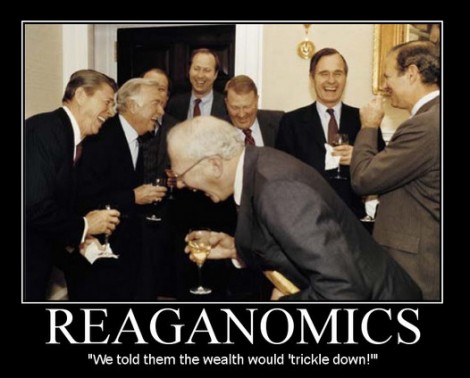

"Another Monday, another “deficit crisis” panic. If you haven’t got the feeling yet that you’re being played like a sucker over this alleged “deficit crisis,” then let me help you cross that cognitive bridge to dissonance. It comes in the figure of the recently-deceased William Niskanen, the embodiment of how Reaganomics and the Koch brothers’ libertarian movement were joined at the hip. Niskanen was an advisor to Ronald Reagan throughout the 1970s; a board director for the Koch-founded Reason Foundation; a member and chairman of Reagan’s Council on Economic Advisers from 1981-85; and he moved directly from Reagan’s side back to the Koch brothers’ side, as chairman of the libertarian Cato Institute from 1985 until 2008.

This is a brief story about how the 1% transformed this country into a failing oligarchy, and their useful tools, starting with A-list libertarian economist William Niskanen, Chicago School disciple of Milton Friedman, advocate of the rancid “public choice theory.”

Rest here:

http://www.nakedcapitalism.com/2011/...t-matter”.html

This is a brief story about how the 1% transformed this country into a failing oligarchy, and their useful tools, starting with A-list libertarian economist William Niskanen, Chicago School disciple of Milton Friedman, advocate of the rancid “public choice theory.”

Rest here:

http://www.nakedcapitalism.com/2011/...t-matter”.html

Comment