FIRE finds a way . . .

FHA insured loans have stepped in to fill the giant void left by the collapse in low to nothing down mortgage products. A low down payment is problematic for a variety of reasons and as we will show in data presented below, is a creature of the housing bubble and nothing standard to a healthy housing market. Low down payments through FHA insured loans are financing a tremendous amount of current home purchasing but this is not necessarily a positive given that default rates are surging for FHA insured loans. For example, in California of the active FHA loans over 9 percent are delinquent. This is not exactly a positive figure. Yet this is the number one mortgage product for first time home buyers. A bailout for the FHA is very likely given the ongoing issues with low down payment mortgage options. Contrary to what some will say, FHA insured loans have become a big player in the market because of stagnant household wages and the difficulty for households to scour up any savings.

FHA steps in to fill in hunger for low down payments

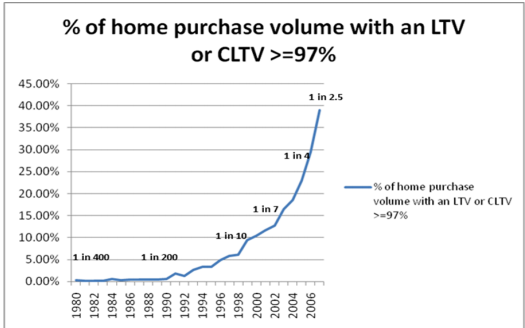

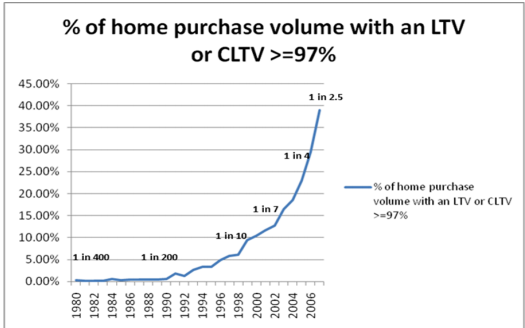

The trend towards low down payment products accelerated in the late 1990s on par with the repeal of Glass-Steagall:

Source: Ed Pinto

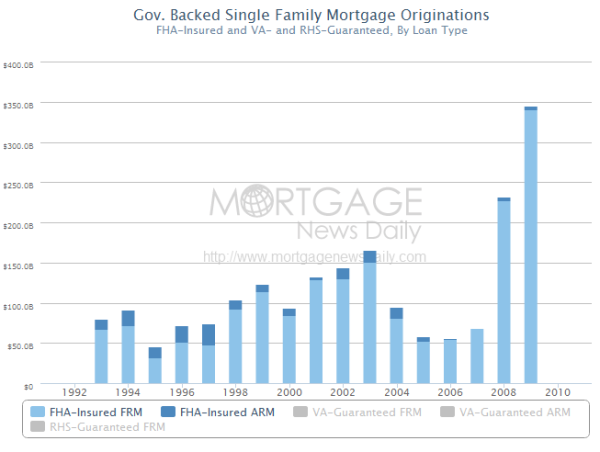

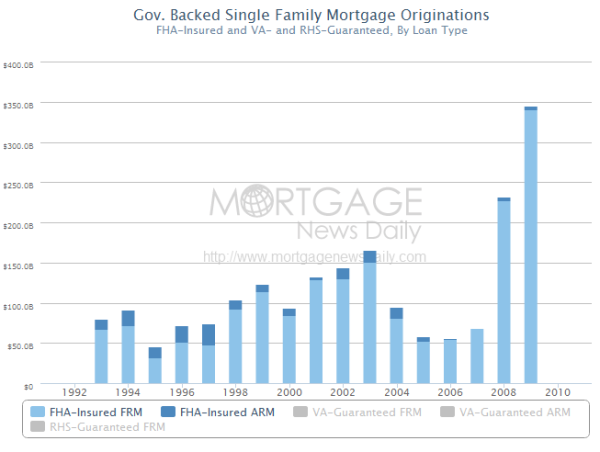

Initially the low down (and eventually the nothing down products) were financially dubious inventions from the financial sector. When the mortgage market imploded and the financial sector was melting down, FHA insured loans stepped in to finance the weak balance sheets of households:

The connection is almost perfect. You’ll notice that FHA loans were a small player until 2008 when it nearly tripled in mortgage originations and has grown ever since. It wasn’t like people suddenly fell in love with FHA loans. What happened is that the government and banks realized that Americans with weak balance sheets and very little savings needed a product to make-up for the lack of toxic mortgages. Instead of the FHA being a small player it suddenly became the product of choice as the chart above highlights.

“(Seattle Times) One big reason: Over the past six years, FHA has been the turnaround champ of residential real estate, offering down payments as low as 3.5 percent despite the recession and housing bust, growing its market share from 3 percent to 25 percent-plus. The program is now financing 40 percent or more of all new home purchases in some metropolitan areas and is a crucial resource for first-time buyers and moderate-income families, especially minorities.

With a maximum loan limit of $729,750 in high-cost areas, it is also a force in some of the country’s most expensive markets — California, Washington, D.C., New York and parts of New England.”

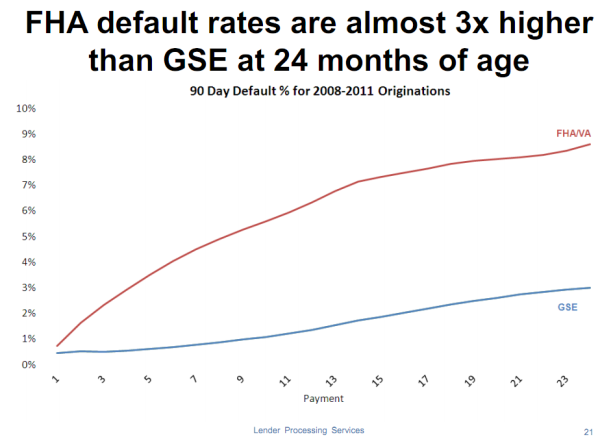

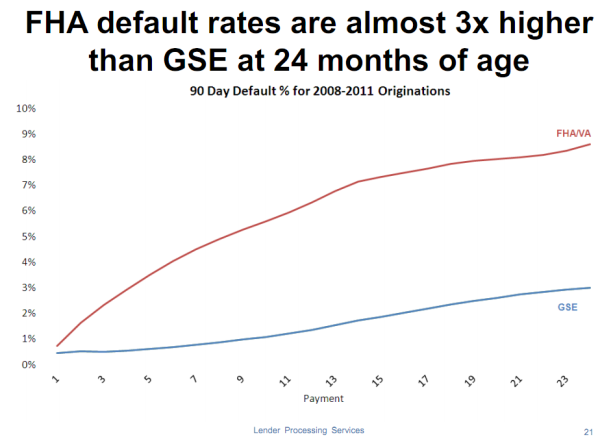

FHA insured loans went from financing three percent of mortgage originations to now financing close to 40 percent of new home purchases. Yet this will come at a heavy cost for taxpayers down the road. The defaults are already surging:

The FHA default rate is now approaching 10 percent. Instead of stepping in we have another Fannie Mae and Freddie Mac on our hands. Why is that? Because home prices continue to fall. With shadow inventory set to begin its purge in 2012, lower priced distressed homes will push prices lower. Many that bought in 2009, 2010, and 2011 have seen their equity washed away especially if they bought with a FHA insured loan and went in with the typical low down payment.

Incredibly the FHA was designed to help support affordable housing but does the exact opposite. Home prices in many regions remain inflated because of products like FHA insured loans. The above data is clear that households have fallen behind in the last decade. Yet home prices in many areas remain inflated. Why? Because of a few major reasons:

-Low down payment products allow many who are not qualified to buy when they should be renting (just look at continuing default rates – many originated between 2008 and 2011)

-Low mortgage rates continue to discount the actual risk inherent in the market

-The government-banking bailout that has allowed the shadow inventory to linger now for half-a-decade

What occurs is that prices become inflated because little skin is required to jump into the market. On one side you have banks being bailed out at every twist and turn. On the other side, you have people willing to buy with very little and treat a home purchase like a call-option. If prices rise then it is great but if they fall as they have, they can walk away with little on the table. The vast majority in the prudent middle end up paying for the true moral hazard players on both sides of the system unfortunately. Yet the FHA is starting to crack in more ways than one. Is this a surprise to anyone following the FHA insured market fiasco?

Nothing down or low down payments used to be a comical method of financing homes for the would-be infomercial real estate mogul. These were pitched to the public more to sell the sizzle than the actual steak. Yet in the late 1990s with full financial market de-regulation, investment banks with an army of grafters created a massive amount of toxic loans to filter into the system in the 2000s through option-ARMs, Alt-As, and subprime loans. Yet this mania covered up the reality that American households were actually becoming poorer. The fact that FHA insured loans went from the inner-city to financing prime cities in Orange County is a complete deviation from their mission statement. Then again, if we didn’t learn a lesson from the biggest financial crisis since the Great Depression should we be surprised?

http://www.doctorhousingbubble.com/f...-payment-risk/

FHA insured loans have stepped in to fill the giant void left by the collapse in low to nothing down mortgage products. A low down payment is problematic for a variety of reasons and as we will show in data presented below, is a creature of the housing bubble and nothing standard to a healthy housing market. Low down payments through FHA insured loans are financing a tremendous amount of current home purchasing but this is not necessarily a positive given that default rates are surging for FHA insured loans. For example, in California of the active FHA loans over 9 percent are delinquent. This is not exactly a positive figure. Yet this is the number one mortgage product for first time home buyers. A bailout for the FHA is very likely given the ongoing issues with low down payment mortgage options. Contrary to what some will say, FHA insured loans have become a big player in the market because of stagnant household wages and the difficulty for households to scour up any savings.

FHA steps in to fill in hunger for low down payments

The trend towards low down payment products accelerated in the late 1990s on par with the repeal of Glass-Steagall:

Source: Ed Pinto

Initially the low down (and eventually the nothing down products) were financially dubious inventions from the financial sector. When the mortgage market imploded and the financial sector was melting down, FHA insured loans stepped in to finance the weak balance sheets of households:

The connection is almost perfect. You’ll notice that FHA loans were a small player until 2008 when it nearly tripled in mortgage originations and has grown ever since. It wasn’t like people suddenly fell in love with FHA loans. What happened is that the government and banks realized that Americans with weak balance sheets and very little savings needed a product to make-up for the lack of toxic mortgages. Instead of the FHA being a small player it suddenly became the product of choice as the chart above highlights.

“(Seattle Times) One big reason: Over the past six years, FHA has been the turnaround champ of residential real estate, offering down payments as low as 3.5 percent despite the recession and housing bust, growing its market share from 3 percent to 25 percent-plus. The program is now financing 40 percent or more of all new home purchases in some metropolitan areas and is a crucial resource for first-time buyers and moderate-income families, especially minorities.

With a maximum loan limit of $729,750 in high-cost areas, it is also a force in some of the country’s most expensive markets — California, Washington, D.C., New York and parts of New England.”

FHA insured loans went from financing three percent of mortgage originations to now financing close to 40 percent of new home purchases. Yet this will come at a heavy cost for taxpayers down the road. The defaults are already surging:

The FHA default rate is now approaching 10 percent. Instead of stepping in we have another Fannie Mae and Freddie Mac on our hands. Why is that? Because home prices continue to fall. With shadow inventory set to begin its purge in 2012, lower priced distressed homes will push prices lower. Many that bought in 2009, 2010, and 2011 have seen their equity washed away especially if they bought with a FHA insured loan and went in with the typical low down payment.

Incredibly the FHA was designed to help support affordable housing but does the exact opposite. Home prices in many regions remain inflated because of products like FHA insured loans. The above data is clear that households have fallen behind in the last decade. Yet home prices in many areas remain inflated. Why? Because of a few major reasons:

-Low down payment products allow many who are not qualified to buy when they should be renting (just look at continuing default rates – many originated between 2008 and 2011)

-Low mortgage rates continue to discount the actual risk inherent in the market

-The government-banking bailout that has allowed the shadow inventory to linger now for half-a-decade

What occurs is that prices become inflated because little skin is required to jump into the market. On one side you have banks being bailed out at every twist and turn. On the other side, you have people willing to buy with very little and treat a home purchase like a call-option. If prices rise then it is great but if they fall as they have, they can walk away with little on the table. The vast majority in the prudent middle end up paying for the true moral hazard players on both sides of the system unfortunately. Yet the FHA is starting to crack in more ways than one. Is this a surprise to anyone following the FHA insured market fiasco?

Nothing down or low down payments used to be a comical method of financing homes for the would-be infomercial real estate mogul. These were pitched to the public more to sell the sizzle than the actual steak. Yet in the late 1990s with full financial market de-regulation, investment banks with an army of grafters created a massive amount of toxic loans to filter into the system in the 2000s through option-ARMs, Alt-As, and subprime loans. Yet this mania covered up the reality that American households were actually becoming poorer. The fact that FHA insured loans went from the inner-city to financing prime cities in Orange County is a complete deviation from their mission statement. Then again, if we didn’t learn a lesson from the biggest financial crisis since the Great Depression should we be surprised?

http://www.doctorhousingbubble.com/f...-payment-risk/