The market seemed to be stunned that pending home sales fell in spite of mortgage rates being so low that they are essentially tracking inflation. Yet the narrow focus on financial liquidity still continues to miss the slow degradation of the American household balance sheet. I always found this fascinating even during the boom how rarely household incomes were mentioned in the context of purchasing a home. People at networking events or cocktail parties were quick to talk about their “$700,000” or “$1 million” home purchase yet felt that it was taboo to discuss actual income growth. In many ways buying a home with a giant mortgage became a socially acceptable way to flaunt your notion of wealth instead of pulling out your electronic pay stub. So this fall in pending home sales is merely a reflection of the shadow inventory leaking out into the market but also of weak household income growth. The Case Shiller Index made a new post bubble low in synchronization with the new mortgage rate low. What is going on with the housing market?

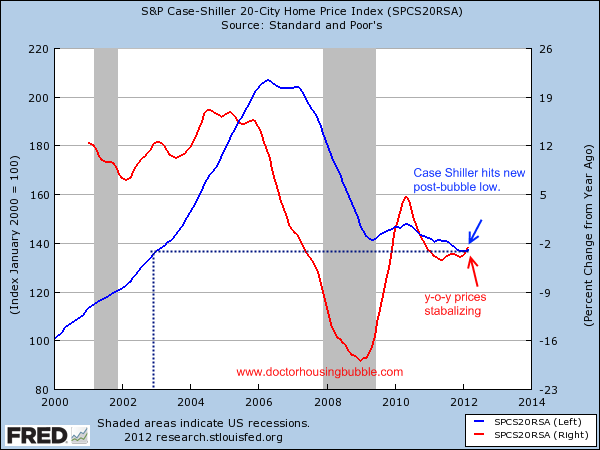

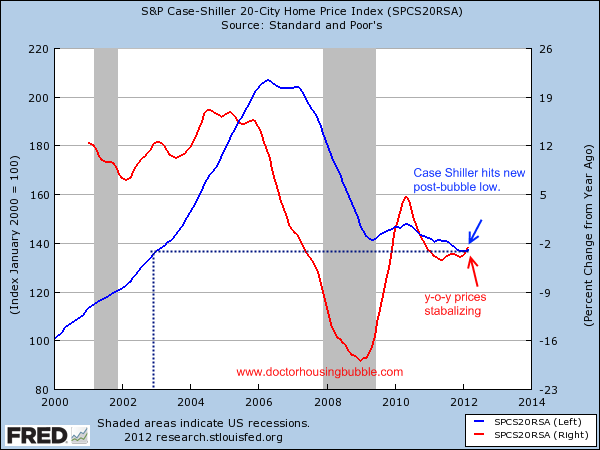

Case Shiller Index

The Case Shiller Index showed a new post bubble low but overall with year-over-year changes we do appear to be reaching a nationwide bottom. Even the creators of the index discussed that it trails the market by a few months and recent buying does suggest that overall we may be reaching a bottom. You can see this in the index:

The year-over-year drops are starting to stabilize and will likely turn up. Yet this is likely temporary unless wages go up. But as many are noting, a bottom does not mean home prices will rise or even outpace inflation. The push of mortgage rates lower is occurring because the credit markets need more and more dramatic efforts to keep the massive debt game going. So a lower mortgage rate almost becomes like a pay boost for many homeowners and those massively in debt. Yet with rates straddling the lower bound this fuel is being quickly wasted while the Federal Reserve balance sheet still is at peak levels with nearly $3 trillion in “assets” that we have little idea about.

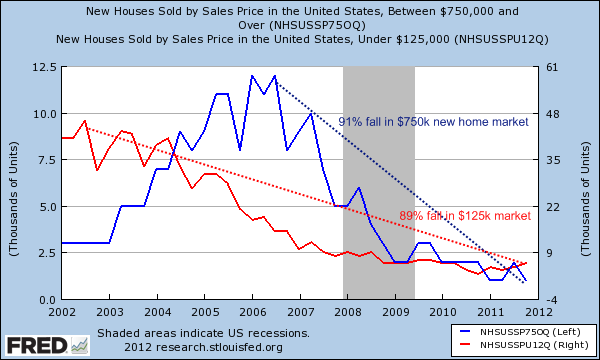

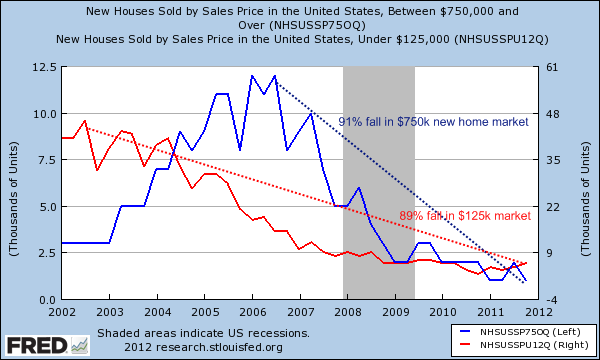

New home sales

The leaking out of shadow inventory also has other unintended consequences. Since we have years of inventory to work through, there is little need for construction or the creation of new homes. In fact, the low range and the high range of new home sales continues to be crushed:

More new homes priced above $750,000 were sold in 2002 than in 2012 and that also applies to homes under the $125,000 range. Both of these markets are down by roughly 90 percent from their peaks and are both near their nadir. You notice that tiny little uptick in the red line? That means whatever new homes sales are occurring are coming from the sub-$125,000 market. Builders that are low-cost are seeing a mini-boost but definitely not in the more expensive segment of new home sales.

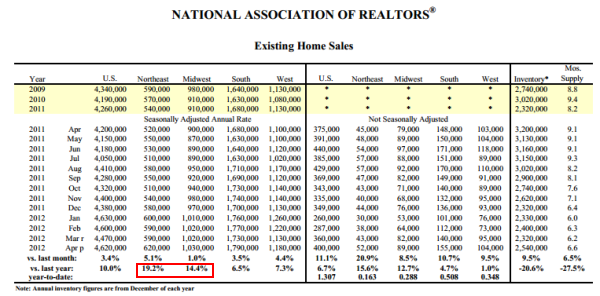

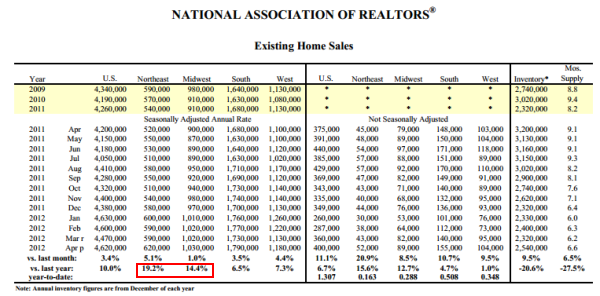

Regional sales differences

I find it interesting that the big existing sales jump has occurred in the Northeast and Midwest. The South and West which had the biggest bubbles are seeing more moderate home sales increases. Sure we hear about ravaging hoards of investors swooning in on Las Vegas and Arizona but overall, it doesn’t seem like a massive jump. What do these investors have in mind? The rental market is currently flooded and the flipping action will slow down since the underlying economy is still hurting.

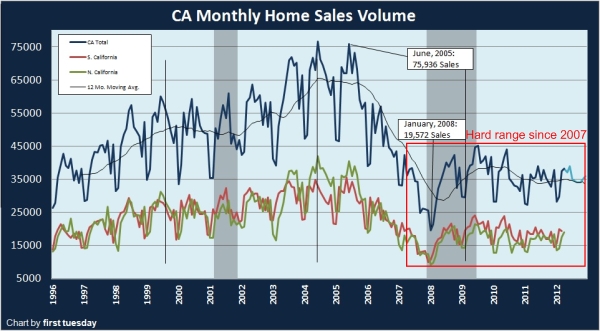

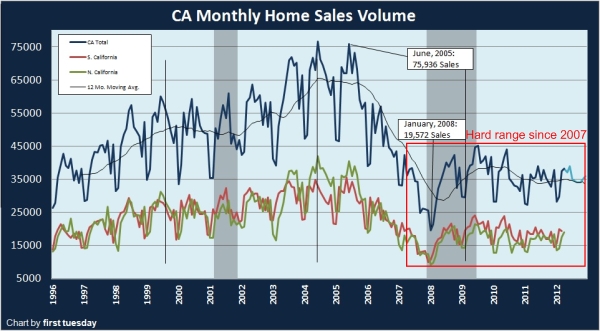

The tight range of sales

The recent tick up in sales which is now losing steam came largely from the ridiculously low mortgage rate that is absolutely artificial. Even in California all the rhetoric about buying a home when put into a bigger picture context shows a very tight sales range:

Where is the massive jump in home sales courtesy to 3% mortgage rates? Could it be that our financially broke state is likely going to be cutting and raising taxes soon? After all, if things were so fantastic you would expect tax revenues to be up but sadly they are not. Remember all the tax revenues we were going to get from the Facebook IPO? Try seeing how well that stock is doing plus you have one of their top winners renouncing their citizenship conveniently to help with taxes. Like Europe is quickly realizing, extending loans into the future is like playing a big game of kick the can. I find it amusing how easily some analysts just quickly accept the fact that the shadow inventory is somehow a normal occurrence instead of a giant pseudo nationalization of the housing market. They talk about the “market” and mortgage rates as if they are being set by the market instead of glorious manipulation to benefit financial institutions. In California, the underemployment is still above 20 percent and tens of thousands are losing unemployment insurance on a monthly basis and falling off the employment statistics but hey, at least we have low mortgage rates!

http://www.doctorhousingbubble.com/e...-sales-luxury/

Case Shiller Index

The Case Shiller Index showed a new post bubble low but overall with year-over-year changes we do appear to be reaching a nationwide bottom. Even the creators of the index discussed that it trails the market by a few months and recent buying does suggest that overall we may be reaching a bottom. You can see this in the index:

The year-over-year drops are starting to stabilize and will likely turn up. Yet this is likely temporary unless wages go up. But as many are noting, a bottom does not mean home prices will rise or even outpace inflation. The push of mortgage rates lower is occurring because the credit markets need more and more dramatic efforts to keep the massive debt game going. So a lower mortgage rate almost becomes like a pay boost for many homeowners and those massively in debt. Yet with rates straddling the lower bound this fuel is being quickly wasted while the Federal Reserve balance sheet still is at peak levels with nearly $3 trillion in “assets” that we have little idea about.

New home sales

The leaking out of shadow inventory also has other unintended consequences. Since we have years of inventory to work through, there is little need for construction or the creation of new homes. In fact, the low range and the high range of new home sales continues to be crushed:

More new homes priced above $750,000 were sold in 2002 than in 2012 and that also applies to homes under the $125,000 range. Both of these markets are down by roughly 90 percent from their peaks and are both near their nadir. You notice that tiny little uptick in the red line? That means whatever new homes sales are occurring are coming from the sub-$125,000 market. Builders that are low-cost are seeing a mini-boost but definitely not in the more expensive segment of new home sales.

Regional sales differences

I find it interesting that the big existing sales jump has occurred in the Northeast and Midwest. The South and West which had the biggest bubbles are seeing more moderate home sales increases. Sure we hear about ravaging hoards of investors swooning in on Las Vegas and Arizona but overall, it doesn’t seem like a massive jump. What do these investors have in mind? The rental market is currently flooded and the flipping action will slow down since the underlying economy is still hurting.

The tight range of sales

The recent tick up in sales which is now losing steam came largely from the ridiculously low mortgage rate that is absolutely artificial. Even in California all the rhetoric about buying a home when put into a bigger picture context shows a very tight sales range:

Where is the massive jump in home sales courtesy to 3% mortgage rates? Could it be that our financially broke state is likely going to be cutting and raising taxes soon? After all, if things were so fantastic you would expect tax revenues to be up but sadly they are not. Remember all the tax revenues we were going to get from the Facebook IPO? Try seeing how well that stock is doing plus you have one of their top winners renouncing their citizenship conveniently to help with taxes. Like Europe is quickly realizing, extending loans into the future is like playing a big game of kick the can. I find it amusing how easily some analysts just quickly accept the fact that the shadow inventory is somehow a normal occurrence instead of a giant pseudo nationalization of the housing market. They talk about the “market” and mortgage rates as if they are being set by the market instead of glorious manipulation to benefit financial institutions. In California, the underemployment is still above 20 percent and tens of thousands are losing unemployment insurance on a monthly basis and falling off the employment statistics but hey, at least we have low mortgage rates!

http://www.doctorhousingbubble.com/e...-sales-luxury/