Higher education the next bubble to burst?

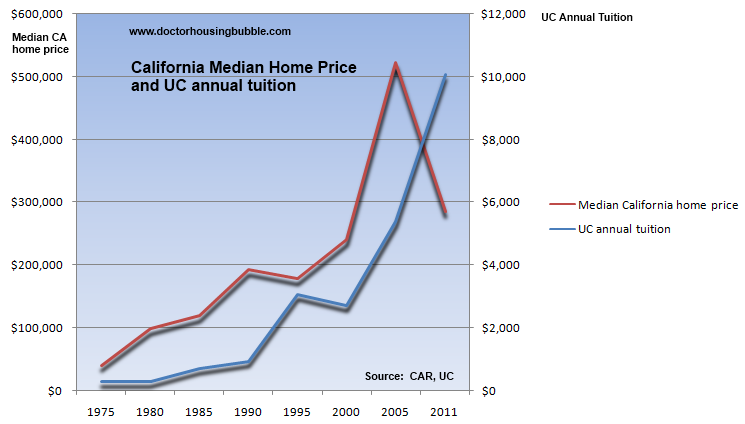

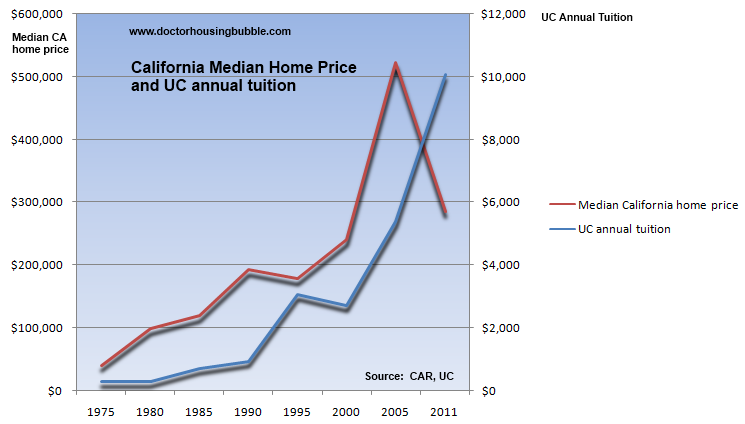

It is hard to put a price on education but this is something that we will try to do. Many young professionals view purchasing a home as their first victory in career success. But when does the cost become too burdensome? I decided to gather a few data points dating back to 1975 and tried to measure the cost of annual tuition to the median cost of a home. Below is a chart showing the median price of a California home versus the cost of attending a University of California (UC) campus for one year:

This chart is simply to show the trajectory of prices. As you can see California had a housing bubble in the late 1980s and early 1990s that led to lower prices in subsequent years. This dip was short lived and home prices entered into the mother of all housing bubbles peaking out in 2006. You notice this early crisis in the 1990s also caused UC fees to rise sharply. Ironically once we entered into the technology bubble UC tuition actually dropped for a few years even though the cost of education was rising. Why save for a rainy day right? Keep in mind that tuition at this time was hovering around $3,000 per year.

Of course the technology bubble burst and left a gaping hole in the California budget. The education system was left scrambling and ever since 2000 tuition has been steadily rising initially in tandem with housing prices. While home prices have cratered tuition continues to move on a steady path upwards.

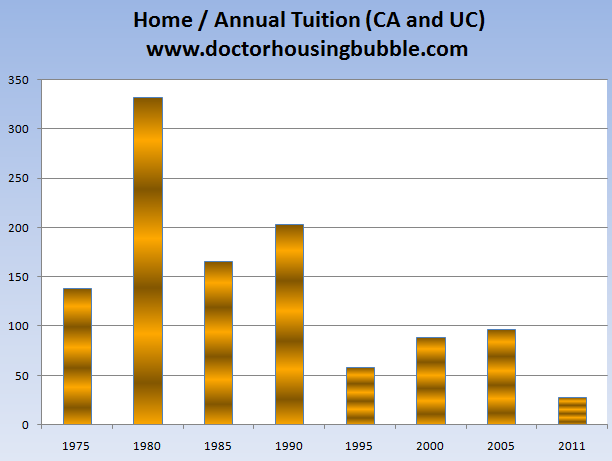

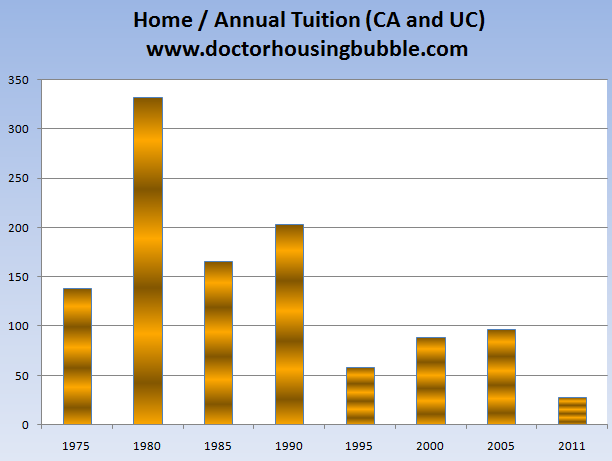

We can look at the above chart in a better way. It is useful to ask at any given point, how many years of UC tuition would it cost to purchase a home? I decided to run this data and this is what was produced:

In 1975 the median priced California home would have gotten you 138 years of tuition at a UC. Education was the cheapest if you want to look at it in relation to housing in 1980 when a median priced California home would have gotten you 331 years of UC tuition (annual UC tuition was $300 at that time).

In 1985 and 1990 the price was still affordable in many ways. Now the typical undergraduate timeline is four years (give or take a year). So if you want to price the home in terms of an actual bachelor’s degree you would have to divide by 4. What this means is that in 1980 the median California home would have purchased 82 UC bachelor’s degrees. Not a bad deal. However today in 2011 it will buy you 7.

Looking at the above charts it is rather clear that housing was in a bubble. Yet a bubble in higher education in the form of a UC degree is not apparent until you compare it to median home prices in the state.

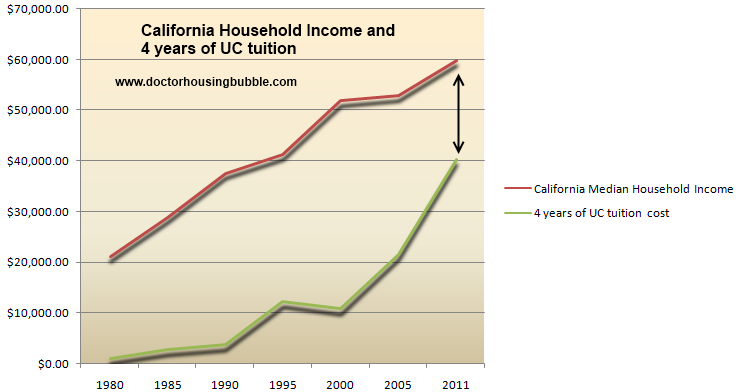

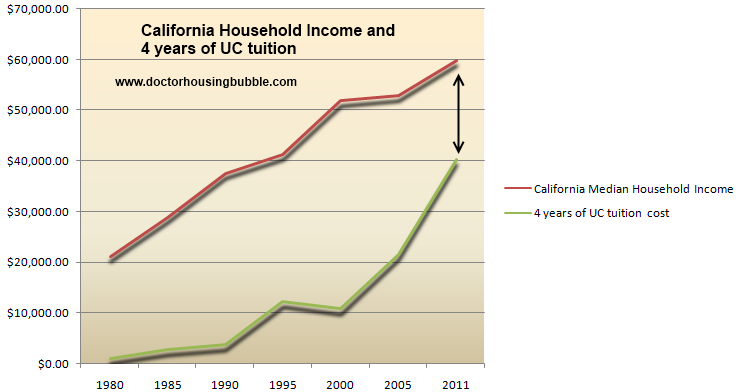

What is more disturbing is when we measure college tuition to the median income of a California family:

This is where the cost of college is really pronounced. In 1980 the typical California household would be able to finance 17 bachelor’s degrees at a UC with one year of household income. In 2000 that number had dropped to 5. Today it is only enough to purchase one bachelor’s degree at the UC system. Now keep in mind we are looking at the cheaper public option partially backed by the state of California. You have other institutions in SoCal like USC that charge over $50,000 per year. Without a doubt higher education is in a bubble more so in the private sector.

Part of the reason for the bubble is similar to what we saw in the housing market. Banks and their government backed supporters work in cahoots to increase liquidity in these markets which helps to create a casino like environment. Initially this starts out slow and ends with option ARMs that have no way of being paid back even though they are made on large ticket items. We now know how the bubble pops with housing but how does it look when it bursts in higher education? The option ARM or subprime equivalent in higher education is the for profit institutions. I’m sure you can find a handful that are strong but many simply operate as a clean setup to extract as much government and private loans from students without producing any measurable results. I know many will say that education is more than just the amount of money you will earn once you graduate. I agree. However, you do not need a multi-million dollar football team to help you read Cicero, Dostoevsky, Kafka, or even Hemingway. You can do that for free at your public library. College in many cases is about making solid contacts and working in a stimulating environment while learning to think critically. What has changed from 1980 to 2011 that has made it so much more expensive? Are professors 20 times better at teaching calculus or derivatives in 2011 than they were in 2008?

I’ve noticed that the “higher education bubble” meme has now gotten around on the internet:

http://www.doctorhousingbubble.com/f...student-loans/

It is hard to put a price on education but this is something that we will try to do. Many young professionals view purchasing a home as their first victory in career success. But when does the cost become too burdensome? I decided to gather a few data points dating back to 1975 and tried to measure the cost of annual tuition to the median cost of a home. Below is a chart showing the median price of a California home versus the cost of attending a University of California (UC) campus for one year:

This chart is simply to show the trajectory of prices. As you can see California had a housing bubble in the late 1980s and early 1990s that led to lower prices in subsequent years. This dip was short lived and home prices entered into the mother of all housing bubbles peaking out in 2006. You notice this early crisis in the 1990s also caused UC fees to rise sharply. Ironically once we entered into the technology bubble UC tuition actually dropped for a few years even though the cost of education was rising. Why save for a rainy day right? Keep in mind that tuition at this time was hovering around $3,000 per year.

Of course the technology bubble burst and left a gaping hole in the California budget. The education system was left scrambling and ever since 2000 tuition has been steadily rising initially in tandem with housing prices. While home prices have cratered tuition continues to move on a steady path upwards.

We can look at the above chart in a better way. It is useful to ask at any given point, how many years of UC tuition would it cost to purchase a home? I decided to run this data and this is what was produced:

In 1975 the median priced California home would have gotten you 138 years of tuition at a UC. Education was the cheapest if you want to look at it in relation to housing in 1980 when a median priced California home would have gotten you 331 years of UC tuition (annual UC tuition was $300 at that time).

In 1985 and 1990 the price was still affordable in many ways. Now the typical undergraduate timeline is four years (give or take a year). So if you want to price the home in terms of an actual bachelor’s degree you would have to divide by 4. What this means is that in 1980 the median California home would have purchased 82 UC bachelor’s degrees. Not a bad deal. However today in 2011 it will buy you 7.

Looking at the above charts it is rather clear that housing was in a bubble. Yet a bubble in higher education in the form of a UC degree is not apparent until you compare it to median home prices in the state.

What is more disturbing is when we measure college tuition to the median income of a California family:

This is where the cost of college is really pronounced. In 1980 the typical California household would be able to finance 17 bachelor’s degrees at a UC with one year of household income. In 2000 that number had dropped to 5. Today it is only enough to purchase one bachelor’s degree at the UC system. Now keep in mind we are looking at the cheaper public option partially backed by the state of California. You have other institutions in SoCal like USC that charge over $50,000 per year. Without a doubt higher education is in a bubble more so in the private sector.

Part of the reason for the bubble is similar to what we saw in the housing market. Banks and their government backed supporters work in cahoots to increase liquidity in these markets which helps to create a casino like environment. Initially this starts out slow and ends with option ARMs that have no way of being paid back even though they are made on large ticket items. We now know how the bubble pops with housing but how does it look when it bursts in higher education? The option ARM or subprime equivalent in higher education is the for profit institutions. I’m sure you can find a handful that are strong but many simply operate as a clean setup to extract as much government and private loans from students without producing any measurable results. I know many will say that education is more than just the amount of money you will earn once you graduate. I agree. However, you do not need a multi-million dollar football team to help you read Cicero, Dostoevsky, Kafka, or even Hemingway. You can do that for free at your public library. College in many cases is about making solid contacts and working in a stimulating environment while learning to think critically. What has changed from 1980 to 2011 that has made it so much more expensive? Are professors 20 times better at teaching calculus or derivatives in 2011 than they were in 2008?

I’ve noticed that the “higher education bubble” meme has now gotten around on the internet:

“(TechCrunch) Instead, for Thiel, the bubble that has taken the place of housing is the higher education bubble. “A true bubble is when something is overvalued and intensely believed,” he says. “Education may be the only thing people still believe in in the United States. To question education is really dangerous. It is the absolute taboo. It’s like telling the world there’s no Santa Claus.”

Like the housing bubble, the education bubble is about security and insurance against the future. Both whisper a seductive promise into the ears of worried Americans: Do this and you will be safe. The excesses of both were always excused by a core national belief that no matter what happens in the world, these were the best investments you could make. Housing prices would always go up, and you will always make more money if you are college educated.

Like any good bubble, this belief– while rooted in truth– gets pushed to unhealthy levels. Thiel talks about consumption masquerading as investment during the housing bubble, as people would take out speculative interest-only loans to get a bigger house with a pool and tell themselves they were being frugal and saving for retirement. Similarly, the idea that attending Harvard is all about learning? Yeah. No one pays a quarter of a million dollars just to read Chaucer. The implicit promise is that you work hard to get there, and then you are set for life. It can lead to an unhealthy sense of entitlement. “It’s what you’ve been told all your life, and it’s how schools rationalize a quarter of a million dollars in debt,” Thiel says.”

This coming from Peter Thiel, co-founder of PayPal who had some rather good timing on the tech bubble. The Federal Reserve has enabled many to become addicted to this boom and bust bubble culture. I find it interesting that few of the economics or financial courses ever examine historical bubbles or look at the Fed’s hand in creating these bubbles. Most of that knowledge can be gained for free so maybe that is why you will never find it at a for profit school living off student loans from private banks and the Federal government.Like the housing bubble, the education bubble is about security and insurance against the future. Both whisper a seductive promise into the ears of worried Americans: Do this and you will be safe. The excesses of both were always excused by a core national belief that no matter what happens in the world, these were the best investments you could make. Housing prices would always go up, and you will always make more money if you are college educated.

Like any good bubble, this belief– while rooted in truth– gets pushed to unhealthy levels. Thiel talks about consumption masquerading as investment during the housing bubble, as people would take out speculative interest-only loans to get a bigger house with a pool and tell themselves they were being frugal and saving for retirement. Similarly, the idea that attending Harvard is all about learning? Yeah. No one pays a quarter of a million dollars just to read Chaucer. The implicit promise is that you work hard to get there, and then you are set for life. It can lead to an unhealthy sense of entitlement. “It’s what you’ve been told all your life, and it’s how schools rationalize a quarter of a million dollars in debt,” Thiel says.”

http://www.doctorhousingbubble.com/f...student-loans/

Comment