If we want to start with some serious housing reform we need to increase the down payment amount. I’m not a big fan of Fannie Mae, Freddie Mac, or the FHA but there was a long period of time, decades in fact where the system seemed to be working. At the very least there was no national housing bubble.

The government backed loans with strict underwriting and this included sizeable down payments of close to 20 percent. In the late 1990s and starting in the early 2000s Wall Street investment banks thought it would be a smart idea to go with “easier” standards (aka a pulse) and fueled the housing mania. Fannie Mae and Freddie Mac was put into conservatorship after the collapse and yet little has changed in terms of housing finance. New discussions on reforming the mortgage market do very little in addressing how we went decades with a rather stable housing market with government subsidies in the mortgage market to this once in a lifetime bubble. The FHA has now stepped into the place of exotic mortgage financing to bring buyers into homes with pathetically low down payments. Low down payments are one of the main reasons why home prices became inflated and also lead to future foreclosures as we will explain shortly.

FHA backs 1 out of 3 California loans

Source: 2009 FHA mortgage data

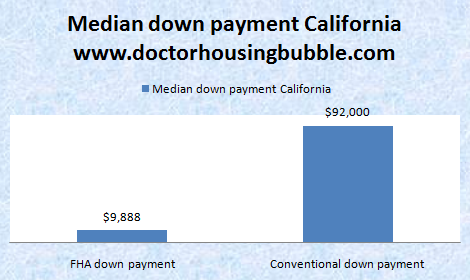

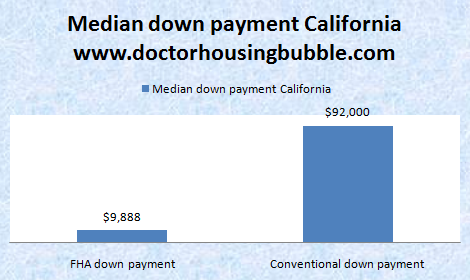

FHA insured loans are facing rising default rates because of their inability to restructure their down payment requirements. The FHA’s mission was to help and keep affordable housing loans open to those who wouldn’t typically qualify for conventional mortgage financing. As you can see above from the aggregate data FHA down payment amounts are nearly 10 times lower than those through conventional loans. This wasn’t a problem when FHA was a tiny part of the market.

Today FHA insured loans make 1 out of 3 California mortgages and California largely is an overpriced market. This has now been going on for two solid years. In other words FHA is going completely against its mission by keeping home prices inflated and allowing a large number of buyers to use their mortgages. If we stick with their mission, does it then mean that 1 out of 3 buyers in California cannot afford their current home purchase and require the ultimate government backed subsidy loan?

There was a time for many decades when the typical down payment requirement was 20 percent. Incredibly over this time Fannie Mae and Freddie Mac did an okay job. Sure, I’m not a fan of the government subsidizing home purchases because in the end this inflates prices but we didn’t have anything close to a national housing bubble. All of this hit when Wall Street figured out they could lower the bar even further to make criminal bonuses and when things were certain to go bust, then the taxpayer would be there to clean it up. How did they know this? They bought politicians who wrote laws in favor of these leeches. All of it played out as planned and it is no surprise that banking bonuses are off the charts again while the economy is mired in distress. The fact that FHA insured loans now make up such a large part of the California housing market shows that people are still too broke to pay the actual market rate of even a basic conventional loan.

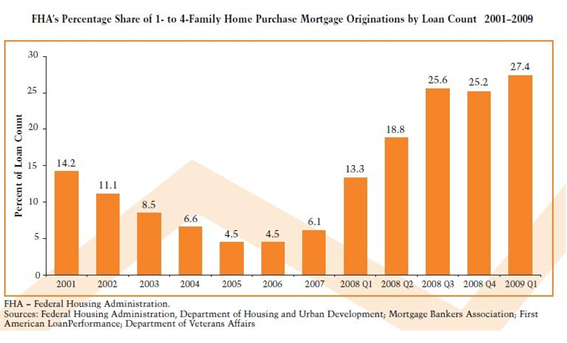

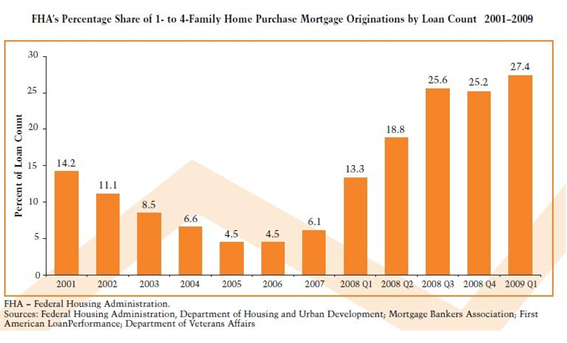

FHA share of the market

Source: Real Estate Channel

FHA loans were never intended to be a big part of the market. Here is part of the FHA background from the HUD website:

Instead of talking about all these hypothetical and convoluted methods of solving the mortgage market how about we all start on the same page and increase the down payment requirement for all government backed loans? We all know this is one of the primary reasons for strategic defaults and it also allows too many people to buy homes when they are not ready. It used to be a ritual that families had to save two to three years (or even more) by tightening up their budgets in order to have enough money saved to buy a home. Now that has been taken out of the equation.

The main reason this nonsense is going on is that many Americans are broke. A decade of stagnant wages and the median household income of $50,000 just does not cut it for even $200,000 priced homes. In California, we are already seeing cracks in the system in prime areas where home prices are still too inflated for local family incomes. The irony is that these programs all keep home prices too expensive for the overall community. They go against their own stated mission.

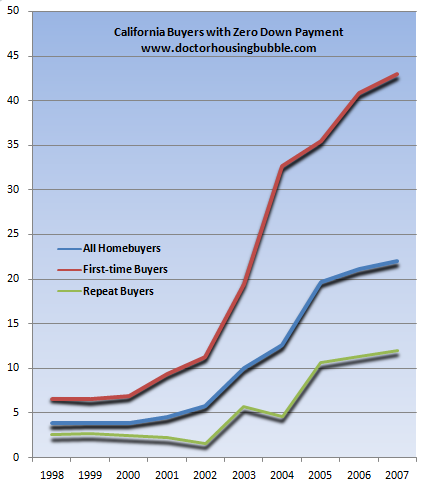

Wiping out a decade of mania gains

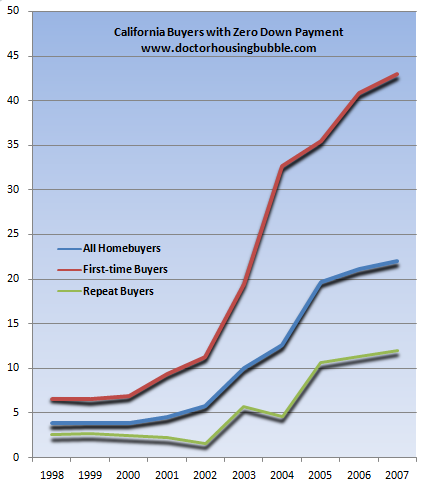

At one point in 2007 over 40 percent of first time home buyers used nothing down loans to purchase homes in California! Think about that. Many of these loans were toxic Alt-A and option ARM with recast dates that started hitting last year and will continue into 2012. Many have imploded but many have not. We already know with the solid number of homes in the shadow inventory that many people are living beyond their means with mortgages they cannot afford (or will not pay). Allowing for the continuation of low down payment programs like FHA insured loans is horrible policy. Immediately the down payment requirement should be put up to 10 percent. Here are a few obvious reasons why:

First step in fixing the housing market is increasing the down payment amount on all government backed loans to 10 percent (at least). This is unlikely because it will reveal how truly broke most Americans are and how few can actually save what used to be a normal amount for a down payment.

http://www.doctorhousingbubble.com/f...insured-loans/

The government backed loans with strict underwriting and this included sizeable down payments of close to 20 percent. In the late 1990s and starting in the early 2000s Wall Street investment banks thought it would be a smart idea to go with “easier” standards (aka a pulse) and fueled the housing mania. Fannie Mae and Freddie Mac was put into conservatorship after the collapse and yet little has changed in terms of housing finance. New discussions on reforming the mortgage market do very little in addressing how we went decades with a rather stable housing market with government subsidies in the mortgage market to this once in a lifetime bubble. The FHA has now stepped into the place of exotic mortgage financing to bring buyers into homes with pathetically low down payments. Low down payments are one of the main reasons why home prices became inflated and also lead to future foreclosures as we will explain shortly.

FHA backs 1 out of 3 California loans

Source: 2009 FHA mortgage data

FHA insured loans are facing rising default rates because of their inability to restructure their down payment requirements. The FHA’s mission was to help and keep affordable housing loans open to those who wouldn’t typically qualify for conventional mortgage financing. As you can see above from the aggregate data FHA down payment amounts are nearly 10 times lower than those through conventional loans. This wasn’t a problem when FHA was a tiny part of the market.

Today FHA insured loans make 1 out of 3 California mortgages and California largely is an overpriced market. This has now been going on for two solid years. In other words FHA is going completely against its mission by keeping home prices inflated and allowing a large number of buyers to use their mortgages. If we stick with their mission, does it then mean that 1 out of 3 buyers in California cannot afford their current home purchase and require the ultimate government backed subsidy loan?

There was a time for many decades when the typical down payment requirement was 20 percent. Incredibly over this time Fannie Mae and Freddie Mac did an okay job. Sure, I’m not a fan of the government subsidizing home purchases because in the end this inflates prices but we didn’t have anything close to a national housing bubble. All of this hit when Wall Street figured out they could lower the bar even further to make criminal bonuses and when things were certain to go bust, then the taxpayer would be there to clean it up. How did they know this? They bought politicians who wrote laws in favor of these leeches. All of it played out as planned and it is no surprise that banking bonuses are off the charts again while the economy is mired in distress. The fact that FHA insured loans now make up such a large part of the California housing market shows that people are still too broke to pay the actual market rate of even a basic conventional loan.

FHA share of the market

Source: Real Estate Channel

FHA loans were never intended to be a big part of the market. Here is part of the FHA background from the HUD website:

“(HUD) Unlike conventional loans that adhere to strict underwriting guidelines, FHA-insured loans require very little cash investment to close a loan. There is more flexibility in calculating household income and payment ratios. The cost of the mortgage insurance is passed along to the homeowner and typically is included in the monthly payment. In most cases, the insurance cost to the homeowner will drop off after five years or when the remaining balance on the loan is 78 percent of the value of the property -whichever is longer.”

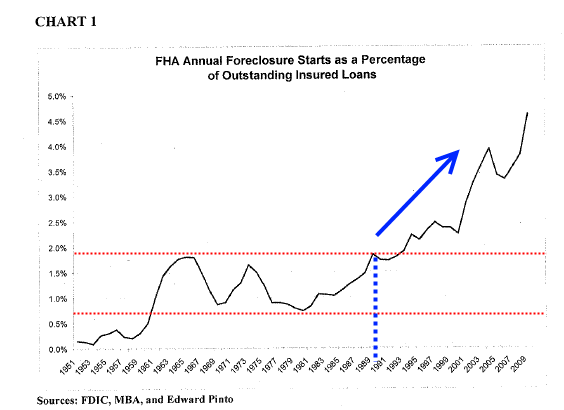

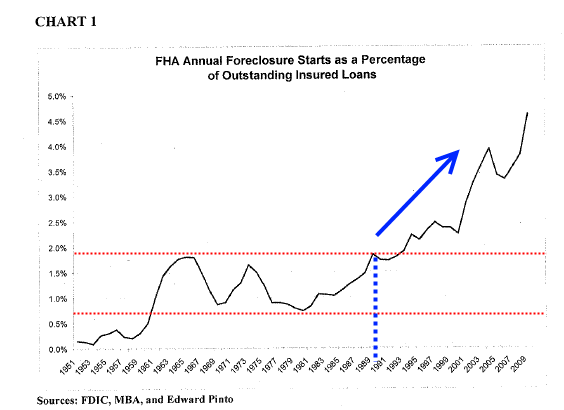

The cost of the insurance is passed onto buyers thus making home payments more expensive and the down payment flexibility is the crux of the issue. As many of you know 3.5 percent down is all that is required. That is why it should be no shock that FHA insured loans are now a big part of defaults:

Instead of talking about all these hypothetical and convoluted methods of solving the mortgage market how about we all start on the same page and increase the down payment requirement for all government backed loans? We all know this is one of the primary reasons for strategic defaults and it also allows too many people to buy homes when they are not ready. It used to be a ritual that families had to save two to three years (or even more) by tightening up their budgets in order to have enough money saved to buy a home. Now that has been taken out of the equation.

The main reason this nonsense is going on is that many Americans are broke. A decade of stagnant wages and the median household income of $50,000 just does not cut it for even $200,000 priced homes. In California, we are already seeing cracks in the system in prime areas where home prices are still too inflated for local family incomes. The irony is that these programs all keep home prices too expensive for the overall community. They go against their own stated mission.

Wiping out a decade of mania gains

At one point in 2007 over 40 percent of first time home buyers used nothing down loans to purchase homes in California! Think about that. Many of these loans were toxic Alt-A and option ARM with recast dates that started hitting last year and will continue into 2012. Many have imploded but many have not. We already know with the solid number of homes in the shadow inventory that many people are living beyond their means with mortgages they cannot afford (or will not pay). Allowing for the continuation of low down payment programs like FHA insured loans is horrible policy. Immediately the down payment requirement should be put up to 10 percent. Here are a few obvious reasons why:

-Buyers come in with a larger equity buffer. As we know empirically, negative equity is the biggest reason for predicting foreclosure.

-Force people to budget over two to three years to test their ability to pay for a mortgage. A home is not like buying a stock, it is a longer term purchase thus requiring people to pay for the privilege of buying a home is important. It is a privilege since the government backs virtually the entire mortgage market.

-Low down payments keep home prices inflated. More and more people qualify or think they qualify and jump in without being ready to buy. This keeps home prices cheap initially but the longer term costs are shouldered by taxpayers (i.e., larger defaults with FHA insured loans).

-Stronger sense of ownership. If you had to put 10 or 20 percent down it is likely you will care about your purchase, more than if you basically bought an option on the home. FHA insured loans amount to call options on a home purchase. If prices go up, good, then you can sell later. If they go down, you only lose a tiny amount and the temptation to walk is increased much more thus adding fuel to future disruptions in communities.

This doesn’t take away from the fact that there are many wealthy buyers in California:-Force people to budget over two to three years to test their ability to pay for a mortgage. A home is not like buying a stock, it is a longer term purchase thus requiring people to pay for the privilege of buying a home is important. It is a privilege since the government backs virtually the entire mortgage market.

-Low down payments keep home prices inflated. More and more people qualify or think they qualify and jump in without being ready to buy. This keeps home prices cheap initially but the longer term costs are shouldered by taxpayers (i.e., larger defaults with FHA insured loans).

-Stronger sense of ownership. If you had to put 10 or 20 percent down it is likely you will care about your purchase, more than if you basically bought an option on the home. FHA insured loans amount to call options on a home purchase. If prices go up, good, then you can sell later. If they go down, you only lose a tiny amount and the temptation to walk is increased much more thus adding fuel to future disruptions in communities.

“(DQ News) In 2010, 29.4 percent of the $1 million-plus buyers paid cash, up from 28.9 percent in 2009 and the highest for any year since 1994, when 32.3 percent of $1 million-plus sales were cash. In the over-$5 million category, 62.2 percent of the purchases were cash. Among those who did finance their purchase last year, the median down payment was 40.1 percent of the purchase price. The lending institutions most willing to provide mortgage financing for $1 million-plus homes were Wells Fargo, Bank of America and Union Bank.”

Nearly 30 percent of all buyers of $1 million-plus homes paid all cash. Those who financed the home went in with a median of 40 percent. This market is now operating with jumbo loans and you need to either have money or show sizeable income. Then again this is a tiny sliver of the market. Unlike the majority of the market where the median down payment is 3.5 percent (how convenient that it is the FHA standard) there is likely to be more problems yet again because of low down payment FHA insured loans.First step in fixing the housing market is increasing the down payment amount on all government backed loans to 10 percent (at least). This is unlikely because it will reveal how truly broke most Americans are and how few can actually save what used to be a normal amount for a down payment.

http://www.doctorhousingbubble.com/f...insured-loans/

Comment