The student loan problem connects very closely to the future success or issues housing will face in the next decade. A large part of the housing machine is based on stable and predictable home price appreciation over long periods of time. This equilibrium is broken thanks to the recent housing bubble but also many younger professionals are now carrying student loan burdens that sometimes rival the size of a mortgage. This is unprecedented in history but we seem to be saying this often during this decade of incredible debt bubbles. The stories of boomerang college graduates heading back home unable to find jobs is now somewhat known by most since the Great Recession started. What is under reported however is that each subsequent class of college graduates is producing a new class of worker that is in massive amounts of debt because of their education and will need to put off buying a home. Debt is debt and ultimately student loan debt is crushing many young professionals. The fact that many are unable to reap the rewards of their education in the job market is sending repercussions deep into the housing market especially the new home buyer segment. The data on recent college graduates is rather sobering.

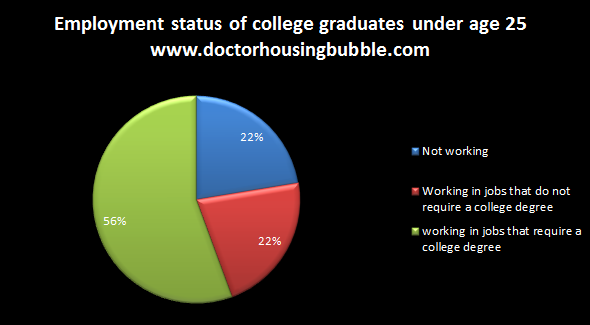

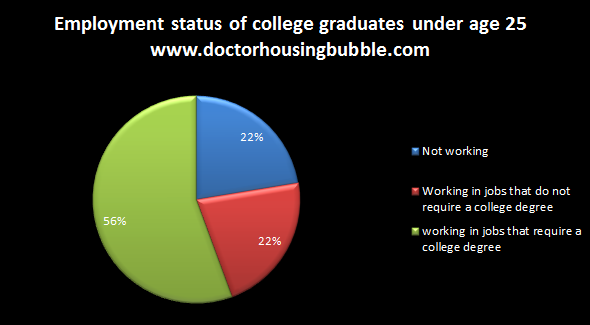

Employment status of the class of 2010

Source: John J. Heldrich Center for Workforce Development at Rutgers University

I found the above data reported this week rather startling. Of the class of 2010 22 percent are not working. Ironically in the survey many reported that they were going on to graduate school and going further into student loan debt. I’m all for higher education and owning a home if purchased correctly. This is the absolute nucleus of the issue here. The only reason housing ever increased to the levels that it did was first, Wall Street juiced the market and turned it into a casino and second the government was there to backstop the entire mess. The same is happening with higher education being privatized by sub-prime non-profits that simply push out degrees that are one step above junk mail. You might as well go online and stream free courses for some of these institutions. This only can happen because of Wall Street turning education into another sector to be exploited but also massive government loans that have also infiltrated the private and state college systems chasing tuition up.

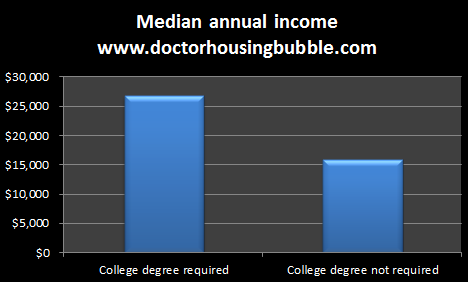

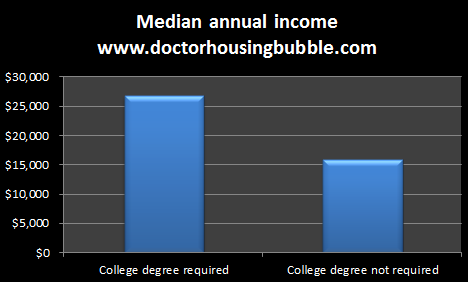

What is more disturbing is you also have 22 percent of 2010 college graduates working in jobs that don’t require a college degree. In other words since the Great Recession hit in 2007 how many people have become underemployed? These are workers who look as fully employed Americans on monthly job reports yet their income is massively lower as we will show. The class of 2010 is facing some harsh times even though the recession is “officially” over. 56 percent are working in fields where a college degree is required which is low. And the salary for those working in fields where a college degree is required isn’t exactly flying off the charts:

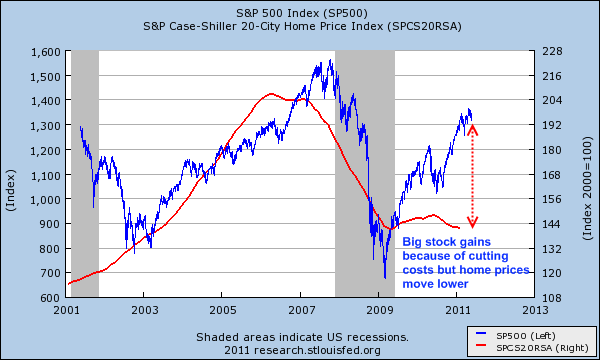

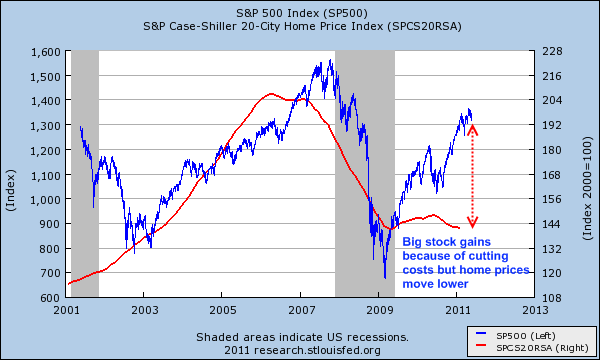

The median starting salary for those that graduated in 2009 and 2010 is $27,000 per year. This is down from $30,000 for those who entered into the employment world between 2006 and 2008. So the Great Recession is being solved by cutting wages for the many and increasing profits for the very few. In past recoveries there were real sizeable income gains for middle class Americans and the growth was distributed. That is no longer the case. Yet this may be good for short-term stock market gains for those who hold sizeable amounts of stock, but what about the future buyers of homes? This is why we are seeing the stock market rally and home prices move lower. I haven’t seen a chart putting home prices and stock prices together recently but let us try:

Now this is a fascinating trend. In the early 2000s you see the technology bubble bursting dragging stock values down but money flowing to the next bubble in housing. After that you have a near synergy between home prices and stock values. In the bottom of 2009 stock values suddenly rebound furiously thanks to the Federal Reserve and trillions of dollars in bailouts to banks but also big cost cutting measures. Interestingly enough all these “housing bailouts” have done nothing for home prices. Why? Because people need to pay for homes via their earned income. As the recent graduates are finding out, firms are getting away with paying much lower wages or offshoring jobs. What this also means is that home values must adjust lower if new home buyers are going to buy new homes with their adjusted lower wages.

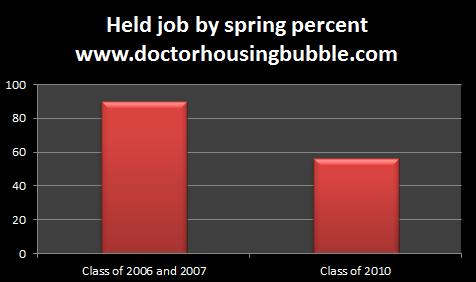

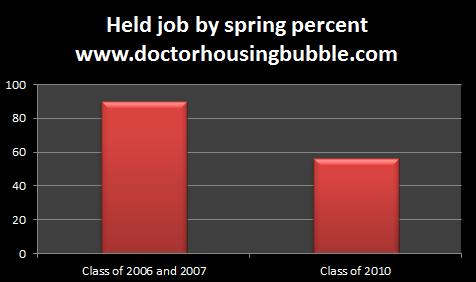

Keep in mind many recent college graduates are moving back home. Take a look at the percent of those holding jobs by spring:

The class of 2006 and 2007 had 90 percent of graduates with at least one job held by the spring quarter versus 56 percent from the class of 2010. Does this mean the class of 2006 and 2007 is simply better or more intelligent? Of course not. It is a matter of timing. Yet a Catch-22 enters these deep economic recessions because to get a job, many employers want to find those with experience. With many people looking for work without experience, recent college graduates have a tougher time entering their own fields and thus have to take jobs outside of their profession. As the economic crisis lingers, once the market rebounds (and I mean the market for middle class Americans) many of these workers will have experience in fields unrelated to their jobs. This is why an older longitudinal study on the Great Depression showed that many individuals simply did not recover economically from the struggles faced during the crisis. The longer individuals have to work at lower paying jobs outside of their field or remain unemployed or underemployed the longer it takes to build real wealth. Yet we have a new variable unlike that of the Great Depression in massive amounts of student loan debt. Are recent graduates looking to buy homes anytime soon? We’ve been in this mess for four solid years now. Are we seeing wages go up? To the contrary as graduates of 2010 are facing wages that have actually gone down.

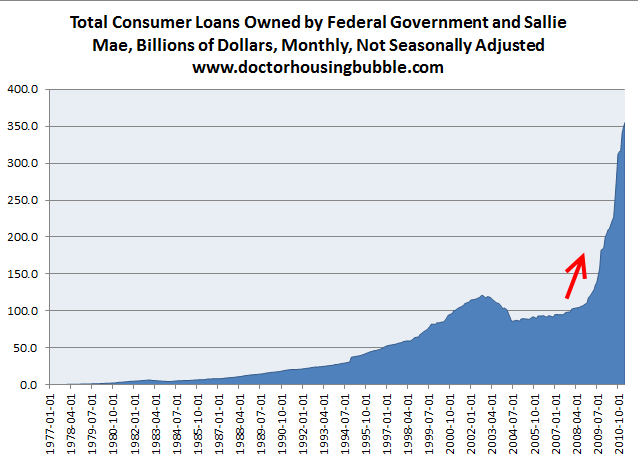

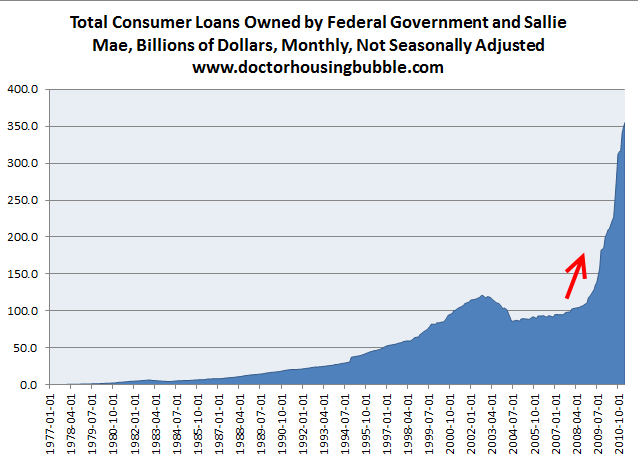

While wages are going down student loan debt is doing the exact opposite:

Source: Federal Reserve

What we have is a merging of massive debt bubbles. The housing bubble, higher education bubble, automotive bubble, and credit card bubble. Many bubbles like housing have burst and are held by a thread by low down payment programs like FHA insured loans. Yet higher education costs have inflated higher than any other sector and quality schools are being heavily impacted while shadowy institutions come up with salespeople to pitch their program and merely siphon off student loans and aid from incoming students by promising absurd job opportunities. The message falls on open ears as the realities of the job market are painful. Somehow I doubt they are telling students that they will likely earn $27,000 if they are part of the few that get jobs on graduation. As we recently noted some for-profit schools were claiming individuals would earn $150,000 to $250,000 a year as barbers. If that is the case we would all be working at Supercuts and driving around in European imported cars.

We know housing was in a bubble even though the majority denied it to the very painful end. We all know higher education is in a bubble yet just like housing there is a near religion around college without distinguishing between excellent schools, programs with value, and absolute junk institutions that are vampires for financial aid. Like I’ve said countless times, a college education is fantastic and will help many grow and become better overall individuals. Yet why does it now cost $50,000 a year for most private colleges, the equivalent of a median household income for an entire year? Even worse, why does it cost on average $20,000 a year for a paper mill for-profit where lower income individuals are sucked in and no measurable results in terms of career, education, or knowledge are created? The only wealth is in the stock profits for these organizations:

These institutions are like the shadowy mortgage brokers pushing people into option ARMs or other subprime junk during the housing bubble. Think this is only a tiny portion of the problem?

Without a doubt you have hundreds of good institutions in the country. We also have many good homes around the country. The issue at hand is that it has been inflated thanks to the Wall Street financial machine that seeks continuous bubbles and uses the government as a dumping ground for bad bets. This mix is what is causing all the bubbles. The government has been involved in housing since the Great Depression and never have we seen nationwide bubbles like this (only after the culture of de-regulation took a massive hold).

At this point Wall Street and the government are tied at the hip. What a shocker that we now have bubbles popping up on a continuous basis. The bottom line is that nothing is changing and many are going to school and coming out ill prepared and massively in debt. We are locking out an entire generation of college graduates from purchasing homes. Plus, there is no walking away from student loan debt unlike a toxic mortgage. Who are all these home sellers planning to unload homes to? The U.S. sells over 5,000,000 homes a year. The math is simple and new buyers are a necessary lubricant for the market. With these low wages, expect lower priced homes.

http://www.doctorhousingbubble.com/c...ent-loan-debt/

Employment status of the class of 2010

Source: John J. Heldrich Center for Workforce Development at Rutgers University

I found the above data reported this week rather startling. Of the class of 2010 22 percent are not working. Ironically in the survey many reported that they were going on to graduate school and going further into student loan debt. I’m all for higher education and owning a home if purchased correctly. This is the absolute nucleus of the issue here. The only reason housing ever increased to the levels that it did was first, Wall Street juiced the market and turned it into a casino and second the government was there to backstop the entire mess. The same is happening with higher education being privatized by sub-prime non-profits that simply push out degrees that are one step above junk mail. You might as well go online and stream free courses for some of these institutions. This only can happen because of Wall Street turning education into another sector to be exploited but also massive government loans that have also infiltrated the private and state college systems chasing tuition up.

When isn't government participation necessary in today's bubble schemes?

The median starting salary for those that graduated in 2009 and 2010 is $27,000 per year. This is down from $30,000 for those who entered into the employment world between 2006 and 2008. So the Great Recession is being solved by cutting wages for the many and increasing profits for the very few. In past recoveries there were real sizeable income gains for middle class Americans and the growth was distributed. That is no longer the case. Yet this may be good for short-term stock market gains for those who hold sizeable amounts of stock, but what about the future buyers of homes? This is why we are seeing the stock market rally and home prices move lower. I haven’t seen a chart putting home prices and stock prices together recently but let us try:

Now this is a fascinating trend. In the early 2000s you see the technology bubble bursting dragging stock values down but money flowing to the next bubble in housing. After that you have a near synergy between home prices and stock values. In the bottom of 2009 stock values suddenly rebound furiously thanks to the Federal Reserve and trillions of dollars in bailouts to banks but also big cost cutting measures. Interestingly enough all these “housing bailouts” have done nothing for home prices. Why? Because people need to pay for homes via their earned income. As the recent graduates are finding out, firms are getting away with paying much lower wages or offshoring jobs. What this also means is that home values must adjust lower if new home buyers are going to buy new homes with their adjusted lower wages.

Keep in mind many recent college graduates are moving back home. Take a look at the percent of those holding jobs by spring:

The class of 2006 and 2007 had 90 percent of graduates with at least one job held by the spring quarter versus 56 percent from the class of 2010. Does this mean the class of 2006 and 2007 is simply better or more intelligent? Of course not. It is a matter of timing. Yet a Catch-22 enters these deep economic recessions because to get a job, many employers want to find those with experience. With many people looking for work without experience, recent college graduates have a tougher time entering their own fields and thus have to take jobs outside of their profession. As the economic crisis lingers, once the market rebounds (and I mean the market for middle class Americans) many of these workers will have experience in fields unrelated to their jobs. This is why an older longitudinal study on the Great Depression showed that many individuals simply did not recover economically from the struggles faced during the crisis. The longer individuals have to work at lower paying jobs outside of their field or remain unemployed or underemployed the longer it takes to build real wealth. Yet we have a new variable unlike that of the Great Depression in massive amounts of student loan debt. Are recent graduates looking to buy homes anytime soon? We’ve been in this mess for four solid years now. Are we seeing wages go up? To the contrary as graduates of 2010 are facing wages that have actually gone down.

While wages are going down student loan debt is doing the exact opposite:

Source: Federal Reserve

What we have is a merging of massive debt bubbles. The housing bubble, higher education bubble, automotive bubble, and credit card bubble. Many bubbles like housing have burst and are held by a thread by low down payment programs like FHA insured loans. Yet higher education costs have inflated higher than any other sector and quality schools are being heavily impacted while shadowy institutions come up with salespeople to pitch their program and merely siphon off student loans and aid from incoming students by promising absurd job opportunities. The message falls on open ears as the realities of the job market are painful. Somehow I doubt they are telling students that they will likely earn $27,000 if they are part of the few that get jobs on graduation. As we recently noted some for-profit schools were claiming individuals would earn $150,000 to $250,000 a year as barbers. If that is the case we would all be working at Supercuts and driving around in European imported cars.

We know housing was in a bubble even though the majority denied it to the very painful end. We all know higher education is in a bubble yet just like housing there is a near religion around college without distinguishing between excellent schools, programs with value, and absolute junk institutions that are vampires for financial aid. Like I’ve said countless times, a college education is fantastic and will help many grow and become better overall individuals. Yet why does it now cost $50,000 a year for most private colleges, the equivalent of a median household income for an entire year? Even worse, why does it cost on average $20,000 a year for a paper mill for-profit where lower income individuals are sucked in and no measurable results in terms of career, education, or knowledge are created? The only wealth is in the stock profits for these organizations:

These institutions are like the shadowy mortgage brokers pushing people into option ARMs or other subprime junk during the housing bubble. Think this is only a tiny portion of the problem?

“(Pew) Students at for-profit institutions represent only 9% of all college students, but receive roughly 25% of all Federal Pell Grants and loans, and are responsible for 44% of all student loan defaults.”

An easy first step is to stop all federal loans and grants to for-profits until the above is addressed. There are many larger issues at hand of course in higher education but why not start in the most obvious place? For-profits represent 9 percent of all college students but take in 25 percent of all Pell grants and loans? They are also responsible for 44 percent of student loan defaults? Does it sound like a good idea to keep pushing money here?Without a doubt you have hundreds of good institutions in the country. We also have many good homes around the country. The issue at hand is that it has been inflated thanks to the Wall Street financial machine that seeks continuous bubbles and uses the government as a dumping ground for bad bets. This mix is what is causing all the bubbles. The government has been involved in housing since the Great Depression and never have we seen nationwide bubbles like this (only after the culture of de-regulation took a massive hold).

Bubbles have proven to be the vehicle of choice for wealth transfer from the sheeple to the oligarchs.

http://www.doctorhousingbubble.com/c...ent-loan-debt/