Re: Silver

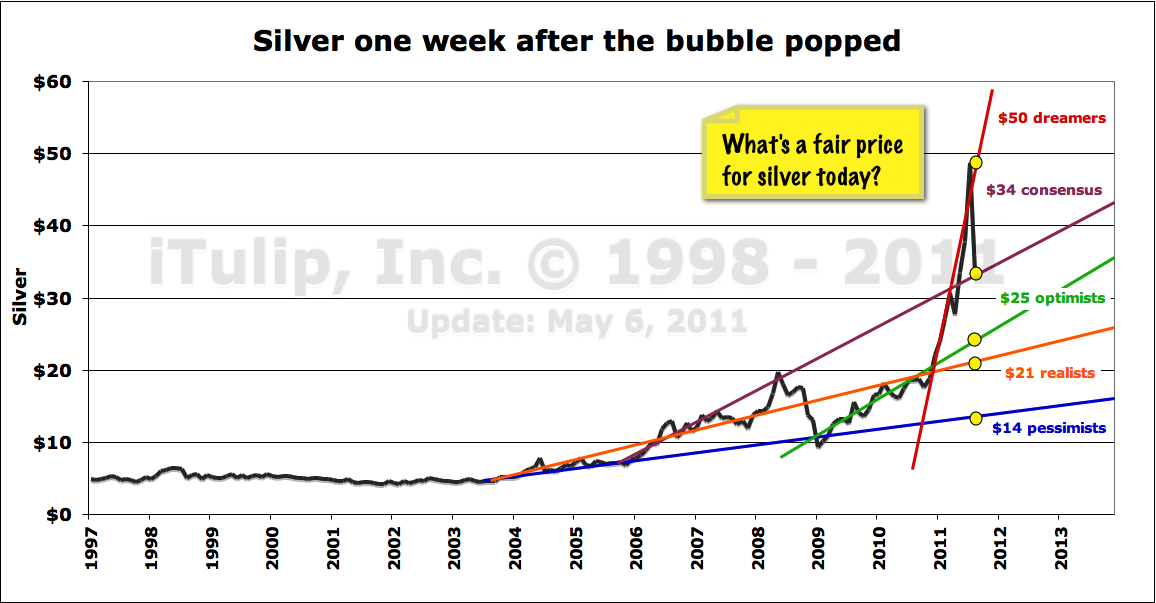

I may buy down at 27-30 and then buy more in low 20s.

I forgot to add my rationale- the unwinding of the value of the dollar.

I like the 2000 plus year long term chart for gold and silver. PMs (gold and silver) been used as a currency. Besides Utah there are 12 states proposing use of gold and silver as alternate forms of currency.

Whether states continue or not, divergence between paper and physical will continue. We got glimpses of it during Carter admin. Appliance and furniture stores accepted two forms of money 1) the us dollar 2) silver or gold.

I may buy down at 27-30 and then buy more in low 20s.

I forgot to add my rationale- the unwinding of the value of the dollar.

I like the 2000 plus year long term chart for gold and silver. PMs (gold and silver) been used as a currency. Besides Utah there are 12 states proposing use of gold and silver as alternate forms of currency.

Whether states continue or not, divergence between paper and physical will continue. We got glimpses of it during Carter admin. Appliance and furniture stores accepted two forms of money 1) the us dollar 2) silver or gold.

(Those who bought a year ago are still up nearly 100%.)

(Those who bought a year ago are still up nearly 100%.)

Comment