Distressed property data

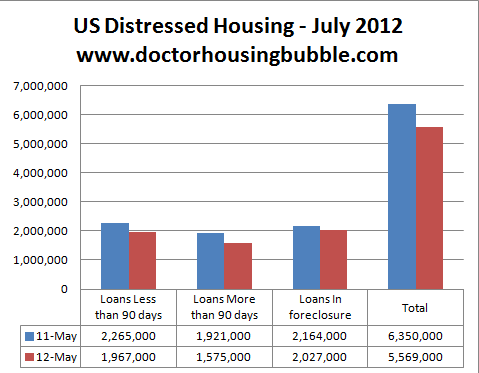

The latest data shows that over 5.5 million properties are in the distressed pipeline:

Source: LPS

Compared to the 6.3 million last year, this is a significant improvement but shows that we are still a long way from having a normal market. Data highlights that distressed properties have been selling for more than 40 percent below their peak level prices. Given how many millions of people have lost homes through foreclosure in the last few years you have to wonder about the impact of these people being unable to purchase properties for a few years?

The one big multi-year trend in places like Nevada and Arizona is the massive proportion of investors buying up properties. In the early 2000s the bet was on real estate appreciation. The current big bet now is that rental yields in these markets will hold steady.

Las Vegas reaches 6-year high of sales with unique set of buyers

Las Vegas home sales reached a 6-year high:

Last month nearly half of all sales came from “absentee buyers” which means these are likely to be investment properties. The rate was 46 percent last year so this trend has been holding steady in Las Vegas. The median price was $122,000 which is a far cry from the $312,000 median price reached in November of 2006.

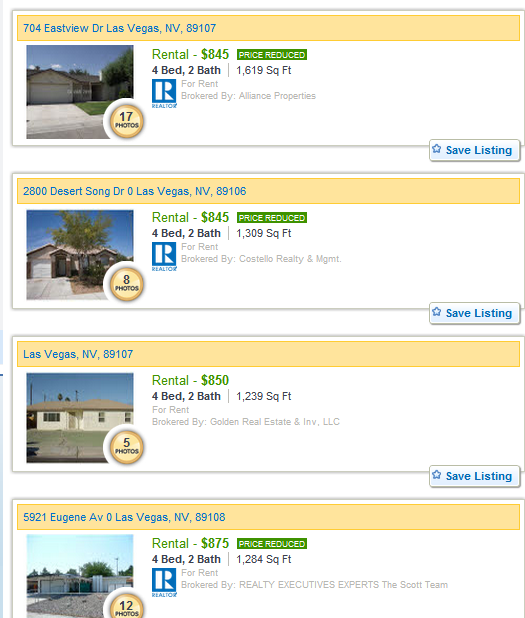

Most of these buyers are coming into the market with the same mindset. Many are likely looking to keep these as rentals. Some for the long-term others just long enough to sell for appreciation if it ever comes. A quick glance shows some 4,500+ active rental listings in Las Vegas. In a large region, you need to know your market and some are reducing prices to attract renters:

From analyzing various reports it looks like the region has a 10 percent vacancy rate. Being a landlord is no walk in the park and many of these people are buying without even being close to their properties to manage. Many will pay 8 to 10 percent simply in property management. Another 5 or 6 percent if they ever decide to sell. What are the implications of having so many investors buying up a large portion of your homes without living in the region? Will this be good or bad for the area? For now, this is the engine driving sales and we will soon find out.

Fixes for the 10 million underwater homeowners

Part of the command control housing market is based on programs to artificially keep inventory low. At last count some 10 million homeowners are underwater on their mortgages. A new program named the Homeownership Protection Program (HPP) seeks to help this underwater group:

“(DSNews) The use of eminent domain proposed in San Bernardino County and supported by the cities of Ontario and Fontana differs from more familiar applications in that it involves the forced purchase of homes from underwater borrowers at “fair” market value. This use of eminent domain was first presented by Robert C. Hockett, a Cornell University law professor.

Dubbed the Homeownership Protection Program (HPP), the solution considered proposes to have the local government purchase private label loans from current, underwater borrowers by using financing from Mortgage Resolution Partners. The program would have the original homeowner stay in his or her home, but with a new mortgage and a lower principal balance.

Mortgage Resolution Partners first approached San Bernardino County with the idea. In order to further consider the program, the Board of Supervisors in San Bernardino County approved a resolution to establish a Joint Powers Agreement (JPA) with Ontario and Fontana and other cities that decide to join.”

This is definitely not a free market approach. The use of eminent domain is always a touchy subject and not many are buying this approach especially those with the most to lose:

“In the report, Amherst stated it believes that the intent of the program is to buy the targeted loans out of the trusts at 75-80 percent of automated valuation model (AVM) on the property.

A joint letter issued by 18 organizations, including Securities Industry and Financial Markets Association, Association of Mortgage Investors, and National Association of Home Builders, expressed strong opposition towards JPA’s consideration of the program.”

It is odd that all these programs in place are trying to find a “true market” price when we have anything but a true market. You have bundled programs selling packages of properties to big time investors while banks selectively leak out certain properties. Whenever a program comes that seeks to “mark-to-market” and help homeowners institutions balk at the program yet are more than willing to take all the other programs that have subsidized the housing market for years.

You then have the Federal Reserve artificially pushing mortgage rates to record lows simply to keep prices inflated. What you have left is a market dominated by investors and many squeezing into homes with FHA insured loans. A normal market is one where the bulk of properties sold come from sellers willingly placing their property on the market and seeking out a buyer. Today’s market is driven by investors looking for the lowest price properties (typically distressed properties) and home buyers fighting for the few properties that hit the market. It is hard to predict how this will play out because never have we had such a controlled market for so long. From boom to bust to controlled housing market. The bottom line is the economy has to hold up to justify prices in many regions including rentals.

http://www.doctorhousingbubble.com/i...-rentals-2012/