Homeowners have little wiggle room - whatever equity, often nada, they have is the only card in their negotiating hand as a seller. Banks have both no mortgage, only the paper loss on their books, which Uncle Sam will make good, depending on their status. They want your cash. Homeowners just want out, with the shirt on their backs if possible.

Subjects under hypnosis are susceptible to the powers of suggestion. If that is the case, a large part of our nation has been in full slumber when it comes to housing propaganda. If the nation is facing a double dip in regards to housing prices California will face a double housing crash. Let us be clear that many areas in California like Riverside, San Bernardino, and the Central Valley have seen home prices absolutely collapse. Take for example Riverside County. Riverside County is home to over 2,200,000 people and is part of the Inland Empire, an area devastated by the housing crash. In June of 2006 Riverside County hit a median home price peak of $422,000. Today the median price is $190,000 or what amounts to a 54 percent drop. That is a crash. Yet other areas have seen prices adjust lower on a more controlled basis for a couple of reasons including the shadow inventory being held back by banks and a touch of delusion brought on by financial self-hypnosis. Yet market sentiment is fickle and is turning. One of the many reasons the economics and financial field has failed miserably in predicting this crisis is that it was largely one of consumer behavior and manic psychology. Incomes are certainly not supporting current prices and the Federal Reserve is dangerously overheating its own balance sheet trying to prop up inflated real estate values to keep the dream-state going. California is in for a very long haul moving forward and this is hitting just in time for the typically hot summer selling season.

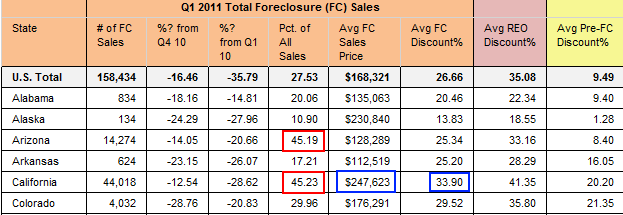

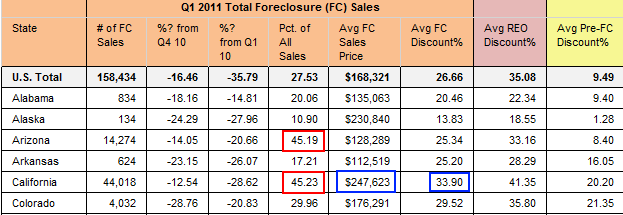

Q1 foreclosures make up 45 percent of all California sales

Source: RealtyTrac

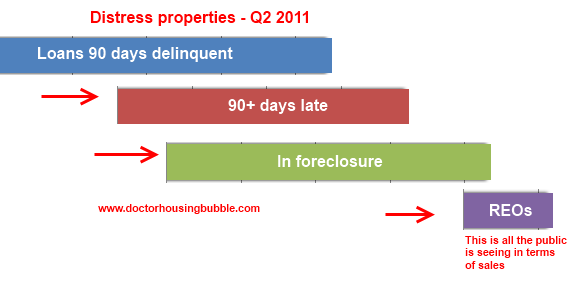

I had to do a double take with the above chart. Foreclosure sales made up 45 percent of all home sales in California during the first quarter. This number even surpassed the apocalyptic housing market in Arizona. It is no secret that foreclosures sell for a steep discount like expired milk or older vegetables at your grocery store. In California the average “discount” is 33 percent. We’ve had enough foreclosure sales to anticipate the future for the massive shadow inventory in the state. If Q1 of 2011 is any indication we are moving 44,000 foreclosures per quarter. At the same time 68,000 notice of defaults were filed in Q1. At the moment 227,000 homes are either bank owned, are scheduled for auction, or have a notice of default filed. Just to get rid of the current viewable shadow inventory would take 5 quarters. This is 5 quarters of cheaper home sales dominating the market and naively thinking that those 68,000 recent NODs will not become actual REOs (most will). And don’t forget that we are still adding more foreclosures to the pipeline since our economy in the state is still shaky:

Source: OC Register

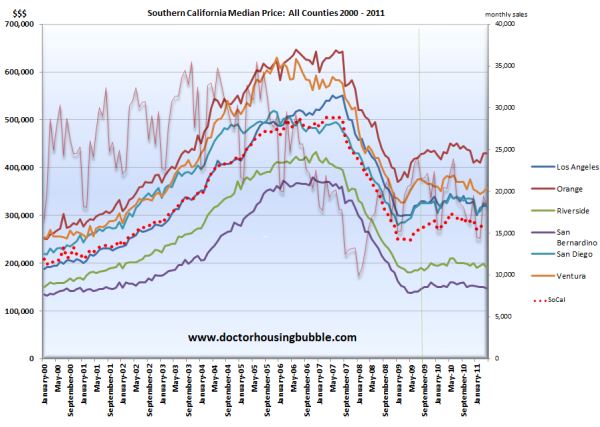

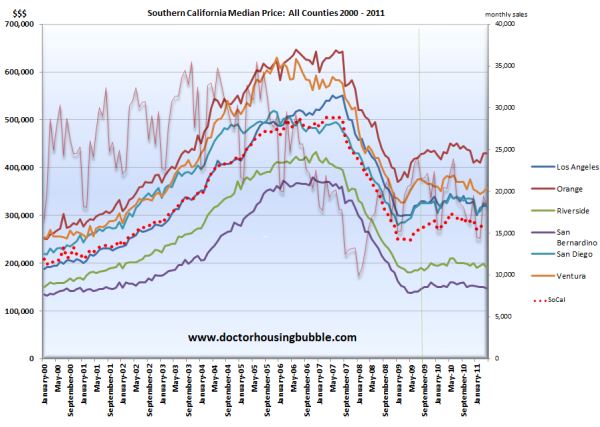

Southern California enters double dip

Southern California is officially in the double dip. The above chart shows the brief respite in home prices reached in 2010 but we are now clearly moving lower as people start to wake from their hypnotic state. As usual home sales are a leading indicator and they are much lower on a year over year basis. Home sales are down 9.2 percent from a year ago for the region. The median price is down 1.8 percent. Yet the bigger issue moving forward is the willingness for banks to leak out the shadow inventory. Going back to the first chart you will notice that foreclosures resales in say Alabama go for a 20 percent discount. On a $70,000 home this might not be a big deal. But what about the million dollar foreclosures in areas like Beverly Hills? Then the California 33 percent discount looms extremely large.

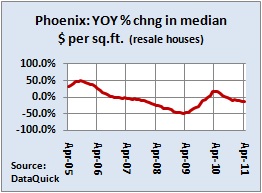

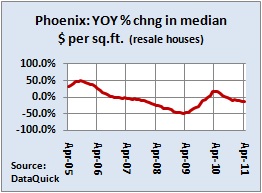

Even low home prices may not be enough to support a market. Just look at Phoenix where home prices have cratered:

Source: DataQuick

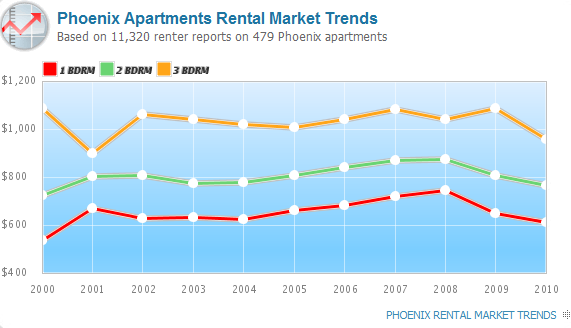

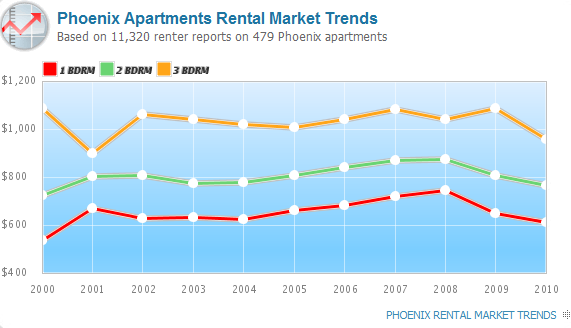

The double dip is hitting even in an area that is seeing home prices going back to the late 1990s. Why? Because of the economy and employment. Last year the run-up was largely due to investors rushing in and selling to other investors. Yet with this market being exhausted there are only so many local renters that can support current market rents. Contrary to propaganda rents are not skyrocketing in many areas:

Source: Apartment Ratings

Rents in many cases are lower than they were in 2000! Going back to California, the shadow inventory that still festers in the background is largely expensive and inflated. Banks were willing to move fast and quickly in lower priced areas yet this still will not bring prices back up. The same will happen in the second phase when higher priced areas start being dumped. It isn’t a question of when since it is already happening. The remaining issue is the depth of the next correction.

Take the more expensive Orange County market. The median price peaked at $642,500 in August of 2007. Today the median price is $430,000 in the most exclusive county in Southern California (this is a decline of 33 percent). It is interesting that more headlines are psychologically preparing sellers to accept the reality that the days of 2006 and 2007 are long gone:

-More price drops

-Bloated inventory

-Tight credit (I disagree with this one. If you have enough for a 3.5 percent FHA insured loan you are golden)

-Unemployment (23% are underemployed in the state of California)

And one more thing I will add is our manic budget process. We will need to raise revenues (aka taxes) or cut spending (aka jobs). In the end this will decline your buyer pool. The double dip is already here. Prices are going to move lower because incomes simply do not justify prices. This has been the story for four years now and for many more years going forward. Don’t let the hypnosis drag you into a false trap like those that jumped in head first in 2010 when the “housing is going back up” dream was moving with full steam ahead.

http://www.doctorhousingbubble.com/h...ypnosis-mania/

Subjects under hypnosis are susceptible to the powers of suggestion. If that is the case, a large part of our nation has been in full slumber when it comes to housing propaganda. If the nation is facing a double dip in regards to housing prices California will face a double housing crash. Let us be clear that many areas in California like Riverside, San Bernardino, and the Central Valley have seen home prices absolutely collapse. Take for example Riverside County. Riverside County is home to over 2,200,000 people and is part of the Inland Empire, an area devastated by the housing crash. In June of 2006 Riverside County hit a median home price peak of $422,000. Today the median price is $190,000 or what amounts to a 54 percent drop. That is a crash. Yet other areas have seen prices adjust lower on a more controlled basis for a couple of reasons including the shadow inventory being held back by banks and a touch of delusion brought on by financial self-hypnosis. Yet market sentiment is fickle and is turning. One of the many reasons the economics and financial field has failed miserably in predicting this crisis is that it was largely one of consumer behavior and manic psychology. Incomes are certainly not supporting current prices and the Federal Reserve is dangerously overheating its own balance sheet trying to prop up inflated real estate values to keep the dream-state going. California is in for a very long haul moving forward and this is hitting just in time for the typically hot summer selling season.

Q1 foreclosures make up 45 percent of all California sales

Source: RealtyTrac

I had to do a double take with the above chart. Foreclosure sales made up 45 percent of all home sales in California during the first quarter. This number even surpassed the apocalyptic housing market in Arizona. It is no secret that foreclosures sell for a steep discount like expired milk or older vegetables at your grocery store. In California the average “discount” is 33 percent. We’ve had enough foreclosure sales to anticipate the future for the massive shadow inventory in the state. If Q1 of 2011 is any indication we are moving 44,000 foreclosures per quarter. At the same time 68,000 notice of defaults were filed in Q1. At the moment 227,000 homes are either bank owned, are scheduled for auction, or have a notice of default filed. Just to get rid of the current viewable shadow inventory would take 5 quarters. This is 5 quarters of cheaper home sales dominating the market and naively thinking that those 68,000 recent NODs will not become actual REOs (most will). And don’t forget that we are still adding more foreclosures to the pipeline since our economy in the state is still shaky:

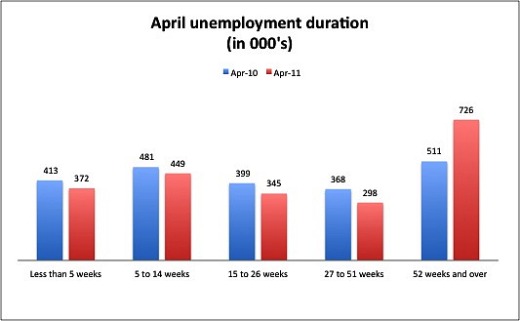

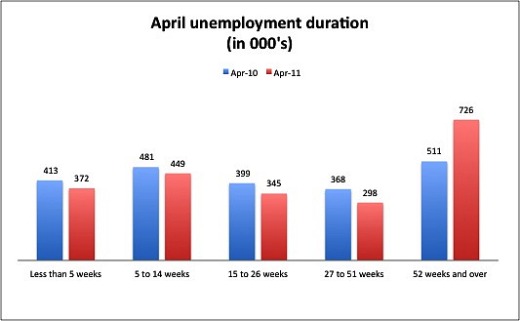

Source: OC Register

“(OC Register) Nearly three-quarters of a million people in California who were unemployed in April had been out of work a year or more, according to the state Employment Development Department. It is the only category of unemployment based on time out of work that increased year-over-year.

The EDD says another 431,000-plus people have exhausted their 99 weeks of unemployment benefits. It is not known how many of those have since found work.”

It is insane that 431,000 people have exhausted their benefits and it is not known if they have found work. Many people are simply falling off the official statistics. Then you have the reality that 33 percent of those without jobs in the state have been unemployed for a year or longer. This signifies that our current recession isn’t merely a business cycle one but a structural change to how we run things in the state. The idea that California home prices will always be higher depended on a stronger state economy. Is that largely the case right now?The EDD says another 431,000-plus people have exhausted their 99 weeks of unemployment benefits. It is not known how many of those have since found work.”

Southern California enters double dip

Southern California is officially in the double dip. The above chart shows the brief respite in home prices reached in 2010 but we are now clearly moving lower as people start to wake from their hypnotic state. As usual home sales are a leading indicator and they are much lower on a year over year basis. Home sales are down 9.2 percent from a year ago for the region. The median price is down 1.8 percent. Yet the bigger issue moving forward is the willingness for banks to leak out the shadow inventory. Going back to the first chart you will notice that foreclosures resales in say Alabama go for a 20 percent discount. On a $70,000 home this might not be a big deal. But what about the million dollar foreclosures in areas like Beverly Hills? Then the California 33 percent discount looms extremely large.

Even low home prices may not be enough to support a market. Just look at Phoenix where home prices have cratered:

Source: DataQuick

The double dip is hitting even in an area that is seeing home prices going back to the late 1990s. Why? Because of the economy and employment. Last year the run-up was largely due to investors rushing in and selling to other investors. Yet with this market being exhausted there are only so many local renters that can support current market rents. Contrary to propaganda rents are not skyrocketing in many areas:

Source: Apartment Ratings

Rents in many cases are lower than they were in 2000! Going back to California, the shadow inventory that still festers in the background is largely expensive and inflated. Banks were willing to move fast and quickly in lower priced areas yet this still will not bring prices back up. The same will happen in the second phase when higher priced areas start being dumped. It isn’t a question of when since it is already happening. The remaining issue is the depth of the next correction.

Take the more expensive Orange County market. The median price peaked at $642,500 in August of 2007. Today the median price is $430,000 in the most exclusive county in Southern California (this is a decline of 33 percent). It is interesting that more headlines are psychologically preparing sellers to accept the reality that the days of 2006 and 2007 are long gone:

“Home clearance sale coming from ‘desperate’ sellers

NEW YORK (CNNMoney) — Home prices are already a third off their highs, but this summer could bring the real discounts.

Buyers are still cautious, and anxious sellers will have to price aggressively to get them off the fence.”

The reasons given are issues we’ve discussed many times:NEW YORK (CNNMoney) — Home prices are already a third off their highs, but this summer could bring the real discounts.

Buyers are still cautious, and anxious sellers will have to price aggressively to get them off the fence.”

-More price drops

-Bloated inventory

-Tight credit (I disagree with this one. If you have enough for a 3.5 percent FHA insured loan you are golden)

-Unemployment (23% are underemployed in the state of California)

And one more thing I will add is our manic budget process. We will need to raise revenues (aka taxes) or cut spending (aka jobs). In the end this will decline your buyer pool. The double dip is already here. Prices are going to move lower because incomes simply do not justify prices. This has been the story for four years now and for many more years going forward. Don’t let the hypnosis drag you into a false trap like those that jumped in head first in 2010 when the “housing is going back up” dream was moving with full steam ahead.

http://www.doctorhousingbubble.com/h...ypnosis-mania/

Comment