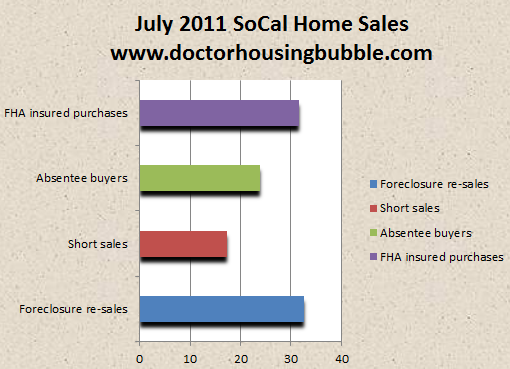

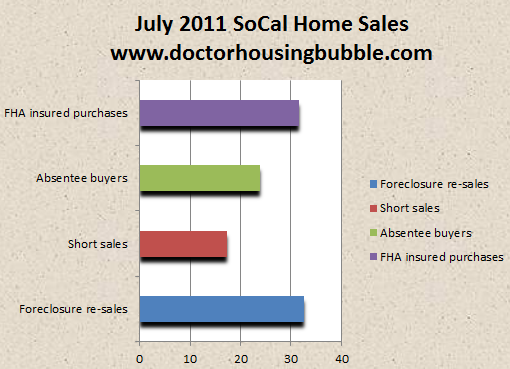

what is selling is selling like this:

You have nearly 50 percent of home sales coming from the distressed category. Over 32 percent of the sales were foreclosure re-sales (aka cheaper homes) and over 17 percent were from the short sale pile (aka cheaper homes). Then, you have over 23 percent of the sales coming from absentee buyers (aka potential investors) and these folks are not buying your massive bubble properties in bubble cities. Many of the absentee buyers come from the all cash pile and they are paying a median price of $212,000 for their purchases. And finally, you have FHA insured loans dominating the financing game. 31 percent of all homes purchased last month were financed with FHA insured loans which only requires a minimum of 3.5 percent as a down payment and this is what the vast majority are putting down (or all they can afford). Where is the big money here? There isn’t any large deep pocket cohort and this is why banks are hoping (praying) that somehow inflation starts to pick-up so they can off load the giants of the shadow inventory. Many of these are in areas like Culver City, Pasadena, Cerritos, Santa Monica, and other areas you might not associate with collapsing housing markets. Folks are still delusional at this point.

a peek into the shadows:

a peek into the shadows:

Total SoCal MLS non-distressed inventory: 121,356

Total SoCal distressed inventory: 114,343

Total SoCal distressed inventory for sale: 36,488

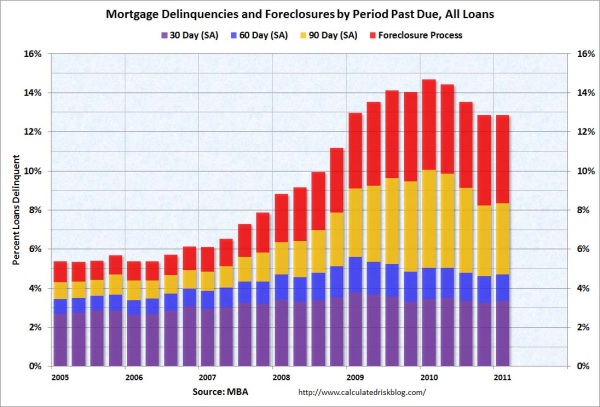

The banks would love nothing more than to drag this thing out for years. Why? (besides extend & pretend) They keep getting a paycheck along the way! (this is often overlooked in the portfolio view. Keep the underwater ARM sheeple sending in those payments until the bank is ready to step away from ZIRP, effectively beheading them) This is horrible for the economy because resources are being displaced into a sinkhole here.

So what if home prices go down if this is all that households can sensibly afford? In regions where home prices have collapsed sales are picking up solid steam. It is important to get to a normal level quickly and liquidate inventory fast so we can get on to the bigger task at hand which is fixing the overall economy and putting Americans back to work. Yet the Wall Street obsessed politicians have focused way too much on housing. Ironically these policies have kept prices inflated and even with those trillions of dollars wasted, SoCal home prices are back to 2002 levels! So what was really solved aside from keeping failed institutions floating and more banks able to pay themselves at the taxpayers’ expense? Horrible financial policy and bad politics now seem to dominate the economy. The SoCal housing market is anything but normal. You’ll know it is a normal market when non-distressed sales dominate and FHA insured loans are a tiny piece of the financing.

http://www.doctorhousingbubble.com/s...ear-over-year/

Total SoCal distressed inventory: 114,343

Total SoCal distressed inventory for sale: 36,488

The banks would love nothing more than to drag this thing out for years. Why? (besides extend & pretend) They keep getting a paycheck along the way! (this is often overlooked in the portfolio view. Keep the underwater ARM sheeple sending in those payments until the bank is ready to step away from ZIRP, effectively beheading them) This is horrible for the economy because resources are being displaced into a sinkhole here.

So what if home prices go down if this is all that households can sensibly afford? In regions where home prices have collapsed sales are picking up solid steam. It is important to get to a normal level quickly and liquidate inventory fast so we can get on to the bigger task at hand which is fixing the overall economy and putting Americans back to work. Yet the Wall Street obsessed politicians have focused way too much on housing. Ironically these policies have kept prices inflated and even with those trillions of dollars wasted, SoCal home prices are back to 2002 levels! So what was really solved aside from keeping failed institutions floating and more banks able to pay themselves at the taxpayers’ expense? Horrible financial policy and bad politics now seem to dominate the economy. The SoCal housing market is anything but normal. You’ll know it is a normal market when non-distressed sales dominate and FHA insured loans are a tiny piece of the financing.

http://www.doctorhousingbubble.com/s...ear-over-year/

Comment