July 16 2011: The Real State of US Housing

Frances Benjamin Johnston Spring House 1944

"Spring house, Hill Plantation. Washington vicinity, Wilkes County, Georgia"

"Spring house, Hill Plantation. Washington vicinity, Wilkes County, Georgia"

In the end, the US economy -as expressed in the GDP- remains 70% dependent on consumers. And I doubt there's anyone left who would pretend that consumers are doing well, or even getting better. The richest few percent perhaps, but certainly not the majority. This is obvious from all kinds of data, like unemployment, consumer confidence etc., but it's nowhere clearer than in housing. Which, conveniently, seems to have fallen off most radars. Convenient, but also patently ridiculous. So here we go once again, the true shape of US housing -and banking-, seen through the lens of a few recent articles that did offer a look behind the -media- veil:

On June 12, Suzanne Kapner wrote this in the Financial Times:

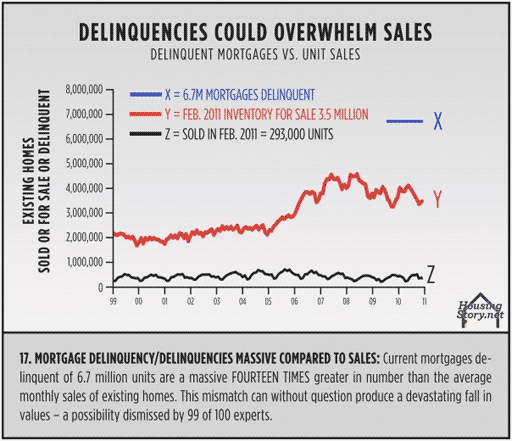

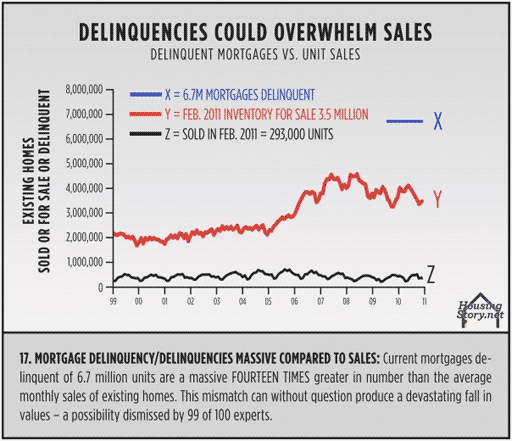

An admittedly crude calculation would seem to indicate that on non-securitized mortgages alone, US banks are at risk for 20% of $3 trillion, or $600 billion. The typical return is 35% to 40% of face value, meaning between $210 billion and $240 billion can be expected to be recovered, and therefore $360 billion to $390 billion to be lost. And that's today's face value. That implies a housing market that doesn't deteriorate any further, and isn't flooded with more of the foreclosed homes, the 3.5 million in inventory and the 6.7 million already delinquent mortgages.

Again, the $600 billion at risk at US banks is just for non-securitized mortgages. We're not taking into account risks US banks carry on other assets, and we're not even mentioning mortgage backed securities and other derivatives, like CDS issued on Greece and other PIIGS members. $600 billion is scary enough all by itself.

Not that you would know it from the banks themselves, or the media, indicates Shanthi Bharatwaj at The Street:

There are of course multiple reasons (MERS, judges come to mind) why banks don't execute foreclosure proceedings, but non-recognition of losses is certainly one of the big ones. Still, when you see in the graph above that 20-30 times more homes stay in foreclosure than are sold off, and 6.7 million mortgages are delinquent, you need to ask yourself a few questions. Like: what on earth is going on here? What happens when this ship starts leaking and refuses to sail any longer? Who's going to pay the piper then?

And what are the chances that the housing situation will improve? First of all, that's simply not going to happen with the unemployment numbers as we see them today, not even with the embellished ones the US government reports, let alone the more realistic ones that include all Americans with no or too little work.

From the same piece by Michael David White, Spring 2011 Guide of 30 Key Charts to See Before You Buy or Sell Your Home , published March 30,. here's a number of other graphs which make it all a lot clearer, starting off with White's version of the Case/Shiller index until its 2006 peak:

And then the same index, but including the 37% drop since 2006, as well as the projected trendline:

US domestic real estate has lost 37% of an estimated $22 trillion 2006 peak value, or over $8 trillion. More is lost each and every day. This loss has no reason to stop at $10 trillion. Real unemployment is sky high, as is the housing inventory. There is far too much supply and not nearly enough demand. It's not rocket science.

The only "solution" to this problem, only it isn't truly one, is that the US government starts buying up all homes for sale, or maybe even all homes, period. The Bulgaria model: socialized housing for everyone. Well, teh US has been very busy trying to achieve just that:

And the idea that mortgages are less risky these days doesn't float either. The government, through Fannie Mae, Freddie Mac and Ginnie Mae has a larger share of the mortgage market than ever before, at a time when homes are bought with more leverage than ever before. How 'bout them apples?

So once mortgage debt catches up with real home values (let's call it mark to market), and it necessarily must, as you can easily deduct from the next graph, it's the government, and that means the American taxpayers, who will be on the hook for the trillions of dollars in zombie value that has yet to evaporate. Or, actually, we should say, as we have so many times before: the value disappears, but the debt remains.

But those trillions of dollars are not counted when it comes to the debt ceiling, and the government doesn't even carry Fannie and Freddie on its books. Is proper accounting were applied, that ceiling would have to be raised close to $20 trillion, not the paltry $14.5 trillion or so that Congress says it's fighting about.

The sole comfort for Americans is that they're by no means alone. There have been real estate bubbles in many places, and the US doesn't even come close to being the worst, though we must remember that homeownership rates are higher than in many other countries:

One last graph from Michael David White, which brings us back to banks, in this case the Irish ones.

Ireland is in really bad shape. I wouldn't be surprised at all if the EU decides to let it fall, alongside Greece and Portugal, before the year is over.

There are many comparisons out there between the Greek debt situation and the fall of Lehman Brothers. I think there's one important difference, albeit one of many: the bond vigilantes were not involved in Lehman, at least not to a similar degree. They're very much there today, and they can smell blood.

http://theautomaticearth.blogspot.co...ce=patrick.net

On June 12, Suzanne Kapner wrote this in the Financial Times:

Concern rises over US mortgage defaults

Ilargi: On June 20, Dan Alpert reacted to Kapner's article in a guest post at The Big Picture:Mortgages held by US banks are performing far worse than home loans sold to Fannie Mae and Freddie Mac, the government-controlled mortgage finance companies, according to federal data made available to the Financial Times. The Office of the Comptroller of the Currency has never before released the data but is considering adding the information to its monthly mortgage report.

Bank-retained loans would typically be made to higher-risk borrowers and, therefore, tend to have higher default rates than loans sold to or guaranteed by the government. But the rate at which bank-held loans are going delinquent raises questions about whether the banks have properly reserved for future losses.

Nearly 20 per cent of non-government-guaranteed mortgages held by the banks are at least 30 days late or in some stage of foreclosure, compared with 7 per cent for loans held by Fannie Mae and Freddie Mac, now controlled by the federal government, according to the data.

The rate at which borrowers of these bank-held loans are falling behind on payments is second only to mortgages that were packaged by banks into securities and sold to investors. Roughly 30 per cent of borrowers with mortgages in these instruments, known as “private-label” securities, have missed at least two payments, according to Laurie Goodman of Amherst Securities

Bank-retained loans would typically be made to higher-risk borrowers and, therefore, tend to have higher default rates than loans sold to or guaranteed by the government. But the rate at which bank-held loans are going delinquent raises questions about whether the banks have properly reserved for future losses.

Nearly 20 per cent of non-government-guaranteed mortgages held by the banks are at least 30 days late or in some stage of foreclosure, compared with 7 per cent for loans held by Fannie Mae and Freddie Mac, now controlled by the federal government, according to the data.

The rate at which borrowers of these bank-held loans are falling behind on payments is second only to mortgages that were packaged by banks into securities and sold to investors. Roughly 30 per cent of borrowers with mortgages in these instruments, known as “private-label” securities, have missed at least two payments, according to Laurie Goodman of Amherst Securities

The Next Crisis in Residential Mortgages – New Data Emerges

Ilargi: US banks have $3 trillion "worth" of non-securitized mortgages on their books. 20% of these loans are in various stages of grave distress ("loans that are about to miss two or more payments"). That made me think of a few graphs, and the text below it, from Chicago real estate man Michael David White at Housingstory.net this past March:[..] lender recoveries of loan principal through the liquidation of foreclosed mortgage collateral has been dismal – averaging between 35% and 40% of loan face amount (taking into consideration both selling price and all costs related to the foreclosure and liquidation) for years now and showing no signs of improving.

With home prices, per the S&P Case Shiller 20-City Index, having fallen 6.2% from the end of Q3 2010 through the end of Q1 2011, and now more than 33% below peak levels in July of 2006, the largest banks in the U.S. are therefore loath to repossess and liquidate defaulted home loan collateral. [..]

Some 20% of bank-held mortgage loans, according to Kapner, are 30-days or more past due, which we read as meaning loans that are about to miss two or more payments. We are very interested in seeing more work from Ms. Kapner on this subject as banks hold nearly $3 trillion of mortgage loans in non-securities form on their books. 20% could be an alarmingly large number relative to existing loan loss provisions if such loans are eventually liquidated at anything near today’s prevailing recovery rates.

With home prices, per the S&P Case Shiller 20-City Index, having fallen 6.2% from the end of Q3 2010 through the end of Q1 2011, and now more than 33% below peak levels in July of 2006, the largest banks in the U.S. are therefore loath to repossess and liquidate defaulted home loan collateral. [..]

Some 20% of bank-held mortgage loans, according to Kapner, are 30-days or more past due, which we read as meaning loans that are about to miss two or more payments. We are very interested in seeing more work from Ms. Kapner on this subject as banks hold nearly $3 trillion of mortgage loans in non-securities form on their books. 20% could be an alarmingly large number relative to existing loan loss provisions if such loans are eventually liquidated at anything near today’s prevailing recovery rates.

An admittedly crude calculation would seem to indicate that on non-securitized mortgages alone, US banks are at risk for 20% of $3 trillion, or $600 billion. The typical return is 35% to 40% of face value, meaning between $210 billion and $240 billion can be expected to be recovered, and therefore $360 billion to $390 billion to be lost. And that's today's face value. That implies a housing market that doesn't deteriorate any further, and isn't flooded with more of the foreclosed homes, the 3.5 million in inventory and the 6.7 million already delinquent mortgages.

Again, the $600 billion at risk at US banks is just for non-securitized mortgages. We're not taking into account risks US banks carry on other assets, and we're not even mentioning mortgage backed securities and other derivatives, like CDS issued on Greece and other PIIGS members. $600 billion is scary enough all by itself.

Not that you would know it from the banks themselves, or the media, indicates Shanthi Bharatwaj at The Street:

Dividend Bump May be in JPMorgan's Future

Ilargi: Yes, that is just completely weird, having hundreds of billions at serious risk but being flush with cash regardless, but still, come on, why make loan loss provisions when you're not required to by regulators and politicians, and you know when push comes to shove you'll simply be handed more taxpayer money? Oh, the pleasures of being too big to fail...U.S. banks are going to have so much extra capital over the 12 months, they are not going to know what to do with it, JPMorgan Chase CEO [Jamie Dimon] said Thursday, signaling investors should expect more dividends and share buybacks from the nation's second largest bank.

There are of course multiple reasons (MERS, judges come to mind) why banks don't execute foreclosure proceedings, but non-recognition of losses is certainly one of the big ones. Still, when you see in the graph above that 20-30 times more homes stay in foreclosure than are sold off, and 6.7 million mortgages are delinquent, you need to ask yourself a few questions. Like: what on earth is going on here? What happens when this ship starts leaking and refuses to sail any longer? Who's going to pay the piper then?

And what are the chances that the housing situation will improve? First of all, that's simply not going to happen with the unemployment numbers as we see them today, not even with the embellished ones the US government reports, let alone the more realistic ones that include all Americans with no or too little work.

From the same piece by Michael David White, Spring 2011 Guide of 30 Key Charts to See Before You Buy or Sell Your Home , published March 30,. here's a number of other graphs which make it all a lot clearer, starting off with White's version of the Case/Shiller index until its 2006 peak:

And then the same index, but including the 37% drop since 2006, as well as the projected trendline:

US domestic real estate has lost 37% of an estimated $22 trillion 2006 peak value, or over $8 trillion. More is lost each and every day. This loss has no reason to stop at $10 trillion. Real unemployment is sky high, as is the housing inventory. There is far too much supply and not nearly enough demand. It's not rocket science.

The only "solution" to this problem, only it isn't truly one, is that the US government starts buying up all homes for sale, or maybe even all homes, period. The Bulgaria model: socialized housing for everyone. Well, teh US has been very busy trying to achieve just that:

And the idea that mortgages are less risky these days doesn't float either. The government, through Fannie Mae, Freddie Mac and Ginnie Mae has a larger share of the mortgage market than ever before, at a time when homes are bought with more leverage than ever before. How 'bout them apples?

So once mortgage debt catches up with real home values (let's call it mark to market), and it necessarily must, as you can easily deduct from the next graph, it's the government, and that means the American taxpayers, who will be on the hook for the trillions of dollars in zombie value that has yet to evaporate. Or, actually, we should say, as we have so many times before: the value disappears, but the debt remains.

But those trillions of dollars are not counted when it comes to the debt ceiling, and the government doesn't even carry Fannie and Freddie on its books. Is proper accounting were applied, that ceiling would have to be raised close to $20 trillion, not the paltry $14.5 trillion or so that Congress says it's fighting about.

The sole comfort for Americans is that they're by no means alone. There have been real estate bubbles in many places, and the US doesn't even come close to being the worst, though we must remember that homeownership rates are higher than in many other countries:

One last graph from Michael David White, which brings us back to banks, in this case the Irish ones.

Ireland is in really bad shape. I wouldn't be surprised at all if the EU decides to let it fall, alongside Greece and Portugal, before the year is over.

There are many comparisons out there between the Greek debt situation and the fall of Lehman Brothers. I think there's one important difference, albeit one of many: the bond vigilantes were not involved in Lehman, at least not to a similar degree. They're very much there today, and they can smell blood.

http://theautomaticearth.blogspot.co...ce=patrick.net

Comment