some quotes from karl denninger on another forum

thoughts?

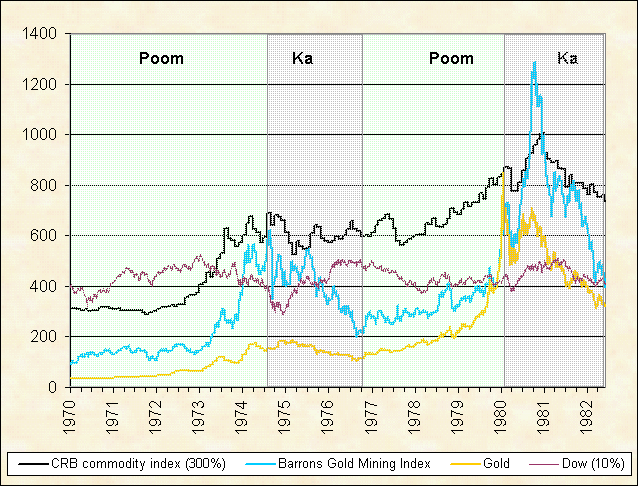

Ok, Value, so you don't know, you weren't there. You're too young. I lived through it. It sucked. Badly. Very, very badly. The middle class got buttfucked for a long time; housing stagnated, incomes stagnated, inflation skyrocketed. Real purchasing power was utterly destroyed. Guess what - you're wrong about how this will turn out. You know how I know you're wrong? Look at the 10. Up 1.29% today on rates, and rising. Fed Cuts rates, real rates go up. Exactly the opposite of what The Fed intended and what you predicted would happen. This is why I say that Equities ride "The Short Bus" - because they do. Be very careful going long here. It is not about The Fed - it is about The Economy, and Bernanke just fucked us hard. Now in addition to a recession we are going to get both higher rates AND inflation.

Yeah ok. Yal, if the 10 doesn't drop by 50 bips then the "cut" is not really a cut - it magically turned into an increase. You're projecting again. Trade what the market does, not what you want it to do. What the market is doing is telling you that The Fed actually INCREASED real interest rates yesterday. Why? Because The Bond Market gets it - inflation is coming back with a roar, not a wimper, and thus The Bond Market is demanding more return for its money. This is why cutting Fed Funds was a mistake - it will not do what people said it would and will have the opposite impact to what people expected. You'll see. I'm not going to argue with the market. You can if you want but you will simply wind up broke.

"Permashort"? You're an idiot. From 2003 until this spring I hadn't held a single short position in my portfolio. I was entirely in LONG positions. You don't remember the 70s because you're too young. You're an arrogant bastard - that which you didn't personally live through "never happened". You're why 2000 happened and the tech wreck - "there is no business cycle; it has been repealed." Horseshit. The business cycle runs in roughly 7 year periods. Guess what - it did, and in 2000 we found out. Now its 2007, and we're going to find out AGAIN. Cutting rates into a commodity bull market is the dumbest single thing you can do as an economic policy maker. It ALWAYS results in insane inflation and crazy spikes in interest rates. ALWAYS. The last time it impoverished huge numbers of people, resulted in a punishing recession, insane unemployment, double-digit inflation and 18% interest rates. You weren't on this planet when it happened. I was, I lived through it, I know what happened and I know why it happened. Bernanke just did the same thing, and it will have the same result.

Comment