Short sales are now a hefty part of the real estate market. Short sales are the process of selling a home for less than the stated mortgage balance. The process unfortunately has allowed a tremendous amount of fraud to occur and with more purchases going through the short sale route, this is simply another concern potential buyers must be aware of. One of the most blatant methods of fraud is through a process known as flopping. The agent will not submit the highest bid and at times, these homes suddenly turn into pending sales almost on the same time. The big losers here are potential buyers, sellers eating a larger loss, and the lender holding the note. Part of the shadow inventory is being slowly cleared out with lenders approving short sales and some are combating against the fraud that has been going on in this growing segment of housing sales.

The details on short sale fraud

It is worth the time to examine the process to get a deeper understanding of what is going on here:

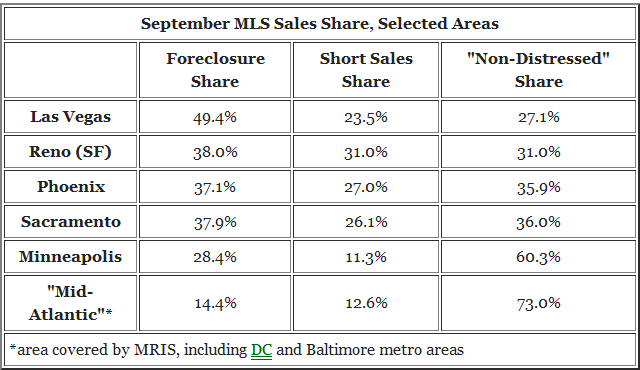

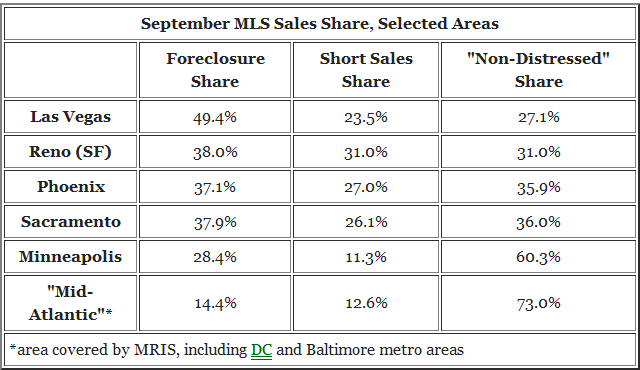

Source: Calculated Risk

CoreLogic estimates that close to $375 million will be the cost to lenders this year because of short sale fraud. The shadow inventory is being cleared out little by little but fraud is happening on both ends because we are allowing the same system that allowed the bubble to blossom to also clear it out. Take a look at the chart above. In a place like Reno short sales make up 31 percent of all sales in September. Phoenix is up to 27 percent and Sacramento is up to 26 percent. These markets are also the hardest hit so adding fraud to the mix is only going to compound the issues.

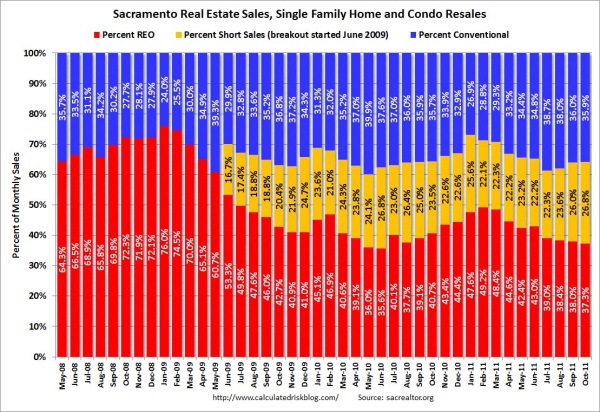

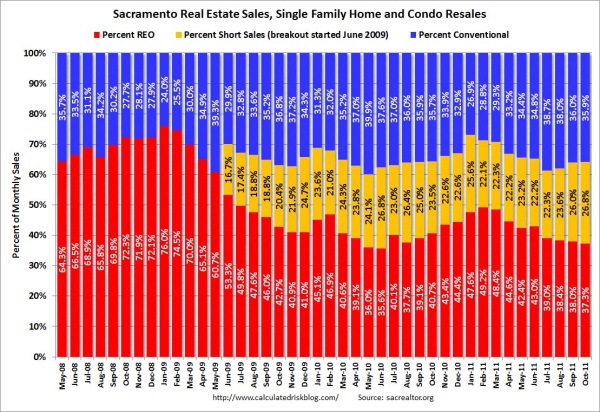

You can see the growth of short sales in a market like Sacramento:

Short sales are an ever expanding part of the market and because of this the temptation for fraud is growing.

Finding out the details

Potential buyers have been figuring this out for a long time:

You even have creative methods of using option contracts to quickly flop a house over. Lenders are late to the game but it does seem like some holes are being plugged:

Source: DQNews

Last month in Southern California, one of the most expensive markets in the nation, short sales accounted for close to 20 percent of all sales being closed. In some cases REOs sell for 40 percent below the balance price while short sales sell for 20 percent below. If you are looking to buy a short sale, just be aware of the process of flopping and make sure you are working with a trusted team. In the end short sale fraud harms potential buyers by inflating prices, hurts lenders, and ultimately is another bill the taxpayer needs to pay in this endless game of bailouts.

http://www.doctorhousingbubble.com/s...ort-sale-data/

The details on short sale fraud

It is worth the time to examine the process to get a deeper understanding of what is going on here:

“NEW YORK (CNNMoney) — Just as the housing market began to collapse near the end of 2007, a real estate agent in Bridgeport, Conn. asked Regions Bank if it would accept a $102,375 bid on a home that was underwater on its mortgage. Under the impression that this was the best offer on the home, Regions agreed to the short sale and released the mortgage it owned on the home.

Later that same day, the new owner — an investment group owned by another real estate agent — resold the home to a buyer who had been lined up before the short sale transaction went through. The final sale price: $132,500, netting the seller a cool $30,000 — a profit that should have gone to Regions.”

The problem is of asymmetrical information. This is similar to investment banks selling off toxic mortgage backed securities to unsuspecting foreign investors or pension funds knowing the full extent of the troubled securities they were unloading. The assumption is typically that a listing agent will always want to take the highest bid. In these cases however, a lower bid is usually accepted from someone that is close to the deal only later to be flopped to a later buyer:Later that same day, the new owner — an investment group owned by another real estate agent — resold the home to a buyer who had been lined up before the short sale transaction went through. The final sale price: $132,500, netting the seller a cool $30,000 — a profit that should have gone to Regions.”

“In this latest twist on short sale fraud, scammers have found a way to rip off mortgage lenders by tens of thousands of dollars — sometimes in a matter of hours.

The scam artists, usually real estate agents, will secure a legitimate bid on a home, one where the borrower owes far more on the mortgage than the home is worth. Then they arrange for an accomplice investor to make a lower offer on the home.”

This in a way is similar to inside information. A higher bid is usually secured or can be secured quickly. The process ends as follows:The scam artists, usually real estate agents, will secure a legitimate bid on a home, one where the borrower owes far more on the mortgage than the home is worth. Then they arrange for an accomplice investor to make a lower offer on the home.”

“The agent then presents the lower bid to the lender and asks them to forgive any remaining balance owed — without disclosing that there was a higher bid made on the home. Once the short sale is approved, the scammer then sells the home to the higher bidder, often on the same day.”

Now fraud has always been rampant with short sales. This may have been a miniscule issue when short sales were a tiny fraction of any market but today they are now a dominant force:

Source: Calculated Risk

CoreLogic estimates that close to $375 million will be the cost to lenders this year because of short sale fraud. The shadow inventory is being cleared out little by little but fraud is happening on both ends because we are allowing the same system that allowed the bubble to blossom to also clear it out. Take a look at the chart above. In a place like Reno short sales make up 31 percent of all sales in September. Phoenix is up to 27 percent and Sacramento is up to 26 percent. These markets are also the hardest hit so adding fraud to the mix is only going to compound the issues.

You can see the growth of short sales in a market like Sacramento:

Short sales are an ever expanding part of the market and because of this the temptation for fraud is growing.

Finding out the details

Potential buyers have been figuring this out for a long time:

“(ModBee) Using public records, Finch determined the company holding the mortgage and sent his offer directly, suspecting that the listing agent had not passed it along. “I told them, ‘I think you’re getting scammed,’ ” he said. “I could tell it piqued their interest.”

The agent suddenly asked him to resubmit his offer and a contract was signed the next day, he said.

Finch shares the story to give others hope, he said. “If you think you’re getting jerked around, you can actually do this. It worked for me. I got the house.”

What a shocker that the agent then suddenly asked to have the offer resubmitted. Many readers have e-mailed cases or suspected cases of short sale fraud. What normally occurs is someone submits a bid and expects it to be a high bid. The place sells quickly but the closing information isn’t recorded for a month or two. The potential buyer checks in later and views that a lower bid was accepted and the home was re-sold again in that time period.The agent suddenly asked him to resubmit his offer and a contract was signed the next day, he said.

Finch shares the story to give others hope, he said. “If you think you’re getting jerked around, you can actually do this. It worked for me. I got the house.”

You even have creative methods of using option contracts to quickly flop a house over. Lenders are late to the game but it does seem like some holes are being plugged:

“(HousingWire) Freddie Mac will force parties involved in a short sale to sign affidavits making them liable for their negligent or intentional misrepresentations in the deal, an effort to be sure it’s an arms-length transaction, according to guidance released Friday.

The new affidavit will go into effect Jan. 1, but Freddie is asking servicers to implement the change immediately to fight fraud. However this, and other changes, are meant to expedite the process of getting borrowers in default relocated.

In August, the government-sponsored enterprise alerted real estate agents to the rise in shady short sale deals. The main concern is flopping. There is a growing trend of real estate agents on the buy-side of the deal failing to disclose other bids on the property, rigging the sale at a lower price.

The fraudsters can then flip it, sometimes the same day, and pocket the difference.”

In the end, the finance and housing industry are still running on the same standards that created this incredible housing bubble. An industry that forged documents, lied to investors, and gorged itself at the public’s expense is back at it although on a much smaller yet equally blatant extent. And with many homes bought for cash and at times with investor groups, it is easy to tell where the advantage is today:The new affidavit will go into effect Jan. 1, but Freddie is asking servicers to implement the change immediately to fight fraud. However this, and other changes, are meant to expedite the process of getting borrowers in default relocated.

In August, the government-sponsored enterprise alerted real estate agents to the rise in shady short sale deals. The main concern is flopping. There is a growing trend of real estate agents on the buy-side of the deal failing to disclose other bids on the property, rigging the sale at a lower price.

The fraudsters can then flip it, sometimes the same day, and pocket the difference.”

Source: DQNews

Last month in Southern California, one of the most expensive markets in the nation, short sales accounted for close to 20 percent of all sales being closed. In some cases REOs sell for 40 percent below the balance price while short sales sell for 20 percent below. If you are looking to buy a short sale, just be aware of the process of flopping and make sure you are working with a trusted team. In the end short sale fraud harms potential buyers by inflating prices, hurts lenders, and ultimately is another bill the taxpayer needs to pay in this endless game of bailouts.

http://www.doctorhousingbubble.com/s...ort-sale-data/

Comment