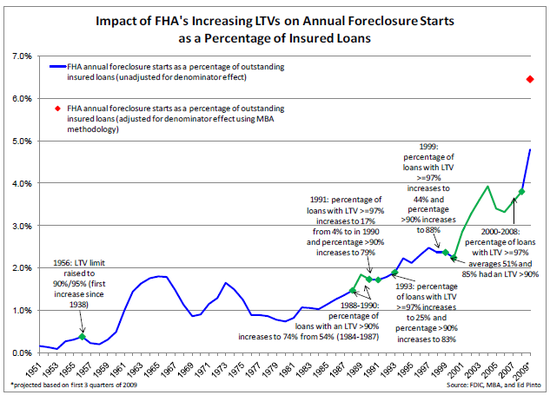

The options are running out in terms of artificially keeping the housing market inflated. Too much time, money, and effort has been funneled to the financial industry over the last five years since the bubble popped and so far, little results have been measured in the market for many Americans. The core of the issue, which ironically is what even drove the no-doc exotic mortgage bonanza, is the stagnant income growth of households. The Federal Reserve has stepped in with artificially low interest rates to keep the game going and it is running on fumes at this point. You also have FHA insured loans stepping in to make up for the low down payment market that is now gone. Right on queue the problems with FHA loans are ballooning. Not like this was foreseeable right? Yet the state even on the property tax front isnít fully recognizing the changes in assessed values.

Property taxes assessed at a minor correction

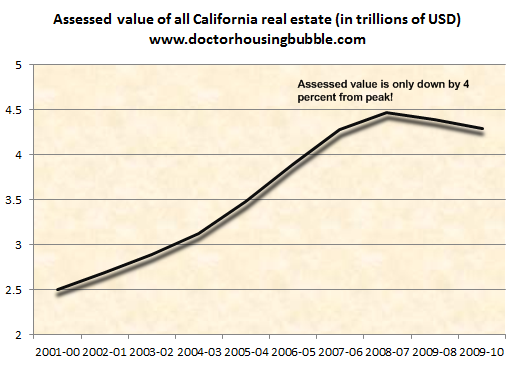

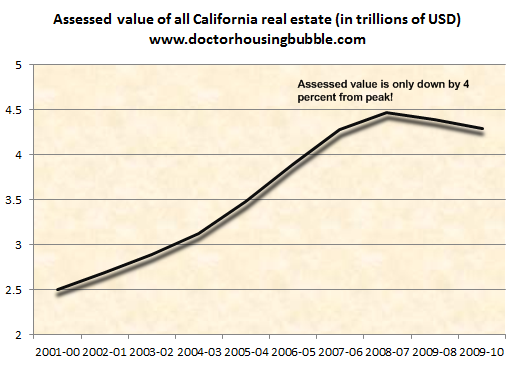

I have yet to see any solid assessment or market analysis on California property taxes. Most of the attention has been given to the general funds budget which is an absolute mess. Yet I put together a chart highlighting the actual assessed value of all California real estate over the last decade:

Source: BOE

This chart is fascinating. From 2000-01 to the peak in 2007-08 total assessed property values in California climbed by a whopping 78 percent. To put this into perspective California real estate values surged by $2 trillion in seven years! No wonder why people started looking at real estate as some sort of money tree. This was largely pulled up by over optimistic valuations (aka a bubble). Now of course some of this has come from the increase in housing units but from 2000 to 2010 housing units in California only increased by 12 percent:

Housing units

12,214,549 2000

13,680,081 2010

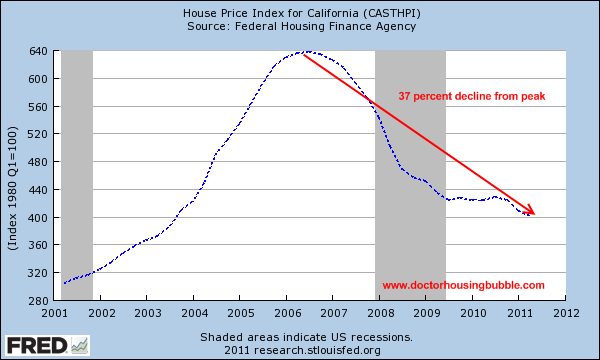

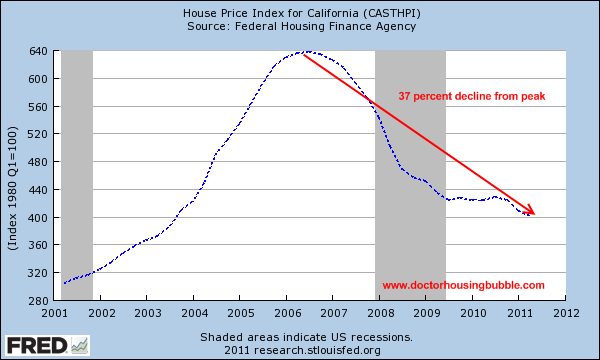

So based on the latest assessment data California properties are worth $4.3 trillion but this is only a 4 percent drop from the peak when actual real estate values have done this:

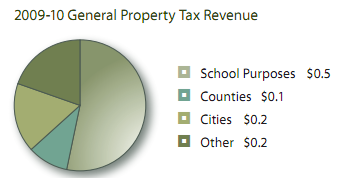

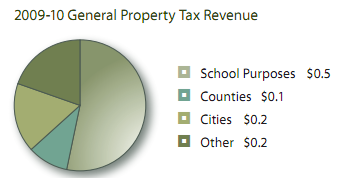

Seems like a disconnect of course but with Prop 13 real estate taxes are already low with a massive burden being placed on those who bought within the last decade. Most of the taxes go to the local community:

I found this information fascinating but also realize that here is another segment of our economy where we have shadow figures. Assessed values are not being mark to market just like the inflated balance sheets of banks with shadow properties.

The dangers of a low rate environment

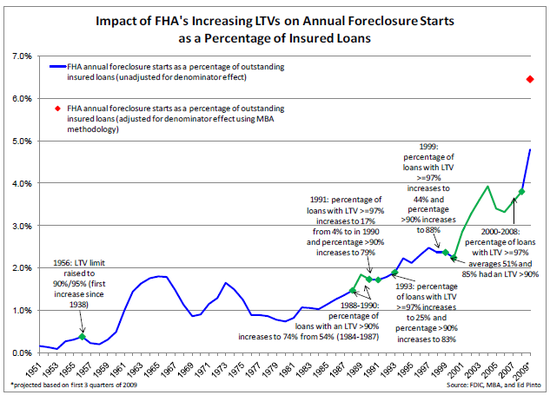

Let us assume we operated in a truly free market (which we donít) then an interest rate would truly reflect the risk of lending out money to a venture or a securitized asset. Yet in this current market we are largely operating in a distorted netherworld of easy money. Is there really almost no risk in giving a 30 year mortgage to someone in this volatile economy? Absolutely but current mortgage rates reflect an almost risk free bet that the 30 year note will be paid in full. This reminds me of Talebís Black Swan where you are right until you are wrong. Home values never went down on a nationwide basis prior to the Great Depression, until they did. This is why problems are now cropping up with FHA insured loans:

FHA defaults are now surging as a percent of the overall mortgage market. Of course this would make sense since FHA loans stepped in largely in 2008 and going forward for the low down payment market. It should be no shock that things are getting bad quickly because a low rate canít make up for a lost job or low income growth.

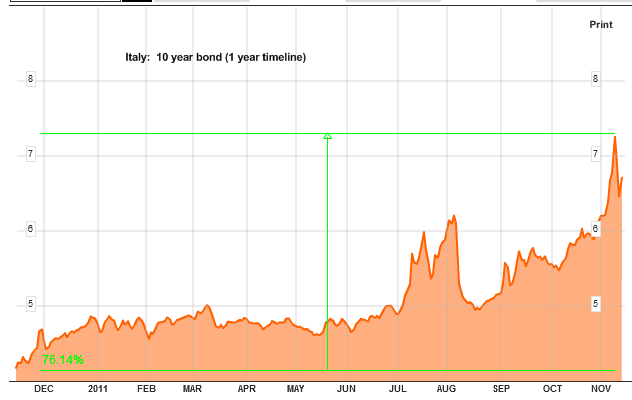

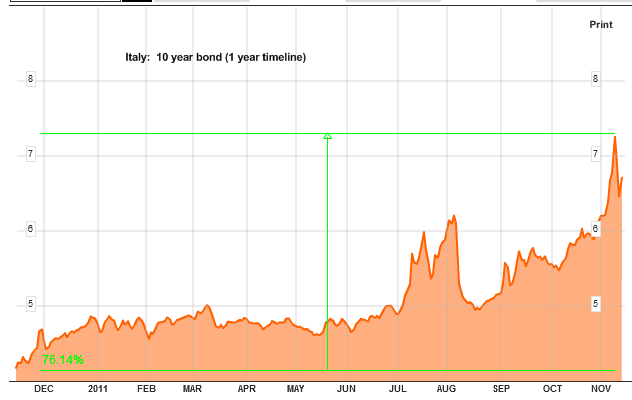

And if you think a central bank can keep rates low forever you are wrong. Greece is too small of country to relate to but take a look at Italy and how quickly things got out of hand once people realized that risk free bets were no longer risk free:

The 10 year Italian bond has surged an incredible 76 percent in one year with most of it coming since August. Italy is not a small country with a $2 trillion GDP, almost on par with California. So keep that in mind when you look at longer term market projections.

For anyone buying today you need to be willing to stay put for a decade or more. If you buy with an FHA insured loan only 3.5 percent is required as a down payment. The going fees associated with selling are easily 5 to 6 percent. So right off the bat you are underwater. If home values even tick lower by 5 or 10 percent which is feasible given the uncertainty with the economy, you will have a large surge in underwater homeowners (we are already at 25 to 30 percent of all mortgage holders in a negative equity position).

When people are shocked why low rates, FHA loans, and all these incentives fail to jump start housing you need only look at household incomes. As always, home values should be driven by a healthy economy and not the other way around. You would think that this lesson would be learned five years after the bubble has burst.

http://www.doctorhousingbubble.com/m...s-surge-again/

Property taxes assessed at a minor correction

I have yet to see any solid assessment or market analysis on California property taxes. Most of the attention has been given to the general funds budget which is an absolute mess. Yet I put together a chart highlighting the actual assessed value of all California real estate over the last decade:

Source: BOE

This chart is fascinating. From 2000-01 to the peak in 2007-08 total assessed property values in California climbed by a whopping 78 percent. To put this into perspective California real estate values surged by $2 trillion in seven years! No wonder why people started looking at real estate as some sort of money tree. This was largely pulled up by over optimistic valuations (aka a bubble). Now of course some of this has come from the increase in housing units but from 2000 to 2010 housing units in California only increased by 12 percent:

Housing units

12,214,549 2000

13,680,081 2010

So based on the latest assessment data California properties are worth $4.3 trillion but this is only a 4 percent drop from the peak when actual real estate values have done this:

Seems like a disconnect of course but with Prop 13 real estate taxes are already low with a massive burden being placed on those who bought within the last decade. Most of the taxes go to the local community:

I found this information fascinating but also realize that here is another segment of our economy where we have shadow figures. Assessed values are not being mark to market just like the inflated balance sheets of banks with shadow properties.

The dangers of a low rate environment

Let us assume we operated in a truly free market (which we donít) then an interest rate would truly reflect the risk of lending out money to a venture or a securitized asset. Yet in this current market we are largely operating in a distorted netherworld of easy money. Is there really almost no risk in giving a 30 year mortgage to someone in this volatile economy? Absolutely but current mortgage rates reflect an almost risk free bet that the 30 year note will be paid in full. This reminds me of Talebís Black Swan where you are right until you are wrong. Home values never went down on a nationwide basis prior to the Great Depression, until they did. This is why problems are now cropping up with FHA insured loans:

FHA defaults are now surging as a percent of the overall mortgage market. Of course this would make sense since FHA loans stepped in largely in 2008 and going forward for the low down payment market. It should be no shock that things are getting bad quickly because a low rate canít make up for a lost job or low income growth.

And if you think a central bank can keep rates low forever you are wrong. Greece is too small of country to relate to but take a look at Italy and how quickly things got out of hand once people realized that risk free bets were no longer risk free:

The 10 year Italian bond has surged an incredible 76 percent in one year with most of it coming since August. Italy is not a small country with a $2 trillion GDP, almost on par with California. So keep that in mind when you look at longer term market projections.

For anyone buying today you need to be willing to stay put for a decade or more. If you buy with an FHA insured loan only 3.5 percent is required as a down payment. The going fees associated with selling are easily 5 to 6 percent. So right off the bat you are underwater. If home values even tick lower by 5 or 10 percent which is feasible given the uncertainty with the economy, you will have a large surge in underwater homeowners (we are already at 25 to 30 percent of all mortgage holders in a negative equity position).

When people are shocked why low rates, FHA loans, and all these incentives fail to jump start housing you need only look at household incomes. As always, home values should be driven by a healthy economy and not the other way around. You would think that this lesson would be learned five years after the bubble has burst.

http://www.doctorhousingbubble.com/m...s-surge-again/

Comment