthy, why are we seeing a large number of short sales?

-If supply is so low and demand is here, why are banks restricting inventory?

Bottom line, banks are trying to maximize profits via re-writing accounting rules and using massive government bailouts to their benefit. Short sales do better than foreclosures. Constricting supply obviously will push prices higher. The Fed owns trillions of dollars in MBS and we are left with a record low mortgage rate. The market is looking for lower priced housing while the financial system is determined to do everything to keep prices inflated. Financial scandals are hitting left and right and no solid reform are ushered forward.

Moving in with mom and dad

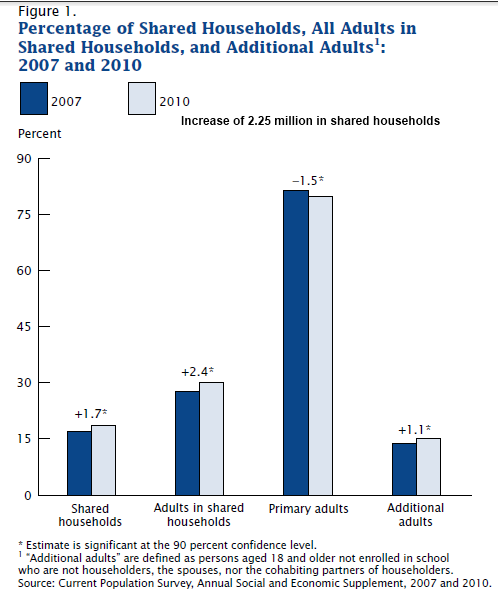

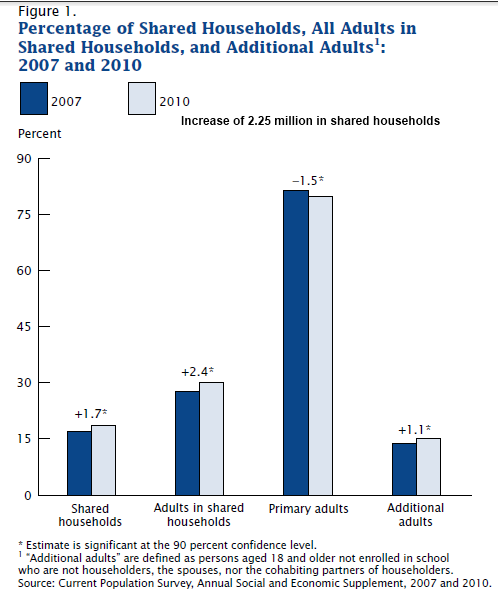

The increase in prices and sales is a short-term trend unless the overall economy gains traction. What will be important to see play out over the next decade is how younger Americans will perceive housing. This will be a less affluent generation. Many are already massively in debt for their pursuits of a college degree. Since the recession hit, many have moved back home with parents:

2.25 million adults have moved back home for a variety of reasons since the recession hit. You wonder if this generation is willing to dive into massive debt to purchase a home simply because a mortgage rate is low. How many will qualify if they have lower wages, a bigger student debt obligation, car loans, and other forms of debt?

What is more likely is that demand for rentals in the short-term will be stronger and we are seeing this with increases in rent nationwide. You also see many of these people unable to qualify for mortgages in a tighter lending environment. The typical pattern goes:

Live at home >> go to college >> rent >> buy a home

In the past it was easier to go into the workforce as a blue collar worker and still qualify to purchase a home. Yet many Americans are now competing for lower paying service sector work so college or vocational training is the only route to a stable lifestyle and what one would consider middle class. Couple this with the massive baby boomer wave of retirements and we are certainly entering a different time.

http://www.doctorhousingbubble.com/t...-healthy-2012/

The decrease in nationwide inventory is an ongoing trend. Keeping supply constricted has clearly helped with pushing prices higher as demand is now competing for a smaller number of homes. A lower mortgage rate has also pushed the monthly payment amount lower thus allowing home buyers to purchase more home with stagnant income levels. The recent employment report should come as no surprise. The recent moves in the housing market are spurred on by record low interest rates and constrained inventory. Yet this should not be mistaken with an improving economy that is pushing prices higher which would be healthier. We have a limited horizon before the summer selling season comes to an end and the market is put to a bigger test in fall and winter. Looking at market data from a variety of perspectives shows that the market is far from being normal.

Orange Country Snapshot

Orange County is seeing a solid jump in sales this year. We have seen a good amount of short sales hit the market recently. If we look at MLS inventory and last month sales we have approximately two months of inventory! This is back to the days of the mania. Yet this is only part of the story. Take a look at the total Orange County market:

Short sales are a big part of the visible MLS inventory making up roughly 30 percent of all inventory. Look at how tiny the REO listings are. But take a look at the yellow foreclosure pipeline. These are homes in the foreclosure process. This figure is nearly twice the size of the non-distressed visible inventory. These are households unable (or unwilling) to pay their mortgages in an expensive county. Does that seem healthy to you? Just because banks are selectively leaking out inventory does not mean the market is healthy.

It is an interesting observation on human behavior when you examine the thought process of those buying.

“Banks can do whatever they want and I need a home to start a family.”

“These record low interest rates are making it tempting to buy.”

It is fascinating that many do thoroughly understand what is occurring. That is, the market is like a Hollywood set and is fake. It is a façade yet the financial system that proclaims “free market” capitalism all the way through is more than willing to let a command-control housing market take place. The irony of this all is that many of the programs holding up the market (i.e., FHA insured loans, GSEs MBS, etc) at their core are set to keep housing affordable for Americans.

So what you see for example in Orange County is a surge in home sales:

Price gains are seen in condos and new home sales. Prices declined a bit in resale homes. The jump in sales from last year is solid.

Foreclosure filings still occurring

In spite of home prices moving up and visible inventory going down, foreclosure filings are still occurring at an elevated level:

These are fresh filings entering the pipeline. These are filings that will go to the yellow column above. The good news is that year-over-year the number of filings has declined substantially. This is a positive for the market. At this rate we are years away from any semblance of a normal market.

What needs to be taken into context as well is the desire to modify loans and also, the jump in short sales. Banks seem to be willing to agree to short sales (if a place like Orange County has 30 percent of visible MLS inventory as short sales this is definitely a strategy that is being pursued). Short sales by definition will likely push prices lower in metrics like the Case-Shiller that look at repeat home sale.

Nationwide inventory

The trend of lower inventory is occurring on a nationwide basis:

Inventory is back to levels last seen in 2005. The strategy of leaking out inventory in a controlled fashion while leveraging low mortgage rates seems to be the ongoing plan. If you speak with many investors in the trenches their investment strategy really is dependent on the moves the banks and government make. If you truly looked at the market as being transparent and open, you would likely jump in with both hands since visible supply is low and demand is still there. Yet you are contenting with a multitude of other factors:

-If the market is healthy, why are we seeing a large number of short sales?

-If supply is so low and demand is here, why are banks restricting inventory?

Bottom line, banks are trying to maximize profits via re-writing accounting rules and using massive government bailouts to their benefit. Short sales do better than foreclosures. Constricting supply obviously will push prices higher. The Fed owns trillions of dollars in MBS and we are left with a record low mortgage rate. The market is looking for lower priced housing while the financial system is determined to do everything to keep prices inflated. Financial scandals are hitting left and right and no solid reform are ushered forward.

Moving in with mom and dad

The increase in prices and sales is a short-term trend unless the overall economy gains traction. What will be important to see play out over the next decade is how younger Americans will perceive housing. This will be a less affluent generation. Many are already massively in debt for their pursuits of a college degree. Since the recession hit, many have moved back home with parents:

2.25 million adults have moved back home for a variety of reasons since the recession hit. You wonder if this generation is willing to dive into massive debt to purchase a home simply because a mortgage rate is low. How many will qualify if they have lower wages, a bigger student debt obligation, car loans, and other forms of debt?

What is more likely is that demand for rentals in the short-term will be stronger and we are seeing this with increases in rent nationwide. You also see many of these people unable to qualify for mortgages in a tighter lending environment. The typical pattern goes:

Live at home >> go to college >> rent >> buy a home

http://www.doctorhousingbubble.com/t...-healthy-2012/