With the Federal Reserve promising to bailout the entire world it is hard to grab any headlines away from that kind of action. In spite of putting the American taxpayer at risk for global debt issues especially when we have big enough problems at home we have now reached an all-time high with foreclosure inventories. That is correct, the shadow inventory is still enormous and the number of homes owned by banks is now at record levels. Of course this was all predictable like seeing a pig work its way through a python. The large bet that has failed was the belief that simply holding onto overpriced assets for two, three, and even four years would somehow allow home prices to catch up. The suspension of mark-to-market accounting and other shenanigans are now coming home to roost and home prices are making post-bubble lows. In other words, the day of reckoning for housing is already here. Don’t look now but foreclosure inventories are at record levels. What does this mean for housing going forward?

Foreclosure inventories at record levels

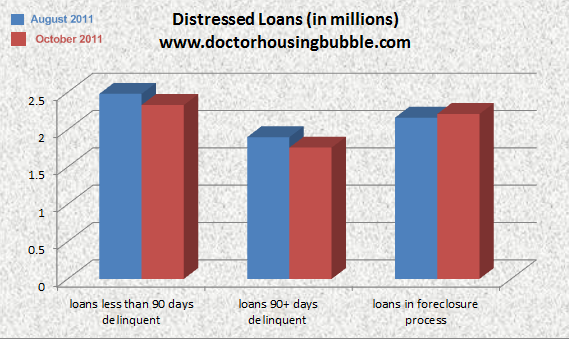

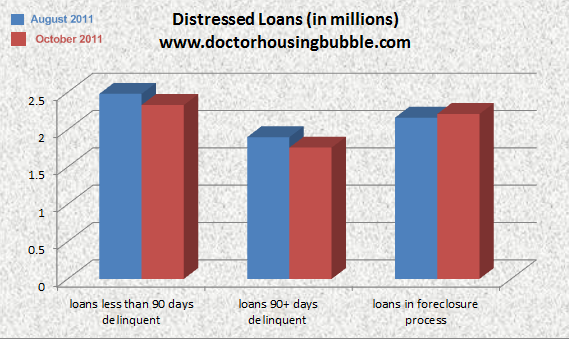

Foreclosure inventories are now at post-bubble records:

Total home listed as “foreclosed” has shot up to 2.21 million. The other two categories above show that there are still millions of other homes in the foreclosure pipeline. What this means is that for a few more years, we will have pricing pressure to the downside. Now most of the other two categories don’t even show up in MLS data since these are not completed foreclosures. But with five years of data it is very likely that these loans will go through the entire process and become REOs.

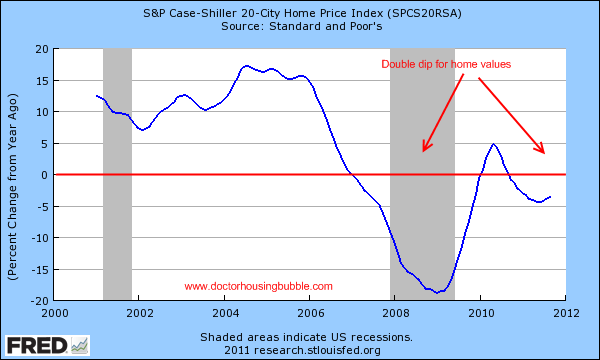

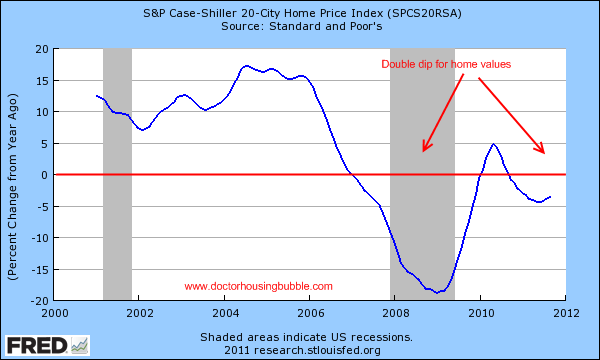

There is no debate that the housing market is now fully into a double-dip:

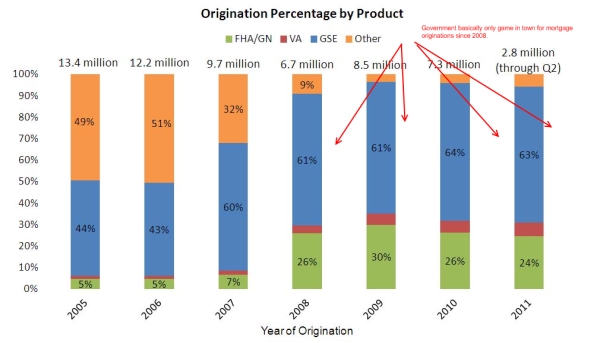

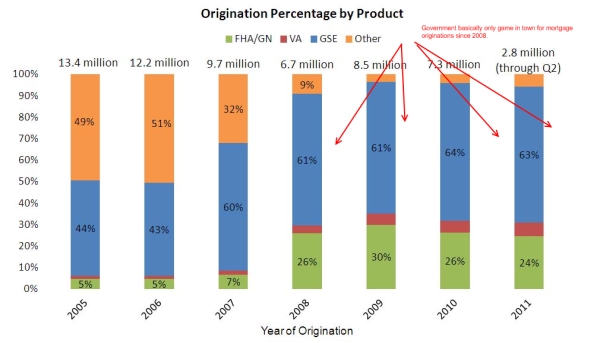

The trend for lower home prices has been baked in for nearly a year now. Last summer we had a mini burst of buyers thanks to artificial tax credits and low interest rates. I still view the current market as being designed for the nothing down leverage happy mentality that is present in our society. You have a large number of buyers purchasing homes with 3.5 percent down FHA mortgages and the default rates are soaring in this category. Just take a look at the below chart as the toxic mortgage channel was plugged up, suddenly much of this action shifted to FHA insured loans:

Source: LPS

How surprising is this now? If you can’t qualify for a mortgage with 3.5 percent down and mortgage rates in the 4 to 5 percent range then you have absolutely no business buying a home. Yet the lingering nostalgia for no-doc / no-income loans still runs rampant in the consumer psychology.

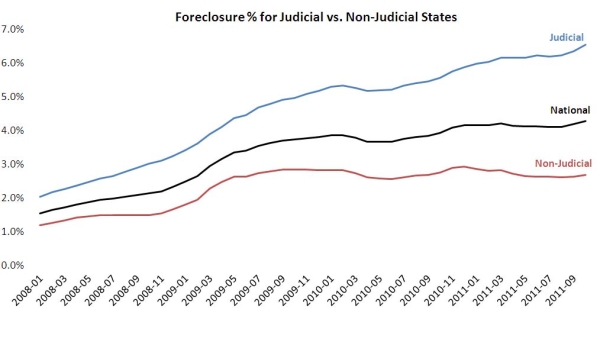

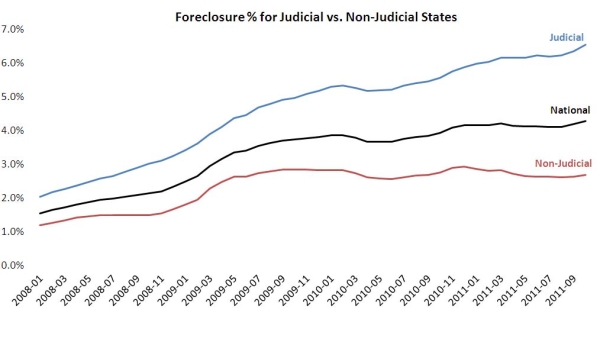

Judicial versus non-judicial

It should come as no surprise that non-judicial states have a lower inventory of foreclosures since they are clearing inventory out at a rate that is four to five times faster than judicial states:

Ultimately the demand for housing is coming from the lower priced market. In that sense, the 2.21 million foreclosed homes will provide households with lower incomes an opportunity to purchase a home that is within their budget. At least for those that purchase wisely, they are likely avoiding a repeat of the past. Yet some are still over paying in bubble markets and will likely realize their mistake years down the road. It took over a decade to build this bubble so don’t expect it to clean out quickly.

Over half a decade ago I knew the bigger issue would be the cognitive dissonance that would linger from a post-bubble world. Many now realize that what occurred in the housing market was a once in a lifetime spending binge induced by debt. Yet some still think those days are only around the corner. The global debt crisis will not allow that. This is why most of the mortgage market is now dominated by the government. How many foreign governments or investors are going to trust Goldman Sachs or Morgan Stanley when they drop by their door steps with new mortgage backed securities? I think some have learned their lessons well and the data reflects this.

The housing market was bound to have a day of reckoning and it looks like it is slowly unraveling. It was simply impossible to have a shadow inventory growing with banks just ignoring the reality. We are now going into year five of the housing bubble bursting. You have millions of those in foreclosure who have not made a payment in one to even two years.

Ultimately the burden falls largely on the middle class. The Federal Reserve has a primary mission to protect banks. That is their bottom line. They are not looking out for the best interest of homeowners or working Americans. For the cost of the bailouts and shadow loans, they could have paid off close to every mortgage in the country. Yet even principal reductions were never on the radar because to do that, it would be to admit a financially broken system. Instead they opted to give out $7.7 trillion in backdoor loans to banks and forced the public to deal with “free market” solutions. An interesting situation no doubt but the problems we are now facing are based on this two-tiered system.

The charts above show a massive foreclosure pipeline. You think banks want to hold onto millions of foreclosures for another five years? From the increase in short sales, REOs, and reduced home prices something tells me the answer is a big no.

http://www.doctorhousingbubble.com/j...inate-markets/

Foreclosure inventories at record levels

Foreclosure inventories are now at post-bubble records:

Total home listed as “foreclosed” has shot up to 2.21 million. The other two categories above show that there are still millions of other homes in the foreclosure pipeline. What this means is that for a few more years, we will have pricing pressure to the downside. Now most of the other two categories don’t even show up in MLS data since these are not completed foreclosures. But with five years of data it is very likely that these loans will go through the entire process and become REOs.

There is no debate that the housing market is now fully into a double-dip:

The trend for lower home prices has been baked in for nearly a year now. Last summer we had a mini burst of buyers thanks to artificial tax credits and low interest rates. I still view the current market as being designed for the nothing down leverage happy mentality that is present in our society. You have a large number of buyers purchasing homes with 3.5 percent down FHA mortgages and the default rates are soaring in this category. Just take a look at the below chart as the toxic mortgage channel was plugged up, suddenly much of this action shifted to FHA insured loans:

Source: LPS

How surprising is this now? If you can’t qualify for a mortgage with 3.5 percent down and mortgage rates in the 4 to 5 percent range then you have absolutely no business buying a home. Yet the lingering nostalgia for no-doc / no-income loans still runs rampant in the consumer psychology.

Judicial versus non-judicial

It should come as no surprise that non-judicial states have a lower inventory of foreclosures since they are clearing inventory out at a rate that is four to five times faster than judicial states:

Ultimately the demand for housing is coming from the lower priced market. In that sense, the 2.21 million foreclosed homes will provide households with lower incomes an opportunity to purchase a home that is within their budget. At least for those that purchase wisely, they are likely avoiding a repeat of the past. Yet some are still over paying in bubble markets and will likely realize their mistake years down the road. It took over a decade to build this bubble so don’t expect it to clean out quickly.

Over half a decade ago I knew the bigger issue would be the cognitive dissonance that would linger from a post-bubble world. Many now realize that what occurred in the housing market was a once in a lifetime spending binge induced by debt. Yet some still think those days are only around the corner. The global debt crisis will not allow that. This is why most of the mortgage market is now dominated by the government. How many foreign governments or investors are going to trust Goldman Sachs or Morgan Stanley when they drop by their door steps with new mortgage backed securities? I think some have learned their lessons well and the data reflects this.

The housing market was bound to have a day of reckoning and it looks like it is slowly unraveling. It was simply impossible to have a shadow inventory growing with banks just ignoring the reality. We are now going into year five of the housing bubble bursting. You have millions of those in foreclosure who have not made a payment in one to even two years.

Ultimately the burden falls largely on the middle class. The Federal Reserve has a primary mission to protect banks. That is their bottom line. They are not looking out for the best interest of homeowners or working Americans. For the cost of the bailouts and shadow loans, they could have paid off close to every mortgage in the country. Yet even principal reductions were never on the radar because to do that, it would be to admit a financially broken system. Instead they opted to give out $7.7 trillion in backdoor loans to banks and forced the public to deal with “free market” solutions. An interesting situation no doubt but the problems we are now facing are based on this two-tiered system.

The charts above show a massive foreclosure pipeline. You think banks want to hold onto millions of foreclosures for another five years? From the increase in short sales, REOs, and reduced home prices something tells me the answer is a big no.

http://www.doctorhousingbubble.com/j...inate-markets/