I do not know for a fact my house is worth more than that!

(moving a bit closer to the day of sheeple reckoning, when 'you can't sell a house for any price')

(moving a bit closer to the day of sheeple reckoning, when 'you can't sell a house for any price')

Ignoring a problem might bring temporary relief but ultimately a day of reckoning must occur. The underlying problems with housing have been swept under the rug for many years like dust (more accurately dog shit) trying to be ignored. Yet the dust is still there and it will ultimately need to be cleaned up. The housing market is simply in a temporary lull yet more troubles are ahead. Take for example the HAMP program that was designed to help 3 to 4 million homeowners. As of the first quarter of 2011 only 634,000 loans have been modified. Why was this program such a major failure? Simply put the program sought to fix an issue that was temporary in nature yet the reality was that the housing collapse is much more systemic than a temporary problem. It was a massive bubble embedded in our banking system. Perspective is important here. Over the last three years some 3 million loans have fallen to foreclosure. Yet some in the industry are projecting another 5 to 7 million foreclosures by the end of 2012. If we figure that foreclosure is the ultimate sign of housing failure then the worse may still be ahead for housing.

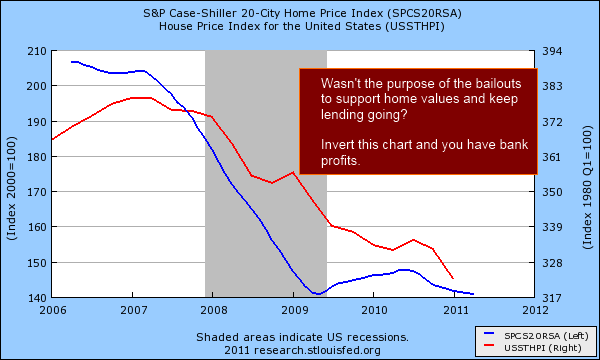

Home prices falling for five solid years

Home prices continue to move lower and are now bouncing in a short-term trough. For some parts of the country home prices are more justified with local area incomes but other markets like in California remain stubbornly in a bubble holding pattern. I think the psychology in bubble states keeps prices inflated even longer because people want to believe that somehow the rules of economics do not apply to their own area. Of course, home prices have fallen hard in many once untouchable markets yet many are still willing to bet that things will somehow miraculously turn around even though the economy is weak. What is even more surprising is the notion that with broke state governments and a broke Federal government that somehow taxes will not be going up. It is only a matter of time that taxes move up and in a state like California where property receives favorable treatment I would suspect that this will be on the table shortly. Taxes seem to be blistering high on everything but property in the state. Regardless of the politics money is running out and tough choices need to be made. So how do we envision price appreciation in property with this economic climate in mind?

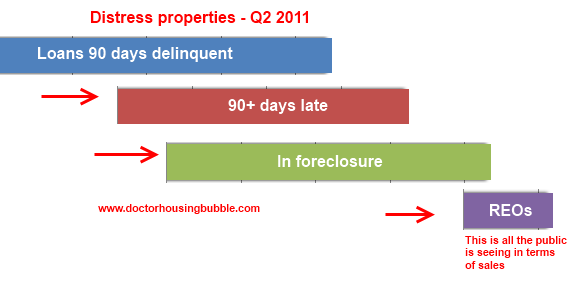

Loans currently in foreclosure

Over 2 million loans are currently in the foreclosure process. To envision 5 million more foreclosures in the next two years isn’t hard to imagine since nearly half of those homes are already in the process and only waiting to be finalized. It should be obvious to most of you that the banking bailouts were merely programs to protect financial institutions from facing reality. That was it. It was one giant bread and circus spectacle to fool the public into believing that somehow these bailouts were necessary in keeping home values inflated (instead they inflated the pocketbooks of bankers). Now the government is talking about renting out REOs as some kind of solution. We have gone back to square one except we have already spent most of the money on propping up the financial institutions that caused this mess. People are losing faith in the system especially with the insanity now going on with the debt ceiling. Apparently we have no problem dolling out trillions of dollars to banks so they don’t have to practice normal accounting procedures but when it comes to paying our bills we now have to tighten our fiscal belts? What an odd universe we live in at the moment.

Half of mortgage holders think they have equity

It would seem that homeowners have a better grasp on reality than those on Wall Street. Only half of homeowners actually believe that they have equity in their home:

“(DSNews) Less than half of homeowners – 49 percent – currently believe their home is worth more than the amount they still owe on their mortgage.

…One-third of homeowners believe they are underwater with their mortgage, and 18 percent of respondents said they weren’t sure.”

I find this fascinating because it sheds useful information into the psychology of the current homeowner. If you believe you are underwater you are less likely to list your home for sale I would imagine unless you had to desperately sell and had the cash and desire to rid yourself of the property. I see this happening in cases of a job move or a divorce for example. Yet this reality now shows that the data is matching up with perceived notions of housing value. People are now more accurately valuing their property. This also is a likely explanation of the lack of move up buying in this market. I find it amazing that 18 percent of those surveyed simply have no idea whether they have equity in their property. Maybe this group simply does not care? Consider this another lingering symptom of the housing bubble mania. With a 20 percent down standard you can rest assured that most people would know if they had equity in their home.…One-third of homeowners believe they are underwater with their mortgage, and 18 percent of respondents said they weren’t sure.”

Where future foreclosures are coming from

Here is the drawn to scale pipeline of future foreclosures. We have roughly 6 million mortgages in some state of distress or foreclosure. As you can see from the chart above the REO category is a tiny fraction of the other problem properties gearing up to hit the market. Again, this relates to our argument that ignoring problems does not solve them. The banks felt that after five years of nonsense that somehow, another bubble would hit and home values would be back on their way up. Well guess what? That has not materialized because incomes are falling or stagnant! Watch the mainstream press and you will never hear a figure given for the median household income. Even on those “professional” housing shows you get a home value but you never get the breakdown of household income even though this is by far the most important factor in purchasing a home. Of course they don’t want to open up that can of worms because they want everyone to continue spending mindlessly and keeping the gig going especially in housing.

This mess is going to drag painfully out. Just look at how the synergy between politicians and investment banks work to keep the public in the dark. 3 million finalized foreclosures in the last three years with another 5 to 7 million coming up in the next two years yet somehow things are on the mend. What kind of math are these people using? Probably the same math they are using to deal with the debt ceiling.

http://www.doctorhousingbubble.com/w...y-end-of-2012/