Option ARM Time Bomb Blows Early, Easing Damage to U.S. Housing

By Prashant Gopal and Jody Shenn - Feb 15, 2011

This was the year thousands of U.S. homeowners with option adjustable-rate mortgages were supposed to default as their payments spiked. Low interest rates and a surge of early delinquencies mean the numbers probably won’t be as bad as forecast, softening the blow to a housing market where prices have resumed falling.

Consider Stan Jones, who took out option ARMs in 2005 and 2006 to buy homes for his daughter and son during their college years. He estimates that the loans, which have a floating rate tied to a short-term bond index, saved him thousands of dollars as the Federal Reserve drove borrowing costs to record lows.

“They’re calling these loans ‘exotic mortgage schemes,’” said Jones, an executive with a Fort Lauderdale, Florida, firm that provides workers and technology for home-based call-center networks. “And the whole time I’m thinking, ‘What, are you crazy? This is the greatest thing in the world.’”

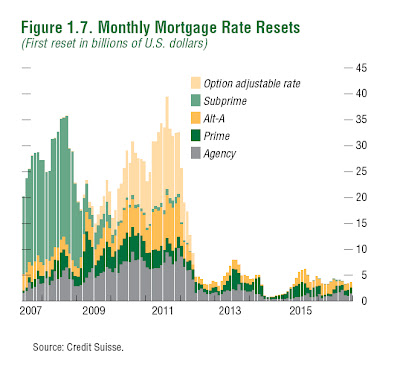

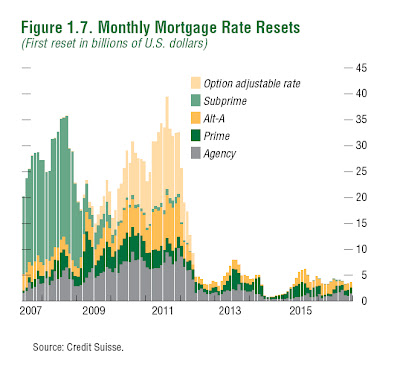

Monthly payments on option ARMs reset after an initial low- rate period, usually five years, and researchers at CoreLogic Inc. in Santa Ana, California, estimated in 2009 that such recasts would peak at 54,000 a month in August of this year. In a 2006 cover story in BusinessWeek magazine titled “Nightmare Mortgages,” George McCarthy, a housing economist at the Ford Foundation in New York, compared the looming resets to a neutron bomb.

“It’s going to kill all the people but leave the houses standing,” he said at the time.

What he and other analysts didn’t anticipate was that so many option ARMs would go bad before resetting, and that interest rates would stay low enough to minimize the impact of the adjustments on borrowers like Jones who are making their payments. Still, a model developed by JPMorgan Chase & Co. analysts predicts that 70 percent of remaining option-ARM loans that were bundled into bonds will eventually default.

‘Disaster Already Happened’

About $600 billion of the loans were made from 2005 through 2007, according to industry newsletter Inside Mortgage Finance. Of those packaged into bonds, some 20 percent have been liquidated at losses to investors, and almost half of the remaining ones are at least 30 days delinquent, in foreclosure or have been seized by lenders, according to data from JPMorgan.

“It’s not that option ARMs weren’t a bad way to finance homes, it’s just that the disaster already happened before the resets,” McCarthy said in a telephone interview last week.

The prospect of fewer defaults is a plus for the housing market, which was burdened by 2.2 million foreclosed homes as of Dec. 31, according to data from Lender Processing Services Inc. in Jacksonville, Florida. The S&P/Case-Shiller index of home values in 20 cities fell 1.6 percent in November from a year earlier, the biggest decrease since December 2009, the group said Jan. 25. The gauge remains 30 percent below its 2006 high.

Loan Modifications

Lenders and servicers are seeking to limit losses by modifying loans. Terms on about 20 percent of option ARMs have been revised, sometimes with a switch to a fixed rate, said Michael Fratantoni, vice president of research at the Mortgage Bankers Association, a Washington-based trade group. JPMorgan, Bank of America Corp. and Wells Fargo & Co. hold the biggest portfolios of option ARMs.

About half of the loans issued from 2003 to 2007 remain outstanding, he said.

For the remaining homeowners, payment increases will be limited to 30 percent to 40 percent, Barclays Capital Inc. estimated in a Jan. 7 report. Some borrowers are seeing their bills go down, lenders including Bank of America say. Analysts a few years ago were forecasting that payments for some borrowers could double.

“Of the borrowers who are still paying, the recast will not be a big deal,” Fratantoni said. “It’s not at all what people anticipated.”

1980s Debut

Option ARMs, introduced in the early 1980s by companies such as Golden West Financial Corp.’s World Savings unit, initially appealed to well-off borrowers who had uneven income streams or received most of their compensation in large yearend bonuses, which made conventional mortgages with regular monthly payments difficult. By the mid-2000s, as the housing market boomed, the loans gained widespread popularity, especially in California and Florida, where home prices were rising quickly and the option for a minimum payment allowed borrowers to qualify for homes they couldn’t otherwise afford. The initial payments, known as teaser rates, could be as low as 1 percent.

The loans were mostly sold to borrowers with at least average credit scores.

Subprime loans, which triggered the financial crisis, went to the least creditworthy homebuyers.

Cheapest Option

Option adjustable-rate mortgages are structured to give borrowers a choice of payment options: principal and interest, interest-only or a minimum outlay covering only a portion of the interest and none of the principal. Most borrowers opted to pay as little as possible, with the shortfall added to the principal. The minimum-payment option increased 7.5 percent a year.

Many couldn’t keep up and defaulted or abandoned homes long before the loans hit scheduled five-year recasts. The loans can reset sooner if the balance reaches specified principal caps, usually 110 percent to 125 percent of the original balance.

“They took a loan that was borrower friendly and made it into a toxic loan, which we warned regulators about again and again and again,” Herb Sandler, who with his wife, Marion, was co-chief executive officer of Golden West, said in a Sept. 22 interview with the Financial Crisis Inquiry Commission that was released last week. The Sandlers ran Golden West from 1963 until it was purchased by Wachovia Corp. in 2006. Wells Fargo bought Wachovia two years later as its shares collapsed under the weight of overdue mortgages.

Dangers Remain

Sandler said Golden West structured its option ARMs more conservatively than competitors, using a 10-year recast period and eschewing 1 percent teaser rates. The company also kept its loans rather than package them into securities that were sold to investors, so it had more riding on their quality.

Countrywide Financial Corp. and Washington Mutual Inc., the first- and third-largest home lenders in 2005, that year granted 68 percent of their option ARMs with little or no documentation of borrowers’ incomes, according to the FCIC’s report. Wells Fargo, upon buying Wachovia, marked down its option ARMs by $26.5 billion, the company said in a 2009 presentation.

While the threat to the housing market may be diminished, option-ARM lenders and borrowers aren’t out of danger. About 46 percent of the loans that were securitized are at least 30 days delinquent or worse.

Underwater Borrowers

Borrowers accounting for 42 percent of securitized option ARMs have never fallen behind on their payments, according to data from Amherst Securities Group, an Austin, Texas-based bond broker. This group on average owes 17 percent more than the value of their properties. Such underwater homeowners are more likely to stop paying their mortgages, according to Amherst. The firm estimates that as many as 11 million borrowers may default without action being taken to help them.

A sudden rise in interest rates could trigger defaults in markets where option ARMs are popular, hastening the speed and magnitude of recasts. About 60 percent of the loans were written in California, while 12 percent are in Florida, according to Credit Suisse Group AG analysts.

For now, the interest rate environment remains benign. An index tied to one-year Treasury yields commonly used as a benchmark for option ARMs is at 0.29 percent, down from almost 5 percent at the start of 2007, according to data compiled by Bloomberg. Those benchmark rates are guided by the Fed.

Impact of Rates

“Lots of lenders have taken action to stave it off, knowing it’s a problem,” Jon Maddux, chief executive officer of YouWalkAway.com in Carlsbad, California, said of option-ARM delinquencies. Maddux’s firm advises borrowers on strategic defaults.

“They have extra time because rates are low. But when those rates go up, that’s when we’re going to see this problem happen,” he said.

While a spike in rates would cause more borrowers to default, the two-year lag from the time a borrower becomes delinquent to the foreclosure would delay the impact on the market, according to Chandrajit Bhattacharya, a senior mortgage strategist at Credit Suisse in New York.

“The negative-equity issue and strategic defaulting have been around for several years now,” said Celia Chen, a housing economist for Moody’s Analytics Inc. in West Chester, Pennsylvania. “If these option-loan borrowers haven’t succumbed to them, I don’t think they will.”

JPMorgan Efforts

The biggest option-ARM lenders have been restructuring loans, converting them into fixed-rate mortgages, extending terms and forgiving principal, said Guy Cecala, publisher of Inside Mortgage Finance.

“Everyone identified option ARMs as a potential time bomb if they didn’t defuse it,” Cecala said.

JPMorgan has reworked about a quarter of the $40 billion of option ARMs it inherited when it acquired Washington Mutual in 2008. The New York-based bank plans to adjust terms on an additional $2 billion to $4 billion before resets kick in, said David Lowman, who heads its home-loan unit.

While Bank of America’s portfolio faces high loan-to-value ratios and delinquencies, it doesn’t expect “a catastrophic number of defaults” caused by payment increases, Rick Simon, a spokesman for the Charlotte, North Carolina-based company, said in an e-mail.

Of loans issued by its Countrywide Financial unit that have adjusted, more than half experienced less than a 20 percent payment increase and many saw a decrease, Simon said. Bank of America, which bought Countrywide in 2008, expects the same experience this year.

Losses Lower

Wells Fargo, after buying Wachovia, marked down its option ARMs by $26.5 billion, according to Tom Goyda, a spokesman for the bank. The San Francisco-based company has since reduced its estimated writedown by $2.4 billion.

Wells Fargo has modified more than 80,000 loans since the beginning of 2009. The company’s outstanding balance of Pick-A- Pay Loans fell to $54 billion on Dec. 31, 2010, from $101.3 billion at the end of 2008, primarily through payoffs and modifications. The company has forgiven $3.7 billion in principal, Goyda said.

“So far the loan losses continue to be lower than originally projected,” he said.

Three weeks ago, Jones, the Fort Lauderdale executive, got a call from JPMorgan offering to convert the option ARM on one of his investment properties to a 30-year fixed-rate mortgage with a 4 percent interest rate, he said. While his floating interest rate is only 3 percent, the bank offered to hold his monthly payment at $738. Jones locked it in because he expects rates will rise.

Jones’s other loan recast last year. He said the change was so small he didn’t even notice it.

http://www.bloomberg.com/news/2011-0...ng-market.html

By Prashant Gopal and Jody Shenn - Feb 15, 2011

This was the year thousands of U.S. homeowners with option adjustable-rate mortgages were supposed to default as their payments spiked. Low interest rates and a surge of early delinquencies mean the numbers probably won’t be as bad as forecast, softening the blow to a housing market where prices have resumed falling.

Consider Stan Jones, who took out option ARMs in 2005 and 2006 to buy homes for his daughter and son during their college years. He estimates that the loans, which have a floating rate tied to a short-term bond index, saved him thousands of dollars as the Federal Reserve drove borrowing costs to record lows.

“They’re calling these loans ‘exotic mortgage schemes,’” said Jones, an executive with a Fort Lauderdale, Florida, firm that provides workers and technology for home-based call-center networks. “And the whole time I’m thinking, ‘What, are you crazy? This is the greatest thing in the world.’”

Monthly payments on option ARMs reset after an initial low- rate period, usually five years, and researchers at CoreLogic Inc. in Santa Ana, California, estimated in 2009 that such recasts would peak at 54,000 a month in August of this year. In a 2006 cover story in BusinessWeek magazine titled “Nightmare Mortgages,” George McCarthy, a housing economist at the Ford Foundation in New York, compared the looming resets to a neutron bomb.

“It’s going to kill all the people but leave the houses standing,” he said at the time.

What he and other analysts didn’t anticipate was that so many option ARMs would go bad before resetting, and that interest rates would stay low enough to minimize the impact of the adjustments on borrowers like Jones who are making their payments. Still, a model developed by JPMorgan Chase & Co. analysts predicts that 70 percent of remaining option-ARM loans that were bundled into bonds will eventually default.

‘Disaster Already Happened’

About $600 billion of the loans were made from 2005 through 2007, according to industry newsletter Inside Mortgage Finance. Of those packaged into bonds, some 20 percent have been liquidated at losses to investors, and almost half of the remaining ones are at least 30 days delinquent, in foreclosure or have been seized by lenders, according to data from JPMorgan.

“It’s not that option ARMs weren’t a bad way to finance homes, it’s just that the disaster already happened before the resets,” McCarthy said in a telephone interview last week.

The prospect of fewer defaults is a plus for the housing market, which was burdened by 2.2 million foreclosed homes as of Dec. 31, according to data from Lender Processing Services Inc. in Jacksonville, Florida. The S&P/Case-Shiller index of home values in 20 cities fell 1.6 percent in November from a year earlier, the biggest decrease since December 2009, the group said Jan. 25. The gauge remains 30 percent below its 2006 high.

Loan Modifications

Lenders and servicers are seeking to limit losses by modifying loans. Terms on about 20 percent of option ARMs have been revised, sometimes with a switch to a fixed rate, said Michael Fratantoni, vice president of research at the Mortgage Bankers Association, a Washington-based trade group. JPMorgan, Bank of America Corp. and Wells Fargo & Co. hold the biggest portfolios of option ARMs.

About half of the loans issued from 2003 to 2007 remain outstanding, he said.

For the remaining homeowners, payment increases will be limited to 30 percent to 40 percent, Barclays Capital Inc. estimated in a Jan. 7 report. Some borrowers are seeing their bills go down, lenders including Bank of America say. Analysts a few years ago were forecasting that payments for some borrowers could double.

“Of the borrowers who are still paying, the recast will not be a big deal,” Fratantoni said. “It’s not at all what people anticipated.”

1980s Debut

Option ARMs, introduced in the early 1980s by companies such as Golden West Financial Corp.’s World Savings unit, initially appealed to well-off borrowers who had uneven income streams or received most of their compensation in large yearend bonuses, which made conventional mortgages with regular monthly payments difficult. By the mid-2000s, as the housing market boomed, the loans gained widespread popularity, especially in California and Florida, where home prices were rising quickly and the option for a minimum payment allowed borrowers to qualify for homes they couldn’t otherwise afford. The initial payments, known as teaser rates, could be as low as 1 percent.

The loans were mostly sold to borrowers with at least average credit scores.

Subprime loans, which triggered the financial crisis, went to the least creditworthy homebuyers.

Cheapest Option

Option adjustable-rate mortgages are structured to give borrowers a choice of payment options: principal and interest, interest-only or a minimum outlay covering only a portion of the interest and none of the principal. Most borrowers opted to pay as little as possible, with the shortfall added to the principal. The minimum-payment option increased 7.5 percent a year.

Many couldn’t keep up and defaulted or abandoned homes long before the loans hit scheduled five-year recasts. The loans can reset sooner if the balance reaches specified principal caps, usually 110 percent to 125 percent of the original balance.

“They took a loan that was borrower friendly and made it into a toxic loan, which we warned regulators about again and again and again,” Herb Sandler, who with his wife, Marion, was co-chief executive officer of Golden West, said in a Sept. 22 interview with the Financial Crisis Inquiry Commission that was released last week. The Sandlers ran Golden West from 1963 until it was purchased by Wachovia Corp. in 2006. Wells Fargo bought Wachovia two years later as its shares collapsed under the weight of overdue mortgages.

Dangers Remain

Sandler said Golden West structured its option ARMs more conservatively than competitors, using a 10-year recast period and eschewing 1 percent teaser rates. The company also kept its loans rather than package them into securities that were sold to investors, so it had more riding on their quality.

Countrywide Financial Corp. and Washington Mutual Inc., the first- and third-largest home lenders in 2005, that year granted 68 percent of their option ARMs with little or no documentation of borrowers’ incomes, according to the FCIC’s report. Wells Fargo, upon buying Wachovia, marked down its option ARMs by $26.5 billion, the company said in a 2009 presentation.

While the threat to the housing market may be diminished, option-ARM lenders and borrowers aren’t out of danger. About 46 percent of the loans that were securitized are at least 30 days delinquent or worse.

Underwater Borrowers

Borrowers accounting for 42 percent of securitized option ARMs have never fallen behind on their payments, according to data from Amherst Securities Group, an Austin, Texas-based bond broker. This group on average owes 17 percent more than the value of their properties. Such underwater homeowners are more likely to stop paying their mortgages, according to Amherst. The firm estimates that as many as 11 million borrowers may default without action being taken to help them.

A sudden rise in interest rates could trigger defaults in markets where option ARMs are popular, hastening the speed and magnitude of recasts. About 60 percent of the loans were written in California, while 12 percent are in Florida, according to Credit Suisse Group AG analysts.

For now, the interest rate environment remains benign. An index tied to one-year Treasury yields commonly used as a benchmark for option ARMs is at 0.29 percent, down from almost 5 percent at the start of 2007, according to data compiled by Bloomberg. Those benchmark rates are guided by the Fed.

Impact of Rates

“Lots of lenders have taken action to stave it off, knowing it’s a problem,” Jon Maddux, chief executive officer of YouWalkAway.com in Carlsbad, California, said of option-ARM delinquencies. Maddux’s firm advises borrowers on strategic defaults.

“They have extra time because rates are low. But when those rates go up, that’s when we’re going to see this problem happen,” he said.

While a spike in rates would cause more borrowers to default, the two-year lag from the time a borrower becomes delinquent to the foreclosure would delay the impact on the market, according to Chandrajit Bhattacharya, a senior mortgage strategist at Credit Suisse in New York.

“The negative-equity issue and strategic defaulting have been around for several years now,” said Celia Chen, a housing economist for Moody’s Analytics Inc. in West Chester, Pennsylvania. “If these option-loan borrowers haven’t succumbed to them, I don’t think they will.”

JPMorgan Efforts

The biggest option-ARM lenders have been restructuring loans, converting them into fixed-rate mortgages, extending terms and forgiving principal, said Guy Cecala, publisher of Inside Mortgage Finance.

“Everyone identified option ARMs as a potential time bomb if they didn’t defuse it,” Cecala said.

JPMorgan has reworked about a quarter of the $40 billion of option ARMs it inherited when it acquired Washington Mutual in 2008. The New York-based bank plans to adjust terms on an additional $2 billion to $4 billion before resets kick in, said David Lowman, who heads its home-loan unit.

While Bank of America’s portfolio faces high loan-to-value ratios and delinquencies, it doesn’t expect “a catastrophic number of defaults” caused by payment increases, Rick Simon, a spokesman for the Charlotte, North Carolina-based company, said in an e-mail.

Of loans issued by its Countrywide Financial unit that have adjusted, more than half experienced less than a 20 percent payment increase and many saw a decrease, Simon said. Bank of America, which bought Countrywide in 2008, expects the same experience this year.

Losses Lower

Wells Fargo, after buying Wachovia, marked down its option ARMs by $26.5 billion, according to Tom Goyda, a spokesman for the bank. The San Francisco-based company has since reduced its estimated writedown by $2.4 billion.

Wells Fargo has modified more than 80,000 loans since the beginning of 2009. The company’s outstanding balance of Pick-A- Pay Loans fell to $54 billion on Dec. 31, 2010, from $101.3 billion at the end of 2008, primarily through payoffs and modifications. The company has forgiven $3.7 billion in principal, Goyda said.

“So far the loan losses continue to be lower than originally projected,” he said.

Three weeks ago, Jones, the Fort Lauderdale executive, got a call from JPMorgan offering to convert the option ARM on one of his investment properties to a 30-year fixed-rate mortgage with a 4 percent interest rate, he said. While his floating interest rate is only 3 percent, the bank offered to hold his monthly payment at $738. Jones locked it in because he expects rates will rise.

Jones’s other loan recast last year. He said the change was so small he didn’t even notice it.

http://www.bloomberg.com/news/2011-0...ng-market.html

Comment