Re: Market Outlook: More From The Fed

The Poom dollar denominated asset repatriation phase of the process is predicated on a degree of repudiation of US economic and monetary policy by Europe and Asia afforded by a degree, if not independence, then of at least the precedence of domestic political and economic needs over US interests. Rather than cooperating to support the US economy and dollar after the next crash, EU and Asia instead focus economic reconstruction efforts on improving economic and trade ties with each other.

Since I proposed this idea back in 1999, I have always considered the greatest threat to the theory that yet another instantiation of US-centric systems we have seen since WWII will happen after the next post crash "jump ball" because EU/Asia and intra-Asian economic development failed to happen much. Since then, economic inter-dependence between Europe and Asia, and intra-dependence within Asia, have grown so strong that they have recently earned the term "de-coupling," and I'm starting to think that the next major recession for the US will have a relatively minor impact on Europe and Asia even during the event, creating weak motivations for supporting of the US economy to support the dollar and maintain export income during the recovery phase.

It's important to understand the political issues here. The way the dollar's depreciation was managed since 2002 was via sales of mortgage-backed securities and other creative paper to Europe and Asia. That's how the dollars were sold, in order to create a leveling of currency depreciation. Turns out that US ratings agencies were as corrupt as the big US consulting firms that said that Enron's and a lot of other bogus companies' books were good so that EU and Asian pension funds would buy them back in the 1990s.

Their financial markets are also better protected. After hosing them twice in ten years, what's the US going to sell them this time to support the dollar?

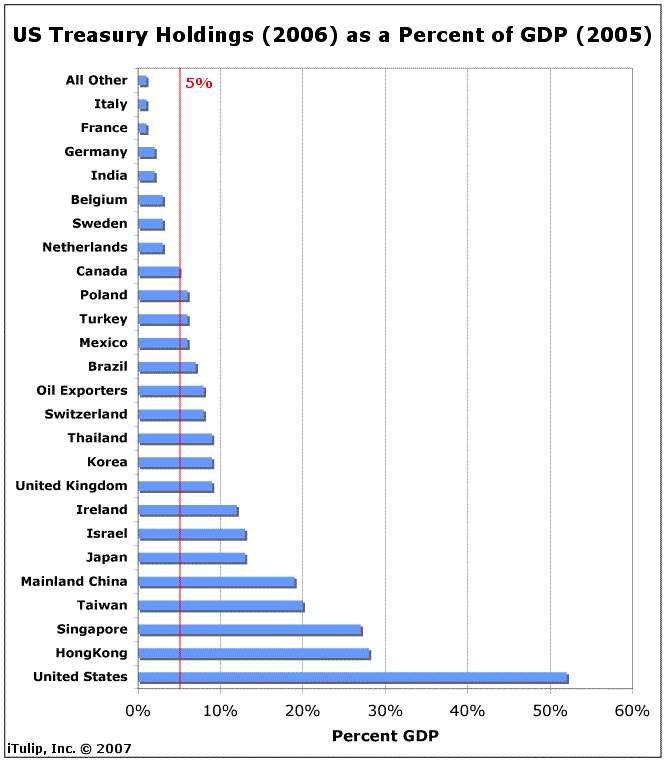

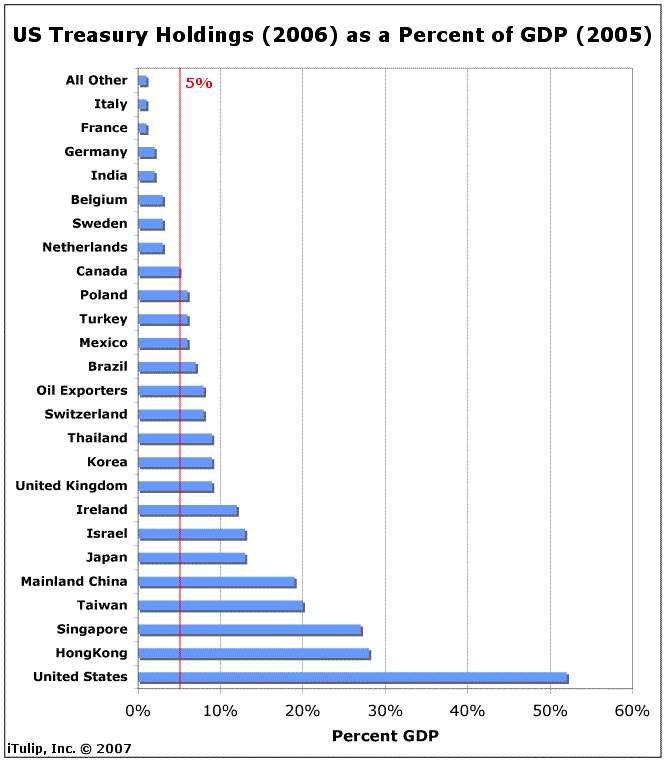

Who the US's friends are...

Originally posted by jk

View Post

The Poom dollar denominated asset repatriation phase of the process is predicated on a degree of repudiation of US economic and monetary policy by Europe and Asia afforded by a degree, if not independence, then of at least the precedence of domestic political and economic needs over US interests. Rather than cooperating to support the US economy and dollar after the next crash, EU and Asia instead focus economic reconstruction efforts on improving economic and trade ties with each other.

Since I proposed this idea back in 1999, I have always considered the greatest threat to the theory that yet another instantiation of US-centric systems we have seen since WWII will happen after the next post crash "jump ball" because EU/Asia and intra-Asian economic development failed to happen much. Since then, economic inter-dependence between Europe and Asia, and intra-dependence within Asia, have grown so strong that they have recently earned the term "de-coupling," and I'm starting to think that the next major recession for the US will have a relatively minor impact on Europe and Asia even during the event, creating weak motivations for supporting of the US economy to support the dollar and maintain export income during the recovery phase.

It's important to understand the political issues here. The way the dollar's depreciation was managed since 2002 was via sales of mortgage-backed securities and other creative paper to Europe and Asia. That's how the dollars were sold, in order to create a leveling of currency depreciation. Turns out that US ratings agencies were as corrupt as the big US consulting firms that said that Enron's and a lot of other bogus companies' books were good so that EU and Asian pension funds would buy them back in the 1990s.

Their financial markets are also better protected. After hosing them twice in ten years, what's the US going to sell them this time to support the dollar?

Who the US's friends are...

Comment