There was a time in our more stable housing history where people wouldn’t even consider buying a home unless they had an adequate down payment.

Part of the buying process required families to tighten their belts and save for a few years for that trek into home ownership. When so much time, effort, and capital is put into buying a property less people are going to walk away from a mortgage. This also created a positive buffer zone. Starting in the late 1990s and going into the 2000s the idea of a down payment played into the narrative that all debt was somehow golden. Why does anyone need to save when you can simply take on a mortgage and forego the years of saving? Banks loved it because the mortgage volume churn was like having a money making machine. Of course much of this philosophy and mentality is what led into the bubble peaking with no-doc, no-job, no-money down mortgages. Today we examine the down payment debate closely and analyze why it is important to have a bigger down payment especially with government backed loans.

The boogeyman of rising down payment requirements

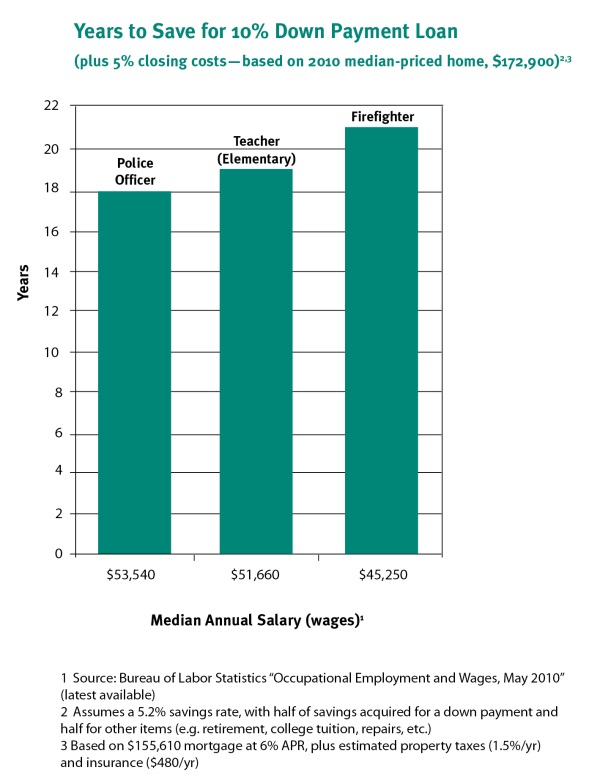

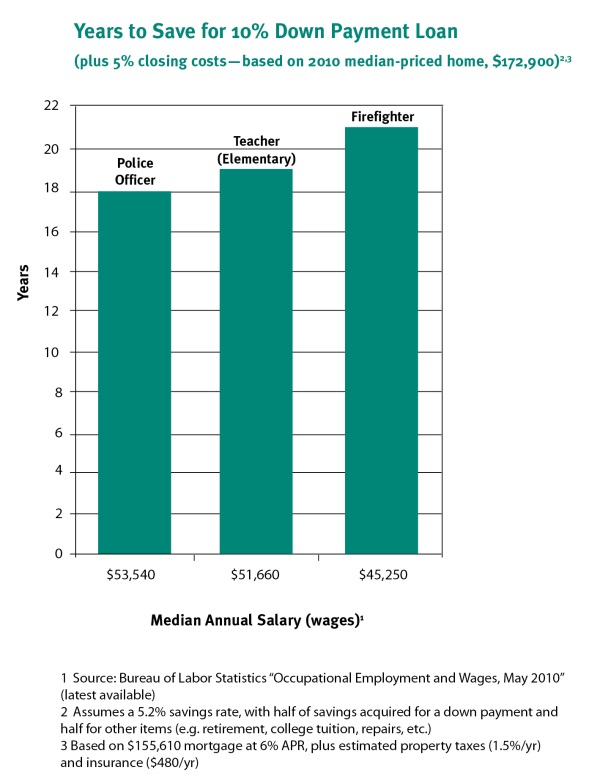

Recent proposals are examining higher down payment requirements. These proposals have been sitting around for a few years since the crisis hit but with 5 million completed foreclosures, it might be worth a consideration since something obviously went wrong with the way housing was being financed. The Center for Responsible Lending argues that increasing down payments will shut out many buyers from the market. They provide a chart like the below:

Source: Center for Responsible Lending

I understand their perspective. They argue the following:

“(CRL) Based on average home prices, it would take 14 years for the typical American family to save enough money for a 20% down payment.

Increasing down payment requirements would materially shrink the mortgage market with little increase in loan performance.”

Let us break down some of the arguments against increasing down payment requirements. The chart above shows the average time it would take for someone to save a down payment but of course, if you read the notes, this is assuming they only save 5 percent of their pay and then this is reduced even further. The assessment is looking at the median priced home of $172,900 in 2010 (it is now down in the $150,000 range) and basing it on a 10 percent down payment. So realistically we are talking about saving $15,000 to $17,000 here. You’re telling me that it will take 20 years to save $15,000? I’m sure many of you have questions about these underlying assumptions.

Or could it be that home prices are still too expensive based on current household incomes? Keep in mind for many decades 10 to 20 percent down payment mortgages were the status quo. How is it that for nearly half a century the dominant 20 percent down payment mortgage kept prices in line with household incomes while the first chance that down payments go out the window we suddenly have a massive bubble?

The math is simple here. People have less money saved. That we know. So each time you push down payments lower you open the pool to more potential buyers. During the bubble, you didn’t need a job or a down payment so in reality every person with a pulse was a potential home buyer.

Not bad for banks packaging this junk together and selling it to unsuspecting investors pocketing billions of dollars.

Today we still have FHA insured loans with 3.5 percent down payment requirements and still, people fear down payments going up? Which leads us to the massive problems now being faced with the FHA which is the model of the low down payment mortgage.

FHA insured loans a major issue now

I know the media is transfixed on the bread and circus that is our election system but the FHA is in some serious problems:

“(WSJ) The FHA has burned through its reserves over the past three years as defaults mount on loans it guaranteed as housing markets deteriorated. FHA-backed mortgages are an attractive option for borrowers because they can make down payments as low as 3.5%. But as home prices continue to fall, many of those borrowers have fallen underwater, where they owe more than their homes are worth and are at greater risk of default if they experience income shocks.

The estimates by the White House’s Office of Management and Budget show that the FHA’s capital reserves, which stood at $4.7 billion in October, would be wiped out in the coming year, forcing the agency to seek nearly $700 million from the U.S. Treasury.”

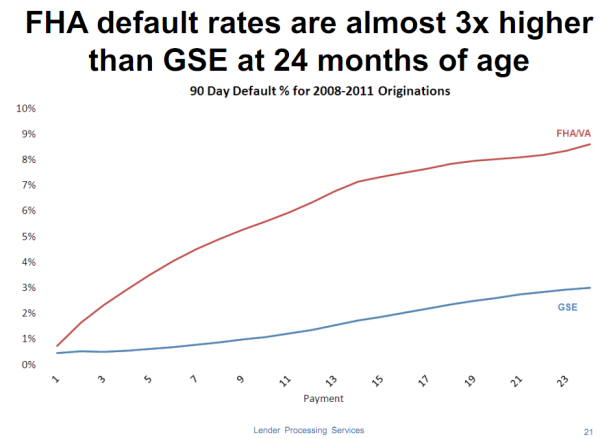

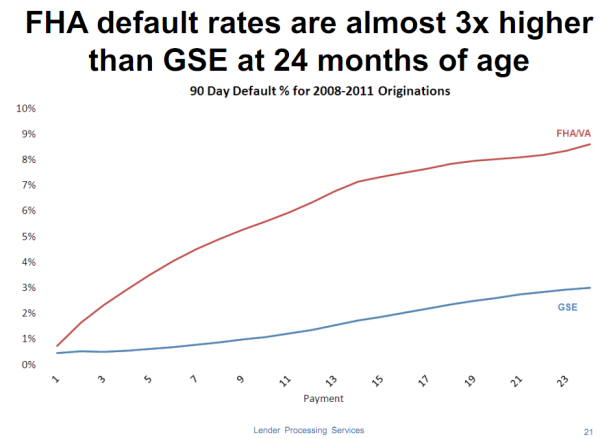

I thought these were safe loans? Apparently the data shows otherwise:

Source: LPS

Make no mistake that FHA insured loans never played a big roll like they have since the housing market imploded. FHA loans were always a tiny sliver of the market. That is until the market used FHA insured loans as a stop-gap for the vacuum created by exotic mortgages imploding. Today in California roughly one out of every three loans is of the FHA variety in a state that is still largely facing pocket bubbles. Yet I think this is simply a symptom of a bigger issue.

Households are strapped for cash and the only method they can keep the gig going is by jumping into large amounts of debt. I think this is why so many people fret when talk of higher down payment requirements are mentioned, especially those with industry ties.

Yet when things go bad the taxpayer pays the bill, not the gambling speculator banks. Who is paying for the major failures in the banking industry? You think it was free to save Fannie Mae and Freddie Mac? You think the investment banks of Goldman Sachs and Morgan Stanley would still be standing without the government stepping in? Would you lend your money to someone with only a 3.5 percent down payment for collateral on say a $500,000 2 bedroom home? It still seems like we have a large part of our population living in the “other people’s money” universe.

The upcoming new home buyer is more reluctant and less affluent

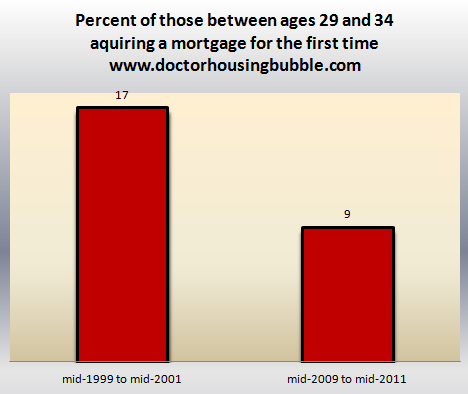

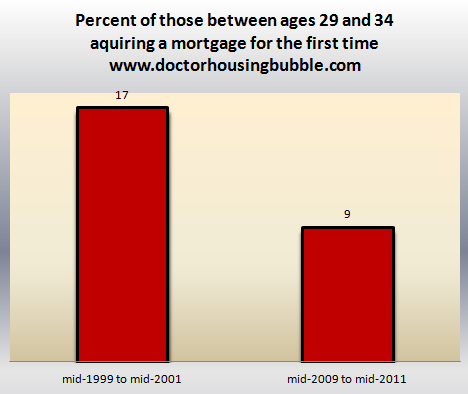

I was examining data by the Federal Reserve this weekend and found this data on first time buyers rather fascinating:

Source: Federal Reserve

This is really interesting but also strikes at the core of the down payment debate. Between mid-1999 and mid-2001 17 percent of those between 29 and 34 acquired a mortgage for the first time. This is the prime age for first time home buying. But look what happened between mid-2009 and mid-2011. During this time period the rate fell to 9 percent. What happened? Well the recession has hit the younger part of our country much harder and many of these people are saddled with mountain loads of student debt.

The first time home buyer has been crushed and this is usually the juice that keeps the market going.

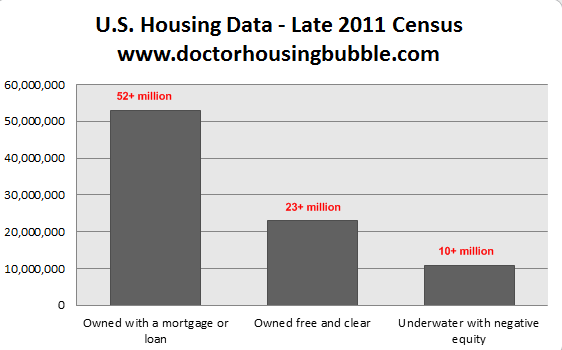

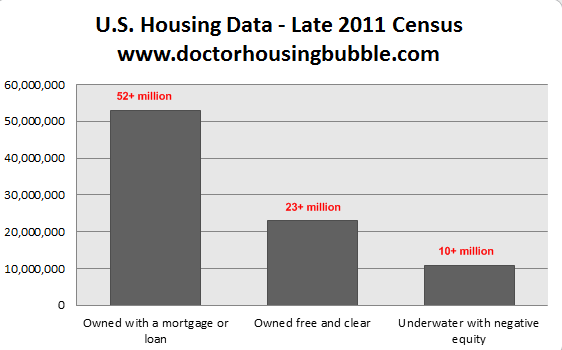

The property ladder game only works when housing values keep going up. But we have over 10,000,000 Americans underwater at this point:

How many others are close to negative equity? So whenever talks of down payment requirements perk up those in the industry largely understand that the balance sheets of many are flawed. Think of what is currently holding the market together:

-Artificial low mortgage rates (rates so low that we have never witnessed them in over a generation)

-FHA insured loans that require only 3.5 percent down

-Government backed loans largely the only game in town

-Bailout and gimmicks keeping the banking system running at the expense of the public

The assumption is never made that home values are simply too expensive relative to household incomes.

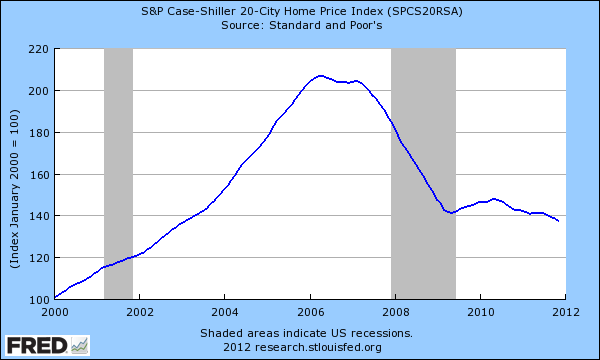

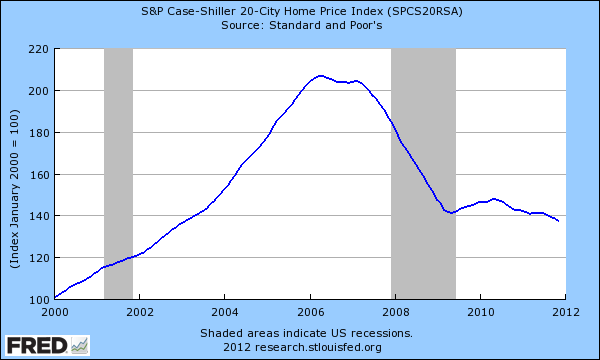

More and more gimmicks are layered on top of each other like an ever growing debt cake and in spite of that home prices continue to make post-bubble lows:

Dean Baker makes a good point regarding the studies advocating for a continuation of low down payment government backed loans:

”(CEPR) I know of almost no planet where a slight increase in the cost of getting a mortgage will shut out 60 percent of creditworthy borrowers. On my planet, we just had a horrible housing bubble burst and wreck the economy for a decade in large part because banks were able to pass on junk mortgages at no risk. This is an incredibly modest provision that will have no impact on creditworthy borrowers.”

At this point in the game, anyone can jump in and grab a mortgage with very little down and a decent job. So if someone has a massive emotional need to buy, they have every path open to them. Yet home prices are going lower for more complicated reasons. Psychologically these people don’t jump in to buy (sales figures are still low) because they understand the above arguments. Where is the big income growth going to come from for these new buyers to sell their home when they try to play property ladder?

I completely agree with Dr. Baker’s assessment. Given a decade of stagnant wages, 5 million households with a foreclosure on their credit report, hundreds of thousands with short sales on their credit report, and a younger and less affluent crowd how many creditworthy borrowers can actually pay inflated home prices in many cities around the country? The fact that so many worry when even a 10 percent down payment requirement for a government backed mortgage is mentioned should tell you something (and look at how badly the FHA is now doing with those 3.5 percent down loans). You also have to ask, if there were so many creditworthy borrowers out there why wouldn’t banks simply write private label mortgages and keep the notes on their books? Banks are basically laundering government backed loans through the GSEs and collecting fees along the way and cheery picking prime loans to keep on their books. Given how little this is now happening with private label mortgages, there are very few cherries to pick.

http://www.doctorhousingbubble.com/d...st-time-buyer/

Part of the buying process required families to tighten their belts and save for a few years for that trek into home ownership. When so much time, effort, and capital is put into buying a property less people are going to walk away from a mortgage. This also created a positive buffer zone. Starting in the late 1990s and going into the 2000s the idea of a down payment played into the narrative that all debt was somehow golden. Why does anyone need to save when you can simply take on a mortgage and forego the years of saving? Banks loved it because the mortgage volume churn was like having a money making machine. Of course much of this philosophy and mentality is what led into the bubble peaking with no-doc, no-job, no-money down mortgages. Today we examine the down payment debate closely and analyze why it is important to have a bigger down payment especially with government backed loans.

The boogeyman of rising down payment requirements

Recent proposals are examining higher down payment requirements. These proposals have been sitting around for a few years since the crisis hit but with 5 million completed foreclosures, it might be worth a consideration since something obviously went wrong with the way housing was being financed. The Center for Responsible Lending argues that increasing down payments will shut out many buyers from the market. They provide a chart like the below:

Source: Center for Responsible Lending

I understand their perspective. They argue the following:

“(CRL) Based on average home prices, it would take 14 years for the typical American family to save enough money for a 20% down payment.

Increasing down payment requirements would materially shrink the mortgage market with little increase in loan performance.”

Let us break down some of the arguments against increasing down payment requirements. The chart above shows the average time it would take for someone to save a down payment but of course, if you read the notes, this is assuming they only save 5 percent of their pay and then this is reduced even further. The assessment is looking at the median priced home of $172,900 in 2010 (it is now down in the $150,000 range) and basing it on a 10 percent down payment. So realistically we are talking about saving $15,000 to $17,000 here. You’re telling me that it will take 20 years to save $15,000? I’m sure many of you have questions about these underlying assumptions.

Or could it be that home prices are still too expensive based on current household incomes? Keep in mind for many decades 10 to 20 percent down payment mortgages were the status quo. How is it that for nearly half a century the dominant 20 percent down payment mortgage kept prices in line with household incomes while the first chance that down payments go out the window we suddenly have a massive bubble?

The math is simple here. People have less money saved. That we know. So each time you push down payments lower you open the pool to more potential buyers. During the bubble, you didn’t need a job or a down payment so in reality every person with a pulse was a potential home buyer.

Not bad for banks packaging this junk together and selling it to unsuspecting investors pocketing billions of dollars.

Today we still have FHA insured loans with 3.5 percent down payment requirements and still, people fear down payments going up? Which leads us to the massive problems now being faced with the FHA which is the model of the low down payment mortgage.

FHA insured loans a major issue now

I know the media is transfixed on the bread and circus that is our election system but the FHA is in some serious problems:

“(WSJ) The FHA has burned through its reserves over the past three years as defaults mount on loans it guaranteed as housing markets deteriorated. FHA-backed mortgages are an attractive option for borrowers because they can make down payments as low as 3.5%. But as home prices continue to fall, many of those borrowers have fallen underwater, where they owe more than their homes are worth and are at greater risk of default if they experience income shocks.

The estimates by the White House’s Office of Management and Budget show that the FHA’s capital reserves, which stood at $4.7 billion in October, would be wiped out in the coming year, forcing the agency to seek nearly $700 million from the U.S. Treasury.”

I thought these were safe loans? Apparently the data shows otherwise:

Source: LPS

Make no mistake that FHA insured loans never played a big roll like they have since the housing market imploded. FHA loans were always a tiny sliver of the market. That is until the market used FHA insured loans as a stop-gap for the vacuum created by exotic mortgages imploding. Today in California roughly one out of every three loans is of the FHA variety in a state that is still largely facing pocket bubbles. Yet I think this is simply a symptom of a bigger issue.

Households are strapped for cash and the only method they can keep the gig going is by jumping into large amounts of debt. I think this is why so many people fret when talk of higher down payment requirements are mentioned, especially those with industry ties.

Yet when things go bad the taxpayer pays the bill, not the gambling speculator banks. Who is paying for the major failures in the banking industry? You think it was free to save Fannie Mae and Freddie Mac? You think the investment banks of Goldman Sachs and Morgan Stanley would still be standing without the government stepping in? Would you lend your money to someone with only a 3.5 percent down payment for collateral on say a $500,000 2 bedroom home? It still seems like we have a large part of our population living in the “other people’s money” universe.

The upcoming new home buyer is more reluctant and less affluent

I was examining data by the Federal Reserve this weekend and found this data on first time buyers rather fascinating:

Source: Federal Reserve

This is really interesting but also strikes at the core of the down payment debate. Between mid-1999 and mid-2001 17 percent of those between 29 and 34 acquired a mortgage for the first time. This is the prime age for first time home buying. But look what happened between mid-2009 and mid-2011. During this time period the rate fell to 9 percent. What happened? Well the recession has hit the younger part of our country much harder and many of these people are saddled with mountain loads of student debt.

The first time home buyer has been crushed and this is usually the juice that keeps the market going.

The property ladder game only works when housing values keep going up. But we have over 10,000,000 Americans underwater at this point:

How many others are close to negative equity? So whenever talks of down payment requirements perk up those in the industry largely understand that the balance sheets of many are flawed. Think of what is currently holding the market together:

-Artificial low mortgage rates (rates so low that we have never witnessed them in over a generation)

-FHA insured loans that require only 3.5 percent down

-Government backed loans largely the only game in town

-Bailout and gimmicks keeping the banking system running at the expense of the public

The assumption is never made that home values are simply too expensive relative to household incomes.

More and more gimmicks are layered on top of each other like an ever growing debt cake and in spite of that home prices continue to make post-bubble lows:

Dean Baker makes a good point regarding the studies advocating for a continuation of low down payment government backed loans:

”(CEPR) I know of almost no planet where a slight increase in the cost of getting a mortgage will shut out 60 percent of creditworthy borrowers. On my planet, we just had a horrible housing bubble burst and wreck the economy for a decade in large part because banks were able to pass on junk mortgages at no risk. This is an incredibly modest provision that will have no impact on creditworthy borrowers.”

I completely agree with Dr. Baker’s assessment. Given a decade of stagnant wages, 5 million households with a foreclosure on their credit report, hundreds of thousands with short sales on their credit report, and a younger and less affluent crowd how many creditworthy borrowers can actually pay inflated home prices in many cities around the country? The fact that so many worry when even a 10 percent down payment requirement for a government backed mortgage is mentioned should tell you something (and look at how badly the FHA is now doing with those 3.5 percent down loans). You also have to ask, if there were so many creditworthy borrowers out there why wouldn’t banks simply write private label mortgages and keep the notes on their books? Banks are basically laundering government backed loans through the GSEs and collecting fees along the way and cheery picking prime loans to keep on their books. Given how little this is now happening with private label mortgages, there are very few cherries to pick.

http://www.doctorhousingbubble.com/d...st-time-buyer/