I don't know how accurate this is, but it would certainly explain the slowdown of bank failures:

http://www.theburningplatform.com/?p=13514

http://www.theburningplatform.com/?p=13514

Let’s Play Hide the Losses

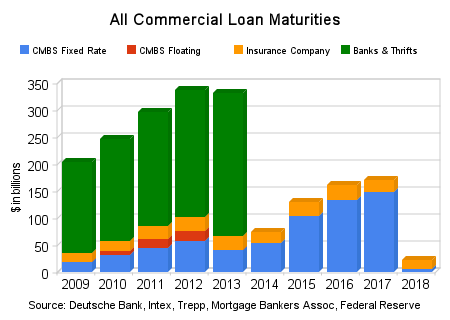

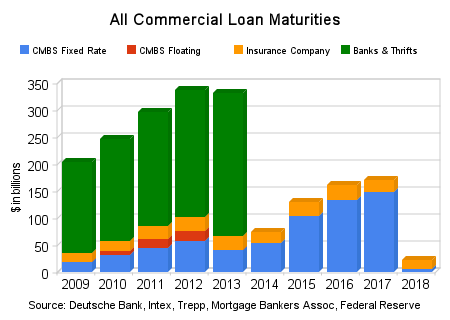

Part two of the master cover-up plan has been the extending of commercial real estate loans and pretending that they will eventually be repaid. In late 2009 it was clear to the Federal Reserve and the Treasury that the $1.2 trillion in commercial loans maturing between 2010 and 2013 would cause thousands of bank failures if the existing regulations were enforced. The Treasury stepped to the plate first. New rules at the IRS weren’t directly related to banking, but allowed commercial loans that were part of investment pools known as Real Estate Mortgage Investment Conduits, or REMICs, to be refinanced without triggering tax penalties for investors.

The Federal Reserve, which is tasked with making sure banks loans are properly valued, instructed banks throughout the country to “extend and pretend” or “amend and pretend,” in which the bank gives a borrower more time to repay a loan. Banks were “encouraged” to modify loans to help cash strapped borrowers. The hope was that by amending the terms to enable the borrower to avoid a refinancing that would have been impossible, the lender would ultimately be able to collect the balance due on the loan.

Ben and his boys also pushed banks to do “troubled debt restructurings.” Such restructurings involved modifying an existing loan by changing the terms or breaking the loan into pieces. Bank, thrift and credit-union regulators very quietly gave lenders flexibility in how they classified distressed commercial mortgages. Banks were able to slice distressed loans into performing and non-performing loans, and institutions were able to magically reduce the total reserves set aside for non-performing loans.

If a mall developer has 40% of their mall vacant and the cash flow from the mall is insufficient to service the loan, the bank would normally need to set aside reserves for the entire loan. Under the new guidelines they could carve the loan into two pieces, with 60% that is covered by cash flow as a good loan and the 40% without sufficient cash flow would be classified as non-performing.

The truth is that billions in commercial loans are in distress right now because tenants are dropping like flies. Rather than writing down the loans, banks are extending the terms of the debt with more interest reserves included so they can continue to classify the loans as “performing.” The reality is that the values of the property behind these loans have fallen 43%. Banks are extending loans that they would never make now, because borrowers are already grossly upside-down.

Extending the length of a loan, changing the terms, and pretending that it will be repaid won’t generate real cash flow or keep the value of the property from declining. U.S. banks hold an estimated $156 billion of souring commercial real-estate loans, according to research firm Trepp LLC. About two-thirds of commercial real-estate loans maturing at banks from now through 2015 are underwater. Media shills proclaiming that the market is improving, doesn’t make it so. The chart below details the delinquency rates from 2007 through 2010 as reported by the Federal Reserve:

Delinquency rates on residential and commercial loans in early 2007 were in the range of 1.5% to 2.0%. Now the MSM pundits get excited over a decline from 8.7% to 8.0%. These figures show that even after trillions of Federal Reserve and Federal Government intervention, delinquencies remain four times higher than normal. In the real world, cash flow matters. Payment of interest and principal on a loan matters. Actual market values matter. According to Trepp, LLC, a data firm specializing in commercial data, non-performing commercial real estate loans makes up 72% of the $320 million in non-performing loans reported by banks in February. These figures are after the “extremely” relaxed definition of non-performing allowed by the Federal Reserve.

The game is ongoing. Misinformation abounds. The SEC now issues press releases saying they are worried that banks are covering up losses, when they were involved in encouraging the banks to cover-up their losses.

Last week the SEC announced they have become concerned that extend and pretend, along with another practice known as “troubled debt restructuring” that allows banks to break loans into pieces, may have been abused in order to diminish the volume of reserves banks are holding. What a shocking revelation. Who could have known?

Part two of the master cover-up plan has been the extending of commercial real estate loans and pretending that they will eventually be repaid. In late 2009 it was clear to the Federal Reserve and the Treasury that the $1.2 trillion in commercial loans maturing between 2010 and 2013 would cause thousands of bank failures if the existing regulations were enforced. The Treasury stepped to the plate first. New rules at the IRS weren’t directly related to banking, but allowed commercial loans that were part of investment pools known as Real Estate Mortgage Investment Conduits, or REMICs, to be refinanced without triggering tax penalties for investors.

The Federal Reserve, which is tasked with making sure banks loans are properly valued, instructed banks throughout the country to “extend and pretend” or “amend and pretend,” in which the bank gives a borrower more time to repay a loan. Banks were “encouraged” to modify loans to help cash strapped borrowers. The hope was that by amending the terms to enable the borrower to avoid a refinancing that would have been impossible, the lender would ultimately be able to collect the balance due on the loan.

Ben and his boys also pushed banks to do “troubled debt restructurings.” Such restructurings involved modifying an existing loan by changing the terms or breaking the loan into pieces. Bank, thrift and credit-union regulators very quietly gave lenders flexibility in how they classified distressed commercial mortgages. Banks were able to slice distressed loans into performing and non-performing loans, and institutions were able to magically reduce the total reserves set aside for non-performing loans.

If a mall developer has 40% of their mall vacant and the cash flow from the mall is insufficient to service the loan, the bank would normally need to set aside reserves for the entire loan. Under the new guidelines they could carve the loan into two pieces, with 60% that is covered by cash flow as a good loan and the 40% without sufficient cash flow would be classified as non-performing.

The truth is that billions in commercial loans are in distress right now because tenants are dropping like flies. Rather than writing down the loans, banks are extending the terms of the debt with more interest reserves included so they can continue to classify the loans as “performing.” The reality is that the values of the property behind these loans have fallen 43%. Banks are extending loans that they would never make now, because borrowers are already grossly upside-down.

Extending the length of a loan, changing the terms, and pretending that it will be repaid won’t generate real cash flow or keep the value of the property from declining. U.S. banks hold an estimated $156 billion of souring commercial real-estate loans, according to research firm Trepp LLC. About two-thirds of commercial real-estate loans maturing at banks from now through 2015 are underwater. Media shills proclaiming that the market is improving, doesn’t make it so. The chart below details the delinquency rates from 2007 through 2010 as reported by the Federal Reserve:

| | Real estate loans | Consumer loans | ||||

| All | Booked in domestic offices | All | Credit cards | Other | ||

| Residential | Commercial | |||||

| 2010 4th Qtr | 9.01 | 9.94 | 7.97 | 3.71 | 4.17 | 3.10 |

| 2010 3rd Qtr | 9.77 | 10.90 | 8.69 | 4.03 | 4.60 | 3.39 |

| 2010 2nd Qtr | 10.02 | 11.32 | 8.74 | 4.25 | 5.07 | 3.37 |

| 2010 1st Qtr | 9.78 | 10.97 | 8.66 | 4.63 | 5.76 | 3.48 |

| 2009 4th Qtr | 9.48 | 10.29 | 8.74 | 4.64 | 6.36 | 3.48 |

| 2009 3d Qtr | 9.00 | 9.67 | 8.57 | 4.72 | 6.51 | 3.61 |

| 2009 2nd Qtr | 8.19 | 8.69 | 7.84 | 4.85 | 6.75 | 3.69 |

| 2009 1st Qtr | 7.19 | 7.89 | 6.55 | 4.62 | 6.50 | 3.52 |

| 2008 4th Qtr | 5.99 | 6.57 | 5.49 | 4.29 | 5.65 | 3.37 |

| 2008 3rd Qtr | 4.88 | 5.26 | 4.66 | 3.73 | 4.80 | 3.05 |

| 2008 2nd Qtr | 4.21 | 4.39 | 4.15 | 3.55 | 4.89 | 2.80 |

| 2008 1st Qtr | 3.56 | 3.70 | 3.50 | 3.48 | 4.76 | 2.76 |

| 2007 4th Qtr | 2.89 | 3.06 | 2.75 | 3.41 | 4.60 | 2.66 |

| 2007 3rd Qtr | 2.40 | 2.78 | 1.98 | 3.20 | 4.41 | 2.48 |

| 2007 2nd Qtr | 2.01 | 2.30 | 1.63 | 2.99 | 4.02 | 2.37 |

| 2007 1st Qtr | 1.77 | 2.03 | 1.43 | 2.93 | 3.97 | 2.29 |

Delinquency rates on residential and commercial loans in early 2007 were in the range of 1.5% to 2.0%. Now the MSM pundits get excited over a decline from 8.7% to 8.0%. These figures show that even after trillions of Federal Reserve and Federal Government intervention, delinquencies remain four times higher than normal. In the real world, cash flow matters. Payment of interest and principal on a loan matters. Actual market values matter. According to Trepp, LLC, a data firm specializing in commercial data, non-performing commercial real estate loans makes up 72% of the $320 million in non-performing loans reported by banks in February. These figures are after the “extremely” relaxed definition of non-performing allowed by the Federal Reserve.

The game is ongoing. Misinformation abounds. The SEC now issues press releases saying they are worried that banks are covering up losses, when they were involved in encouraging the banks to cover-up their losses.

Last week the SEC announced they have become concerned that extend and pretend, along with another practice known as “troubled debt restructuring” that allows banks to break loans into pieces, may have been abused in order to diminish the volume of reserves banks are holding. What a shocking revelation. Who could have known?