The American housing market is entering into a perfectly orchestrated storm of demographics, debt, and cultural shifts. Strongholds do fall and deeply held economic beliefs can crumble in a few short months. If you were to tell someone in 2007 that a lost decade in housing values was just around the corner you would have had a heck of a time trying to convince them. Yet here we are, inching closer to a lost decade in home values. There is a financial tempest ahead of us. Home prices have locked in a lost decade but what about two lost decades? Don’t rule this out until you hear the potential reasons why another lost decade is very likely for American housing values.

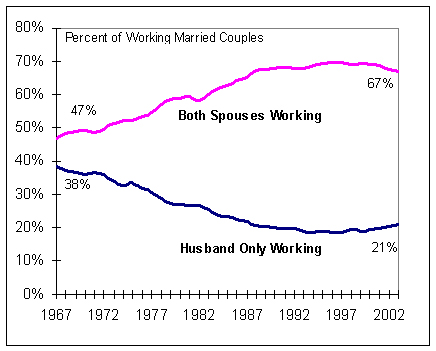

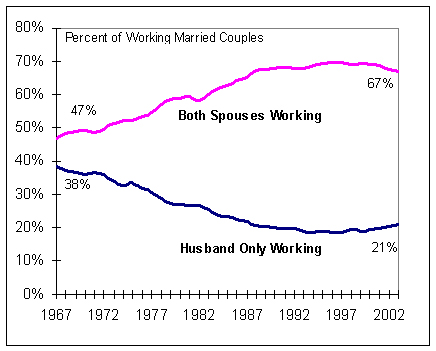

Reason #1 – Dual income peak

Source: Tax Foundation

Part of the reason home values went up from the 1950s through 2000 was largely based on the two income household. Single wage households became a smaller minority while two paychecks made their way into the household bottom-line. Of course this provided more income to be spent on housing. Yet this trend hit a peak in the 1990s. Actual household wages have fallen for over a decade so no longer can the dual income argument be made to support higher prices. What is also problematic is that the rise in dual income households hid the reality that actual per capita wages were falling behind for the last decade.

Part of this trend is also based on the demographics of our country. Raising a family is not cheap so two paychecks in many cases is simply an economic necessity. However many baby boomers are now entering retirement age with many of their kids reaching adulthood.

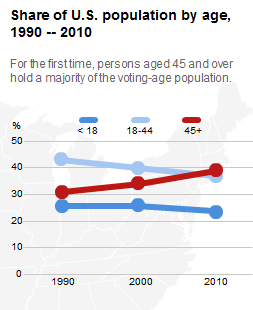

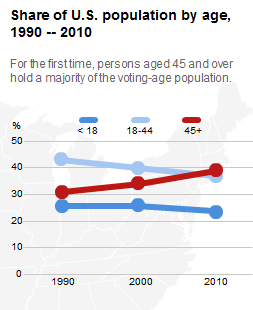

Reason #2 – Older America

Source: Brookings Institution

The U.S. population is undoubtedly getting older. Many baby boomers will look to downsize but demographic shifts will provide fewer potential buyers for those over priced homes. The population is growing but the younger generation is not seeing the large wage gains that baby boomers experienced. So what you have is the largest cohort of Americans gearing up to sell homes simply because of natural progression but a smaller and poorer young cohort unable to pay the inflated prices many have come to expect.

The chart above provides a rather clear look at where things are heading. If current trends are any indication older Americans will vote to protect their funds while pushing on debt to their children and grandchildren. Unfortunately we are not seeing any shared sacrifice here. Yet in a karmic twist baby boomers planning on selling homes and stocks into the market will have lesser demand simply because they have a smaller group following in step. This trend is not going to change so this will add fuel to another lost decade. I’ve seen a few people counter this argument by saying we are not Japan and that our population is growing. This in fact is true but much of the growth is occurring with people picking up lower paying jobs. In other words, no big payday for the McMansion.

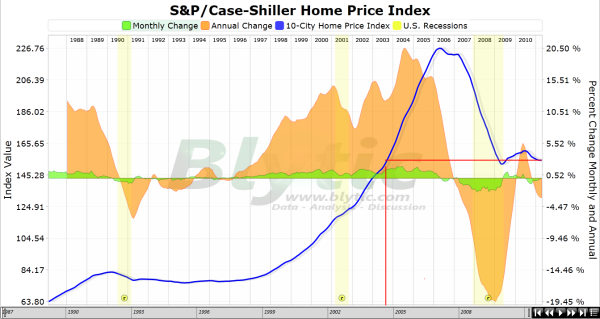

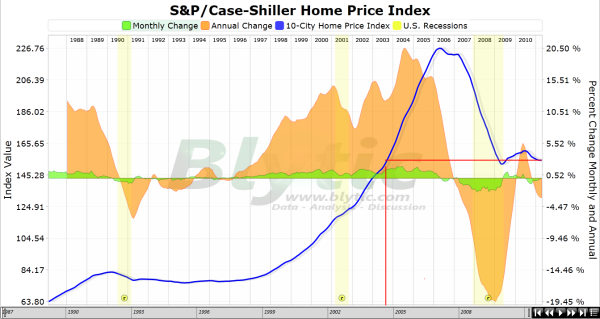

Reason #3 – Case-Shiller double-dip

The Case-Shiller Index is already reflecting a double-dip in home values. Prices are back to 2003 levels and this is only the case because banks continue to maintain an excessive amount of homes in the shadow inventory. The fact that we are double-dipping with historically low interest rates and street vendor like gimmicks tells us many American households are completely maxed out. 40 to 50 years ago virtually any household with a desire to purchase a home could do so without going into gargantuan debt. Today, even a professional couple would likely go into massive debt for a tiny box in an overpriced neighborhood. Yet as the above chart is reflecting, that bounce is largely running its course.

Home prices in many regions of the country are still inflated. More pressure will come as the shadow inventory is leaked out but also the natural flow of selling from older American households looking to retire and downsize. Banks can hide some of their dubious loans but you can’t stop the clock on aging. Some boomers with their pensions and 401ks will need to sell into a market with much lower demand. Did people ever bother to look at the numbers?

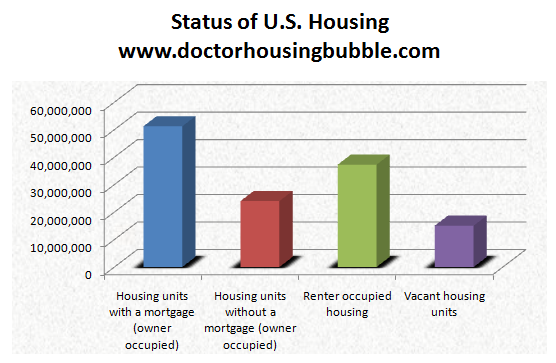

Reason #4 – Housing dynamics

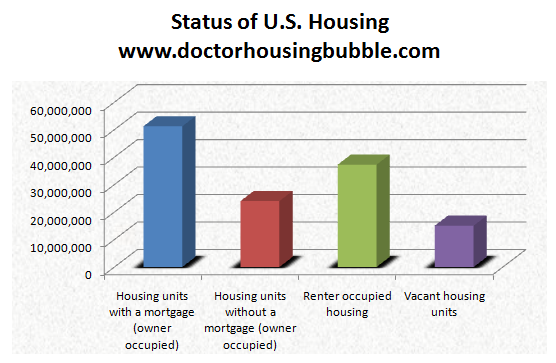

Source: US Census

It is useful to lay out the entire housing data for the United States to get a better picture of where things stand. 24 million Americans own their home free and clear (this doesn’t clear them from paying annual taxes, maintenance, and insurance by the way). 51 million Americans own a home but with a mortgage. 37 million rent and another 15 million housing units sit vacant. The percentage of vacant homes is alarming. This is simply more inventory out in the market that needs to be absorbed. There is little demand for new housing when so much housing is already destined to come online.

When you look at this data carefully seeing another lost decade in home values becomes more apparent. The only wildcard in all of this is if we start to see real household incomes going up. Are we even seeing this? To the contrary, the employment situation is tenuous and the numbers hide the grim reality that many people have taken up new jobs at much lower wages. How is this evidence for rising home values going forward?

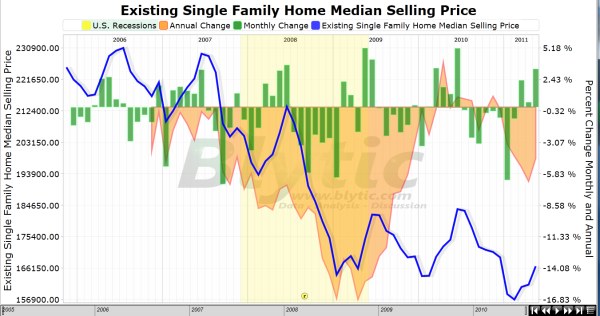

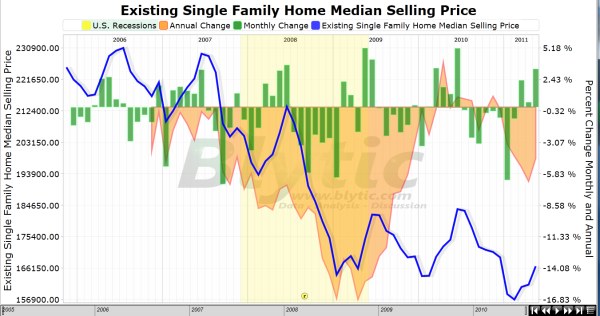

Reason #5 – Median home price

The median home price has fallen dramatically because of toxic mortgages exiting the market but also because household incomes have remained stagnant for over a decade. It should make logical sense that home prices cannot move up without household incomes moving up as well. The gimmicks of low rate teaser mortgages are not enough to mask the financial doldrums we are living through. A large part of this is unavoidable simply because of the demographic nature of our country.

Depending on what measure we look at U.S. home prices are down 30 to 34 percent from their peak reached in 2006. Adjusting for inflation this figure looks more daunting. Lower priced housing seems to be the new status quo. It is hard to say how hard home prices will fall moving forward and some areas have pockets that are still reflecting bubble like dynamics. There is little doubt the next decade will be a tumultuous one for housing. Those arguing for rising home prices ignore the booming demographic tsunami now aligning itself with the epic shadow inventory on the banking balance sheets.

http://www.doctorhousingbubble.com/b...m-real-estate/

Reason #1 – Dual income peak

Source: Tax Foundation

Part of the reason home values went up from the 1950s through 2000 was largely based on the two income household. Single wage households became a smaller minority while two paychecks made their way into the household bottom-line. Of course this provided more income to be spent on housing. Yet this trend hit a peak in the 1990s. Actual household wages have fallen for over a decade so no longer can the dual income argument be made to support higher prices. What is also problematic is that the rise in dual income households hid the reality that actual per capita wages were falling behind for the last decade.

Part of this trend is also based on the demographics of our country. Raising a family is not cheap so two paychecks in many cases is simply an economic necessity. However many baby boomers are now entering retirement age with many of their kids reaching adulthood.

Reason #2 – Older America

Source: Brookings Institution

The U.S. population is undoubtedly getting older. Many baby boomers will look to downsize but demographic shifts will provide fewer potential buyers for those over priced homes. The population is growing but the younger generation is not seeing the large wage gains that baby boomers experienced. So what you have is the largest cohort of Americans gearing up to sell homes simply because of natural progression but a smaller and poorer young cohort unable to pay the inflated prices many have come to expect.

The chart above provides a rather clear look at where things are heading. If current trends are any indication older Americans will vote to protect their funds while pushing on debt to their children and grandchildren. Unfortunately we are not seeing any shared sacrifice here. Yet in a karmic twist baby boomers planning on selling homes and stocks into the market will have lesser demand simply because they have a smaller group following in step. This trend is not going to change so this will add fuel to another lost decade. I’ve seen a few people counter this argument by saying we are not Japan and that our population is growing. This in fact is true but much of the growth is occurring with people picking up lower paying jobs. In other words, no big payday for the McMansion.

Reason #3 – Case-Shiller double-dip

The Case-Shiller Index is already reflecting a double-dip in home values. Prices are back to 2003 levels and this is only the case because banks continue to maintain an excessive amount of homes in the shadow inventory. The fact that we are double-dipping with historically low interest rates and street vendor like gimmicks tells us many American households are completely maxed out. 40 to 50 years ago virtually any household with a desire to purchase a home could do so without going into gargantuan debt. Today, even a professional couple would likely go into massive debt for a tiny box in an overpriced neighborhood. Yet as the above chart is reflecting, that bounce is largely running its course.

Home prices in many regions of the country are still inflated. More pressure will come as the shadow inventory is leaked out but also the natural flow of selling from older American households looking to retire and downsize. Banks can hide some of their dubious loans but you can’t stop the clock on aging. Some boomers with their pensions and 401ks will need to sell into a market with much lower demand. Did people ever bother to look at the numbers?

Reason #4 – Housing dynamics

Source: US Census

It is useful to lay out the entire housing data for the United States to get a better picture of where things stand. 24 million Americans own their home free and clear (this doesn’t clear them from paying annual taxes, maintenance, and insurance by the way). 51 million Americans own a home but with a mortgage. 37 million rent and another 15 million housing units sit vacant. The percentage of vacant homes is alarming. This is simply more inventory out in the market that needs to be absorbed. There is little demand for new housing when so much housing is already destined to come online.

When you look at this data carefully seeing another lost decade in home values becomes more apparent. The only wildcard in all of this is if we start to see real household incomes going up. Are we even seeing this? To the contrary, the employment situation is tenuous and the numbers hide the grim reality that many people have taken up new jobs at much lower wages. How is this evidence for rising home values going forward?

Reason #5 – Median home price

The median home price has fallen dramatically because of toxic mortgages exiting the market but also because household incomes have remained stagnant for over a decade. It should make logical sense that home prices cannot move up without household incomes moving up as well. The gimmicks of low rate teaser mortgages are not enough to mask the financial doldrums we are living through. A large part of this is unavoidable simply because of the demographic nature of our country.

Depending on what measure we look at U.S. home prices are down 30 to 34 percent from their peak reached in 2006. Adjusting for inflation this figure looks more daunting. Lower priced housing seems to be the new status quo. It is hard to say how hard home prices will fall moving forward and some areas have pockets that are still reflecting bubble like dynamics. There is little doubt the next decade will be a tumultuous one for housing. Those arguing for rising home prices ignore the booming demographic tsunami now aligning itself with the epic shadow inventory on the banking balance sheets.

http://www.doctorhousingbubble.com/b...m-real-estate/