Re: Why is Gold Going Up?

Is the unemployment rate identical? No.

But it isn't the amount of the unemployment rate, it is the change in the unemployment rate that matters.

In early 1990's recession, unemployment increased 2.5% from trough to peak - a very significant jump of somewhat under 50% increase in number of unemployed. For the present recession, unemployment has jumped 5% from trough to peak, a larger jump of nearly 100% in number of unemployed.

The point isn't the absolute value - the point was there was a significant recession then much as there is a (even more) significant recession now.

Did the Fed cut to 0%? No, but then again 0% isn't some magical number. It is the change in interest rates which is supposed to spur credit.

The Fed Funds rate went from 9.85% in early 1989 to 2.92% by the end of 1992 - a drop of 693 basis points.

In contrast the Fed Funds rate this time went from 5.26% in 2006 to this years 0.07% - a drop of 519 basis points.

As for Europe - there were plenty of problems then including: German reunification, mass unemployment in the UK, recessions in every nation in Europe.

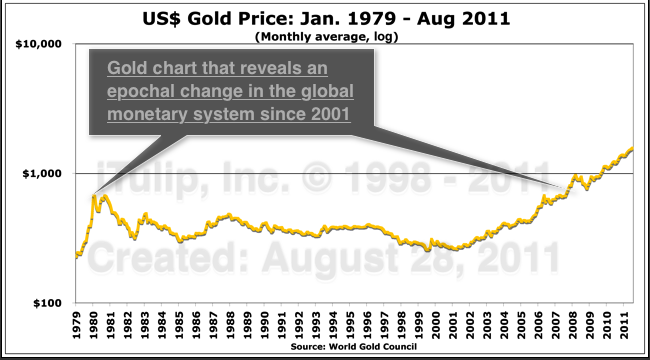

And how did gold fare in the early 1990s?

Seems like gold prices went down in a more or less straight line between 1987 and 1993 - closely in alignment with interest rates.

Need I point out this is 100% opposite to what is happening today?

In a general sense this is obviously true, otherwise we wouldn't have bubbles such as the gold bubble in 1980.

But merely saying this is true doesn't help - what precisely are you asserting as a factor in gold prices now? And how much of gold's increase can be attributed to these factor(s)?

You're trying to poke holes by asserting some truism, but without in turn providing any actual theoretical or factual support.

I think everyone would be interested in hearing a well considered, well presented, and well supported counterpoint to the iTulip thesis.

Krugman is a useful idiot.

The mere fact that he's focusing on gold this week merely highlights his somewhat well disguised, but constant, search for the limelight.

Originally posted by raja

But it isn't the amount of the unemployment rate, it is the change in the unemployment rate that matters.

In early 1990's recession, unemployment increased 2.5% from trough to peak - a very significant jump of somewhat under 50% increase in number of unemployed. For the present recession, unemployment has jumped 5% from trough to peak, a larger jump of nearly 100% in number of unemployed.

The point isn't the absolute value - the point was there was a significant recession then much as there is a (even more) significant recession now.

Did the Fed cut to 0%? No, but then again 0% isn't some magical number. It is the change in interest rates which is supposed to spur credit.

The Fed Funds rate went from 9.85% in early 1989 to 2.92% by the end of 1992 - a drop of 693 basis points.

In contrast the Fed Funds rate this time went from 5.26% in 2006 to this years 0.07% - a drop of 519 basis points.

As for Europe - there were plenty of problems then including: German reunification, mass unemployment in the UK, recessions in every nation in Europe.

And how did gold fare in the early 1990s?

Seems like gold prices went down in a more or less straight line between 1987 and 1993 - closely in alignment with interest rates.

Need I point out this is 100% opposite to what is happening today?

Originally posted by raja

But merely saying this is true doesn't help - what precisely are you asserting as a factor in gold prices now? And how much of gold's increase can be attributed to these factor(s)?

You're trying to poke holes by asserting some truism, but without in turn providing any actual theoretical or factual support.

I think everyone would be interested in hearing a well considered, well presented, and well supported counterpoint to the iTulip thesis.

Originally posted by raja

The mere fact that he's focusing on gold this week merely highlights his somewhat well disguised, but constant, search for the limelight.

Comment