As millions of Americans struggle in foreclosure with little hope of relief, big banks are going to borrowers who are not even in default and cutting their debt or easing the mortgage terms, sometimes with no questions asked.

Two of the nation’s biggest lenders, JPMorgan Chase and Bank of America, are quietly modifying loans for tens of thousands of borrowers who have not asked for help but whom the banks deem to be at special risk.

Rula Giosmas is one of the beneficiaries. Last year she received a letter from Chase saying it was cutting in half the amount she owed on her condominium.

Ms. Giosmas, who lives in Miami, was not in default on her $300,000 loan. She did not understand why she would receive this gift — although she wasted no time in taking it.

Banks are proactively overhauling loans for borrowers like Ms. Giosmas who have so-called pay option adjustable rate mortgages, which were popular in the wild late stages of the housing boom but which banks now view as potentially troublesome.

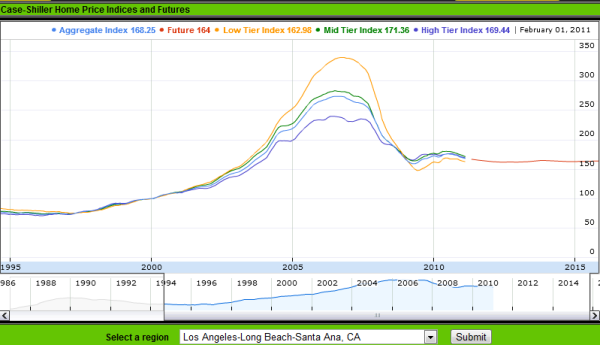

Before Chase shaved $150,000 off her mortgage, Ms. Giosmas owed much more on her place than it was worth. It was a fate she shared with a quarter of all homeowners with mortgages across the nation. Being underwater, as it is called, can prevent these owners from moving and taking new jobs, and places the households at greater risk of foreclosure.

“It’s a huge problem,” said the economist Sam Khater. “Reducing negative equity would spark a housing recovery.”

While many homeowners desperately need help to keep their homes and cannot get it, the borrowers getting unsolicited relief from Chase sometimes suspect a trick.

Option ARM loans like Ms. Giosmas’s gave borrowers the option of skipping the principal payment and some of the interest payment for an introductory period of several years. The unpaid balances would be added to the body of the loan.

Ms. Giosmas bought her two-bedroom, two-bath apartment north of downtown Miami for $359,000 in early 2006, according to real estate records. She made a large down payment, but because each month she paid less than was necessary to pay off the loan, her debt swelled to about $300,000.

Meanwhile, the value of the apartment nosedived. By the time Ms. Giosmas got the letter from Chase, the condominium was worth less than half what she paid. “I would not have defaulted,” she said. “But they don’t know that.”

The letter, which Ms. Giosmas remembers as brief and “totally vague,” said Chase was cutting her principal by $150,000 while raising her interest rate to about 5 percent. Her payments would stay roughly the same.

A few months ago, Ms. Giosmas sold the place for $170,000, making a small profit. Having a loan that her lender considered toxic, she said, “turned out to be a blessing in disguise.”

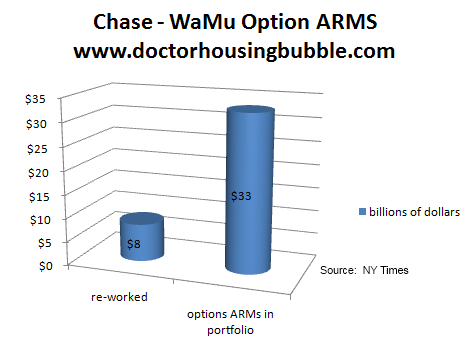

Chase, which declined to comment on its program, got $50 billion in option ARM loans when it bought Washington Mutual in 2008. The lender, which said last fall that it had dealt with 22,000 option ARM loans with an unpaid principal balance of $8 billion, still has $33 billion of them in its portfolio.

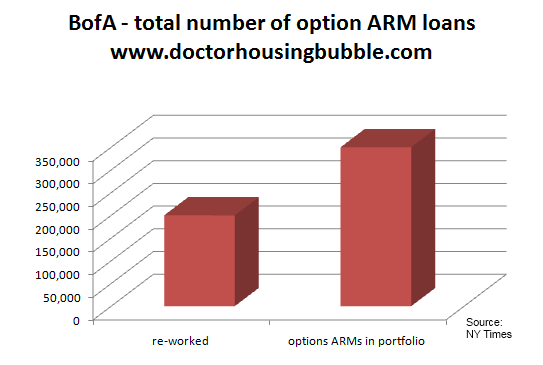

Bank of America acquired a portfolio of 550,000 option ARMs from its purchase of Countrywide Financial in 2008. The lender said more than 200,000 had been converted to more stable mortgages.

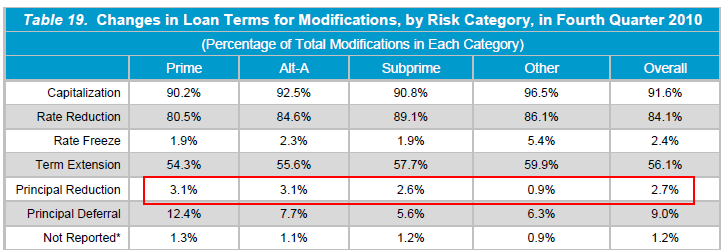

Dan B. Frahm, a spokesman for Bank of America, said it was using every technique short of principal reduction to remake its loans, including waiving prepayment penalties, refinancing, lowering the interest rate, postponing some of the balance and extending the term.

“By proactively contacting pay option ARM customers and discussing other products with better options for long-term, affordable payments, we hope to prevent customers from reaching a point where they struggle to make their payments,” Mr. Frahm said.

Chase, Bank of America and the other big lenders are negotiating with the Obama administration and the nation’s attorneys general over foreclosures. Debt forgiveness and the moral hazard question of who deserves to be helped are among the most contentious issues.

The banks say cutting mortgage balances would be unfair to borrowers who remain current as well as impractical because so many loans are securitized into pools owned by investors. Bank of America’s chief executive, Brian T. Moynihan, told the attorneys general in April that cutting principal for current borrowers would send the wrong message to all those who have struggled to pay their bills. His counterpart at Chase, Jamie Dimon, bluntly said it was “off the table.”

http://www.nytimes.com/2011/07/03/bu...ef=todayspaper

By now your head should be spinning . . . .

three who put moral hazard at the top of their priorities . . .

Two of the nation’s biggest lenders, JPMorgan Chase and Bank of America, are quietly modifying loans for tens of thousands of borrowers who have not asked for help but whom the banks deem to be at special risk.

Rula Giosmas is one of the beneficiaries. Last year she received a letter from Chase saying it was cutting in half the amount she owed on her condominium.

Ms. Giosmas, who lives in Miami, was not in default on her $300,000 loan. She did not understand why she would receive this gift — although she wasted no time in taking it.

Banks are proactively overhauling loans for borrowers like Ms. Giosmas who have so-called pay option adjustable rate mortgages, which were popular in the wild late stages of the housing boom but which banks now view as potentially troublesome.

Before Chase shaved $150,000 off her mortgage, Ms. Giosmas owed much more on her place than it was worth. It was a fate she shared with a quarter of all homeowners with mortgages across the nation. Being underwater, as it is called, can prevent these owners from moving and taking new jobs, and places the households at greater risk of foreclosure.

“It’s a huge problem,” said the economist Sam Khater. “Reducing negative equity would spark a housing recovery.”

While many homeowners desperately need help to keep their homes and cannot get it, the borrowers getting unsolicited relief from Chase sometimes suspect a trick.

Option ARM loans like Ms. Giosmas’s gave borrowers the option of skipping the principal payment and some of the interest payment for an introductory period of several years. The unpaid balances would be added to the body of the loan.

Ms. Giosmas bought her two-bedroom, two-bath apartment north of downtown Miami for $359,000 in early 2006, according to real estate records. She made a large down payment, but because each month she paid less than was necessary to pay off the loan, her debt swelled to about $300,000.

Meanwhile, the value of the apartment nosedived. By the time Ms. Giosmas got the letter from Chase, the condominium was worth less than half what she paid. “I would not have defaulted,” she said. “But they don’t know that.”

The letter, which Ms. Giosmas remembers as brief and “totally vague,” said Chase was cutting her principal by $150,000 while raising her interest rate to about 5 percent. Her payments would stay roughly the same.

A few months ago, Ms. Giosmas sold the place for $170,000, making a small profit. Having a loan that her lender considered toxic, she said, “turned out to be a blessing in disguise.”

Chase, which declined to comment on its program, got $50 billion in option ARM loans when it bought Washington Mutual in 2008. The lender, which said last fall that it had dealt with 22,000 option ARM loans with an unpaid principal balance of $8 billion, still has $33 billion of them in its portfolio.

Bank of America acquired a portfolio of 550,000 option ARMs from its purchase of Countrywide Financial in 2008. The lender said more than 200,000 had been converted to more stable mortgages.

Dan B. Frahm, a spokesman for Bank of America, said it was using every technique short of principal reduction to remake its loans, including waiving prepayment penalties, refinancing, lowering the interest rate, postponing some of the balance and extending the term.

“By proactively contacting pay option ARM customers and discussing other products with better options for long-term, affordable payments, we hope to prevent customers from reaching a point where they struggle to make their payments,” Mr. Frahm said.

Chase, Bank of America and the other big lenders are negotiating with the Obama administration and the nation’s attorneys general over foreclosures. Debt forgiveness and the moral hazard question of who deserves to be helped are among the most contentious issues.

The banks say cutting mortgage balances would be unfair to borrowers who remain current as well as impractical because so many loans are securitized into pools owned by investors. Bank of America’s chief executive, Brian T. Moynihan, told the attorneys general in April that cutting principal for current borrowers would send the wrong message to all those who have struggled to pay their bills. His counterpart at Chase, Jamie Dimon, bluntly said it was “off the table.”

http://www.nytimes.com/2011/07/03/bu...ef=todayspaper

By now your head should be spinning . . . .

three who put moral hazard at the top of their priorities . . .

Comment