from FT.

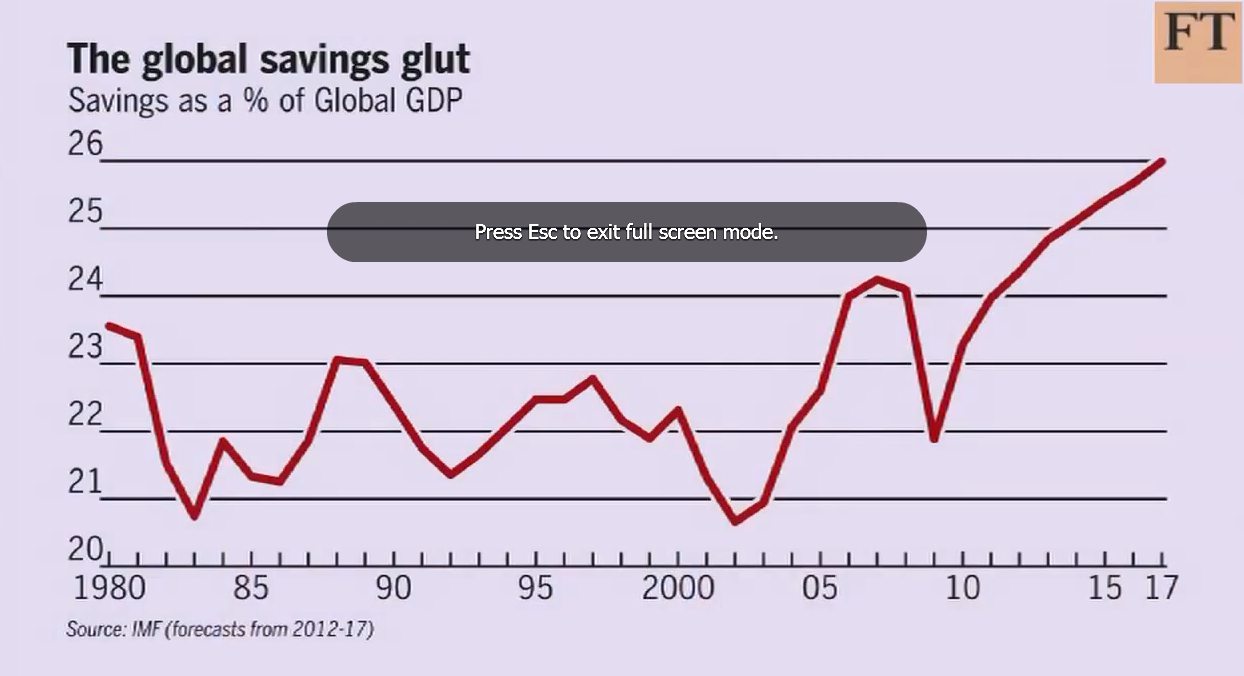

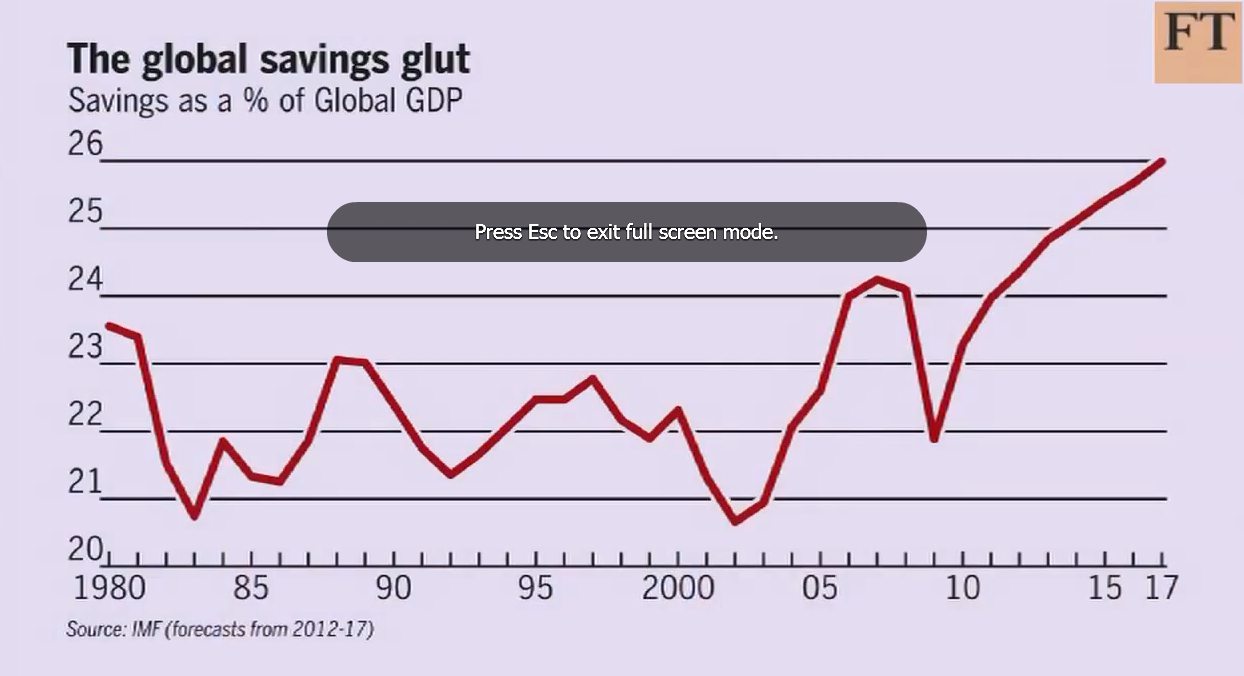

Dumas shows this graph:

and says that this is the result of governments paying down debts and not indicative of private individuals saving and investing more. Does this strike you as correct? What if he is wrong and we are going to see five plus years of zero interest rates?

Published on Jul 3, 2012 by FinancialTimesVideos

http://www.FT.com/ The growth of savings globally exacerbated by negative economic policies is choking economic growth, according to Charles Dumas, chief economist of Lombard Street Research. As a result, he suggests to Long View columnist John Authers that the best route to take now - and politically the easiest for Germany - is to dismantle the eurozone.

http://www.FT.com/ The growth of savings globally exacerbated by negative economic policies is choking economic growth, according to Charles Dumas, chief economist of Lombard Street Research. As a result, he suggests to Long View columnist John Authers that the best route to take now - and politically the easiest for Germany - is to dismantle the eurozone.

and says that this is the result of governments paying down debts and not indicative of private individuals saving and investing more. Does this strike you as correct? What if he is wrong and we are going to see five plus years of zero interest rates?

Comment