ya gotta learn how to herd 'em, son, make them do what you want them to do, without lettin' them know . . .

May 30, 2012, 9:11 pm

Weakness in Facebook Stock Adds to Pause in I.P.O.’s

By MICHAEL J. DE LA MERCED

In the days since the highly anticipated opening of Facebook turned into a flop last week, the impact has become worse as would-be issuers have taken a second look at what they’re getting into.

In one of the latest setbacks, Kayak, a discount travel Web site, didn’t like what it saw and postponed its initial public offering on Wednesday, a person briefed on the matter said. The company’s roadshow for investors, which was expected to begin soon, has been delayed for the time being, this person said.

Another company, Graff Diamonds, a high-end jeweler, said that it was pulling its initial offering in Hong Kong, citing “adverse market conditions” that made attracting potential investors difficult.

Not all initial public offering troubles can be pinned on Facebook. Europe’s economic woes have worsened and investors are seeking safety, not the risk of new stock issues from companies with little public track record.

Still, Facebook, by failing to instill confidence among investors and executives, has made a weak market weaker. No offerings have priced since Facebook’s debut on May 18. And as of Wednesday, only one company, Loyalty Alliance Enterprise, was set to go public anytime in the near future.

“The current market is on hold,” said James Krapfel, an analyst with Morningstar Research. Facebook’s shares have fallen nearly 26 percent since their opening, and that, he added, has “really put a damper on investors’ enthusiasm for I.P.O.’s.”

A senior I.P.O. banker put it more bluntly, saying, “It’s pretty ugly out there.”

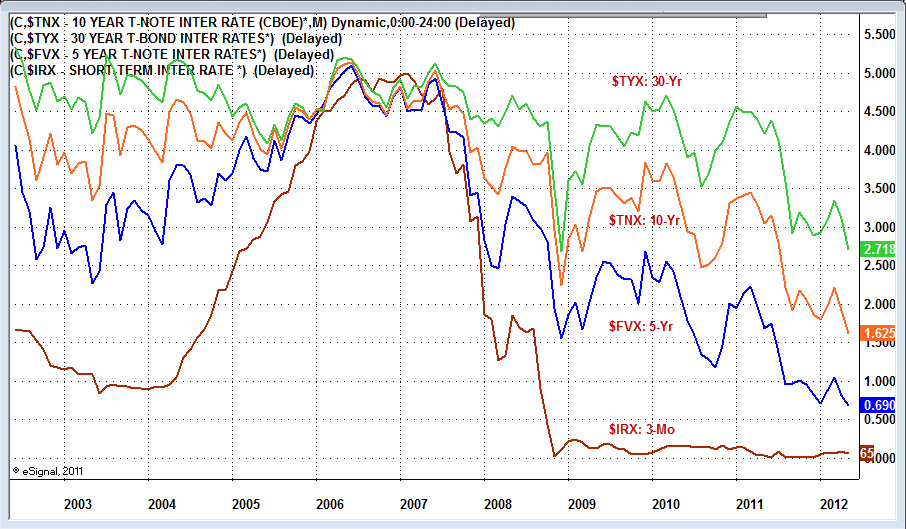

US 10-Year Treasury Yield Hits Record Low of 1.62%

The benchmark U.S. Treasury yield fell to its lowest level in at least 60 years on Wednesday as worries of contagion from Spain's ailing banks raised bids for low-risk investments.

Yields on 10-year notes sank to a record low of 1.62 percent, down sharply from 1.73 percent in late U.S trading on Tuesday.

The 30-year bond yield fell to 2.71 percent, its lowest level since October, and down from a yield of 2.84 percent in late U.S. trade on Tuesday.

keep 'em movin', movin', movin'

though they're disapproven'

keep them doggies movin'

Rawhide!

May 30, 2012, 9:11 pm

Weakness in Facebook Stock Adds to Pause in I.P.O.’s

By MICHAEL J. DE LA MERCED

In the days since the highly anticipated opening of Facebook turned into a flop last week, the impact has become worse as would-be issuers have taken a second look at what they’re getting into.

In one of the latest setbacks, Kayak, a discount travel Web site, didn’t like what it saw and postponed its initial public offering on Wednesday, a person briefed on the matter said. The company’s roadshow for investors, which was expected to begin soon, has been delayed for the time being, this person said.

Another company, Graff Diamonds, a high-end jeweler, said that it was pulling its initial offering in Hong Kong, citing “adverse market conditions” that made attracting potential investors difficult.

Not all initial public offering troubles can be pinned on Facebook. Europe’s economic woes have worsened and investors are seeking safety, not the risk of new stock issues from companies with little public track record.

Still, Facebook, by failing to instill confidence among investors and executives, has made a weak market weaker. No offerings have priced since Facebook’s debut on May 18. And as of Wednesday, only one company, Loyalty Alliance Enterprise, was set to go public anytime in the near future.

“The current market is on hold,” said James Krapfel, an analyst with Morningstar Research. Facebook’s shares have fallen nearly 26 percent since their opening, and that, he added, has “really put a damper on investors’ enthusiasm for I.P.O.’s.”

A senior I.P.O. banker put it more bluntly, saying, “It’s pretty ugly out there.”

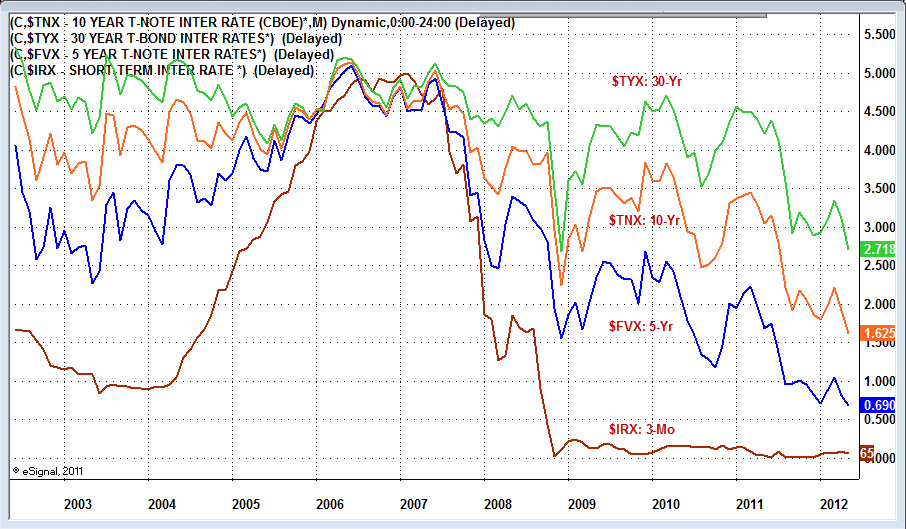

US 10-Year Treasury Yield Hits Record Low of 1.62%

The benchmark U.S. Treasury yield fell to its lowest level in at least 60 years on Wednesday as worries of contagion from Spain's ailing banks raised bids for low-risk investments.

Yields on 10-year notes sank to a record low of 1.62 percent, down sharply from 1.73 percent in late U.S trading on Tuesday.

The 30-year bond yield fell to 2.71 percent, its lowest level since October, and down from a yield of 2.84 percent in late U.S. trade on Tuesday.

keep 'em movin', movin', movin'

though they're disapproven'

keep them doggies movin'

Rawhide!