Five years of falling home prices have caused societal shifts in the perception of housing. We need to remember that psychologically this is the first generation where a prolonged and severe crash in home values has occurred since the Great Depression. We are hard pressed to even use the Great Depression as an example since this crisis in housing has impacted virtually every American city from coast to coast. Japan is one decade ahead of us in a post-housing bubble economy. You have unique trends that are emerging in America where young adults are moving back home with the descriptive title of being called boomerang children. Japan has an apparently harsher term called “parasite single” for young adults that move back home and draw on parent resources. Yet the overall dynamic is troubling because it causes fractions between generations. Many older boomers are realizing their faux home equity and stock portfolios will not support lavish lifestyles while many of their children unable to find good paying jobs move back into the depreciating nest. As it turns out, the United States recession is starting to look like the lost decades of Japan in more ways than one.

The post bubble markets of Japan and the United States

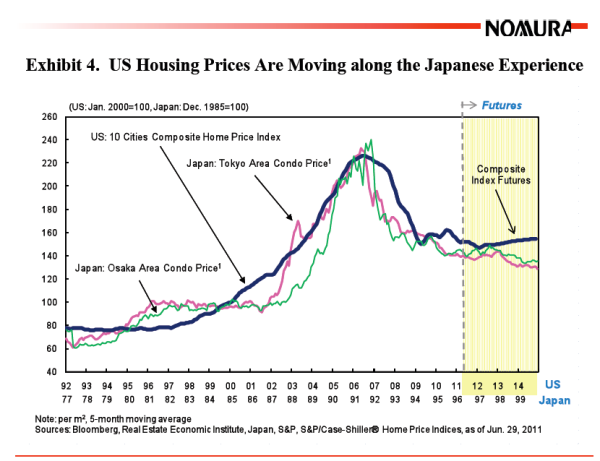

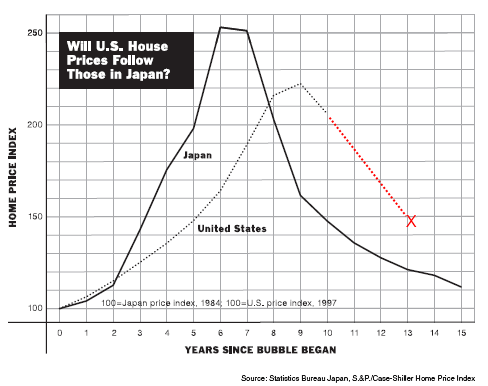

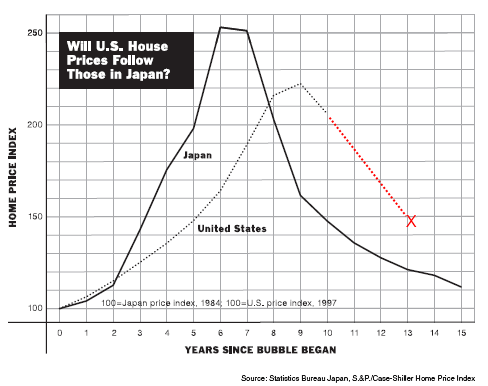

Japan had a tremendous bubble in real estate followed by a crash that is lingering to this day. If we overlap the trajectory of both real estate crashes we find a similar pattern:

Source: Richard Koo

Home values continue to fall in the United States and the Case-Shiller Index is reflecting a year-over-year fall yet again. Part of this push to lower prices stems from millions of properties in the shadow inventory combined with the desire for lower priced homes by young households and investors. Home prices in the U.S. are quickly approaching a lost decade in nominal terms. There is no doubt that we will have a lost decade but will home prices rebound anytime soon? The growing ranks of the part-time workforce bring similar parallels to the large part-time workforce in Japan. Is it any wonder why so many young Americans are moving back home?

The young come back to the home only to find lost equity

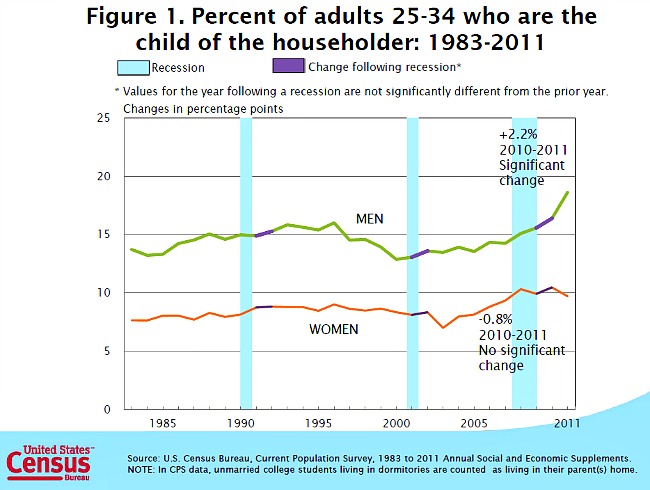

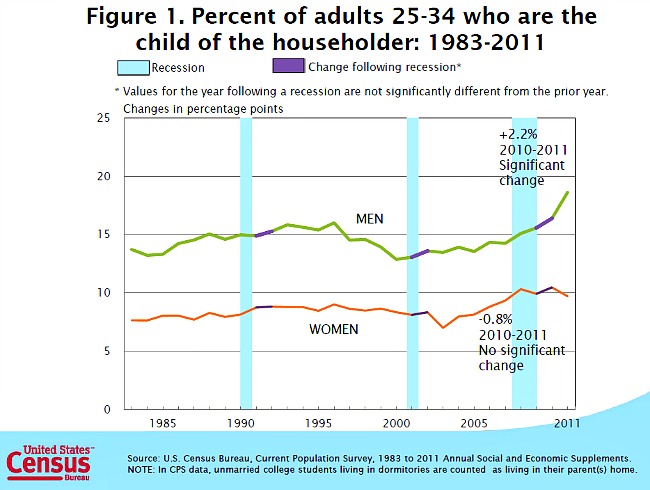

Census data shows a solid number of younger adults moving back home:

The above amounts to a few million young adults living at home that would otherwise be in independent households. A large part of this has to do with the recession and weak job market but also the reality that some areas still have inflated home values. It is hard to figure out exactly what each reason for this trend is but in Japan, you have some clear reasons for the move back home:

Japan and U.S. have mirror reflection in contraction in lending

Typically the U.S. has been resilient in bouncing back from recession and getting back to “normal” life. That normalcy is not going to come from this recession. The amount of debt floating in the global system is simply unsustainable. Europe is entering into a tipping point. Take an economy like Greece with a GDP of $300 billion or so and debts above $500 billion. There is absolutely no way this will ever be repaid and people are coming to this conclusion. Even Germany is facing struggles in the bond markets. This does not mean the U.S. is out of the woods, it just means the dominoes are starting to fall.

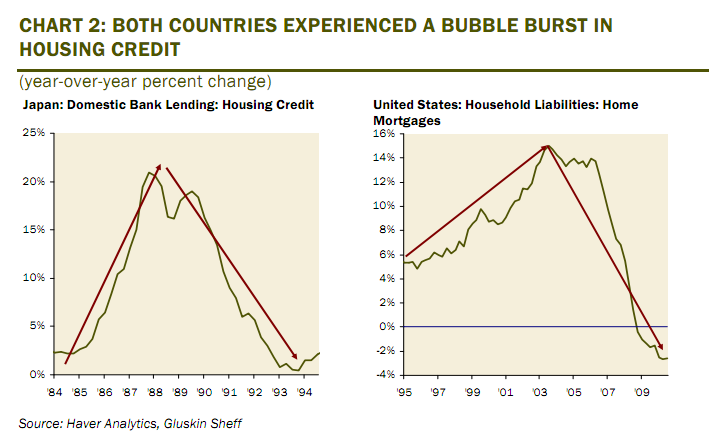

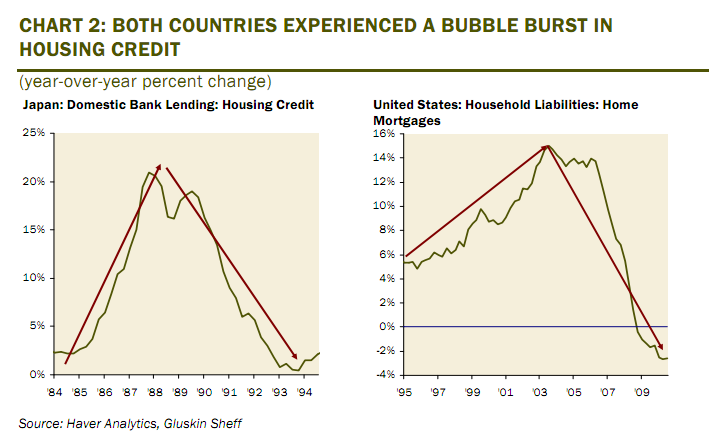

Take a look at the contraction in housing credit:

Source: Gluskin Sheff

Now this is fascinating because the contraction in home lending has followed very similar paths. Here in the U.S. even with lower mortgage rates the demand for housing is not really booming. Why? First, it has to do with the contraction in household income but also consumer confidence for the future. A home purchase is a big commitment and if many younger Americans are destined to free floating part-time work, then why many lock down to a location for 30 years? Things change over time and the visions once built into Levittown with fixtures of a community are probably not appropriate to the new generation.

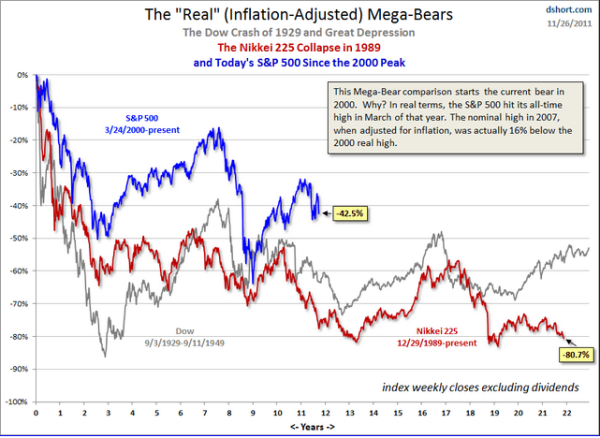

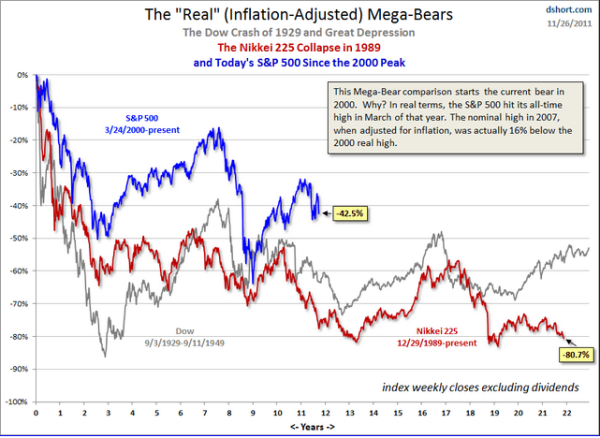

A stagnant stock market

Japan and the U.S. have dealt with stock markets unable to reach previous peaks:

Source: Dshort.com

Japan’s Nikkei 225 is down 80 percent from the point reached 22 years ago! The S&P 500 is down 42 percent from the point reached 12 years ago. The perma-growth model of ever-rising home prices and DOW 30,000 are simply unsupportable based on the current economy. What many are starting to realize is that much of the entire global economy was built on debt that would never be repaid. This is the hard to digest reality that is hitting everyone.

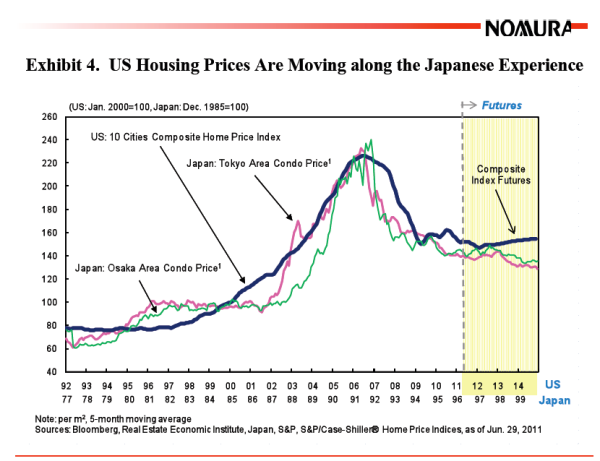

These long slow stagnant growth futures are live lava flowing down to your home down the road. You know it is going to hit but it will take a long time before it arrives. Take a look at another chart of Japanese real estate values compared to U.S. home values:

There is an unmistakable similarity here. And keep in mind the growth of part-time work and low job security are also a new tradition here in the U.S. Now how is a young non-secure workforce going to soak up all that excess demand pushed out by retiring baby boomers? They may afford lower priced homes and we do see home sales doing well at the lower range. But the mega McMansion dreams of many homeowners were built on cozy economic trends that benefitted a generation born at the right time and at the right place.

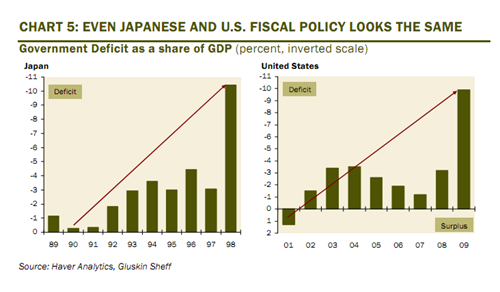

The debt ceiling debacle and global debt issues

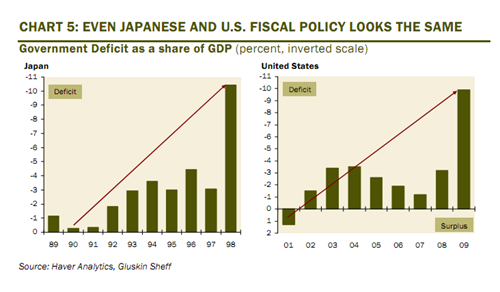

Each economy reaches a breaking point with debt. A few research papers seem to put this number at 10 percent of government debt to GDP before a tipping point is reached. Japan and the U.S. are already there:

Yet borrowing costs at both nations are at historic lows. Why? First, the ratios in Europe look much worse so you have a rush to safe haven nations. Yet this only means that reality is delayed for a few more years in these countries. Plus, you have the Federal Reserve following the same quantitative easing path followed by the Bank of Japan. Why are we to expect any different results here? I have seen a few articles point out that the low borrowing costs in the U.S. somehow reflect our healthy economy. This is absolutely not the case and is simply a reflection of the trillions of dollars put in by the Federal Reserve to keep borrowing costs artificially low and also the rush to a safe haven from the issues being faced in Europe.

The low inflation of Japan

It is fascinating to see the low inflation rate of Japan since their bubbles burst:

For over 20 years it looks like Japan has been battling a low level of deflation. We have had 5 years of falling home prices and over a decade of falling household incomes. It will definitely be an interesting future but Japan does offer some troubling parallels of what may lie ahead for us. The reality that home prices nationwide are falling year-over-year yet again reflects this trajectory.

http://www.doctorhousingbubble.com/j...ets/#more-5116

The post bubble markets of Japan and the United States

Japan had a tremendous bubble in real estate followed by a crash that is lingering to this day. If we overlap the trajectory of both real estate crashes we find a similar pattern:

Source: Richard Koo

Home values continue to fall in the United States and the Case-Shiller Index is reflecting a year-over-year fall yet again. Part of this push to lower prices stems from millions of properties in the shadow inventory combined with the desire for lower priced homes by young households and investors. Home prices in the U.S. are quickly approaching a lost decade in nominal terms. There is no doubt that we will have a lost decade but will home prices rebound anytime soon? The growing ranks of the part-time workforce bring similar parallels to the large part-time workforce in Japan. Is it any wonder why so many young Americans are moving back home?

The young come back to the home only to find lost equity

Census data shows a solid number of younger adults moving back home:

The above amounts to a few million young adults living at home that would otherwise be in independent households. A large part of this has to do with the recession and weak job market but also the reality that some areas still have inflated home values. It is hard to figure out exactly what each reason for this trend is but in Japan, you have some clear reasons for the move back home:

“As the unemployment rate soared in the 1990s, the number of unemployed went up sharply not only among middle-aged and older workers but among young people, as did the number of young people known as “freeters” who do not work as full-time employees but move from one part-time to another. The increase in these two groups was seen as the result of a change in attitudes toward work among young Japanese. Young adults who continue to live at home with their parents were labeled “parasite singles” and ridiculed as symbols of a weaking sense of self-reliance among Japanese youth, or a growing dependence on their parents. What lies behind the change in Japanese young people’s behavior, however, is not simply a change in the work ethic or a rise in dependence. Rather, these are the by-products of the confusion in the Japanese employment system, which is unable to deal adequately with the new age. Japanese companies still lack the flexibility to adjust employment, and this defect has manifested itself as a reduction in job opportunities for young people. Reduced to the status of social underdogs, Japanese young people have had no alternative but to become economically dependent on their parents.”

Of course we have similar issues hitting here in the U.S. where baby boomers often berate younger Americans that now have to navigate a debt infused education system that they never had to contend with. Japan also continues to deal with this problem:“Contrary to the belief that parasite singles enjoy the vested right to live at their parents’ expense, the real parasites are the parents, the generation of middle-aged and older workers on whom society has conferred vested rights and who make their livelihood at the expense of young people.”

We also need to remember that Japan is more tolerant to multi-generational families simply because of cultural reasons. You have to wonder how well some of the baby boomers are going to deal with their young adult children moving back home and dealing with a more fluid workforce. That vision of the future doesn’t coincide with the advertisements of older aged Americans floating carefree in some Caribbean Island. Now we have to include an extra flotation device for an extra family member.Japan and U.S. have mirror reflection in contraction in lending

Typically the U.S. has been resilient in bouncing back from recession and getting back to “normal” life. That normalcy is not going to come from this recession. The amount of debt floating in the global system is simply unsustainable. Europe is entering into a tipping point. Take an economy like Greece with a GDP of $300 billion or so and debts above $500 billion. There is absolutely no way this will ever be repaid and people are coming to this conclusion. Even Germany is facing struggles in the bond markets. This does not mean the U.S. is out of the woods, it just means the dominoes are starting to fall.

Take a look at the contraction in housing credit:

Source: Gluskin Sheff

Now this is fascinating because the contraction in home lending has followed very similar paths. Here in the U.S. even with lower mortgage rates the demand for housing is not really booming. Why? First, it has to do with the contraction in household income but also consumer confidence for the future. A home purchase is a big commitment and if many younger Americans are destined to free floating part-time work, then why many lock down to a location for 30 years? Things change over time and the visions once built into Levittown with fixtures of a community are probably not appropriate to the new generation.

A stagnant stock market

Japan and the U.S. have dealt with stock markets unable to reach previous peaks:

Source: Dshort.com

Japan’s Nikkei 225 is down 80 percent from the point reached 22 years ago! The S&P 500 is down 42 percent from the point reached 12 years ago. The perma-growth model of ever-rising home prices and DOW 30,000 are simply unsupportable based on the current economy. What many are starting to realize is that much of the entire global economy was built on debt that would never be repaid. This is the hard to digest reality that is hitting everyone.

These long slow stagnant growth futures are live lava flowing down to your home down the road. You know it is going to hit but it will take a long time before it arrives. Take a look at another chart of Japanese real estate values compared to U.S. home values:

There is an unmistakable similarity here. And keep in mind the growth of part-time work and low job security are also a new tradition here in the U.S. Now how is a young non-secure workforce going to soak up all that excess demand pushed out by retiring baby boomers? They may afford lower priced homes and we do see home sales doing well at the lower range. But the mega McMansion dreams of many homeowners were built on cozy economic trends that benefitted a generation born at the right time and at the right place.

The debt ceiling debacle and global debt issues

Each economy reaches a breaking point with debt. A few research papers seem to put this number at 10 percent of government debt to GDP before a tipping point is reached. Japan and the U.S. are already there:

Yet borrowing costs at both nations are at historic lows. Why? First, the ratios in Europe look much worse so you have a rush to safe haven nations. Yet this only means that reality is delayed for a few more years in these countries. Plus, you have the Federal Reserve following the same quantitative easing path followed by the Bank of Japan. Why are we to expect any different results here? I have seen a few articles point out that the low borrowing costs in the U.S. somehow reflect our healthy economy. This is absolutely not the case and is simply a reflection of the trillions of dollars put in by the Federal Reserve to keep borrowing costs artificially low and also the rush to a safe haven from the issues being faced in Europe.

The low inflation of Japan

It is fascinating to see the low inflation rate of Japan since their bubbles burst:

For over 20 years it looks like Japan has been battling a low level of deflation. We have had 5 years of falling home prices and over a decade of falling household incomes. It will definitely be an interesting future but Japan does offer some troubling parallels of what may lie ahead for us. The reality that home prices nationwide are falling year-over-year yet again reflects this trajectory.

http://www.doctorhousingbubble.com/j...ets/#more-5116