Over the last few months I’ve received more e-mails from readers highlighting properties that have adjusted in price significantly to the downside. To be more specific, the examples of quality properties facing major price corrections are growing larger. Now this isn’t a revelation but what it does tell me about the thousands of readers interested in real estate and who just happen to cross this blog is that many are willing and able to buy at the right price. Patience now seems to be a virtue. The California economy has taken a toll on more working class counties. California is a microcosm of the US economy. You have pockets of markets completely oblivious to the crumbling walls in the economy while most housing areas are struggling to stay afloat. More people are taking a critical eye when purchasing real estate and tighter lending standards have forced many into real estate withdrawal. To quote Jerry Maguire, “show me the money!”

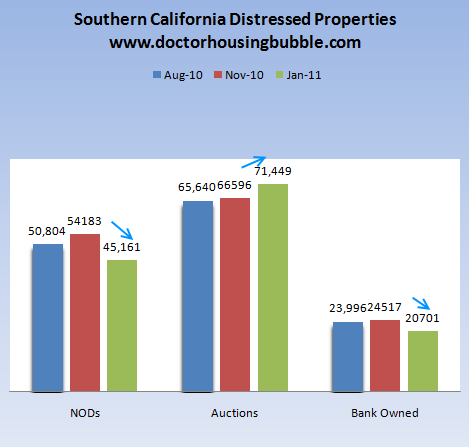

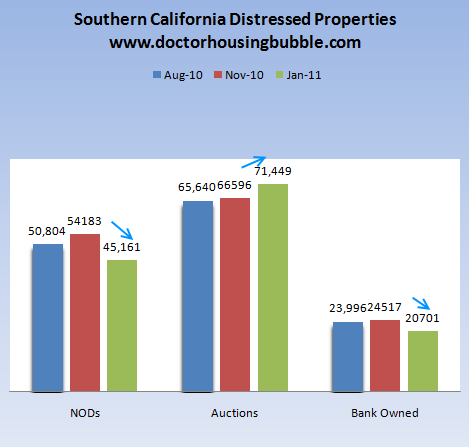

It is fascinating how we went from a belief that no shadow inventory existed to suddenly shadow inventory being a carefully managed policy from the banking sector. We’ll chalk that up to creative propaganda. As banks have shored up their capital through investment banking and other forms of speculation courtesy of taxpayer bailouts, many banks now seem more willing to leak out the troubled real estate onto the market. Let us take a look at Southern California distressed properties over the last six months:

Now this is an interesting view of things and this is only showing data from filings. As we know, many banks don’t even file for people missing payments (at least not early on). First, you will notice that from August to November notice of defaults spiked as many of the government modification programs failed. From November to January notice of defaults tumbled largely due to the paperwork fiasco that hit the banking industry. As the NODs filter through the process, you see the decent size spike in scheduled auctions. 71,449 homes in Southern California are sitting eagerly in the auction pipeline gearing up to become REOs for public consumption. In other words, the shadow inventory is ready to enter the market in 2011.

Now some have been asking why banks are more willing to filter out troubled properties with lower prices. I think the simple answer has to do with the government creating a three year buffer for banks to gather their breath, speculate in global stock markets (which have recovered) and now banks are more able to filter out distressed properties because of their recent profits (and taxpayer handouts). Most of the too big to fail banks have turned solid profits through their investment banking arms so leaking out REOs isn’t such a big deal anymore. There is money to be made elsewhere.

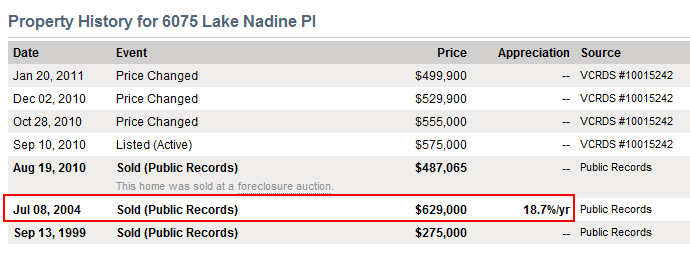

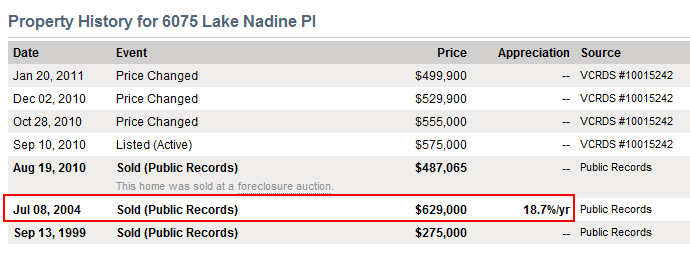

For example, take a look at this Woodland Hills home:

Notice how the price isn’t moving up? Someone paid $629,000 for this home back in 2004, almost seven years ago. Today it is listed at $499,900. These are good areas of Los Angeles County and price cuts are occurring just like they are in Culver City for example.

The trend that seems to have started in fall of last year is the acceleration of price cuts and price reductions from bank owned properties. There seems to be more and more aggressive movement from banks here. Banks have all the above data and more and they realize how overvalued some of their REOs properties are. They also know other banks have the same junk. So now that they know the government will protect them no matter what and their capital base is healthier, they are trying to beat each other to punch by dumping properties before others do. Foreclosures sell for a discount. If banks realize auctions are rising and the economy isn’t getting better, maybe today is the best time to unload.

What we do know is 2011 is not going to be a pleasant year for California real estate. Many of you already can sense this but banks know this firsthand.

http://www.doctorhousingbubble.com/f...es-price-cuts/

It is fascinating how we went from a belief that no shadow inventory existed to suddenly shadow inventory being a carefully managed policy from the banking sector. We’ll chalk that up to creative propaganda. As banks have shored up their capital through investment banking and other forms of speculation courtesy of taxpayer bailouts, many banks now seem more willing to leak out the troubled real estate onto the market. Let us take a look at Southern California distressed properties over the last six months:

Now this is an interesting view of things and this is only showing data from filings. As we know, many banks don’t even file for people missing payments (at least not early on). First, you will notice that from August to November notice of defaults spiked as many of the government modification programs failed. From November to January notice of defaults tumbled largely due to the paperwork fiasco that hit the banking industry. As the NODs filter through the process, you see the decent size spike in scheduled auctions. 71,449 homes in Southern California are sitting eagerly in the auction pipeline gearing up to become REOs for public consumption. In other words, the shadow inventory is ready to enter the market in 2011.

Now some have been asking why banks are more willing to filter out troubled properties with lower prices. I think the simple answer has to do with the government creating a three year buffer for banks to gather their breath, speculate in global stock markets (which have recovered) and now banks are more able to filter out distressed properties because of their recent profits (and taxpayer handouts). Most of the too big to fail banks have turned solid profits through their investment banking arms so leaking out REOs isn’t such a big deal anymore. There is money to be made elsewhere.

For example, take a look at this Woodland Hills home:

6222 FALLBROOK AVE, Woodland Hills, CA 91367

Bedrooms: 3

Bathrooms: 2

Sqft: 1,481

Here is the sales history on the above home:Bedrooms: 3

Bathrooms: 2

Sqft: 1,481

09/01/1995: $160,000

03/10/2005: $530,000

The above home is a REO property. So what is the current list price?03/10/2005: $530,000

Price Reduced:01/07/11 — $399,900 to $379,900

Now is this a good price? Still seems high given current market conditions but we are seeing more decent homes in mid-tier neighborhoods going for a lot less. This home from 2004 to 2009 wouldn’t have cracked the $300,000 barrier if it were listed by a willing seller. More and more areas are breaching these kinds of thresholds. Of course you will notice that this is happening with the REOs and not sellers realizing that much of those bubble gains were purely illusions like street magic from David Blaine. Many sellers that don’t get out now are going to see a slow erosion of equity over the next year. How? Just look at the spike in scheduled auctions. Many of these will become REOs and bank owned properties are being priced to sell. Let us look at another example.

Beds: 4

Baths: 3

Square feet: 1,801

The above is a nice home in Agoura Hills. It is also bank owned. Let us look at the pricing history here:Baths: 3

Square feet: 1,801

Notice how the price isn’t moving up? Someone paid $629,000 for this home back in 2004, almost seven years ago. Today it is listed at $499,900. These are good areas of Los Angeles County and price cuts are occurring just like they are in Culver City for example.

The trend that seems to have started in fall of last year is the acceleration of price cuts and price reductions from bank owned properties. There seems to be more and more aggressive movement from banks here. Banks have all the above data and more and they realize how overvalued some of their REOs properties are. They also know other banks have the same junk. So now that they know the government will protect them no matter what and their capital base is healthier, they are trying to beat each other to punch by dumping properties before others do. Foreclosures sell for a discount. If banks realize auctions are rising and the economy isn’t getting better, maybe today is the best time to unload.

What we do know is 2011 is not going to be a pleasant year for California real estate. Many of you already can sense this but banks know this firsthand.

http://www.doctorhousingbubble.com/f...es-price-cuts/

Comment