Re: MF Global.......

I know very little of the MF Global mess as I'm too busy with family, work, and keeping up to speed with all the other stuff relevant to our family's financial future.

But I have one quite serious question:

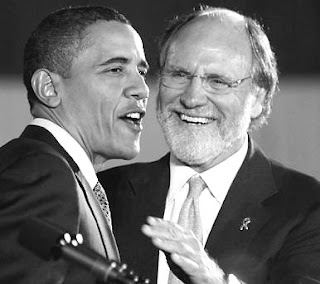

Do I even need to know anything beyond the fact that John Corzine was CEO of Goldman, US Senator, and New Jersey Governor to predict with some accuracy that he will not be punished or deterred for his part in this crisis?

I know very little of the MF Global mess as I'm too busy with family, work, and keeping up to speed with all the other stuff relevant to our family's financial future.

But I have one quite serious question:

Do I even need to know anything beyond the fact that John Corzine was CEO of Goldman, US Senator, and New Jersey Governor to predict with some accuracy that he will not be punished or deterred for his part in this crisis?

Comment