(following the FIRE-induced FHA metamorphosis)

Cash strapped home buyers have quietly shifted to financing their home purchases with FHA insured loans since the crisis accelerated in 2007 after pocket lint was discounted as sufficient collateral to secure a mortgage. The reason for the alteration in loan volume is both disturbing and simply reflects the reality that American households are still broke and addicted to debt. The FHA total book value of loans has soared to over $1 trillion. These are loans made with 3.5 percent down payments and carry laxer lending standards. So it should be no surprise that defaults for FHA insured loans are hitting record levels. The mission of the FHA was to make homes more affordable to lower income households which ironically are now a larger part of the U.S. population. However the FHA has been used as a conduit to increase loans in housing markets where bubbles are still persistent. The median U.S. home prices is $163,000 so to make a FHA loan for say $500,000 makes absolutely no sense and has no resemblance of a low income market. Sort of like the real estate industry claiming option ARMs were for doctors and actors that simply did not want to document large amounts of income, which consequently never materialized and ended up in the hands of aspiring Joneses purchasing million dollar homes on $50,000 to $100,000 annual incomes. Keep in mind simply by loan and market size the FHA secured loan portfolio has increased largely from infiltrating bubble markets like California under the guise of helping lower priced areas. Let us look at the absurd increase of FHA insured loans since the crisis started.

From zero to crazy in a couple of years

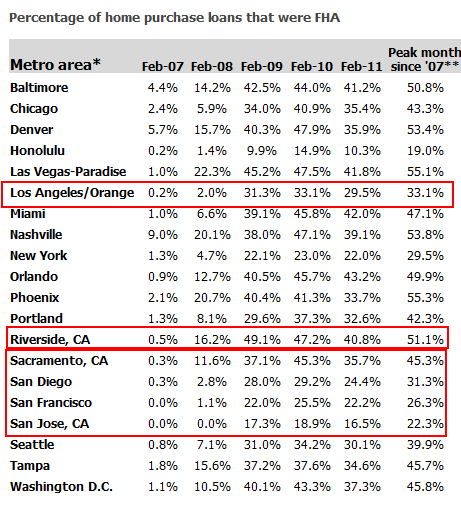

Source: DataQuick

There should be little doubt that FHA insured loans have stepped in to fill the vacuum of low down payment to nothing down NINJA loans. Just because you now have to document some income to qualify for a loan does not make financial sense to give someone a loan with 96.5 percent loan-to-value leverage. The FHA’s mission was never intended to be a large part of the market but it is now the only game in town for many buyers. Take a look at the above chart. In the manic markets of San Francisco and San Jose FHA insured loans made up roughly 0 percent of home purchases in 2007. Today they are up to 22 and 16 percent respectively. These are $500,000+ markets (a very long way from the U.S. median price of $163,000). Or look at a market like Phoenix. Over 33 percent of purchases are made with FHA insured loans and close to 50 percent come from investors. So the entire market is being held up with low down payment households and speculators! When I see the rising defaults of FHA insured loans you realize that one of the main causes of default is having little skin in the game.

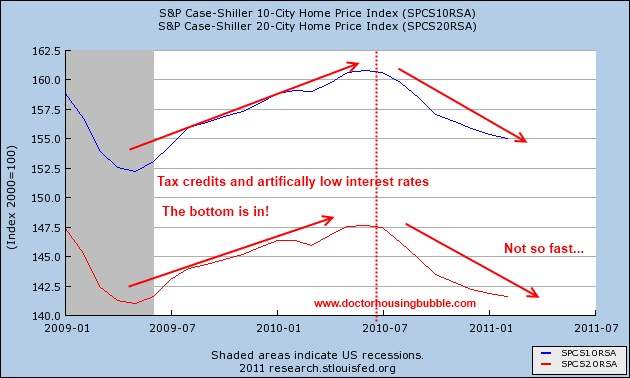

So the above chart is incredibly telling of the nature of the market. Keep in mind that anyone that purchases a home with the typical 3.5 percent down payment is underwater from day one. Why? Well you have to sell your home and that still costs 5 to 6 percent if you use a real estate agent. And home prices haven’t exactly been going up in the last year:

The market is so sensitive to little changes that people even respond to any changes that may alter their monthly nut. Since the FHA insured loan portfolio is experiencing stress the cost of these loans is increasing through PMI. Even a slight change did this to the market:

“(NY Times) In the first quarter, 17.7 percent of new loans were F.H.A., according to Inside Mortgage Finance, an industry data provider, while P.M.I. had a 5.4 percent market share. Applications for F.H.A. loans jumped 20 percent in the month preceding the price increase, then tumbled when it went into effect, according to the Mortgage Bankers Association.

In addition to lower minimum down-payment requirements, F.H.A. has laxer rules for credit scores and debt-to-income ratios. Right now, it also has lower interest rates, said Thatcher Zuse, the president of Sound Mortgage, a lender and broker in Guilford, Conn. “Almost as a rule, as the rates stand right now, the less equity you’re putting down, the better the F.H.A. deal becomes.”

The toxic loan market in terms of Alt-A and option ARM loans is largely nonexistent but there is no doubt that we have a questionable loan products through FHA insured loans. The default rates are soaring because giving loans to people with very little down payment makes absolutely no sense especially when household incomes are so fragile. I’m surprised how many people come to defend the FHA as it inches closer and closer to a bailout. Why not agree on the fact that if FHA’s mission is for lower income households why not cap it at the median U.S. home price? Look at this insanity reported from the CBO regarding the FHA’s missions:In addition to lower minimum down-payment requirements, F.H.A. has laxer rules for credit scores and debt-to-income ratios. Right now, it also has lower interest rates, said Thatcher Zuse, the president of Sound Mortgage, a lender and broker in Guilford, Conn. “Almost as a rule, as the rates stand right now, the less equity you’re putting down, the better the F.H.A. deal becomes.”

“(CBO) To target the program toward low- and moderate-income borrowers, the law limits

the size of a mortgage that may be insured. The limits vary by geographic region and

depend on such factors as the ceilings that apply to mortgages that are legally eligible

for purchase by Fannie Mae and Freddie Mac, appreciation in home prices, and the

cost of living in an area. Currently, the limit for a one-unit property in most areas is

$271,050, although in some high-cost areas FHA can insure loans up to $729,750.

(By comparison, the median sales price of existing single-family homes in the United

States in 2010 was $173,000, according to the National Association of Realtors.)”

How in the world is $729,750 a price geared to low to moderate income buyers? This is the kind of mentality that led us into the bubble in the first place. The higher limit will come down but it is absurd to think that this product is somehow for the “working” people of the country. It is merely another shadow bailout to protect the banking interests to keep loan volume churning. And make no mistake FHA insured loans were never a big part of the market:the size of a mortgage that may be insured. The limits vary by geographic region and

depend on such factors as the ceilings that apply to mortgages that are legally eligible

for purchase by Fannie Mae and Freddie Mac, appreciation in home prices, and the

cost of living in an area. Currently, the limit for a one-unit property in most areas is

$271,050, although in some high-cost areas FHA can insure loans up to $729,750.

(By comparison, the median sales price of existing single-family homes in the United

States in 2010 was $173,000, according to the National Association of Realtors.)”

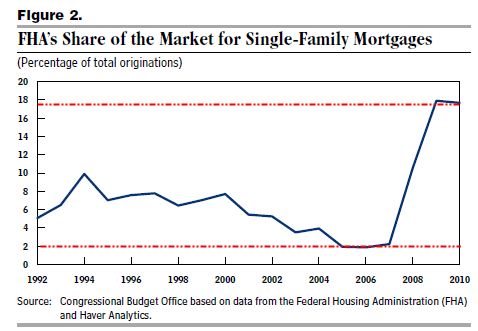

FHA’s share of the market never surpassed 10 percent and went as low as 2 percent. The average from 1992 to 2007 was closer to 6 percent. Today it is 18 percent! This is unsustainable but shows the fact that many people have no ability to even come up with a 10 percent down payment (forget about the more historical average of 20 percent). 20 percent wouldn’t be such a big deal if home prices weren’t inflated by the Federal Reserve, artificially low mortgage rates, and low down payment government products now used as a catchall product. A down payment with enough teeth is absolutely crucial. First, it shows people have the adequate ability to save but it will also lower home prices to reflect actual household incomes. That is the supreme irony here. A program designed to help housing become more “affordable” is actually keeping it inflated because more and more people can buy a home with a pathetic down payment. Not only is that the case, as we have shown above in the 20 metro chart many high priced markets are relying on FHA insured loans and these are not low to moderate income areas.

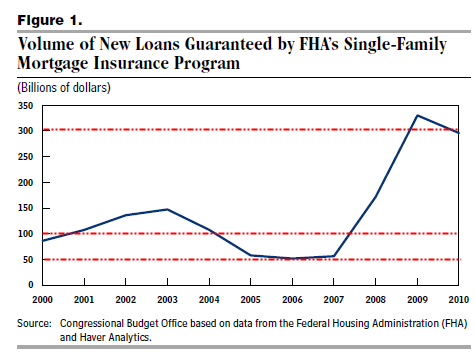

The FHA continues to guarantee an absurd amount of loans:

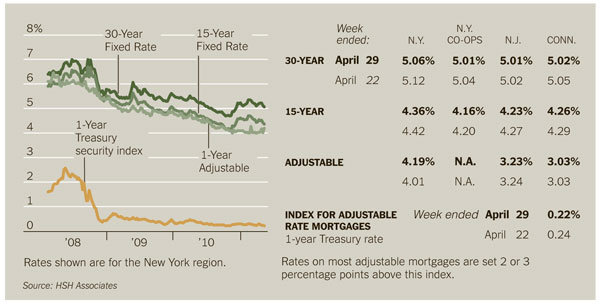

What the above tells me is that we still haven’t learned our lessons about the housing bubble. We went from 2007 where the FHA was insuring about $50 billion of total loan originations to $350 billion in 2009. Can you tell what loan product is taking up the slack from Alt-A and option ARMs going away? The fact that home sales are slow and prices are dropping reflect the fact that wages are weak and jobs are lower paying as an overall trend. It certainly isn’t mortgage rates:

Source: NY Times

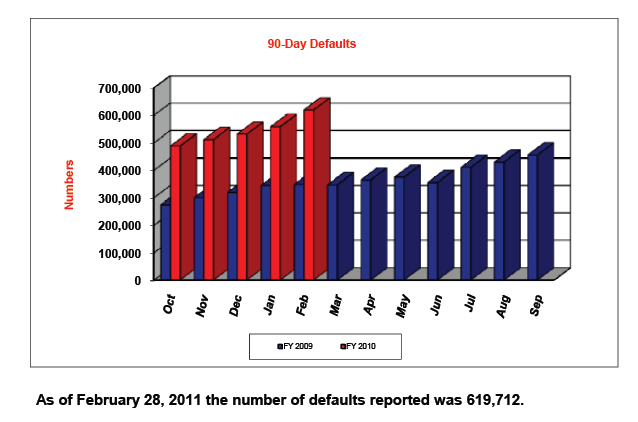

Let me provide you a chart to soothe your mind:

Source: HUD

http://www.doctorhousingbubble.com/f...isk-fha-loans/