http://www.reuters.com/article/2011/...77G2KC20110817

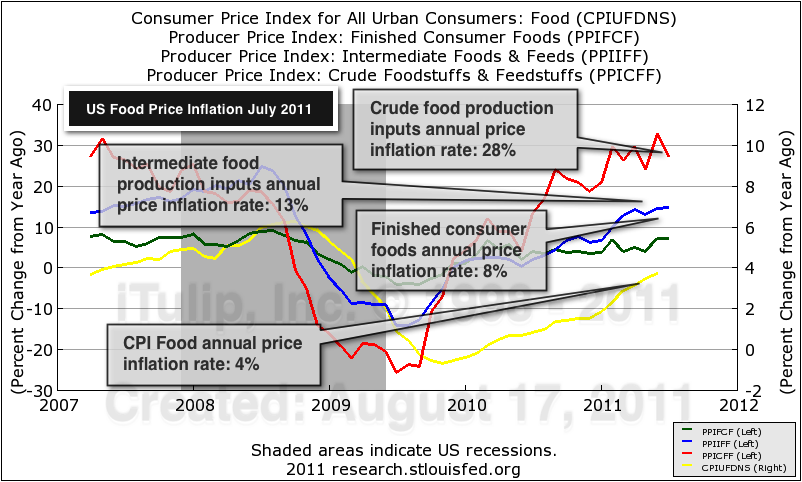

U.S. core producer prices rose at their fastest pace in six months in July...according to a government report on Wednesday that could stoke inflation fears.

http://www.bls.gov/news.release/ppi.nr0.htm

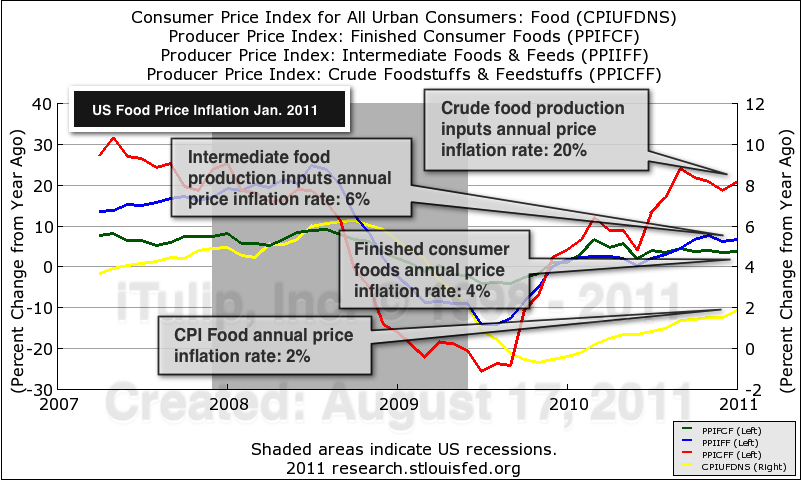

On an unadjusted basis, prices for finished goods moved up 7.2 percent for the 12 months ended July 2011.

U.S. core producer prices rose at their fastest pace in six months in July...according to a government report on Wednesday that could stoke inflation fears.

http://www.bls.gov/news.release/ppi.nr0.htm

On an unadjusted basis, prices for finished goods moved up 7.2 percent for the 12 months ended July 2011.

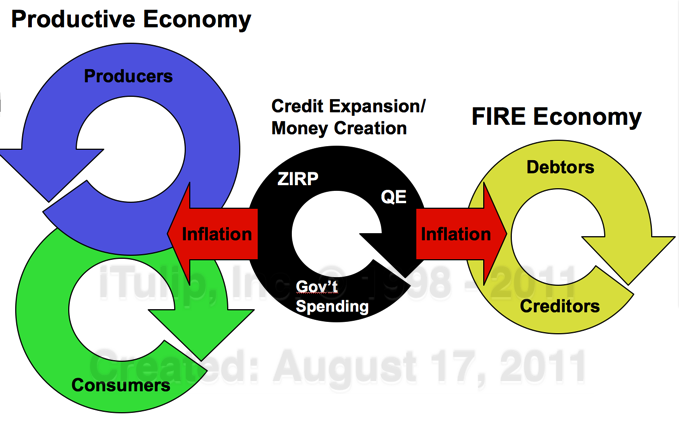

, and stated that the only way to prevent this result is to directly reduce debt levels in the FIRE Economy to eliminate the need for inflationary Fed policy to prevent debt deflation in the private sector.

, and stated that the only way to prevent this result is to directly reduce debt levels in the FIRE Economy to eliminate the need for inflationary Fed policy to prevent debt deflation in the private sector.

Comment